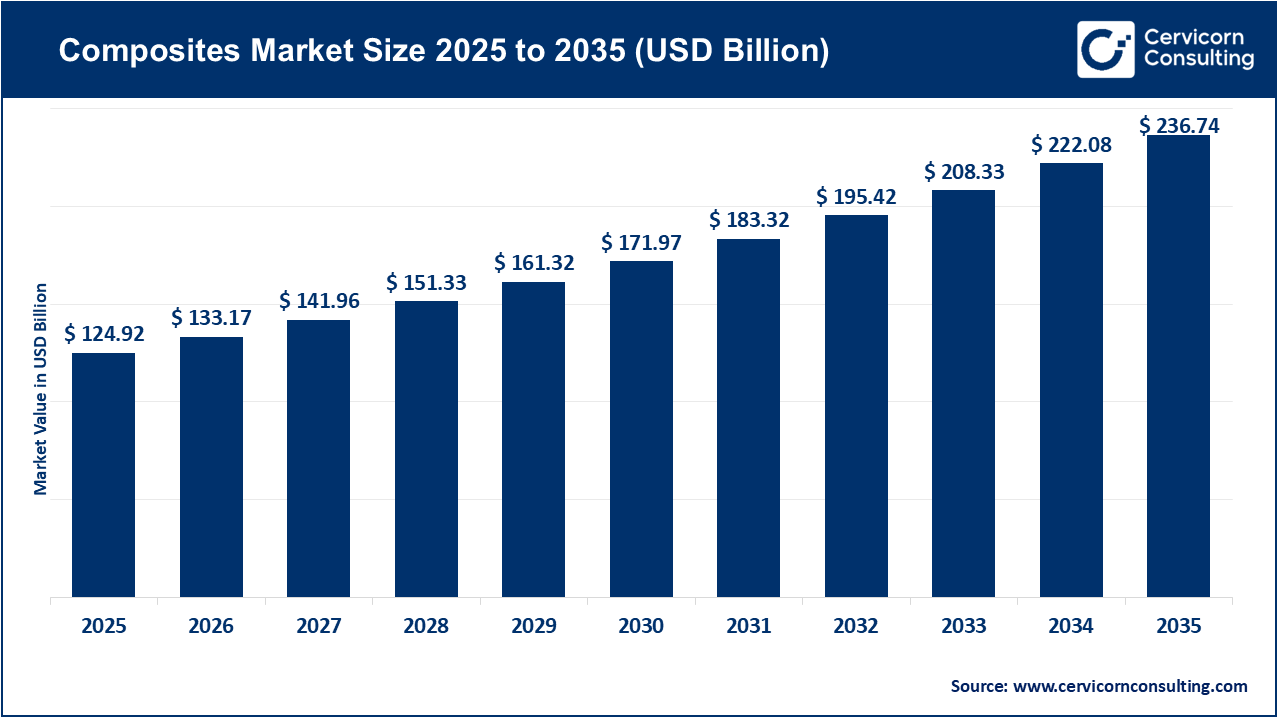

The global composites market size reached at USD 124.92 billion in 2025 and is expected to be worth around USD 236.74 billion by 2035, exhibiting at a compound annual growth rate (CAGR) of 6.6% over the forecast period from 2026 to 2035. The composites market is mainly driven by need for strong, lightweight materials across many industries. Aerospace, automotive, construction, and energy companies are using composites to create products that are lighter, stronger, and more durable than traditional steel or aluminum. This has also enabled improvements in fuel efficiency, performance, and maintenance costs. As more industries seek materials capable of withstanding harsh conditions including extreme heat, pressure, and corrosion, demand for composites will continue to increase.

Growth in the composites market will also benefit from advancing technologies and increasingly accessible manufacturing processes. In particular, improvements related to recycling, automation, and 3D manufacture will allow for a faster, cheaper rate of composite production. Simultaneously, many governments and industries are advocating for cleaner and more energy-efficient solutions, which has led to an increase in the use of composites in wind turbines, electric vehicles, and similar sustainable applications. Creating a pathway for innovation in these areas will likely lead to more product applications, which will improve future growth.

What are Composites?

Composites are materials made up of two or more different materials so that the resulting material is stronger, lighter, and more durable than the individual parts. They are typically made up of a reinforcement such as fibers or chips, and a matrix such as a plastic or resin, which act to hold the fibers or mineral chips together as a single material. This allows composites to have unique properties that allow them to be used in a number of different industries such as cars, planes, sports and construction.

Growing Use of Composites in the Aerospace Industry

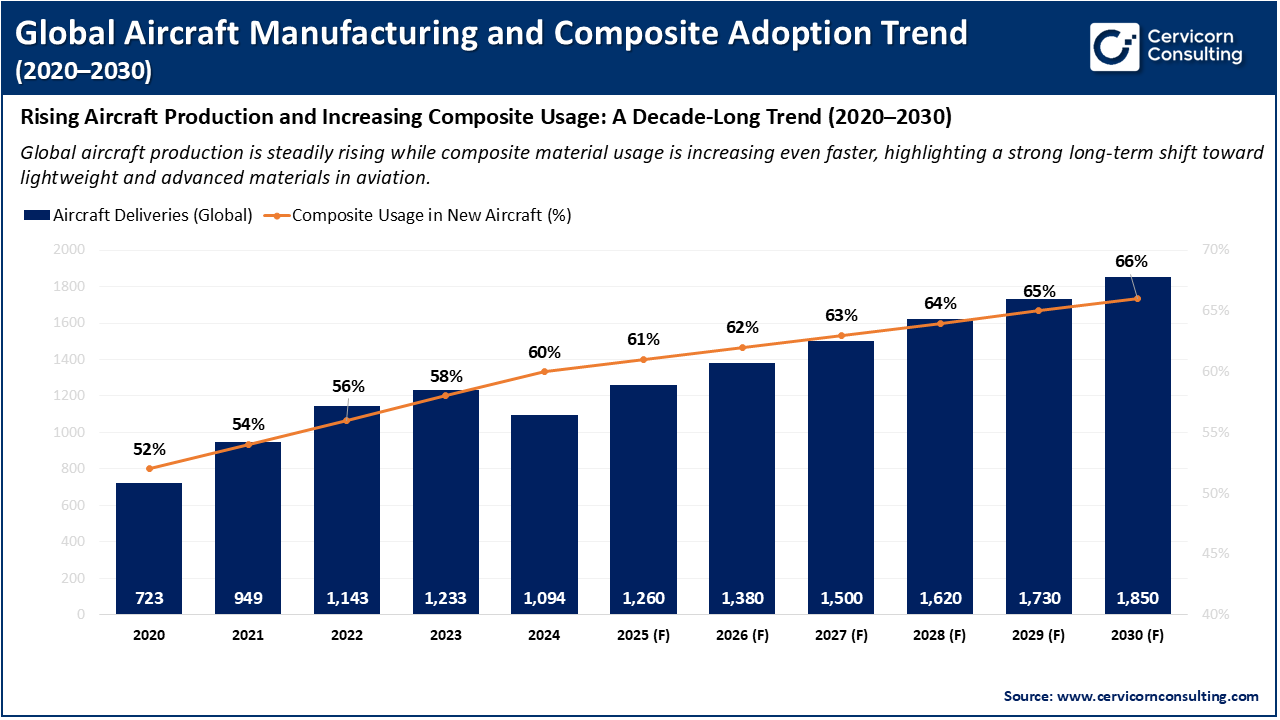

The aerospace sector is increasingly utilizing composites because they can be very strong, light, and handle extreme environments in terms of high pressure and temperature. Aircraft manufacturers are switching to composites to lessen weight – which can improve fuel economy and reduce operating costs. Composites last longer and require less maintenance, whether for commercial or military airframes. As more designs include composite parts, including wings, fuselage sections, and even some interior segments, it is increasing overall demand and implications for the composites market overall.

This is an indication of market growth as aircraft production and the amount of composite used have both increased gradually year-on-year. Aircraft delivered has grown from 723 units in 2020 to a projected 1,850 units in 2030. This demonstrates strong growth in the manufacturing of the aircraft. In addition, composite use in new aircraft has increased from 52% to 66% and aircraft resin composites have clearly been more heavily adopted in new aircraft. When both production numbers rise and composites are adopted more into the manufacturing of the aircraft, it clearly demonstrates robust and uninterrupted composite market growth.

1. Adoption of thermoplastic composites (TPCs) for aerostructures: A recent landmark shows that thermoplastic composites are not only used on small secondary components, but now in large structural components of aerospace applications as well. These components provide benefits of faster manufacturing, increased toughness, and recyclability. This is a landmark for our growth of the composites market because thermoplastic composites are becoming a more attractive option for manufacturers who have speed, durability, and sustainability in their projects. All of these advancements creates an overall increase in demand for composites.

2. Increased use in “new space” applications: Growth in the advanced space composites sector, suggest that composites are being used more in satellites, space vehicles and related systems. This will drive the composites market by creating new use-cases not limited to aerospace or automotive applications, thus broadening the overall addressable market for composite materials.

3. Spin-off of major advanced materials business by a major industrial company: Industrial companies like Honeywell International Inc. recently announced the spin-off of its advanced material business (which includes specialty composites) into a defined publicly traded company. These corporate restructurings highlight the excitement for and value placed in composite materials and advanced composite businesses, and they draw in investment and corporate attention to the composites market, enabling the expansion and growth of composites as a material.

4. Regional investment and expansion in composite manufacturing capacity: For instance, manufacturing investment announcements for aerospace component production facilities utilizing composite materials — e.g., a facility expansion in Connecticut for aerospace composite parts. This development expands the composite marketplace by adding production capabilities and getting around cost or supply chain glitches on composites, which drives wider use of composites — resulting in demand and growth.

Report Scope

| Area of Focus | Details |

| Market Size in 2026 | USD 133.17 Billion |

| Estimated Market Size in 2035 | USD 236.74 Billion |

| Projected CAGR 2026 to 2035 | 6.60% |

| Dominant Region | Asia-Pacific |

| Key Segments | Product Type, Resin Type, Manufacturing Process Type, End Use, Region |

| Key Companies | Toray Industries, Inc., Hexcel Corporation, Owens Corning, DuPont, Cytec Industries (Solvay, S.A.), Huntsman Corporation LLC, Teijin Ltd., SGL Group, Compagnie de Saint-Gobain S.A., PPG Industries, Inc., Weyerhaeuser Company, Kineco Limited, Momentive Performance Materials, Inc., Veplas Group, China Jushi Co., Ltd. |

Rising Demand for Lightweight Materials

Increasing Use in Renewable Energy

High Production Cost

Limited Recycling Options

Growth in Electric Vehicles (EVs)

Expansion in Infrastructure Projects

Complex Manufacturing Process

Shortage of Skilled Labor

The composites market is segmented into various regions, including North America, Europe, Asia-Pacific, and LAMEA. Here is a brief overview of each region:

The North America composites market size reached at USD 34.10 billion in 2025 and is expected to reach around USD 64.63 billion by 2035. North America composites market is driven by strong demand in aerospace, automotive, construction, and renewable energy sectors. Companies in this area are advancing materials in an effort to reduce weight, create improved efficiencies, and produce more durable products. The presence of major aircraft manufacturers and defense contractors generates greater demand of high-strength composite materials, as well as strong research and development, to create new composite material systems that possess improved mechanical properties. Government investment in clean energy and infrastructure improvements includes wind blades, new pipeline systems, and bridge components, which will drive composite usage.

Recent Developments:

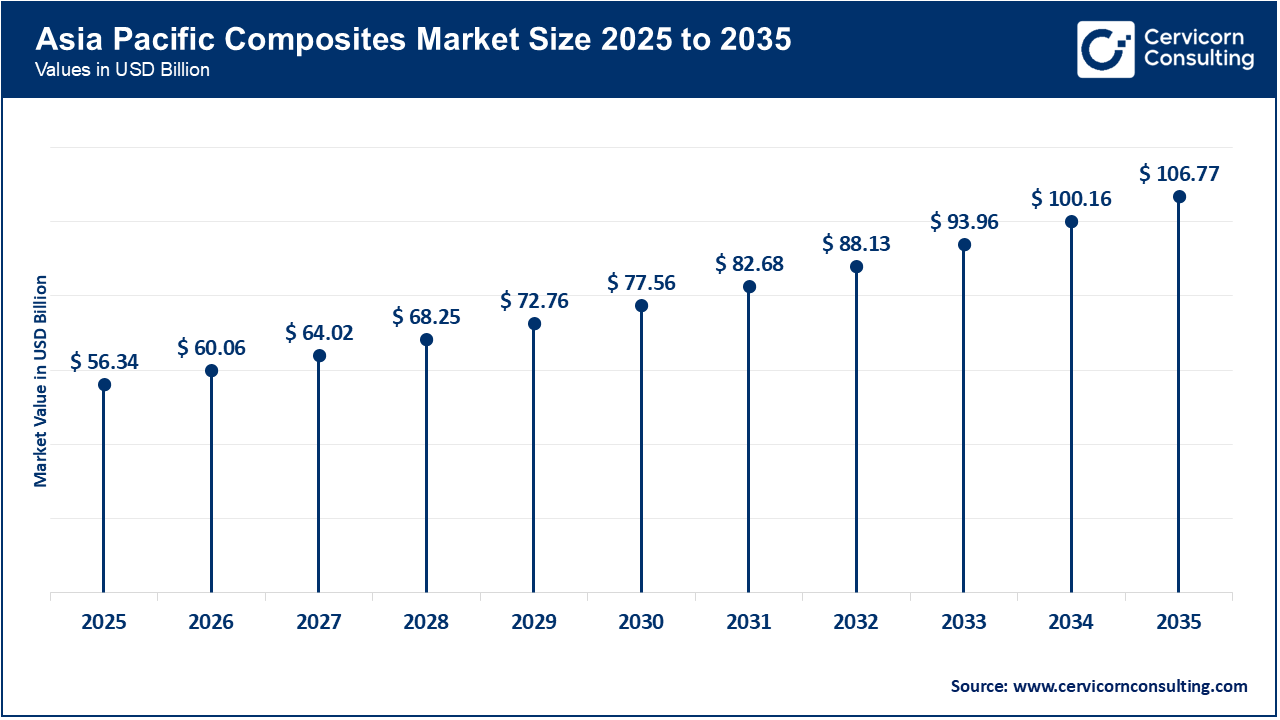

The Asia-Pacific composites market size accounted for USD 56.34 billion in 2025 and is forecasted to hit around USD 106.77 billion by 2035. The Asia-Pacific composites industry is rapidly growing due to rising industrialization, a strong automotive manufacturing industry, and expansion of aerospace programs. Governments in nations like China, India, Japan, and South Korea are increasingly using lightweight materials to improve vehicle performance and to reduce energy consumption. The region has low manufacturing costs and large-volume production, and this has attracted many international composite manufacturers to establish fabrication plants there. Strong government investment in transportation, renewable energy, and infrastructure will continue to drive the demand for strong composites in the region. In addition, the rapid adoption of electric vehicles in the key markets will also encourage industry growth.

Recent Developments:

The Europe composites market size estimated at USD 25.61 billion in 2025 and is projected to surpass around USD 48.53 billion by 2035. The Europe is significantly impacted by strong environmental legislation and demand for lightweight materials in renewable energy and mobility applications. Automotive manufacturers are seeing increasing use of higher grade composites in their vehicles as they work to improve vehicle emissions and comply with legislation around new modes of clean transport. Wind energy is another significant driver, as Europe invests heavily in large offshore wind farms. Europe is also leading the development of bio-composites and recyclable materials, working towards a circular economy. Strong links between academic research, research centers and industry fabricate a culture of collaboration in order to work on innovations so that the use of composites is increased across various sectors.

Recent Developments:

Composites Market Share, By Region, 2025 (%)

| Region | Revenue Share, 2025 (%) |

| Asia-Pacific | 45.10% |

| North America | 27.30% |

| Europe | 20.50% |

| LAMEA | 7.10% |

The LAMEA composites market size valued at USD 8.87 billion in 2025 and is anticipated to reach around USD 16.81 billion by 2035. The LAMEA is driven by rising construction activity, urban development, and the need for corrosion-resistant materials in oil and gas operations. Varied composites offer a considerable advantage for use in pipelines, tanks, and marine structures because they can withstand chemicals and even operate in some of the harshest climates specific to the region. Automotive production is growing in Latin America and the Middle East, and composites are increasingly used in lightweight components of the automotive, marine, and industrial equipment sectors. Government investment in transportation and other large-scale industrial projects is also extended in the region for extended composite use. Collectively, these factors are playing a role in the growth of overall composite usage across multiple sectors within the region.

Recent Developments:

The composites market is segmented into product type, resin type, manufacturing process type, end use, and region.

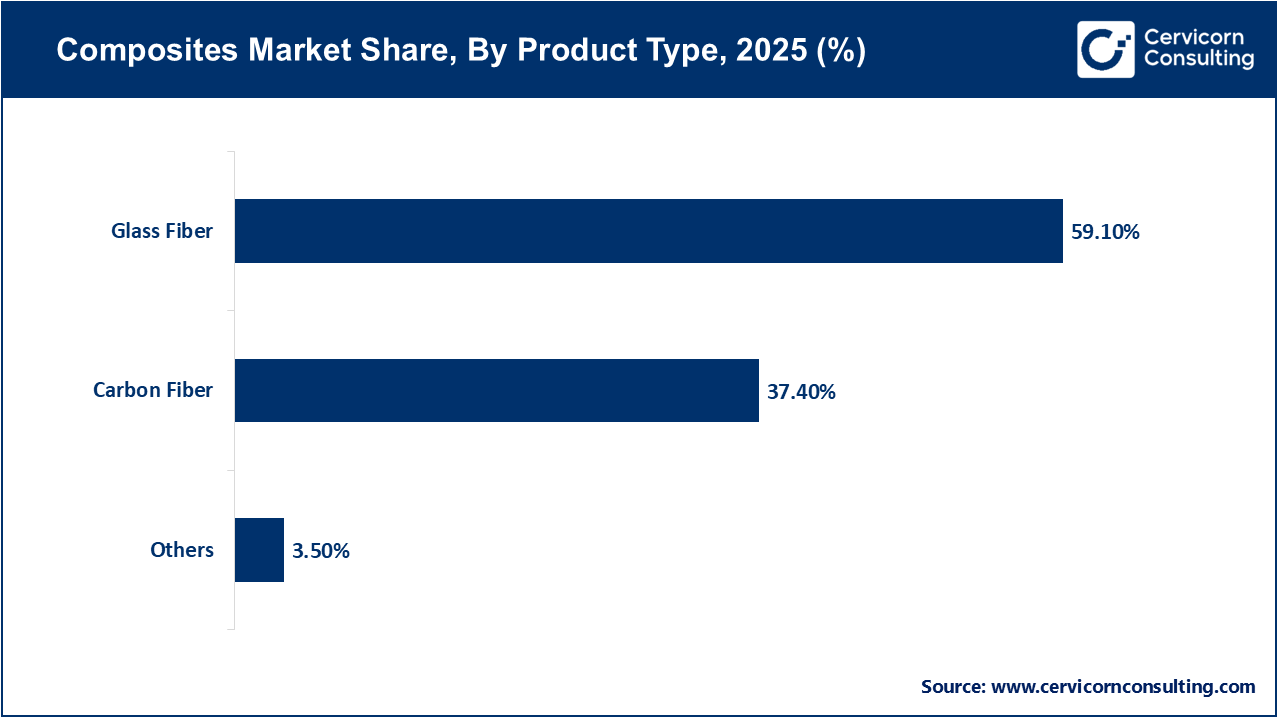

Glass fiber is the dominant segment of the composites market because it is cost-effective, strong, and widely available. Glass fiber is used throughout many different industrial sectors including construction, automotive, marine, and electrical goods where price is vital. Its low price makes it the material of choice for applications requiring large volumes with consistent performance. Other industries choice glass fiber where dependable performance is needed in terms of heat, corrosion, and bump resistance. The long track record of glass fiber, along with the straightforward nature of manufacturing processes only serves to bolster the performance of glass fiber product points on other forms of composite materials.

Carbon fiber is the expanding product type within the composites market because of its superior strength, low-weight options, and high-performance durability. Carbon fiber is emerging in commercial aerospace, automotive applications, sports equipment, and wind energy applications where performance and efficiency matter. Companies consider carbon fiber as a way to produce lightweight materials, improved speed, fuel savings, and overall material product strength. Advances in manufacturing technology have reduced costs associated with carbon fiber production making it available and feasible for mass production. Since more companies will continue to look to lightweight bonded material solutions, this segment of the composites market continues to grow rapidly.

Thermosetting resins are the largest segment of the composites market due to their superior adhesion strength, heat resistance, and high stability/low shrinkage over time during service. Automotive parts, wind turbine blades, aircraft parts, and construction materials are all common applications of thermosetting resins. Thermosetting resins reliably perform in extreme temperature ranges; the demonstrated adhesion and stability create market confidence across ranges of applications and industries. This reliability ensures thermosetting resins remain the standard choice of resin for most manufacturers that produce composites today.

Composites Market Share, By Resin Type, 2025 (%)

| Resin Type Segment | Revenue Share, 2025 (%) |

| Thermosetting | 66.3% |

| Thermoplastic | 30.5% |

| Others | 3.2% |

Thermoplastic resins are the fastest growing segment of the composites market due to their recyclability, fast processing, and ability to be reshaped or remolded. Thermoplastics fit into the modern world of manufacturing for features such as automation and faster cycle times. Aerospace, automotive, electronics, and consumer goods are examples of industries adopting thermoplastic resins to reduce weight and improve sustainability in product designs. Advances in manufacturing technology have reduced costs associated with carbon fiber production making it available and feasible for mass production.

Injection molding dominates the market because it is used in high volume, mass manufacturing opportunities that provide high accuracy, repeatability, and quality. Injection molding is used across industries, including automotive, electronics, consumer products, and packaging, due to its fast production process. The injection molding process enables the manufacturer to form complex parts with the least waste. Finally, injection molding supports both thermoplastic and thermoset materials. This capacity to process variable materials provides variable molding capabilities. These high-volume, low-cost capabilities support injection molding as the leading manufacturing process.

Composites Market Share, By Manufacturing Process Type, 2025 (%)

| Manufacturing Process Type Segment | Revenue Share, 2025 (%) |

| Injection Molding Process | 28% |

| Layup Process | 26% |

| Resin Transfer Molding (RTM) | 12% |

| Filament Winding Process | 10% |

| Compression Molding Process | 8% |

| Pultrusion Process | 6% |

| Others | 10% |

Resin Transfer Molding (RTM) is the fastest-growing process due to its quality surface finish, mechanical properties, and minimal waste. The growth of RTM is primarily seen as a process to produce lightweight yet tough parts for aerospace, automotive and wind energy applications. The RTM process allows for the support of automation. Automation lowers production cost and steps using increased automation and improved precision. The RTM process also features improved fiber orientation, as well as improved uniform thickness of the finished component. Which ultimately improves the performance of the product.

Automotive and transportation is the largest end-use segment in terms of composite usage, owing to its requirement for lightweight materials to attain greater fuel efficiency, lower emissions and improve vehicle safety. Due to regulatory and safety standards, various composites are used for body panels, bumpers, structural frame components and interior components. Consumers' global demand for electric vehicles has further expanded the use of composites in battery housing and lightweight vehicle bodies. Because composites will continue to be produced in mass quantity, this is the highest end-use segment for composites.

Composites Market Share, By End Use, 2025 (%)

| End Use Segment | Revenue Share, 2025 (%) |

| Automotive & Transportation | 27.5% |

| Aerospace & Defense | 18.0% |

| Construction & Infrastructure | 14.0% |

| Wind Energy | 12.0% |

| Electrical & Electronics | 8.5% |

| Pipes & Tanks | 7.0% |

| Marine | 5.0% |

| Others | 8.0% |

Aerospace and defense is the fastest growing end use of composites. Aerospace and defense require high strength-to-weight ratios and durable materials for planes, helicopters, drones, missiles, and other military systems or platforms. Composites will reduce weight, increase fuel efficiency and perform at extreme temperatures and conditions with adverse forces. Composites are used in wings, fuselage, engine components, and cabin interiors. Leading aircraft manufacturers will produce next generation designs that feature composite heavy configurations, and the segment will expand considerably. Strong growth within the aerospace and defense end use sector will also be driven by defense spending and increasing demand for efficient agile military aircraft.

Recent Global Government Initiatives in Composites Market:

1. Toray Advanced Composites – Expansion in Thermoplastic & Carbon Fiber Capacity

Toray Composite Materials America, Inc. announced a significant expansion at its Alabama plant that will double production capacity of high-performance TORAYCA™ T1100 carbon fiber composite. Toray also announced the expansion of a facility for continuous fiber-reinforced thermoplastic composites. This investment solidifies the availability of advanced composite materials in industries like aerospace, automotive and defense. Increased capacity also eases bottlenecks in supply and improves affordability which enables more companies to utilize composites especially at the production volume levels required in automotive assembly lines. This serves to encourage the industry to adopt composites as preferences move towards materials with the advanced performance capabilities of composites.

2. Daikin Industries, Ltd. – Investment in Metal Matrix Composite Materials

Daikin invested via capital increase in Advanced Composite Company, a company developing advanced composites based on metal matrix composites. Metal Matrix Composites (MMCs) are advanced composites with superior performance characteristics compared to polymers, particularly at elevated temperatures, in demanding automobile, aerospace, and military applications. Daikin's investment indicates increasing industrial interest surrounding specialized bullets. With an infusion of industrial investment, technology is improved, awareness is raised, and joint applications will expand. This, in essence, is going to push the composites market in an upward direction.

3. ACS Srl (Italy) – Opening of Second Plant for Carbon Fibre Automotive & Aerospace Components

ACS announced investment of EUR 4 million to complete a second facility in Tortoreto, Italy to provide carbon-fibre composites for automotive and aerospace customers. ACS has indicated production capacity will increase by approximately 400%. This type of investments at the factory level is required in order to support composites in much larger volume industries such as automotive versus niche markets. Increased capacity at the factory level means more parts can be manufactured with composites with increased affordability and a higher production cycle time which is likely to lead to more opportunities for market growth associated with composites.

By Product Type

By Resin Type

By Manufacturing Process Type

By End Use

By Region