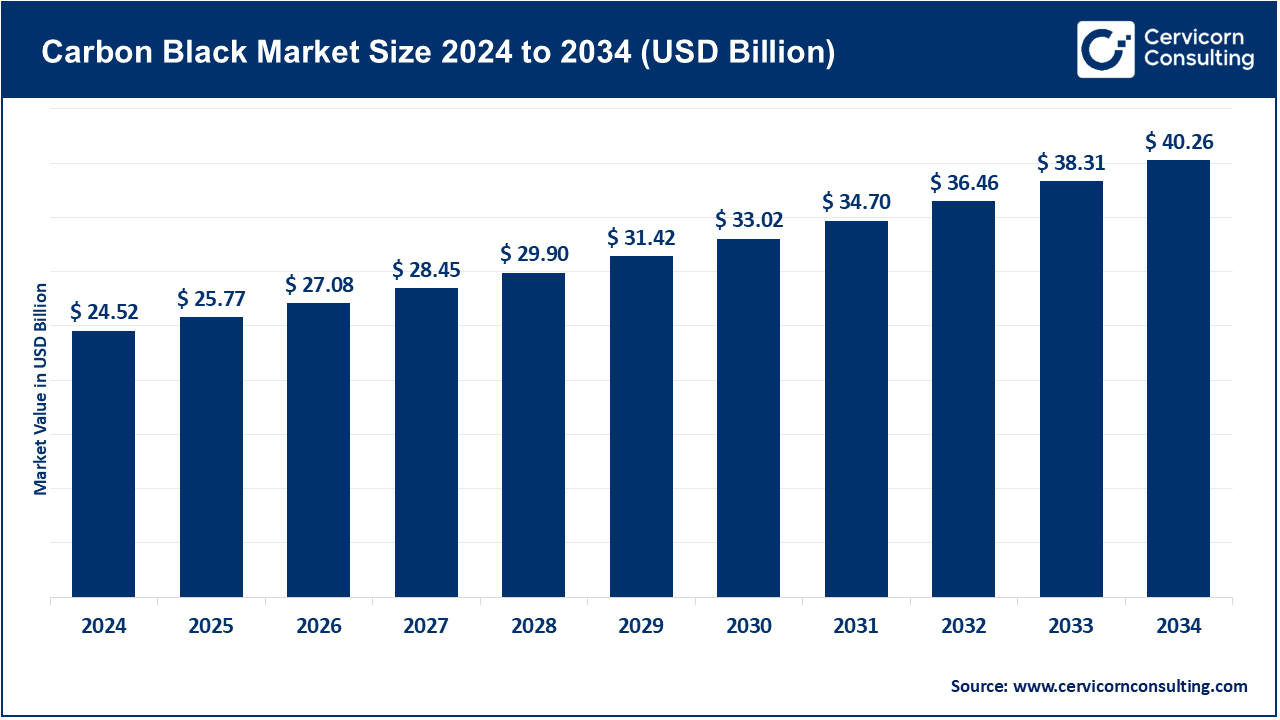

The global carbon black market size was estimated at USD 24.52 billion in 2024 and is expected to reach around USD 40.26 billion by 2034, growing at a compound annual growth rate (CAGR) of 5.1% over the forecast period from 2025 to 2034.

Growth in the carbon black market stems from new applications in the automobile, construction, and electronic industries. We see the highest demand from automotive sector, and it exceeds 65% where carbon black is used in production of tires. Example brands, Michelin and Bridgestone, exemplify premium tire brands which uses carbon black high-performance carbon black grades. Over 63% of the world's demand is fueled from the Asia-Pacific region. In paints, coatings and construction, the region is also increasing demand. Films, cables and packaging in the plastics sector is increasing as well. In these items, carbon black is used for coloration and shield against UV radiation. New environmentally friendly production technologies like Birla Carbon’s low carbon solutions are also fostering growth. The development of new lithium-ion batteries and conductive polymers is expanding application for carbon further opening up channels for its manufacture.

What is carbon black?

Carbon black is a fine black powder which consists elemental carbon and is formed through the controlled incomplete combustion of hydrocarbons. Carbon black is widely used is as a reinforcing agent in tires. Furthermore, carbon black acts as a pigment, a UV stabilizer, and a conductive filler in plastics and paints, as well as in coatings, inks, and in electrical applications. Its characteristics, like particle size, structure, and surface area, are optimized during production by methods like furnace black, channel black, and thermal black. The material is crucial in the automotive, construction, packaging, and energy storage sectors.

Report Scope

| Area of Focus | Details |

| Market Size in 2025 | USD 25.77 Billion |

| Expected Market Size in 2034 | USD 40.26 Billion |

| Projected CAGR 2025 to 2034 | 5.10% |

| Leading Region | Asia-Pacific |

| Key Segments | Type, Grade, Application, End User, Region |

| Key Companies | Cabot Corporation, Orion Engineered Carbons S.A., Birla Carbon, Continental Carbon Company, Tokai Carbon Co., Ltd., Phillips Carbon Black Limited (PCBL), Mitsubishi Chemical Corporation, Omsk Carbon Group, Denka Company Limited, Jiangxi Black Cat Carbon Black Co., Ltd., Longxing Chemical Stock Co., Ltd., Asahi Carbon Co., Ltd. |

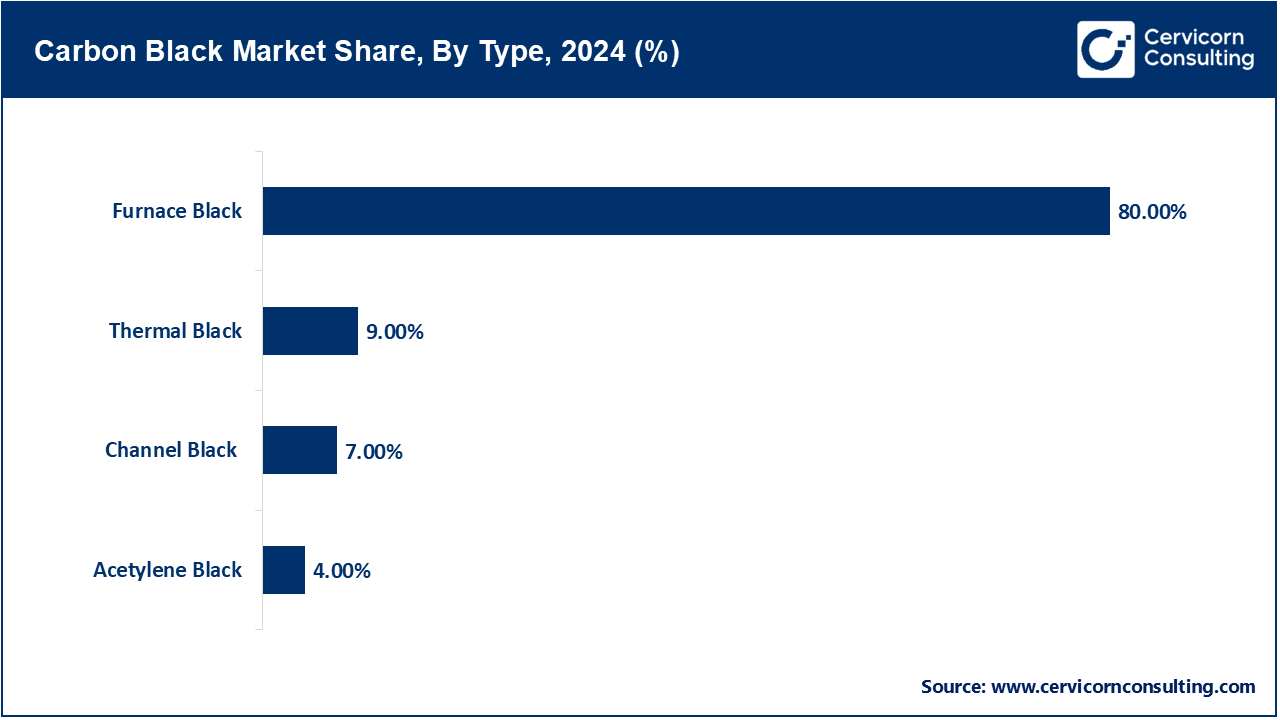

Furnace Black: Over 80% of global production share thoroughly dominates the market due to the cost-effective nature and versatility furnace black offers. It is extensively utilized in tires, mechanical rubber goods, plastics, and coatings as a reinforcement and pigment. For instance, Cabot Corporation furnaces black supplied Michelin with high-performance passenger and truck tires boosting furnace black production. Carefully tailored particle sizes and structures make furnace black a common choice in industrial production, specifically in automotive, construction, and packaging industries, enabling demand stability in the midst of market volatility.

Thermal Black: Roughly 7% of the global share is held by thermal black, which is defined with a low structured large particle size. It is somewhat flexible and provides resilience in rubber goods. Segments that utilize rubber for industrial purposes include seals, gaskets, hoses, and rubber linings requiring elasticity and minimal hysteresis. Orion Engineered Carbons produces thermal black grades specifically for heavy-duty rubber used in the mining and oil sectors. Furthermore, thermal black is appropriate for specialized coatings and insulation materials with lower furnace black requirements due to its high thermal stability.

Channel Black: This grade also has the lowest market share with roughly 4–5% due to its ultra-fine particle size and deep jet-black pigmentation. Its primary application is in high-end printing inks, paints and industrial coatings, and other decorative finishes that rely on the precision dispersion of color as well as its intensity.

Acetylene Black: This is the market's smallest segment with under 3% market share. However, its electrical conductivity and purity make it highly valued.

Rubber Carbon Black: This grade accounts for 75% of the market share, primarily due to tires. Rubber carbon black improves the tensile strength, abrasion resistance, and fatigue life of rubber parts. This grade is used by major tire manufacturers such as Bridgestone and Goodyear in their passenger, truck, and specialty tires for safety and performance. Its use is also found in rubber parts like belts and hoses as well as in vibration damping components. The expansion of demand is closely linked with global automotive manufacturing along with the replacement tire industry, both of which are anticipated to perform well, particularly in developing markets with growing levels of vehicular demand.

Specialty Carbon Black: Specialty carbon black comprises 25% of the market share. This product is utilized in plastics, inks, coatings, and even as a conductive material. It is also used for pigmentation and provides excellent protection against UV radiation, in addition to electrical conductivity. Specialty grades fuels strong growth with more than 6% CAGR forecasted through 2034 due to electronics, packaging, and renewable energy markets. For example, Birla Carbon specialty grades for automotive coatings improves gloss and durability. Additionally, Orion Engineered Carbons provides conductive carbon black used in polymer-based electronics. This segment provides sharpe increases in profits relative to investment, making it the concentrate region for the producers.

Tires & Automotive Rubber: Making up more than sixty five percent of the global demand for carbon black, this is the largest segment of application. It tires improves wear resistance and fuel efficiency. The demand is sustained by the global vehicle production projected to exceed ninety five million units by the year 2025. Goodyear, for instance, makes high performance EV tires that use advanced carbon black and are made to endure higher torque loads. The replacement tire demand is significant as well ensuring consistent consumption during automotive market downturns.

Carbon Black Market Share, By Application, 2024 (%)

| Application | Revenue Share, 2024 (%) |

| Tires and Automotive Rubber | 65% |

| Plastics | 35% |

Plastic: This segment is about 15% of the market and uses black carbon for product pigmenting, for outdoor films and automotive interiors and for UV stabilization and as a conductor in cables. A good example would be, Dow Inc. which uses specialty carbon black for added weather resistance to polyethylene films used in outdoor packaging. The shift towards more lightweight and durable materials in construction and automotive is expected to drive demand for plastics, primarily in the Asia-Pacific and Middle East regions that are expanding their infrastructure and manufacturing undertakings.

Others: Paints and coatings constitute around 8% of the market share due to their pigments, which are valued for their deep pigmentation and weather although preservatives and UV filter resistance. In addition, Inks and toners hold a 5% share due to the requirement of ultra-fine particle carbon black for sharp and consistent printing. It is Important in the packaging, publishing, and office printing markets. Specialty grades of carbon black are used by HP in laser printer toners for clear and durable prints. Concerning shares (~7–8%) conductive material and batteries are the fastest growing segments with >8% CAGR driven by electronics, fuel cells and EV batteries. Conductive carbon black is used to improve performance by improving electrical pathways which enhances performance.

Automotive: The automotive sector accounts for roughly 68% of carbon black consumption through tires, belts, hoses, gaskets and other battery components. Moreover, EV Adoption is making new uses in conductive materials for batteries. Tesla’s suppliers use Acetylene black in battery anodes to improve the range and efficiency of the vehicles. The expansion in the sector is based on the global vehicle manufacturing and aftermarket tire replacement supporting the carbon black demand.

Construction: This industry accounts for 12–14% of the market utilizing carbon black in sealants, roofing, asphalt, and protective coatings. With India’s USD 1.4 trillion National Infrastructure Pipeline, there is growing need for carbon black-based coatings in weatherproof construction materials. Its use is critical for UV resistance and durability in long lasting infrastructure components.

Others: Packaging claims 8–10% share in packaging plastics and containers carbon black adds UV stability and strength. Electronics account for 5% of the industry’s share with conductive carbon black utilized in wires, semiconductors, and energy storage devices. Enhanced conductivity and lifespan due to the use of acetylene black in EV battery electrodes is offered by Samsung SDI. The rest of “Others” (3–5%) is printing, aerospace, and industrial machinery. Carbon black filled composites are used by Boeing for super Lightweight, durable parts for aircrafts.

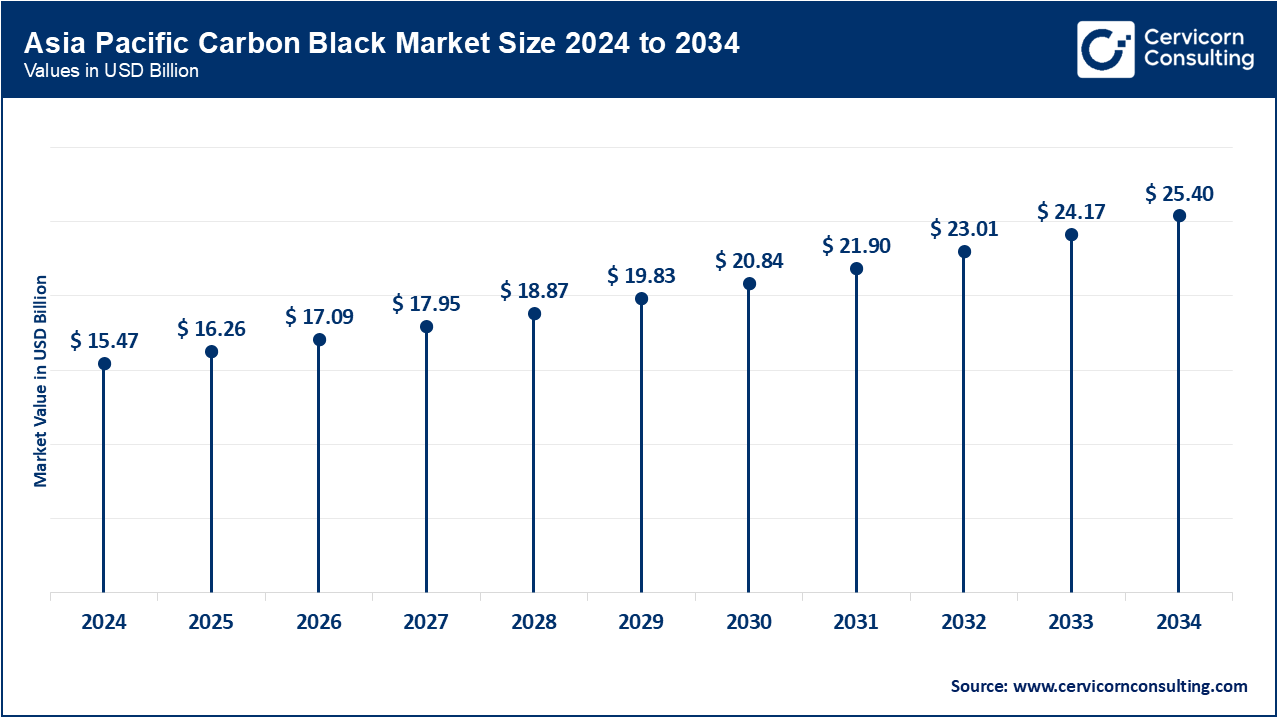

The Asia-Pacific region leads the market. The region’s automotive, construction and plastics industries propel both demand and supply in China and India. For example, Birla Carbon is located in India to serve the growing demand from the tire industry, and Jinzhou Petrochemical manufactures furnace black for the domestic and export market. The region is also driving the demand for specialized carbon black for EV batteries and conductive materials which, in turn, spurs the demand for specialty carbon black for batteries and conductive materials. The region also drives infrastructure construction in high-demand for coatings and sealants with the National Infrastructure Pipeline.

The carbon black market constitutes roughly 15% in North America, where the US leads as the primary contributor. The region's tire replacement sales, automotive manufacturing, and petrochemical specializations drive the demand. For instance, Cabot Corporation produces specialty conductive carbon black used by EV battery magnates such as Tesla and General Motors. The construction industry in the US, projected to exceed USD 2.1 trillion in 2024, creates a requiremnt for carbon black used in construction paints, coatings, and asphalt modifiers. Also, Monolith’s carbon black plant in Nebraska which produce carbon black using hydrogen showcases the regions effort toward sustainable manufacturing and EPA emission compliance.

Europe market is rising with the highest demand coming from Germany, France, and Italy. The region is working on high-performance tires, their specialty, along with eco-friendly coatings and sustainable manufacturing methods. For instance, Orion Engineered Carbons has specialty carbon black plants in Germany which supply to automotive OEMs such as BMW and VW. The EU green regulations like carbon targets and emission caps are pushing low emission production processes.

Carbon Black Market Share, By Region, 2024 (%)

| Region | Revenue Share, 2024 (%) |

| North America | 14.40% |

| Europe | 12.60% |

| Asia-Pacific | 63.10% |

| LAMEA | 9.90% |

Brazil and Mexico are the most important countries for the industry in Latin America. They regionally account for 9% of the global carbon black demand, owing to the automotive and manufacturing industries. As an example, Orion Engineered Carbons has a business in Brazil because the region's tire producers such as Pirelli and Bridgestone are furnace black consumers. Carbon black consumption in Brazil grew steadily, with tire exports surpassing USD 1 billion in 2024. These expenditures were primarily for carbon black utilized in tire production. In construction, infrastructural value investments under the Growth Acceleration Program (PAC) of Brazil are supporting the expansion of carbon black demand in coating and asphalt industry. There is similar steady demand in rubber carbon black for tires and sealing systems for Mexico's automotive exports to the US.

Market Segmentation

By Type

By Grade

By Application

By End User

By Region