The global automotive aftermarket has proven impressively resilient and lucrative, even as it navigates technological disruption and economic uncertainties. Globally, over 2 billion vehicles are expected to be on the road by the mid-2030s, pushing the aftermarket toward the trillion-dollar mark in value.

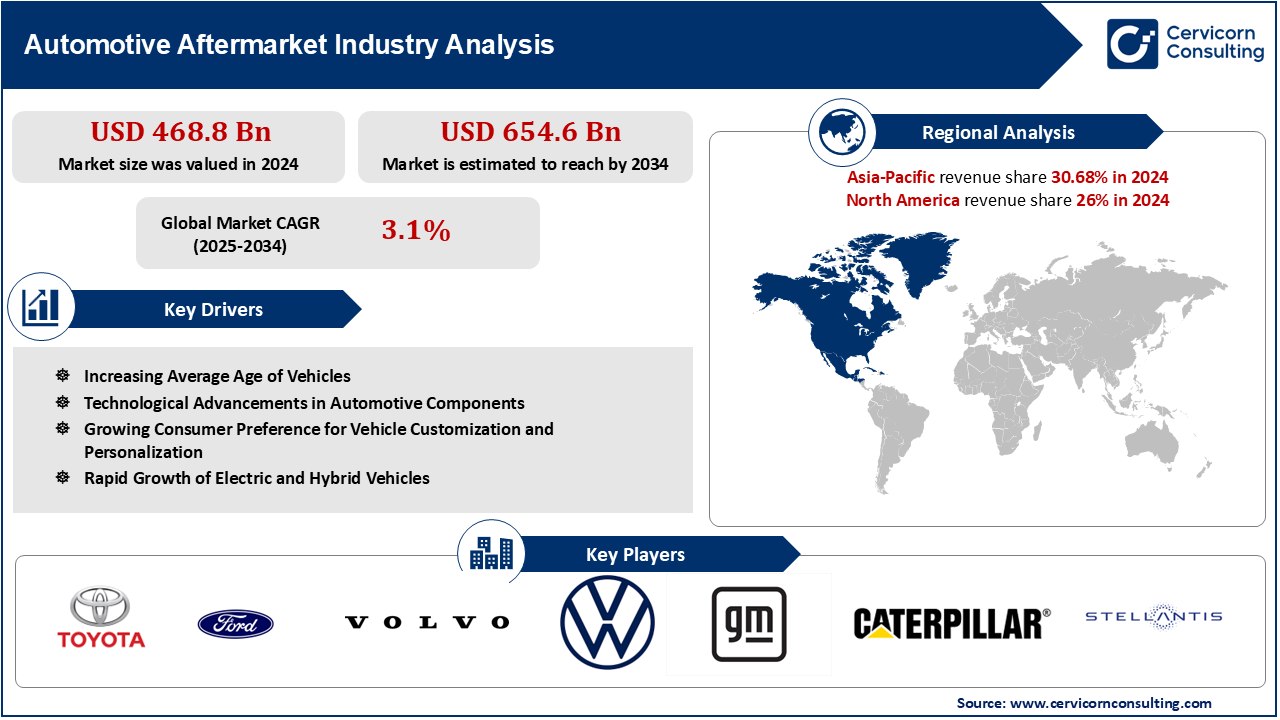

The automotive aftermarket market is around $468.8 billion in 2024, and dominated by replacement parts – from tires and batteries to brake components – and services that keep those billions of vehicles running.

| Category | Value Penetration (%) | Volume Penetration (%) |

| Structural Parts – PV | 27-32% | 12-16% |

| Structural Parts – CV | 40-45% | 15-20% |

| Collision Parts – PV | 70-75% | 85-90% |

| Collision Parts – CV | 60-64% | 85-90% |

| Category | Value Penetration (%) | Volume Penetration (%) |

| Structural Parts – PV | 24-28% | 15-20% |

| Structural Parts – CV | 18-23% | 14-18% |

| Collision Parts – PV | 75-80% | 72-78% |

| Collision Parts – CV | 72-78% | 75-80% |

| Category | Value Penetration (%) | Volume Penetration (%) |

| Structural Parts – PV | 24-28% | 10-14% |

| Structural Parts – CV | 35-38% | 12-16% |

| Collision Parts – PV | 75-80% | 86-91% |

| Collision Parts – CV | 60-65% | 82-86% |

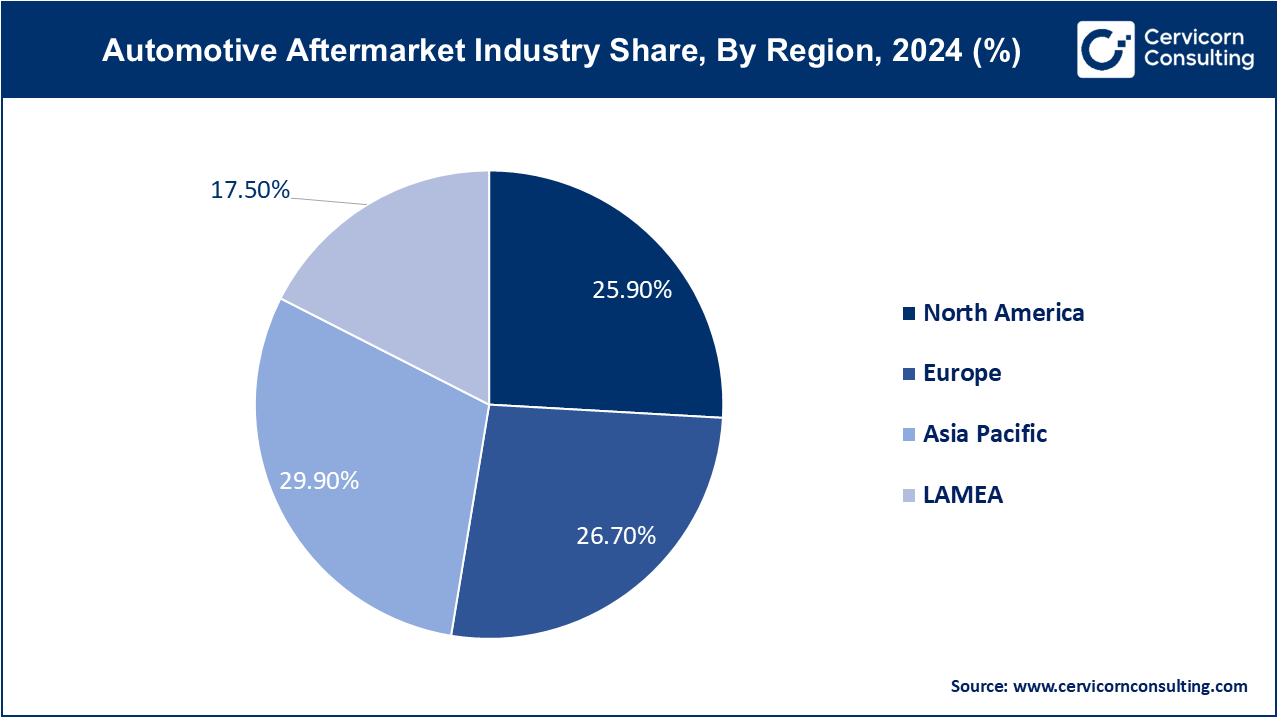

APAC has been the largest and fastest-growing automotive aftermarket globally, underpinned by huge vehicle populations in China, India, and Southeast Asia. In 2024, Asia Pacific accounted for roughly 30% of global aftermarket revenues, the biggest share of any region. China alone, with its enormous car parc, dominated the region’s aftermarket spending in 2024. This dominance is expected to continue over the forecasted period (2025-2034). The Asia-Pacific region will likely be the fastest-growing market through the late 2020s, owing to rising living standards, vehicle ownership growth, and a surging automotive manufacturing base in countries like China, India, and ASEAN nations.

China, in particular, is an aftermarket powerhouse in the making. With new car sales slowing from past double-digit highs, Chinese consumers are keeping vehicles longer and seeking affordable maintenance. The result is a ballooning pool of older, out-of-warranty cars (those 245 million vehicles mentioned earlier) that independent workshops and parts sellers can cater to. Moreover, Chinese consumers are digitally savvy – online parts marketplaces (for instance, Alibaba’s Tmall for auto parts) are extremely popular. It’s no surprise that global and local players are investing heavily in China’s online aftermarket platforms. One analysis by major players projects China’s aftermarket could exceed $100 billion by 2025.

India offers a distinct, yet captivating story of growth. Due to the nation's aging car fleet and rising car ownership, the Indian automotive aftermarket is expanding from a smaller base. Due to their historical cost consciousness and propensity to repair rather than replace, Indian consumers actually increase demand for aftermarket parts, including a substantial gray market for less expensive spares. India's vehicle market is growing, particularly for two-wheelers and reasonably priced cars, as a result of rising disposable income and the desire to own a car. This, in turn, leads to an expansion of the aftermarket. Interestingly, the Indian government has big plans for electrification. By 2030, 30% of new cars are supposed to be electric, according to the "30@30" goal. Currently, EVs are only about 4.3% of new sales (as of 2023), mostly concentrated in scooters, motorcycles, and rickshaws. To push this along, the government launched FAME I and II incentive schemes, and a FAME III is anticipated to further boost EV adoption in the coming years. For the aftermarket, this means the next decade in India will still be dominated by traditional internal combustion engine (ICE) vehicles (since even in 2030, the majority of vehicles on the road will likely be non-electric). Thus, demand for conventional parts (filters, brake pads, engine components) will remain robust through the 2020s. At the same time, a new category of services is emerging – retrofitting CNG kits, converting scooters to electric, setting up charging points at garages, among others.

Beyond China and India, Southeast Asia (countries like Indonesia, Thailand, Malaysia) also offers growth, buoyed by a burgeoning middle class and a love for motorbikes and cars. Many ASEAN markets have high vehicle ownership growth and heavy usage patterns (leading to frequent maintenance needs). Japan, on the other hand, is a more mature market, somewhat akin to Europe – high vehicle density, strong OEM dealer networks, and an aging population (both people and cars). Japanese aftermarket demand is steady but not high-growth, and Japanese consumers are known for regularly maintaining their cars at authorized service centers, which means OEMs capture a large share.

Across Europe, the aftermarket industry stands at a crossroads of opportunity and challenge. This $200+ billion market is mature and has historically been profitable, but multiple forces are converging to reshape its future. Economic headwinds – from persistent inflation eating into drivers’ wallets to energy costs and geopolitical uncertainty – are creating short-term volatility that could dampen spending on car maintenance. More structurally, Europe’s car parc is near saturation; vehicle ownership per capita is high, and new car sales are plateauing or even declining in some countries. An aging population of vehicles (average age >12 years and climbing) has been a boon for independent aftermarket players so far, but the very innovations aimed at sustainability and safety are set to slow aftermarket growth in the long term.

Electrification and regulations loom large in Europe. Stricter emissions rules (like the coming Euro 7 standards around 2025) will push parts recycling, remanufacturing, and cleaner manufacturing practices onto the agenda for all parts suppliers and service shops. This adds both cost pressures and new opportunities – for example, businesses can capitalize on selling remanufactured engines or eco-friendly replacement parts as consumers become more eco-conscious. (Already 75% of consumers in one survey consider a product’s environmental impact when making aftermarket purchases) Many European countries also enforce “right-to-repair” laws and open data access, fostering a favorable environment for independent aftermarket (IAM) companies. As a result, independents command roughly 60% of the market today. This is supported by legislation: indeed, Europe’s regulatory framework actively supports IAM competition – for instance, ensuring that independent garages can access vehicle diagnostic data – whereas in the U.S., OEMs historically hold more sway over aftersales. This difference means European car owners often have more choice in where to service their vehicles, keeping prices competitive and the independent sector strong.

The evolving role of automakers (OEMs) in the aftermarket is one of the most fascinating trends in every region. In the past, independent garages and parts manufacturers handled the majority of the repair market (apart from warranty and dealer service), while OEMs concentrated on selling the next vehicle after a car was sold. OEMs are now actively reclaiming the aftermarket as a key business domain, supported by strategic imperatives and connected car technology. By leveraging each vehicle's lifetime value, they hope to convert one-time car buyers into loyal service clients.

Several strategies highlight this OEM push:

Steering Ahead – Strategies for the Road to 2030

As we’ve traversed the global aftermarket from Europe’s regulation-driven shifts to Asia’s booming demand and the digital revolution everywhere, one thing is clear, change is the only constant. The automotive aftermarket of 2030 will be very different from the one of today; it will be more service-oriented, connected, environmentally friendly, and fiercely competitive. The implications are immediate and strategic for companies in this industry:

Call to Action: The time has come for leaders in the aftermarket to plan ahead and take action. Considering the trends mentioned, honestly evaluate your talent readiness, digital maturity, and strategic positioning. Encourage your teams to think about how your company can not only adapt to the future, but also influence it. For example, you could invest in a neglected local market or test a new service model. Remember that in an industry as broad as the aftermarket, there is no one-size-fits-all playbook. The winners will be those who combine deep market insight with agility and partnership.

We help our clients figure out these complicated futures and come up with winning plans at our consulting firm. We are ready to help with anything from using data to better predict demand to redesigning a supply chain for efficiency and sustainability to coming up with a go-to-market plan for a new digital service. The automotive aftermarket isn't just responding to the future; it's actively shaping it with each new idea. Let's work together to guide your business confidently into 2030 and beyond, turning these problems into a push for long-term growth and success.

Personalize this report to align with your strategy—request here for customization, contact us at sales@cervicornconsulting.com OR +91 74999 31916