The automotive aftermarket—encompassing parts, maintenance services, accessories, and diagnostics—supports the vast fleet of vehicles post-warranty. As vehicles age and the demand for electrification rises, the need for repair, servicing, and replacement parts remains strong. However, geopolitical trade dynamics and digital transformation are reshaping how companies operate and thrive.

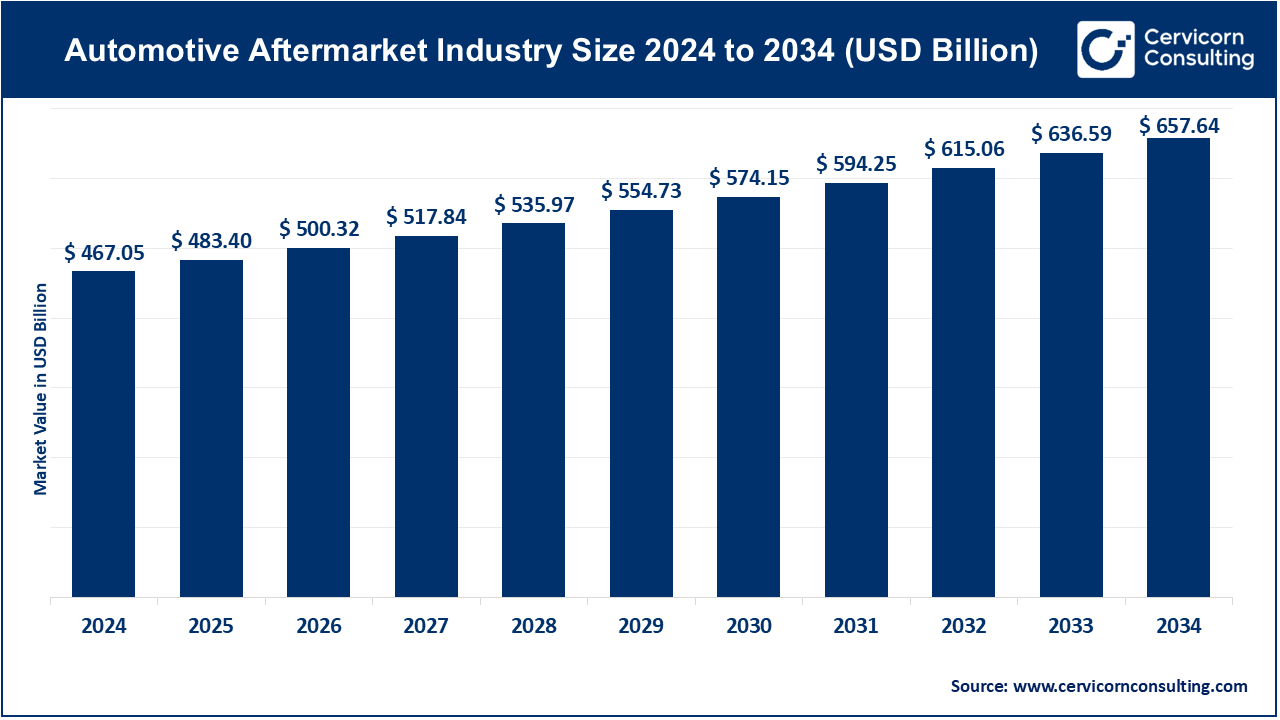

The global automotive aftermarket industry size was reached at USD 468.8 billion in 2024 and is expected to exceed around USD 654.6 billion by 2034, growing at a compound annual growth rate (CAGR) of 3.1% over the forecast period 2025 to 2034.

The automotive aftermarket industry is expanding, due to an increasing average age of vehicles and rising consumer awareness regarding vehicle maintenance. With technological advancements, modern vehicles are equipped with more sophisticated systems, necessitating frequent servicing and part replacements to maintain performance and safety. Additionally, the growing preference for customized vehicles has driven demand for aftermarket accessories like performance parts, aesthetic enhancements, and in-car entertainment systems. In 2023, Germany led automotive parts exports with a value of USD 61.8 billion. The rise of electric and hybrid vehicles (EVs) is transforming the aftermarket industry, introducing new opportunities in EV-specific components, such as battery management systems, charging solutions, and software-based diagnostics. Furthermore, digitalization is playing a critical role, with e-commerce platforms offering consumers easy access to aftermarket products and services.

The automotive aftermarket is a secondary market for vehicles, encompassing all products, services, and solutions after the original sale of an automobile. This includes replacement parts, accessories, equipment, and services for vehicle maintenance, repair, and upgrades. Components like tires, batteries, lubricants, filters, and collision repair parts are critical parts of the aftermarket. Service providers such as mechanics, body shops, and retailers play a significant role in delivering these offerings to consumers. The aftermarket is vital to extending the lifespan of vehicles, ensuring their safety, performance, and compliance with environmental regulations. It is supported by vehicle owners who want to personalize or repair their cars beyond what manufacturers provide. With the rise of electric vehicles (EVs) and advancements in automotive technology, the aftermarket is adapting to new demands, such as EV charging equipment, software updates, and advanced diagnostics.

Key Trends & Industry Drivers

Global Trade & Export-Import Statistics

| Region/Country | Key Trade Data (2023-24) |

| North America (U.S., Canada, Mexico) | 58% of U.S. auto-parts imports from Mexico, 76% of exports to Canada & Mexico |

| Germany | Leading auto-parts exporter: USS 66.5 Bn (14.6% of global auto-parts exports) |

| China | 2nd-largest exporter: USD 53.3 Bn (11.7% global share), a key supplier to ASEAN & EU |

| U.S. Auto-parts Trade Deficit | Estimated at USD 93.5 Bn in 2024, driven by import dependency on Tier-1 and Tier-2 suppliers |

Report Scope

| Area of Focus | Details |

| Market Size in 2025 | USD 468.8 Billion |

| Market Growth Rate | CAGR of 3.1% from 2025 to 2034 |

| Market Size by 2034 | USD 654.6 Billion |

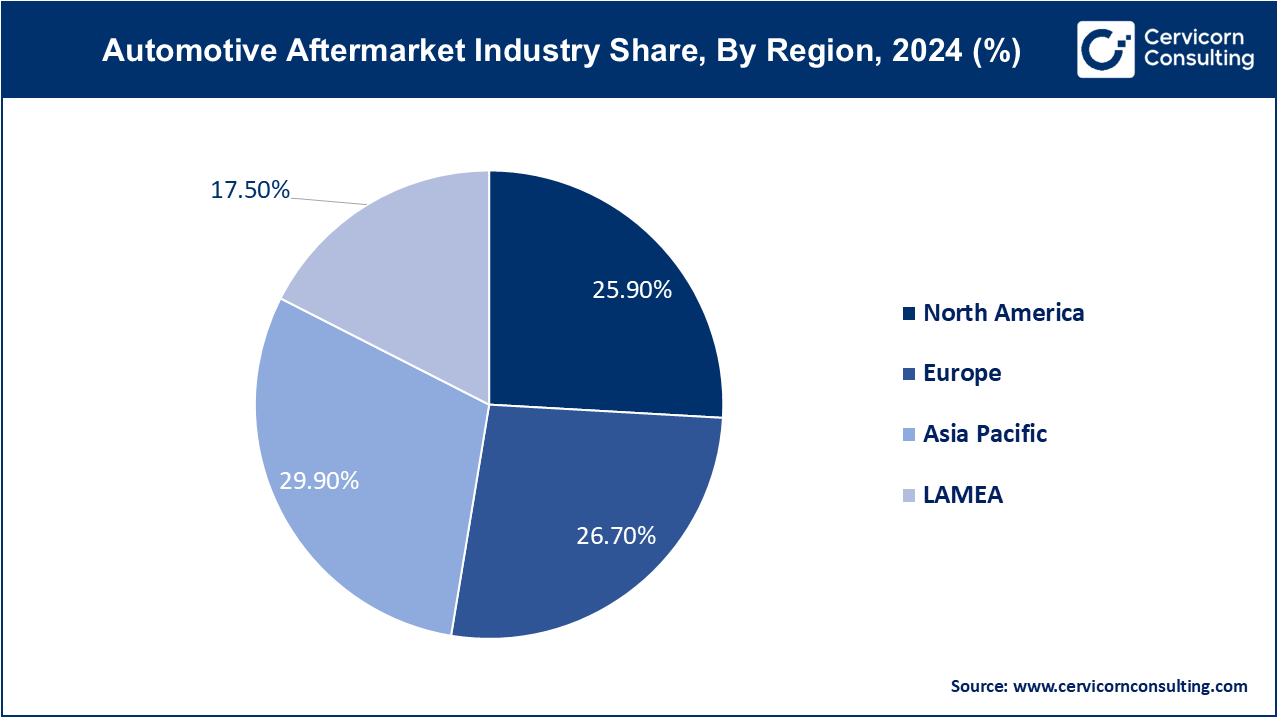

| Largest Market | Asia Pacific |

| Fastest Growing Market | North America |

| Segment Coverage | Product Type, Vehicle Type, Replacement Parts, Distribution Channel, Certification, Service Channel, Region |

Increasing Average Age of Vehicles

The growth of the auto aftermarket industry is certainly fuelled by the rising average age of vehicles, which currently stands at above 12 years in the US. People are now tending to keep cars for longer due to improved vehicle durability and changing ownership patterns, as well as the cost associated with purchasing a new car. Older cars tend to break down more often, and parts such as brakes, tires, and batteries will need to be replaced more often. There is a growing polarization at the low and high ends of the aftermarket economy, with more inexpensive aftermarket products coming into the market, including refurbished parts and expanded warranties. As people drive a car longer, there is positive support for DIY repairs or buying parts through e-commerce. Consumers are looking for new things to do and have the chance to utilize service providers and parts manufacturers with the introduction of EV and hybrid vehicles and parts.

Technological Advancements in Automotive Components

Advancements in vehicle technology are changing aftermarket demands. An increasing demand for parts, repairs, and software is occurring because of enhanced demand of Advanced Driver Assistance Systems (ADAS), and Electric Vehicle (EV) technologies, as well as AI diagnostics. Enhanced aftermarket additions are on the rise such as more elaborate infotainment systems as well as LED illuminated dashboards. Moreover, newer means from materials science for augmenting vehicle performance has been using robust but lightweight structures like synthetic lubricating fluids, ceramic brakes, and advanced composite materials. As vehicles undergo refinements and newer models are rolled out, aftermarket vendors are focusing their research and development, digital initiatives, and other resources to stay competitive. Thus, in the case of the aftermarket parts industry, technology is a driving force for expansion.

Growing Consumer Preference for Vehicle Customization and Personalization

The customization of vehicles has led to new bodywork and styling add-ons which has caused great growth in the aftermarket industry. Younger generations are known to spend considerable amounts on things such as alloy wheels or new audio systems. Social media, along with other online communities, encourages the uniqueness associated with DIY modifications and cars, promoting it further. Aftermarket utilities shift towards a wide variety of modifications such as performance tuning and off-roading enhancements, sometimes even providing eco-friendly options. Self-performed modifications have surged in popularity due to modular customization kits sold by retailers and the ease of acquiring different parts. Moreover, the ability to virtually preview different upgrades further enhances buyer interest. Aftermarket growth is primarily driven by the ever-growing demand for customization from consumers.

Increasing Complexity of Vehicle Technology Leading to Higher Repair Cost

Advanced driver assistance systems (ADAS), electric vehicle (EV) technologies, and vehicle connectivity have remarkably increased the sophistication of modern vehicles. They require specialized tools and certified technicians for repairs. Moreover, proprietary software and their services, along with industry alinged training programs, pose unaffordable challenges to independent repair shops. It forces consumers to have their vehicles serviced at dealer franchises further reducing the savings aftermarkets provide. The way that advanced and integrated professional vehicle software systems with components like smart headlights further undermines the objective of simplifying vehicle repair and maintenance. This further limit people’s ability to DIY repairs while also restricting independent service providers, making competing in the aftermarket difficult.

Growing Competition from OEMs Controlling Access to Vehicle Data and Parts

There is an increasing tendency among independent aftermarket service providers to restrict access to proprietary vehicle information, related diagnostic equipment, and even the tools needed to service these vehicles. The telematics industry combined with proprietary software severely limits the capabilities of third-party diagnostics. These closed ecosystems of parts supply chains serve non-competitive markets. Laws being proposed, like the one Massachusetts is calling the Right to Repair Law, only serve to put the spotlight on these issues without uniform enforcement. Consumers also limit their interaction with vehicle aftermarket services and shift toward dealership services to avoid issues with warranty coverage, thus diminishing the competitive nature of the market. The aftermarket service vehicle industry is greatly stifled from dominating competition, innovation, and emerging technologies because of this control exercised by OEMs.

Rapid Growth of Electric and Hybrid Vehicles

There are vast opportunities in the automotive aftermarket with the introduction of electric and hybrid vehicles. Increased adoption of electric vehicles (EVs) results with new environmental policies and changing preferences which create additional battery diagnostics, thermal management, and high-voltage component repair services. Such transitions also enhance prospects in parts compatible with EVs, infrastructure for charging, and battery recycling. Independent shops will profit from EVspecific training and certification. In addition, smart energy systems and second-life battery applications technologies further deepen aftermarket opportunities. Businesses that complement their research and development to the EV trends and establish strategic alliances will sharpen their competitiveness in the market.

Expansion of E-Commerce and Digital Platforms

The aftermarket is going through tremendous transformation as a result of digitalization, particularly from e-commerce which has enabled effortless acquisition of parts that are customizable. Purchases through online shopping centers, mobile applications, and even AI help for diagnostics and maintenance services have taken a new approach where traditional service centers are less used. Peripherals powered by AR paired with subscription-based services enable installations to be done by customers themselves. AI and predictive tools further personalize and optimize the inventory. Blockchain is improving reliability and trust on the supply chains. The combination of digital retail, virtual help, and real-time analytics serves makes it more convenient which encourages greater customer interaction, leading to faster growth and changing the marketing, selling, and delivery approaches of aftermarket services.

Increasing Demand for Advanced Vehicle Safety and Connectivity Solutions

As consumer interest in advanced telematics with augmented safety features grows, OEMs are integrating ADAS, infotainment, and telematics into older models. Economical add-on kits with lane assist, emergency braking, and blind-spot monitoring are especially favored by safety-conscious consumers. Telematics devices, along with OBD-II dongles, allow real-time diagnostics and enable usage-based insurance, which provides value to both insurers and consumers. At the same time, tech-savvy buyers tend to prefer large displays and smartphone integrations for infotainment upgrades. The aftermarket potential will be further increased with the launch of 5G and V2X connectivity. This shift presents robust opportunities for the suppliers of modular, intelligent, and customizable vehicle enhancement solutions.

Counterfeit Parts

Supply Chain Disruptions

Structural parts: This segment has reported market share of 32% in the year of 2024. In the automotive aftermarket industry, structural parts pertain to the chassis and frame of the vehicle which include part including chassis components, suspension, and axles. These components are essential for the vehicle’s performance and safety, especially in the case of accidents and normal wear and tear. The growing lifespan of vehicles, as well as the commercial and off-roading use of these vehicles, has increased the demand for replacement structural parts. This segment is further fueled by the need for better fuel efficiency and emission control in older vehicle fleets across North America, Europe, and Asia-Pacific owing to the advancements in the use of lightweight materials such as aluminum and composites.

Collision parts: Collision parts comprise of body panels, fenders, bumpers, hoods, lights, etc which get damaged during accidents and therefore have to be replaced often. For collision parts, the major driving force is the repair of vehicles due to insurance claims and increased traffic considered as a runaway economy. Furthermore, the growing number of vehicle registrations as well as rising accident rates in urban areas has further accelerated rate of replacement. OEMs and aftermarket suppliers are more active by diversifying distribution channels to increase the availability of aftermarket parts. The growth of online estimating tools, procurement, and replacement of collision parts has enhanced the efficiency of these processes which has strengthened this segment in both developed and developing economies.

Passenger Vehicles: This segment has garnered the highest market share of 76.96% in 2024. The expansion of the automotive aftermarket industry is mainly driven by passenger vehicles such as sedans, SUVs, and hatchbacks that are frequently serviced and have a global presence. These vehicles require the changing of oil filters, brake pads, and spark plugs among other things. The personal mobility trend, the rise of vehicle ownership in developing countries, and customisation vehicles further enhances demand for these types of vehicles. The increased number of elderly cars still in use are also increasing the need for aftermarket maintenance parts. Furthermore, the increasing availability of electric and hybrid passenger cars creates new opportunities for the industry which focuses on specialized battery components and other EV-specific parts.

Commercial Vehicles: The commercial vehicles segment has registered a market share of 23.4% in 2024. This category incorporates trucks of varying capacities, vehicles used for delivering goods, public transport buses, and specialist commercial vehicles for construction and heavy logistics work. Uptime which fleet operators prioritize greatly impacts spending, encouraging preventive maintenance as the key driver of this aftermarket. The growing level of e-commerce and freight has further increased the number of commercial vehicles globally. Regulatory requirements for emission control and safety attention increase the need to upgraded or replacement parts, especially in Europe and North America where there are stricter control standards for fleet modernization.

Tire: This segment has reported market share of 22.15% in the year of 2024. Tires are essential automotive components that ensure vehicle safety, performance, and fuel efficiency. They include different types like all-season, winter, and performance tires. Growing demand for durable, high-performance tires and increasing popularity of eco-friendly and low-rolling-resistance tires drive the market. Advancements in tire technology, such as run-flat and self-sealing tires, and the rise of online tire retailing are notable trends in the aftermarket.

Battery: Automotive batteries provide the electrical power necessary to start the engine and support vehicle electrical systems when the engine is off. The shift towards electric vehicles (EVs) has spurred demand for advanced batteries like lithium-ion. Additionally, advancements in battery technology, such as enhanced durability and faster charging capabilities, along with increasing sales through online platforms, are prominent trends in the aftermarket battery segment.

Brake Parts: Brake parts include components such as brake pads, rotors, calipers, and brake fluid, essential for vehicle safety and performance. Trends: Increasing focus on vehicle safety drives demand for high-quality, durable brake components. Trends include the development of low-dust and noise-reducing brake pads, the rise of ceramic brake parts, and the growing popularity of electronic braking systems, contributing to the segment's evolution.

Filters: Filters in vehicles, such as oil, air, fuel, and cabin filters, remove contaminants and ensure optimal engine performance and air quality inside the vehicle. Rising awareness of air quality and engine efficiency drives demand for high-performance and eco-friendly filters. Trends include the adoption of nanofiber technology in filters, increasing preference for washable and reusable filters, and growth in online sales channels.

Body Parts: Body parts include components such as bumpers, fenders, doors, and hoods, essential for vehicle aesthetics and protection. The demand for customized and high-quality body parts is rising, driven by consumer preference for vehicle personalization. Trends include advancements in lightweight materials, such as carbon fiber and aluminum, and the growing popularity of aftermarket body kits and accessories for aesthetic enhancement.

Lighting & Electronic Components: This category includes headlights, taillights, interior lighting, and electronic systems like infotainment and navigation units. Advancements in LED and OLED technology are driving growth in the lighting segment, while increasing integration of smart electronics and connectivity features boosts demand for electronic components. Trends include the rise of adaptive lighting systems and the growing popularity of aftermarket infotainment and connectivity upgrades.

Wheels: Wheels, including rims and tires, are crucial for vehicle performance, aesthetics, and safety. The aftermarket wheel segment is driven by consumer desire for customization and performance enhancement. Trends include the rise of lightweight alloy wheels, the popularity of larger diameter wheels for aesthetic appeal, and increasing sales through online platforms offering a wide range of customization options.

Exhaust Components: Exhaust components, such as mufflers, catalytic converters, and exhaust pipes, are essential for controlling vehicle emissions and noise. Stricter emissions regulations drive demand for advanced exhaust components. Trends include the development of high-performance and eco-friendly exhaust systems, the increasing popularity of aftermarket performance exhausts, and growing consumer preference for stainless steel components for durability and aesthetics.

Turbochargers: Turbochargers are forced induction devices that increase engine power and efficiency by forcing more air into the combustion chamber. Rising demand for fuel-efficient and high-performance vehicles drives the aftermarket turbocharger segment. Trends include the development of advanced turbocharging technologies, such as variable geometry turbochargers (VGTs), and the growing popularity of turbocharger upgrades among performance enthusiasts.

Others: This category includes miscellaneous aftermarket components such as suspension parts, engine components, and interior accessories. The demand for high-performance and customized components drives growth in this diverse segment. Trends include the rise of advanced suspension systems for better handling, increasing adoption of performance-enhancing engine parts, and the growing popularity of interior upgrades such as custom seats and infotainment systems for enhanced comfort and connectivity.

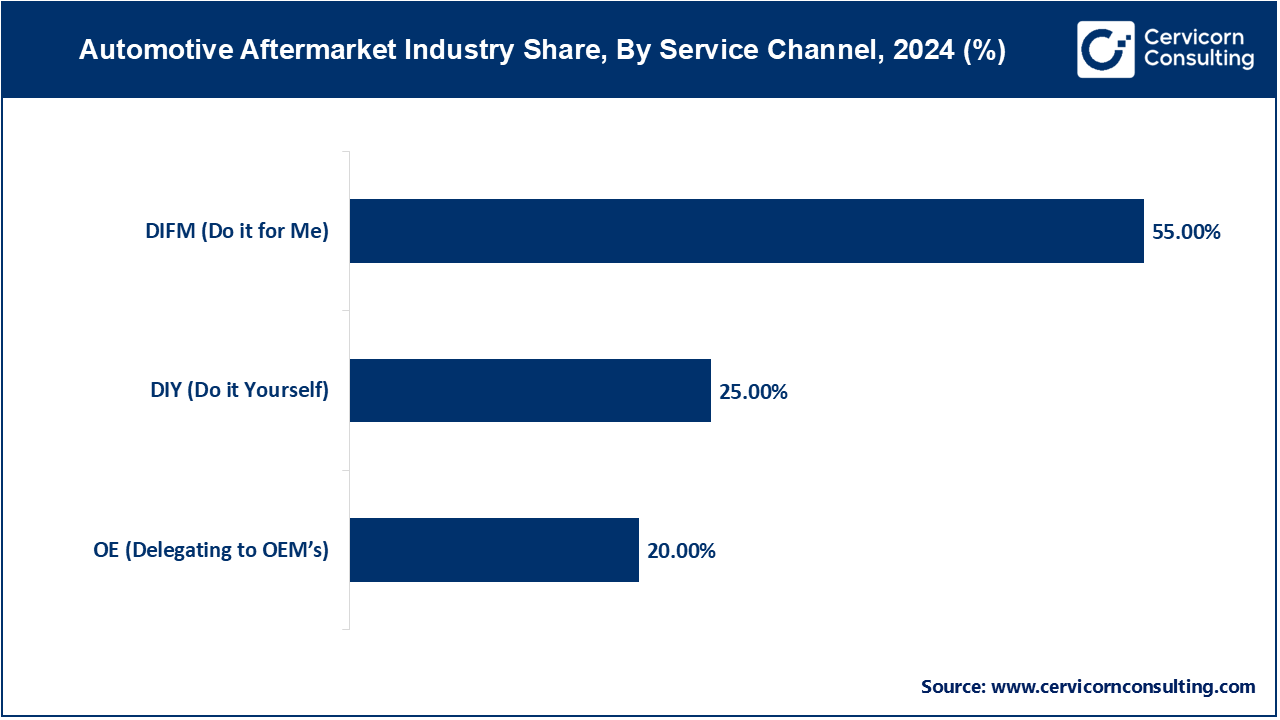

DIY (Do it Yourself): This channel segment has registered market share of 25% in 2024. DIY in the automotive aftermarket industry refers to vehicle owners performing maintenance, repairs, and upgrades themselves, using tools and parts purchased from retailers. The DIY segment is growing due to increased access to online tutorials, instructional videos, and readily available parts through e-commerce platforms. Enthusiasts and cost-conscious consumers are driving demand for user-friendly products and comprehensive repair kits, contributing to the segment's expansion.

DIFM (Do it for Me): The DIFM channel segment has garnered highest market share of 55% in 2024. DIFM involves vehicle owners outsourcing maintenance, repairs, and upgrades to professional service providers, such as mechanics and auto repair shops. The DIFM segment is expanding as vehicles become more technologically complex, requiring specialized knowledge and tools for repairs. Convenience and the assurance of professional expertise are driving more consumers to opt for professional services. Additionally, the growth of service chains and franchises is enhancing accessibility and trust in DIFM services.

OE (Delegating to OEMs): The OE service channels segment has considered a small market share of 20% in 2024. OE service channels refer to vehicle owners delegating maintenance, repairs, and parts replacement to Original Equipment Manufacturers (OEMs) and their authorized service centers. The OE segment benefits from consumer trust in OEM quality and warranty assurances. As vehicles incorporate advanced technology, the need for specialized diagnostics and genuine parts increases, driving more consumers to OEM service centers. OEMs are also expanding their service offerings and investing in customer loyalty programs to retain and attract customers.

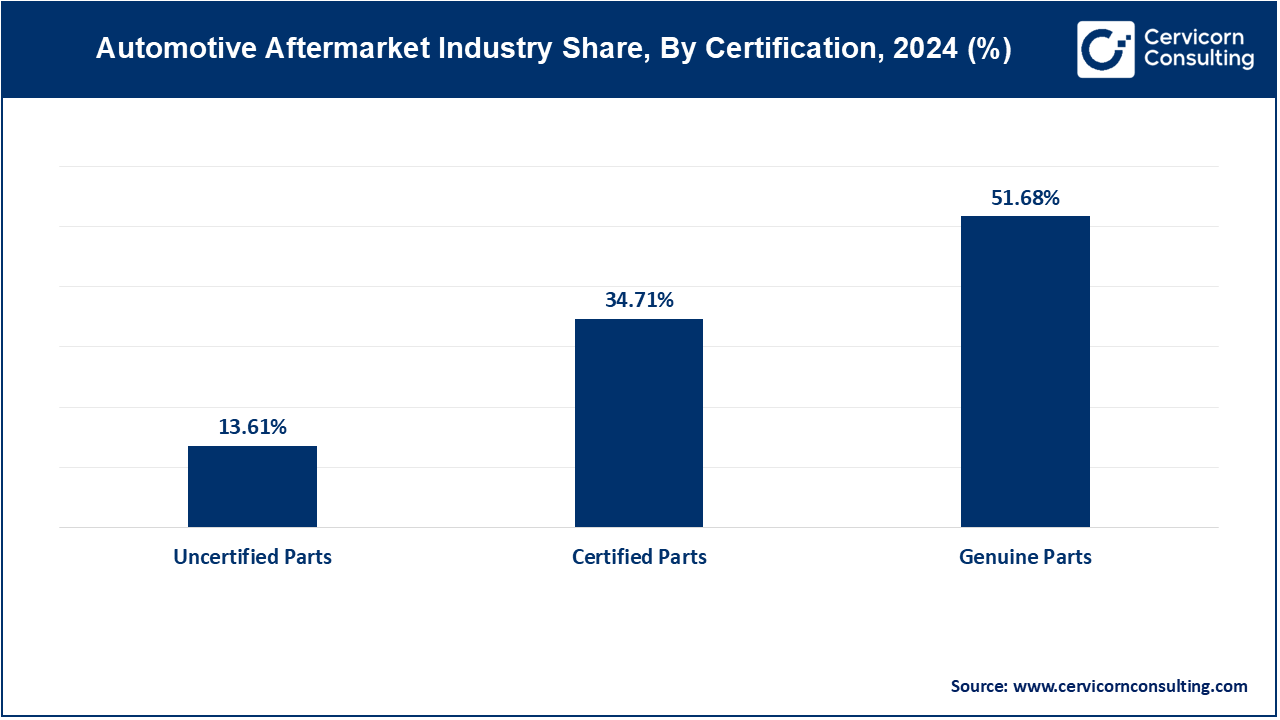

Genuine Parts: The genuine parts segment has confirmed highest market share of 50.31% in 2024. Genuine parts are OEM (Original Equipment Manufacturer) components produced by the vehicle’s manufacturer or authorized suppliers. These parts are designed to meet the exact specifications and quality standards of the original equipment. Trends indicate a growing preference for genuine parts due to their reliability and compatibility, often backed by warranties and a higher assurance of performance and safety.

Certified Parts: This segment has captured market share of 32.24% in the year of 2024. Certified parts are aftermarket components that have been tested and approved by a recognized third-party organization for quality and performance. These parts meet specific industry standards and are often endorsed by manufacturers. Trends show increasing consumer trust in certified parts as they offer a balance between quality and cost, and are increasingly available through reputable suppliers.

Uncertified Parts: In 2024, the uncertified parts segment has recorded market share of 17.45%. Uncertified parts lack formal testing and approval by recognized organizations. They are typically less expensive but may vary widely in quality and performance. Trends reveal that while some consumers seek these parts for cost savings, the risk of poor performance and safety issues poses significant concerns, leading to growing industry efforts to increase awareness and regulation of these components.

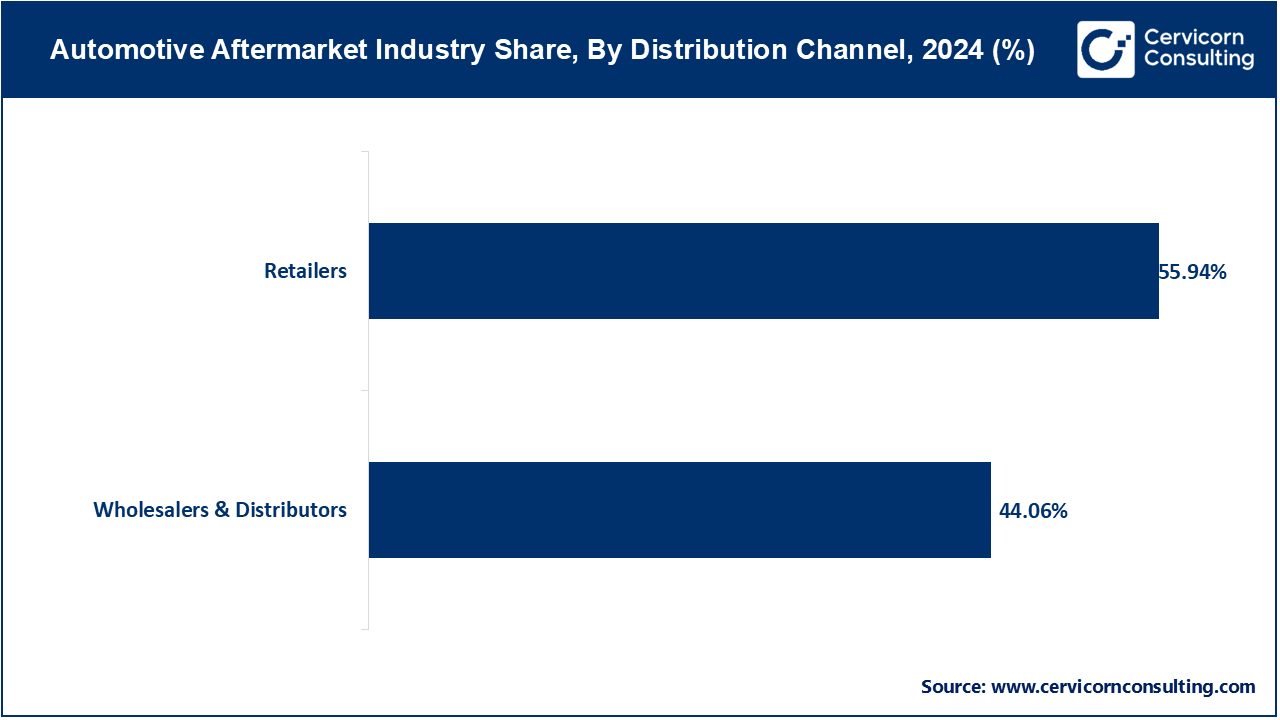

Retailers: The retailers segment has covered market share of 44.13% in 2024. Retailers in the automotive aftermarket industry sell parts and accessories directly to consumers. Trends include the rise of online retail platforms offering convenience and competitive pricing, and an increase in physical store formats focusing on personalized customer service. Retailers are also expanding their product ranges to include more advanced and high-tech automotive products.

OEMs: Original Equipment Manufacturers (OEMs) produce parts and components that are used in new vehicles and also provide replacement parts. Trends include a growing focus on high-quality, reliable components and expanding product lines to include advanced technologies. OEMs are increasingly involved in the aftermarket to ensure parts compatibility and maintain vehicle performance standards.

Repair Shops: Repair shops provide maintenance and repair services for vehicles, using aftermarket parts. Trends show a rise in specialized repair shops focusing on advanced technologies, such as electric and autonomous vehicles. There is also growth in mobile repair services, offering convenience and immediate service to consumers at their locations.

Wholesalers & Distributors: Wholesalers and distributors act as intermediaries between manufacturers and retailers or repair shops, managing bulk inventory and logistics. The wholesalers and distributors segment has generated largest market share of 47.16% in the year of 2024. Trends include the adoption of digital platforms for inventory management and order processing, and enhanced focus on supply chain efficiency to meet the increasing demand for automotive parts promptly.

Others: This segment includes e-commerce platforms, aftermarket service providers, and automotive parts manufacturers. Trends involve the expansion of digital marketplaces, integration of smart technologies for better diagnostics and services, and growth in subscription-based models for regular maintenance and upgrades, reflecting evolving consumer preferences and technological advancements in the automotive sector.

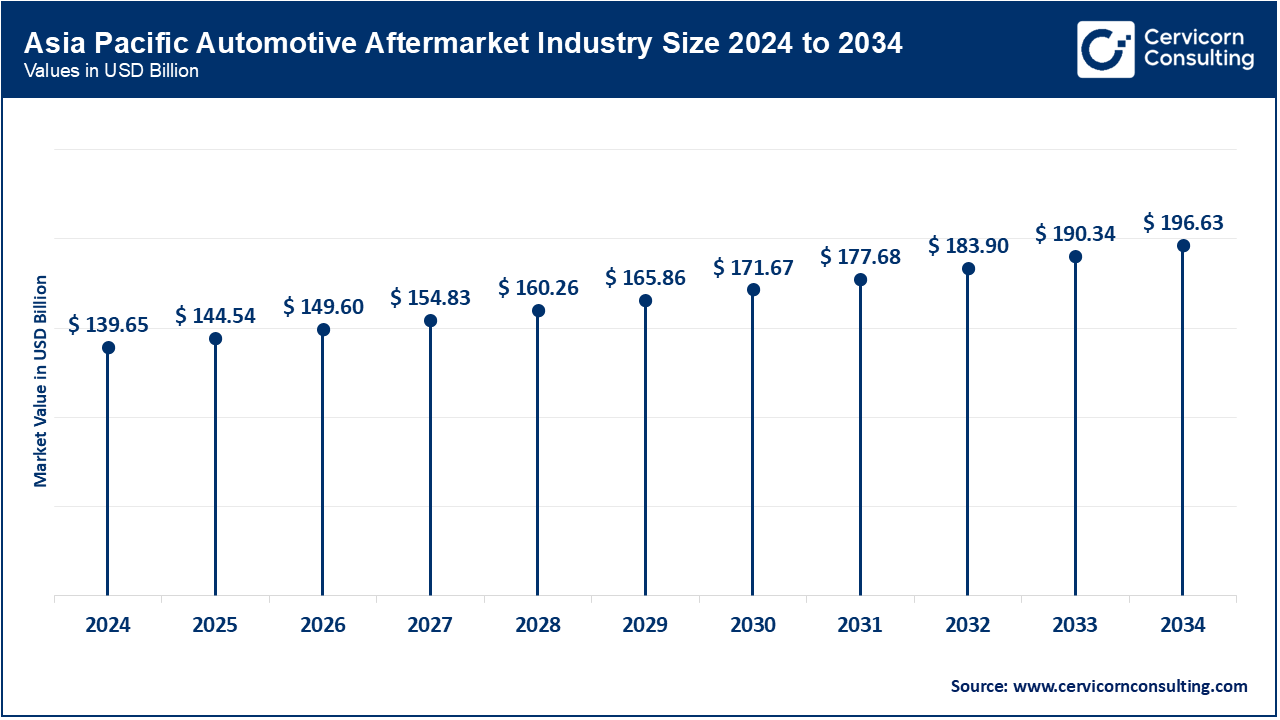

The Asia Pacific market size is calculated at USD 143.8 billion in 2024 and is projected to grow around USD 201.8 billion by 2034 with a CAGR of 3.1%. In the Asia-Pacific region, the automotive aftermarket is expanding rapidly due to rising vehicle ownership and urbanization. Trends include a surge in demand for affordable and locally produced parts, increased investment in e-commerce platforms, and significant growth in repair and maintenance services. The region also faces challenges related to counterfeiting and supply chain issues.

The North America market size is expected to reach around USD 165.3 billion by 2034 increasing from USD 121.9 billion in 2024 with a CAGR of 2.8%. In North America, the automotive aftermarket is characterized by a high demand for advanced automotive technologies and performance parts. Trends include significant growth in online sales platforms, reflecting a shift towards digital purchasing, and an increasing focus on sustainability with eco-friendly parts and services. There is also a rise in premium and specialty parts due to higher consumer spending power.

The Europe market size is measured at USD 127.0 billion in 2024 and is expected to grow around USD 175.6 billion by 2034 with a CAGR of 3%. Europe’s automotive aftermarket industry is driven by stringent environmental regulations and a strong focus on sustainability. Trends include a growing emphasis on green and recyclable parts, adherence to strict emission standards, and the expansion of electric vehicle (EV) aftermarket services. The region also sees high adoption rates of advanced driver-assistance systems (ADAS) and other technology upgrades.

The LAMEA market size is forecasted to reach around USD 111.8 billion by 2034 from USD 76.1 billion in 2024. In LAMEA (Latin America, Middle East, and Africa), the automotive aftermarket is experiencing growth driven by increasing vehicle fleets and improving economic conditions. Trends include a rising preference for cost-effective and durable parts, expansion of repair services in underserved markets, and growing adoption of digital and mobile technologies. Challenges include logistical difficulties and varying regulatory environments across countries.

Companies like Rival Technologies and LumenField are leveraging innovation by integrating advanced technologies like AI and blockchain into their automotive aftermarket solutions, enhancing diagnostics and parts traceability. AutoZone, O'Reilly Automotive, and Advance Auto Parts dominate through extensive distribution networks, strong brand recognition, and broad product offerings. They lead with innovations in e-commerce platforms, robust supply chains, and extensive customer service networks, ensuring comprehensive coverage and convenience for consumers across diverse markets.

Key Players Market Share

| Company Name | Market Share (%) |

| Toyota | 3.3-3.8% |

| Volkswagen Group | 3.1-3.5% |

| General Motors | 2.7-3.0% |

| Ford | 2.5-2.8% |

| Stellantis | 2.2-2.5% |

| Daimler | 1.1-1.2% |

| Volvo Group | 0.5-0.7% |

| Paccar | 0.2-0.4% |

| Caterpillar | 0.5-0.6% |

| John Deere | 0.4-0.5% |

| Others | 81%-83.5% |

Market Segmentation

By Product Type

By Vehicle Type

By Certification

By Distribution Channel

By Replacement Parts

By Service Channel

By Region