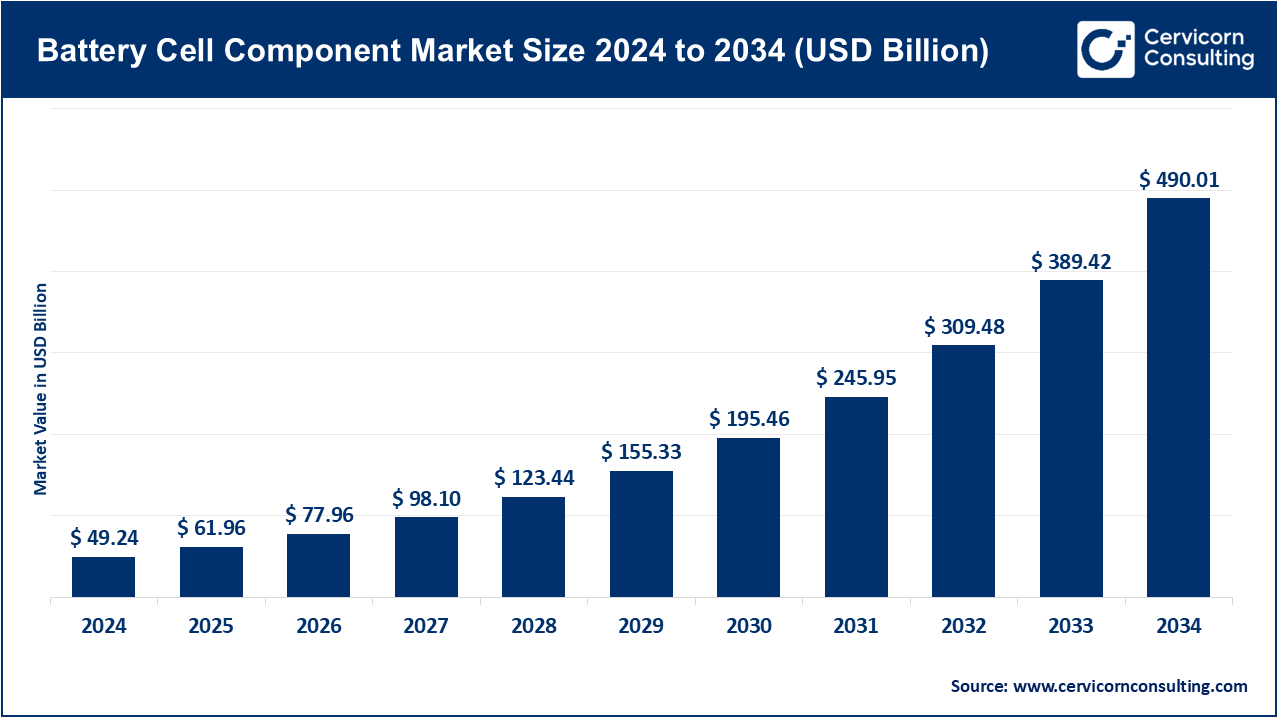

The global battery cell component market size was valued at USD 49.24 billion in 2024 and is expected to hit around USD 490.01 billion by 2034, growing at a compound annual growth rate (CAGR) of 25.83% over the forecast period from 2025 to 2034. The expanding adoption of electric vehicles (EVs), along with the need for EVs to have faster charging capabilities and improved safety features, is bolstering growth in the battery cell component market and, in turn, the automotive sector. Innovation within the market’s primary constituents, including cathodes, anodes, and electrolytes, is essential to performance. With advancements in battery technology, these components will greatly influence the efficacy and environmental impact of vehicles over time. This positions the Battery Cell Component industry as a crucial driver of the worldwide transition toward electrified vehicles.

An electrochemical cell, the fundamental building block of a battery, includes a battery cell component. These elements are necessary for electrical energy to be stored and released. The anode, or negative electrode, the cathode, or positive electrode, and the electrolyte, which facilitates ion movement between them, are the main constituents. One essential safety element that keeps the anode and cathode from coming into contact and short-circuiting is a separator. Lastly, the charge is collected from the electrodes and moved to the external circuit using current collectors. These components work together to create a whole electrical generation system.

Report Scope

| Area of Focus | Details |

| Market Size in 2025 | USD 61.96 Billion |

| Expected Market Size in 2034 | USD 490.01 Billion |

| Projected CAGR | 25.83% |

| Leading Region | Asia-Pacific |

| Key Segments | Component, Material, Battery Type, Application, End-Use Industry, Region |

| Key Companies | CATL, LG Energy Solution, Panasonic Energy Co., Ltd., Samsung SDI Co., Ltd., BYD Company Limited, SK On Co., Ltd., Hitachi Chemical Co., Ltd., BASF SE, Umicore, POSCO Future M, Sumitomo Metal Mining Co., Ltd., Albemarle Corporation, Mitsui Mining & Smelting Co., Ltd., Entek International |

Cathode: In a battery cell, the cathode is a positive electrode that charges and discharges lithium ions. In March 2024, LG Chem revealed the construction of an ultra-high nickel cathode factory in Poland to meet the needs of European EV market. This is a step towards adopting high-energy cathode technologies. Competitors are rushing to market nickel rich and cobalt low hyper-cathodes. To keep up with the trend, new cathode R&D labs in North America were opened in November 2023.

Battery Cell Component Market Share, By Component, 2024 (%)

| Component | Revenue Share, 2024 (%) |

| Cathode | 45.70% |

| Anode | 34.20% |

| Current Collector | 20.10% |

Anode: Anodes are the negative electrodes of the battery and are usually made of graphite or silicon based compounds which allow for storing lithium ions. U.S. Start-up launched a pilot program with silicon-infused anode content, which increases energy density by 20% in September 2022. This led to a partnership with major cell-makers in May 2023. In addition, new purification features for high-purity anodes are an increased focus in February 2024 by Asian graphite suppliers.

Current Collector: Current collectors are conductive metal folds that transport electrons from electrodes to the outer circuit. In June 2023, a research consortium demonstrated a mild aluminum-based collector with a reduction in weight reduction in 27% and 85% cost of pilot production. By October 2024, licensing talks with EV battery manufacturers continue. This technique has the ability to change cell efficiency. In March 2025, several patent applications were indicated by the strong industry interest in the next generation of collector content.

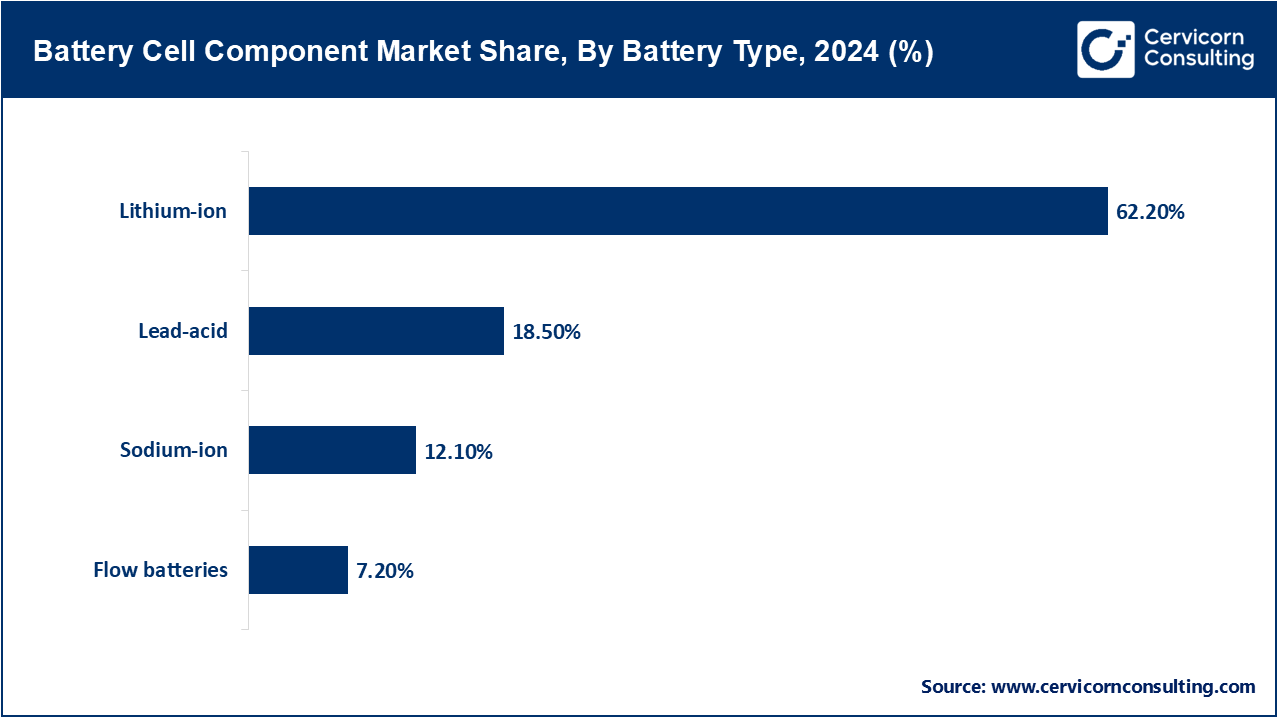

Lithium ion: Lithium-ion batteries continue to use lithium-based chemistry and are used heavy in consumer electronics as well as motor vehicle industry. In April 2023, CATL opened a mega-factory in Germany to produce low-priced cylindrical lithium-ion cells for European EVs. Cell manufacturers focus on new electrolyte additives for long -term life and fast charging. An initiative has begun in November 2022 on the battery recycling that focuses on lithium-ion components, progressing towards improving stability. Constant progresses help to enable scaling for the next- General Aviation, grid storage and mobility devices.

Lead acid: Lead-acid batteries which have lead dioxide as the cathode are common in starter and UPS systems. In August 2022, the manufacturers better AGM (absorbed glass mats) variants with enhanced charge retention for telecom infrastructure. A recycling plant in India started on June 2023 with a joint venture to recover lead and sulfuric acid from spent batteries. This enhances circularity while also aiding local grid-backup applications. The area still has low cost, reliable existance with increased lead-acid battery chemistry.

Sodium ion: The sodium-ion battery substitutes sodium for lithium, enabling lower cost and better resource preservation for large-scale storage. In November 2023, BYD and Huaihai started construction of a 30 GWh sodium-ion plant in China intended for use in stable and entry-level EVs. In June 2024, Cattle revealed his second-generation sodium with improved bicycle life which he collaborated with European storage integrators. Developers are working on sodium compatible electrolytes and dividers aimed for commercialization by 2025.

Flow battery: The Flow battery stores energy in liquid electrolytes in external tanks for grid level storage. An Australian company piloted vanadium redox flow systems at a utility-scale solar farm in May 2022. A US grid operator contracted deployment of a megawatt scale zinc-iron flow system for frequency stabilization in September 2024. These projects highlight the increasing need for long-duration storage. Other focusing on flow battery components are improving membranes and flow stacks in anticipation of a wider deployment.

Lithium: Lithium is an essential raw material for the chemistry of lithium-ion cells, determining their energy storage capacity. In July 2023, Australian miners started new lithium carbonate production facilities aimed at meeting battery-grade specifications for North America. A joint venture in Argentina started expanding lithium brine processing to 40,000 t/year in February 2024. This bolstered supply security for cathode and electrolyte suppliers. Programs aimed at price stabilization for supply and investment support were initiated in December 2022. These were designed to address payment shocks as well as foster investment to improve component value.

Cobalt: Cobalt increases the stability and the energy density of battery cathodes supplied. There are still some concerns about cobalt supply. A Canadian producer opened an ethically sourced cobalt refinery in March 2022, which granted full traceability certifications. In August 2022, an OEM major issuer committed to reduce cobalt content by 50% in the next generation cathodes. Cobalt-free cathode pilot trials reached pilot status in Europe in May 2024. While sourcing performance, suppliers are adjusting high energy hyphenate strategies.

Battery Cell Component Market Share, By Material, 2024 (%)

| Material | Revenue Share, 2024 (%) |

| Lithium | 36.20% |

| Cobalt | 28.50% |

| Manganese | 22.30% |

| Phosphate | 13% |

Manganese: Manganese is utilized in cathodes for its safety and cost-effectiveness benefits relative to nickel-high chemistries. In October 2023, a U.S. cathode manufacturer claimed to commercialize manganese-rich materials with 80% of the output domestically produced. A European consortium initiated large-scale testing of high-manganese LMFP cells in February 2024. These cells are expected to have improved temperature tolerance and decreased reliance on nickel. The component manufacturers are fine-tuning cobalt-free electrolytes specifically designed for use with manganese-based cathodes.

Phosphate: Phosphate-based cathodes (LFP) provide high thermal stability and cycle life without the cobalt or nickel. In May 2023, the Tesla and Panasonic announced new LFP production lines in North America to support the market on a large-scale market EVS. In August 2024, Chinese LFP manufacturer Gotian High-Tech began supply of cell-grade phosphate materials to European vehicle manufacturers. Sequential phosphate electrolytes and binders are now in pilot production for LFP chemistry, strengthening the demand for budget EVS and stable storage.

Electric Vehicles (EVs): Applications of EVS increase the requirement of battery cell parts in which the range, safety features are customized, and can charge quickly. As an example, in March 2024, Ford launched an EV battery development project in Tennessee to secure the cathode and electrolyte supply for its future BEVs. These original equipment manufacturers (OEM) parts continue to deal with supply with growers. The component lines were extended in July 2022 to complete EV rollouts in Europe and Asia. In November 2023, components were further advanced due to improvement in thermal management and capacity in fast-charge engineering.

Consumer Electronics: Portable electronics depend on cell parts being small in size and advanced in performance, spurring advances in electrode scaling. Anode suppliers integrated with smartphones to augment materials for better battery performance which was done in June 2022. Two wearable device batteries with pliable current collectors began pilot production in October 2023. In April 2024, key players in laptop manufacturing adopted high-nickel cathode materials for slimmer designs. The focus of component suppliers is to meet size reduction requirements as well as provide features that allow for rapid charging.

Battery Cell Component Market Share, By Application, 2024 (%)

| Application | Revenue Share, 2024 (%) |

| Electric Vehicles (EVs) | 42.80% |

| Consumer Electronics | 25.10% |

| Energy Storage Systems (ESS) | 23.40% |

| Aerospace & Defense | 8.70 |

Energy Storage Systems (ESS): Long-lasting grid and building energy storage require durable and safe battery parts. A U.S. energy company implemented a 200 MWh lithium-ion ESS with in-country sourced electrolytes and separators in May 2023. By September 2024, contractors integrated flow battery-based energy storage systems units with advanced membranes for utility resiliency. Stricter global cell safety and cycle-life standards went into effect that year. Suppliers responded by launching component lines to meet the newly installed grid-code requirements.

Aerospace and defense: Aerospace and defense demand for ultra-wide battery components for rigid environment. A defense contractor evaluated a solid-state battery pack for satellite missions with specialized separators in August 2023. An European Space Agency approved the cobalt-free cathode system for drone applications in February 2025. These projects require ultra-light current collectors and high-purity material. Components are sewing materials to follow the MIL-STD and aviation certificates.

Automotive: Automotive systems require batteries with high cycle life, thermal safety, and crash safety. In 2024, a major OEM certified high-nickel cathodes from a new North American plant for passenger EVs. Separators passed the enhanced puncture-resistance testing a year later. Non-flammable Automotive Pack Electrolytes were branded late in 2023. Component performance standardization is a developing criteria for temperature and misuse scenarios. Automotive demand is going on for anchor component market growth.

Consumer Electronics: Small size and longevity with fast-charging capacity are optimal for battery cell components used in electronics. A portable gaming company released high energy cathodes to sustain a 12-hour playtime in 2022. Flexible current collectors were incorporated into ultra-thin tablets by 2023. By 2024, manufacturers of wearables demanded new separators to meet IP68 requirements. Chemistries designed specifically for AR and voice assistant devices are in development. The priorities for this segment focus on miniaturization and increased durability.

Battery Cell Component Market Share, By End User, 2024 (%)

| End User | Revenue Share, 2024 (%) |

| Automotive | 39.60% |

| Consumer Electronics | 29.70% |

| Healthcare | 16.40% |

| Aerospace | 14.30% |

Healthcare: Medical devices such as portable diagnostics and pacemakers require batteries that are both long-lasting and reliable. A medical battery manufacturer announced a new lithium-ion line approved for implantable devices in 2022. In 2023, researchers created biodegradable separators for diagnostic devices which are now undergoing pilot trials. By 2024, sterile electrolyte formulations were set to commence GMP-compliant production for use in hospitals. These advancements indicate increasing industry shifts towards certified medical battery technologies. Component selection focuses on safety, reliability, and size in the healthcare sector.

Aerospace: The aerospace industry requires extreme temperature tolerance and high energy density for battery components. In 2023, a European aircraft consortium tested solid-state cells with titanium reinforced current collectors. NASA completed flight tests with cobalt-free high-performance cathodes for lunar rover use in 2024. Suppliers are creating aerospace-grade micro-meteoroid puncture resistant separators. Certification processes have started with the aviation authorities. Lightweight and rugged cell components remain critical to future crewed and unmanned aviation missions.

The battery cell component market is segmented into several key regions: North America, Europe, Asia-Pacific, and LAMEA (Latin America, Middle East, and Africa). Here’s an in-depth look at each region.

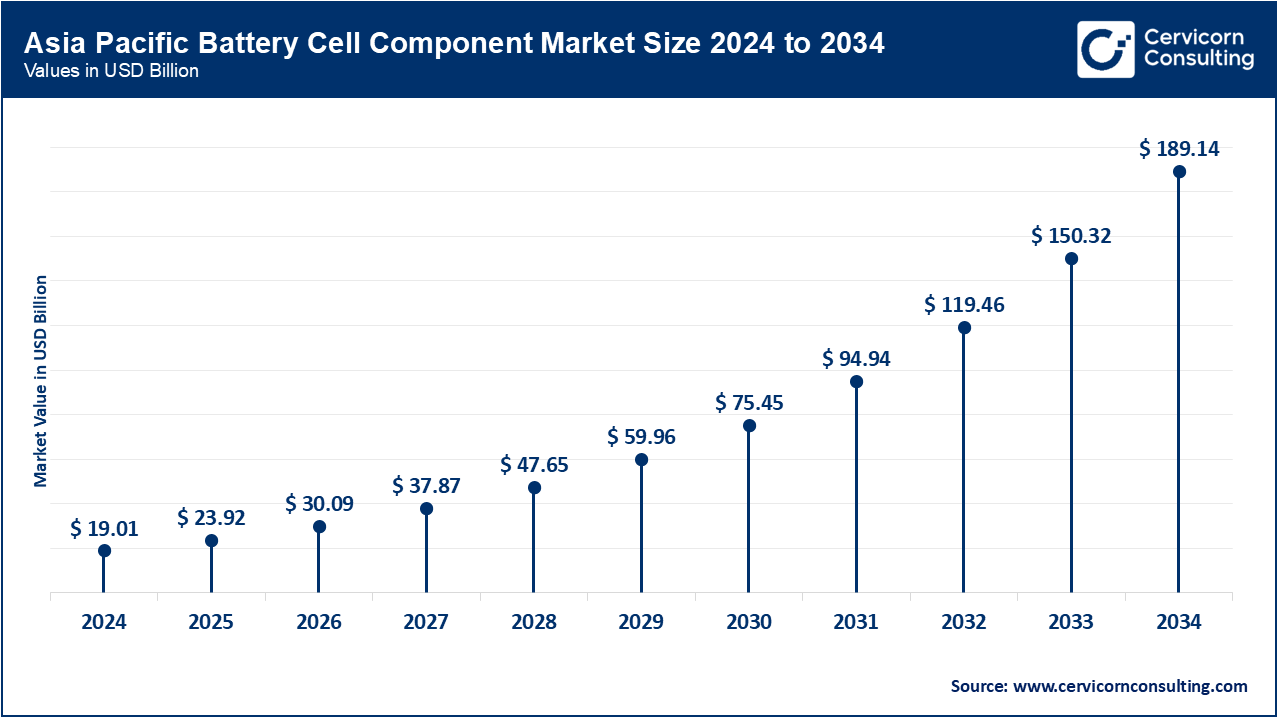

The Asia-Pacific region stands as the foremost global producer and consumer of battery cell components due to the ample raw materials and keen demand for electronics and electric vehicles (EVs). China, Japan, and South Korea continue to lead the region, with new additions like India and Taiwan strongly emerging. In September 2022, BYD and Huaihai commenced construction of a 30 GWh sodium-ion battery plant in China, which will serve the regional stationary storage and economical EV markets. This project illustrates the pace of innovation and scale of next-gen component technologies in the Asia-Pacific.

This region represents the rapidly developing market with high Electric Vehicles usage, government policies, and increasing battery production facilities. It includes old economies like the US and Canada as well as newer ones like Mexico and Central America. in June 2024 Asahi Kasei announced a US$1.6 billion separator plant in Ontario, Canada, which is meant to service the North American EV market. Such investments demonstrate the increasing responsiveness of local manufacturing of battery cell components to the drive towards regional electrification.

Europe remains one of the main regions for battery components production due to the improvement of the automotive industry and the strive for an emission economy. Eastern and southern European countries as well as Germany, France, and the UK show increasing investment in automotive manufacturing. A CATL’s first European battery-grade lithium plant In Thuringia, Germany marks a significant step towards the localization of supply chains for cathodes and electrolytes which first became operational in April 2023. This moves underscores the growing belief in onshore component supply across the continent.

Battery Cell Component Market Share, By Region, 2024 (%)

| Region | Revenue Share, 2024 (%) |

| North America | 45.70% |

| Europe | 34.20% |

| Asia-Pacific | 20.10% |

| LAMEA |

LAMEA comprises Brazil and the rest of the Middle East and Africa, forming new markets for battery components in Latin America, and the Middle East and Africa because of their incipient EV ecosystem and need for utility-scale storage. The driving force for this region is energy transition policies and available resources. A Brazilian energy company Sao Paulo is ready to launch a flow-battery storage feature, designed to balance electrical fluctuations in the grid with regionally formed electrolyte and membrane components in November 2024. The project displays the expanded innovation center of LAMEA using advanced storage technologies and regional produced components.

Market Segmentation

By Component

By Battery Type

By Material

By Application

By End-Use Industry

By Region