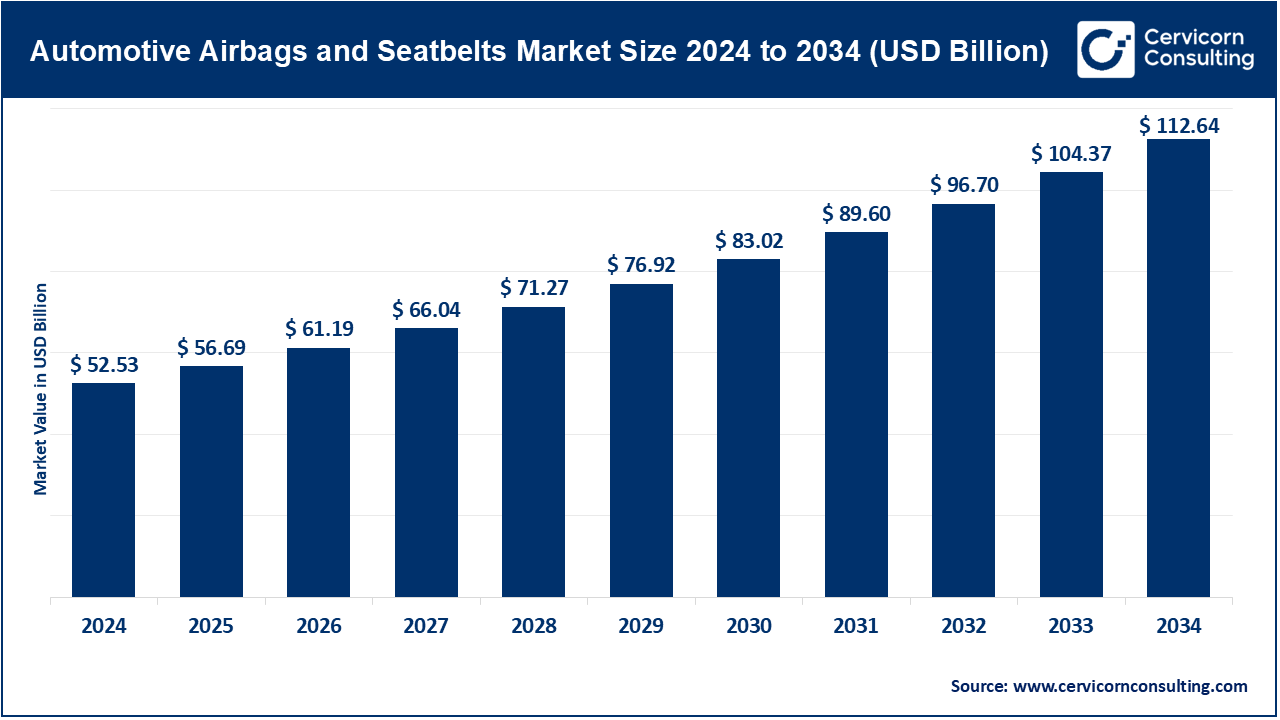

The global automotive airbags and seatbelts market size was estimated at USD 52.53 billion in 2024 and is anticipated to reach around USD 112.64 billion by 2034, growing at a compound annual growth rate (CAGR) of 7.93% over the forecast period from 2025 to 2034. The automotive airbags and seatbelts market is in the midst of a high growth rate and expanding globally due to the heightened vehicle safety, tough government rules and increased adoption of advanced driver assistance systems (ADAS). Other innovations automakers are seeking to improve on include smart airbags, pre-tensioner seatbelts, crash detectors to enhance passenger safety by ensuring that the airbags deploy in time and the response provided in case of collisions is accurate. The recent increase in the uptake of connected and electric vehicles is also increasing the need to implement intelligent restraint systems that have the ability to communicate with onboard sensors and communication networks to maximize the safety of the occupants.

Furthermore, the market is moving towards light and environmentally friendly materials and Internet of Things safety systems to increase energy consumption and mitigate emissions without reducing reliability. The use of predictive analytics and AI-driven systems to observe the vehicle dynamics, evaluate the risk of car crashes, and tailor safety responses in real-time is becoming a common practice. Consequently, the next-generation airbags and seatbelts are becoming intelligent, smarter and greener, as they are being designed to serve the greater interest of sustainability, automation and better occupant protection within the broader objectives of the automotive industry.

Specific Solution Requirement

Technology Improvement and Interrelation with other Technologies

Report Scope

| Area of Focus | Details |

| Market Size in 2025 | USD 56.69 Billion |

| Estimated Market Size in 2034 | USD 112.64 Billion |

| Projected CAGR 2025 to 2034 | 7.93% |

| Dominant Region | Asia-Pacific |

| Key Segments | Component, Airbag Type, Seatbelt Type, Vehicle, Electric Vehicle, Technology, Region |

| Key Companies | Autoliv Inc., ZF Friedrichshafen AG, Joyson Safety Systems, Hyundai Mobis Co., Ltd., Robert Bosch GmbH, Continental AG, Denso Corporation, Toyoda Gosei Co., Ltd., Takata Corporation, Toray Industries, Inc., Ashimori Industry Co., Ltd., Nihon Plast Co., Ltd., Tokai Rika Co., Ltd. |

Increased Need and Demand on Vehicle Safety and Urban Mobility

Change to sustainable and intelligent safety systems

Very high Development and Implementation Costs

Strict Regulations and Certification Restrictions

Supply Chain Disruptions

Technological Complexity and Skills Gap

Connection with Connected and Autonomous Vehicles

Growth in the Emerging Markets

The automotive airbags & seatbelts market is segmented into several key regions: North America, Europe, Asia-Pacific, and LAMEA (Latin America, Middle East, and Africa). Here’s an in-depth look at each region.

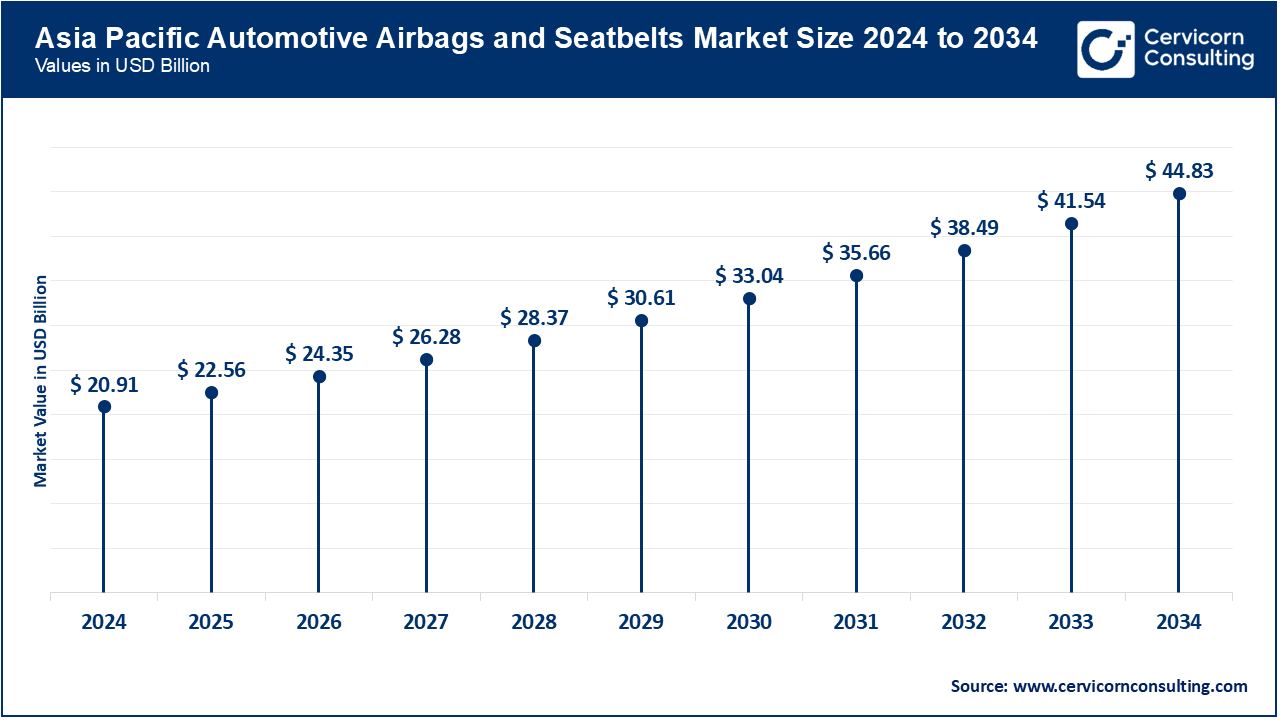

The fastest increasing region is Asi Pacific based on the rapid industrialization, urbanization, and the increased production of vehicles. Such nations as China, Japan, India, and South Korea represent the automotive centers that pay more attention to better occupant safety and regulations supported by the state. The demand of higher levels of consumer income and expectancy in safety features is contributing to the growth of advanced levels of airbag and seatbelt systems. The surge in electric and connected cars in the area is stimulating development in the area of adaptive restraint technologies. The constant R&D and domestic production are reducing the cost of production and making it more affordable. As the region is projected to be on top of others in terms of adoption and volume in the next few years.

The North America has stringent safety requirements in vehicles, is at the forefront in adopting new technology as well as having large automakers and suppliers. The U.S and Canada are in the growth mode, by incorporating new safety models such as smart airbags and pre-tensioned seatbelts. The increase in consumer awareness of road safety and the enactment of government legislation of passive safety systems further increase expansion of the market. Also, new restraint systems are in demand due to the investments into electric and autonomous vehicles. There are strategic alliances between OEMs and technology suppliers that improve product efficiency and compliance. The region goes on to control by way of innovation, regulation that aids, and strong automotive manufacturing groundwork.

The Europe accounted significant portion of the market due to the strict EU safety standards and sustainable objectives. The top countries include Germany, France, and the U.K. because of the high consumerism in these countries and their automotive sectors are also performing well. The introduction of continuous technological development, euro NCAP and ongoing ratings inspire OEMs to implement advanced airbags and adaptive seatbelts. The combination of sensor-based and AI-based safety systems promotes the European emphasis in minimizing traffic fatalities. Adoption is also motivated by increasing production of electric vehicles and smart mobility programs. Europe is a standard of innovation in vehicle safety and responsibility to the environment in the international market.

Market Share, By Region, 2024 (%)

| Region | Revenue Share, 2024 (%) |

| North America | 26.10% |

| Europe | 23.80% |

| Asia-Pacific | 39.80% |

| LAMEA | 10.30% |

The LAMEA has the potential to grow in the future because there is an increase in the production of vehicles and because of increased awareness about the importance of safety. Brazil, Mexico and Argentina are also pushing the demand in Latin America due to the regulatory changes and consumption preference towards safer vehicles. The UAE and Saudi Arabia are putting money in the development of modern automotive production and safety technology in the middle East. Africa is also slowly embracing the use of airbags and seatbelts as governments take road safety campaigns and importation laws into consideration. Global collaboration and OEM growth is enhancing product access and compliance. LAMEA boasts of good prospects due to modernization and improvements in regulation despite the infrastructure difficulties.

Airbags: Airbags are essential elements that are used to give occupants immediate protection when there is a collision as they are employed in a few milliseconds. Smart sensors, AI algorithms, and IoT connections are built into the modern systems in order to identify the severity of crashes and deploy at the optimal time. Manufacturers have been placed into focus of multi-stage inflation systems which adjust pressure based on passenger weight and impact force. Such systems mitigate risks of injuries, and enhance the results of crashes. As the safety regulations have become stricter in most parts of the world, the demand in intelligent and energy saving airbag modules is ever increasing. Situational awareness and occupant safety is also increased with integration with ADAS and autonomous systems.

Market Share, By Component, 2024 (%)

| Component | Revenue Share, 2024 (%) |

| Airbags | 58% |

| Seatbelts | 42% |

Seatbelts: Seatbelts are an essential restraining system that makes passengers stable in cases of crashes. The recent movement is towards adaptive and pretensioner seatbelts which automatically tighten up in the event of a collision with the help of load limiters which control the amount of pressure on the chest. Occupancy posture and tension can be detected in real time with Smart seatbelt systems that have built-in sensors. IoT and AI technologies combined enhance responsiveness and comfort, particularly in high-end vehicles. As a technique to cut down on emissions, light weighted material and sustainable production are also becoming prevalent. Collectively, these innovations improve the safety and global automotive standards.

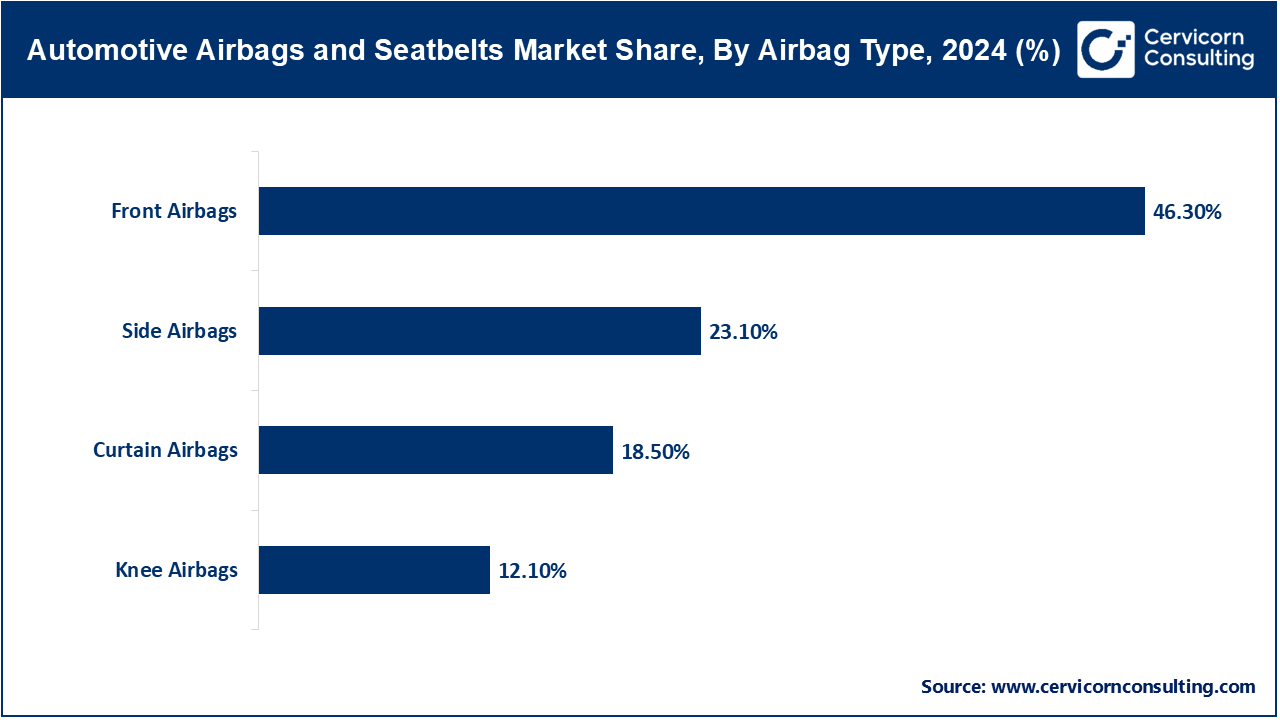

Front Airbags: The front airbags are the highest market share as they are compulsory in most passenger cars. They are fitted in steering wheels and dashboards and absorb head and chest blows in head-on collisions. Newer systems use dual-stage deployment and occupancy sensors to ensure maximum safety. Continuous innovation involves the application of AI-fueled crash detection and lightweight, rapid-deploying materials. Installation rates are still pushed by raising the government safety requirements in Asia-Pacific and North America.

Side Airbags: Side airbags ensure the safety of the occupants by shielding the torso and hips in case of a lateral collision. Increased market share has been achieved by the number of compact cars and SUVs installed with sensor-based deployment systems. The sensing smart technology is integrated to guarantee more accurate and quick activation. Inflator designs and light weight fabric are more efficient and less expensive. The adoption is also being encouraged by increasing crash-test standards in Europe and Japan.

Curtain Airbags: The front and rear occupants have head protection with curtain airbags in both rollovers and side impacts. Such airbags roll down the roofs to reduce head injury during extreme accidents. Long tubular designs and optimization based on gas-inflation enhance coverage and area protection. Multi-row vehicles are being fitted by automakers with maximum curtain airbags. The increasing consciousness of rollover deaths has enhanced their demand in the whole world.

Knee Airbags: Knee airbags cushion the lower limbs, so that they do not come into contact with the dashboards during high-speed accidents. They are mainly applied in the high quality and upper-end models, but are slowly being applied in the mass-market cars. The advanced knee airbags have compact modules with adaptive inflation features. Their inclusion in new models of cars is increasing due to the trend of holistic occupant safety.

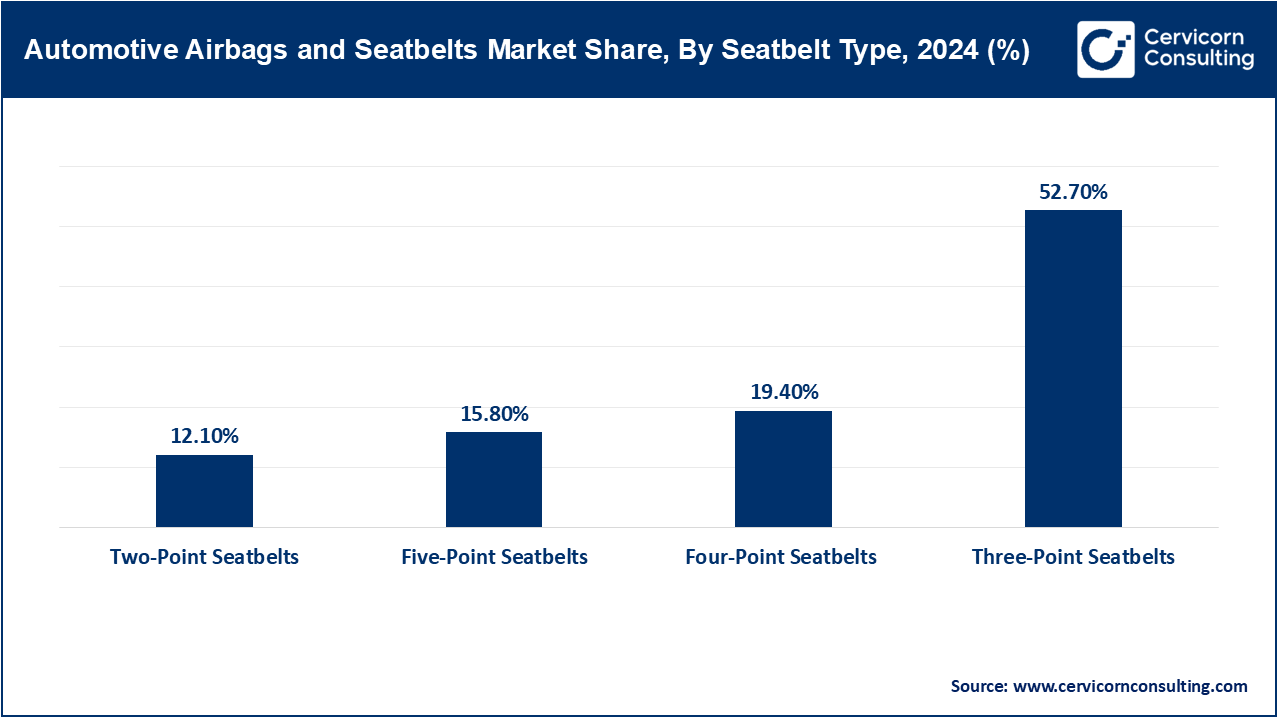

Two-Point Seatbelts: These are the seatbelts, mostly utilized in the older or slow-moving cars, which offer simple lap restraint. Their low protection has diminished their use in the current passenger cars. Nevertheless, they remain in use in aircrafts and industrial vehicles as well as some rear-seat designs.

Three-Point Seatbelts: The three-point seatbelt is used in the industry because it has better restraining power and is easy to use. It is fitted with pretensioners and load limiters to provide the right balance between safety and comfort. On-going innovation is on the automatic adjustment of tension and smart locking system. It is still prevalent in all vehicle categories, which makes it strong in world markets.

Four-Point Seatbelts: Four-point seatbelts are primarily employed in high-performance cars and racing cars, and they provide extra strength to the upper part of the body. In their design, forces of a crash are spread more equally, which decreases the risk of injuries. Automakers are working on the idea of modifying this system to suit luxury cars to provide extra protection.

Five-Point Seatbelts: Five-point systems are often used on child safety seats and sport vehicles to fasten shoulders, hips and between the legs. Their capability to limit the occupant movement upon impact is what allows maximum protection. The growing attention to the child and occupant safety regulations helps to ensure the constant introduction of the measures in the family cars.

Traditional Safety Systems: Traditional safety systems consist of mechanical activated airbags and traditional retractor seatbelts. These systems are cost-effective and offer better protection at lower cost levels and are common in entry-level cars. The materials and the mechanical components are continuously improved to be able to meet the safety standards all over the world. The market is however slowly shifting to electronic and sensor-based systems to be more efficient.

Market Share, By Technology, 2024 (%)

| Technology | Revenue Share, 2024 (%) |

| Conventional Safety Systems | 72.60% |

| Smart/Adaptive Safety Systems | 27.40% |

Smart/Adaptive Safety Systems: Smart safety systems combine AI, IoT, and real-time crash data analysis to provide protection that is adaptive. These technologies detect occupant size, position and impact angle to control the deployment force accordingly. High connectivity permits support of ADAS and V2X communication to enhance proactive safety reactions. Demand is increasing around autonomous and connected vehicles. Also, the adaptive systems minimize false deployments, increase energy efficiency, and occupant safety.

Market Segmentation

By Component

By Airbag Type

By Seatbelt Type

By Vehicle

By Electric Vehicle

By Technology

By Region