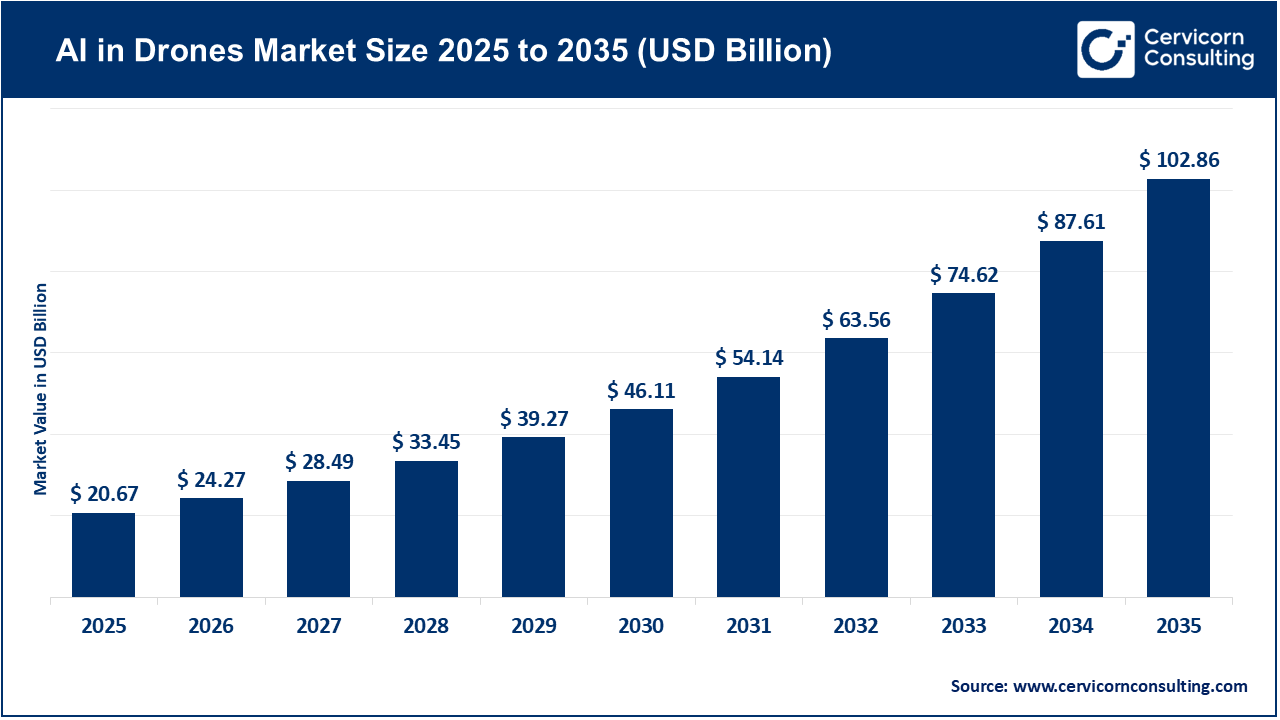

The global AI in drones market size was valued at USD 20.67 billion in 2025 and is expected to hit around USD 102.86 billion by 2035, exhibiting at a compound annual growth rate (CAGR) of 17.4% over the forecast period from 2026 to 2035. The AI in drones market is driven by growing demand for autonomous, intelligent aerial systems across defense, commercial, and public-sector applications. AI enhances drones with real-time object detection, navigation, and decision-making, making them highly effective for surveillance, inspection, agriculture, and industrial monitoring. Advancements in computer vision, edge AI, and high-performance processors, supported by companies such as Intel and Qualcomm, are enabling faster data processing, reduced latency, and improved operational efficiency.

Market growth is further supported by expanding BVLOS regulations, increased investment in smart cities and infrastructure, and rising use of drones in logistics, emergency response, and environmental monitoring. AI-driven capabilities like autonomous navigation and obstacle avoidance improve safety and scalability, while integration with 5G and cloud platforms is opening new commercial opportunities and accelerating adoption across industries.

Shift Toward Autonomous and BVLOS-Enabled Operations Driving Market Growth

The shift toward autonomous and Beyond Visual Line of Sight (BVLOS) operations is a major growth catalyst for the AI in drones market because it fundamentally expands what drones can do and where they can operate. BVLOS approval allows drones to fly long distances without direct human observation, while AI-driven autonomy enables real-time navigation, obstacle avoidance, and decision-making without continuous pilot input. Together, these capabilities unlock high-value use cases such as large-scale infrastructure inspection, long-range surveillance, agricultural monitoring, and logistics delivery, which were previously uneconomical or impossible under Visual Line of Sight constraints.

This transition also improves scalability and cost efficiency, making drones viable for enterprise-level deployment. Autonomous and BVLOS-enabled drones reduce labor requirements, enable centralized control of multiple drones, and support continuous operations over wide areas. As regulators gradually approve BVLOS frameworks and companies demonstrate safe autonomous performance, enterprises are increasing investment in AI-enabled platforms, software, and supporting infrastructure. This accelerates demand for advanced sensors, edge AI processors, detect-and-avoid systems, and autonomy software, directly driving overall market expansion.

Recent Investments and Strategic Initiatives in the AI in Drones Market

| Initiative | Type of Activity | Details | Source |

| Auterion USD 130 Mn Series B funding | Strategic investment | Auterion raised USD 130 Mn in Series B funding led by Bessemer Venture Partners, boosting development of autonomous & swarming drone technologies. | Auterion (Company Website) |

| India INR 20 billion drone incentive programme | Government support | India announced a multi-year INR 20 Bn (USD 234 Mn) incentive programme to support domestic drone manufacturing and software ecosystems. | Bots & Drones India |

| Increase in drone startup funding | Market funding trend | Drone startups raised USD 179.35 Mn in 2025, up from USD 135.51 Mn in 2024, reflecting growing investor confidence. | The Financial Express |

| Ondas & Safe Pro USD 14 Mn strategic investment | Equity investment | Ondas led a USD 14 Mn equity round to accelerate autonomous drone tech with investments into Safe Pro subsidiaries. | AI Magazine |

| China revises aviation law on drones | Regulatory initiative | China revised its Civil Aviation Law to require airworthiness certification for drones, supporting regulated market expansion. | Reuters |

1. National Grid Rolls Out Centralised Autonomous Drone Inspection System (UK)

In 2025, National Grid deployed autonomous drone inspection capabilities across its electricity transmission network, using Beyond Visual Line of Sight (BVLOS) drones controlled from a central command center to inspect high-voltage infrastructure. The system captures high-resolution visual and sensor data for condition monitoring and maintenance planning—replacing slower, more expensive traditional methods.

This deployment demonstrates real-world commercial utility of AI-powered drones in critical infrastructure monitoring, validating reliability and safety of autonomous flight and advanced analytics. It encourages other utilities and industrial firms to invest in similar AI drone systems, expanding adoption beyond early pilots to mainstream operations—boosting demand for BVLOS capable drones, AI analytics platforms, and related software.

2. U.S. Department of Defense Awards Major AI Contracts to Tech Leaders

In July 2025, the U.S. Department of Defense awarded up to USD 200 million contracts each to leading AI firms including OpenAI, Google, Anthropic, and xAI to develop advanced AI tools for national security missions, including autonomous systems.

This represents a significant government commitment to AI integration in defense platforms, including drones for ISR (intelligence, surveillance, reconnaissance) and autonomous mission planning. It accelerates R&D funding, fosters public-private partnerships, and signals to the global defense market that AI-backed autonomous drones will be central to future operations—driving investment and innovation in AI drone capabilities.

3. Auterion to Supply 33,000 AI Drone Guidance Kits to Ukraine

In mid-2025, Auterion, a U.S.-German defense tech firm, announced a contract to deliver 33,000 AI-powered guidance kits to Ukraine. These kits enable drones to autonomously track and engage targets, navigate in GPS-denied environments, and resist signal jamming on the battlefield.

This scale-up illustrates the growing role of AI in combat drone operations and shows that autonomous features are no longer niche—they are becoming integral to modern defense strategy. Large procurement volumes drive production scale, lower unit costs, and push competitors to develop comparable AI capabilities for civilian and military drones alike, expanding the broader market.

4. Regulatory Progress Toward BVLOS Commercial Drone Operations (U.S.)

In 2025, the U.S. Federal Aviation Administration (FAA) made progress toward formal BVLOS operations rules, which would allow drones to fly beyond the pilot’s line of sight without individual waivers. This regulatory shift is a milestone enabling large-scale AI-driven autonomous drone operations in logistics, delivery, inspection, and emergency response.

Regulatory approval of BVLOS operations is a key enabler for commercial scale-up. It unlocks use cases like wide-area surveys, long-range deliveries, agricultural monitoring, and utility inspections using AI-powered drones. With clearer rules, businesses can justify investment in autonomous drone systems, expanding use and fostering ecosystem growth.

The AI in drones market is segmented into various regions, including North America, Europe, Asia-Pacific, and LAMEA. Here is a brief overview of each region:

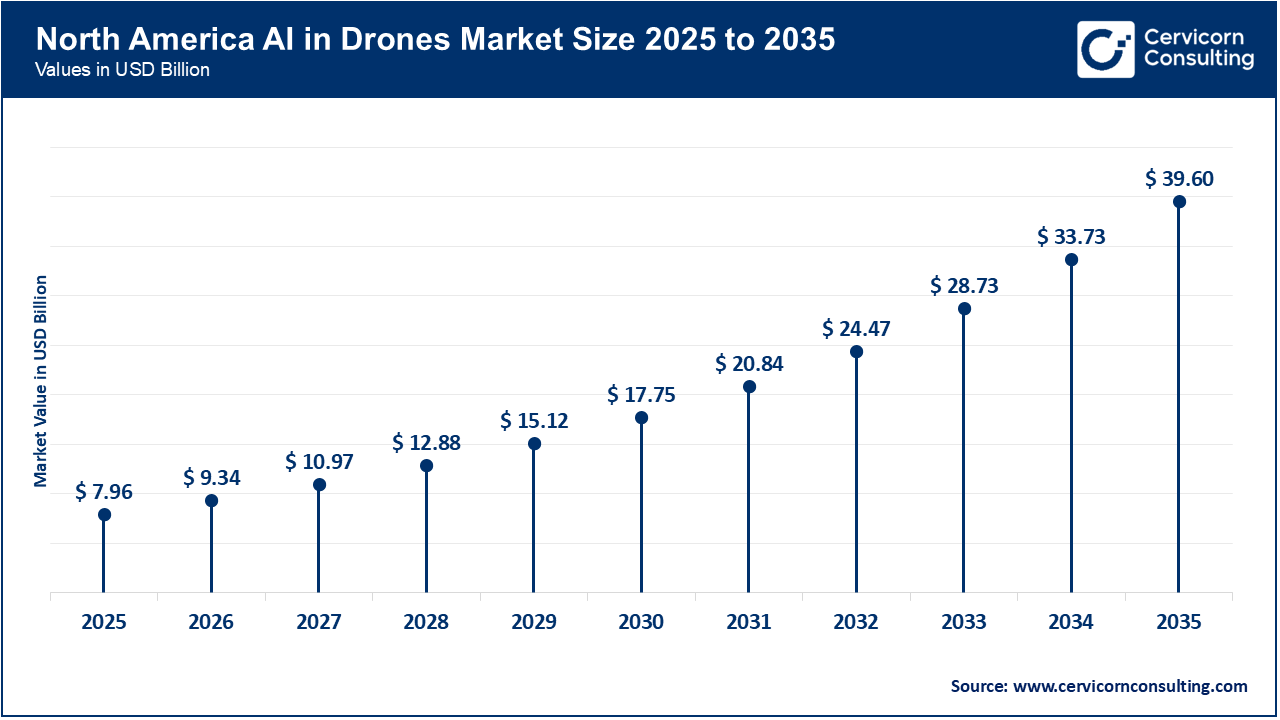

The North America AI in drones market size was estimated at USD 7.96 billion in 2025 and is projected to exceed around USD 39.60 billion by 2035. North America market is being propelled by clearer regulatory pathways for routine BVLOS operations and large defence procurement programs that fund autonomy R&D. The FAA’s BVLOS concept-of-operations and related NPRM work are creating a predictable route for scaled commercial operations (package delivery, long-range inspection), while sizeable DoD and federal contracts (and large awards to autonomy vendors) are accelerating military-grade autonomy, edge AI and perception systems — creating demand for both hardware (airframes, sensors) and software (on-board AI, detect-and-avoid, fleet management).

Recent Developments:

The Asia-Pacific AI in drones market size was reached at USD 6.01 billion in 2025 and is forecasted to attain around USD 29.93 billion by 2035. In Asia-Pacific the market is pushed by a mix of large domestic demand, national defence modernisation, and on-shoring industry partnerships that bring advanced autonomy into local supply chains. Governments and large industrial groups are funding local production hubs and tech transfer partnerships (defence UAS factories, testing corridors), which lower unit costs and speed deployment. Meanwhile, regulatory changes and strategic national programs (drone testing corridors, air-mobility planning) are enabling more commercial applications, from agriculture to urban logistics.

Recent Developments:

The Europe AI in drones market size was estimated at USD 5 billion in 2025 and is projected to surpass around USD 24.89 billion by 2035. Europe’s market growth is being driven by implementation of the EASA U-Space framework and large infrastructure pilots that validate autonomous inspection and BVLOS workflows. Standardised U-Space services and national pilots create interoperable traffic-management that de-risk urban and cross-border operations, encouraging logistics providers, utilities and regulators to adopt AI for safe detect-and-avoid, automated mission execution and data analytics. At the same time, high-profile defense/software deals (combat-tested autonomy shipments) are accelerating capability development and supplier scale.

Recent Developments:

AI in Drones Market Share, By Region, 2025 (%)

| Region | Revenue Share, 2025 (%) |

| North America | 38.5% |

| Europe | 24.2% |

| Asia-Pacific | 29.1% |

| LAMEA | 8.2% |

The LAMEA AI in drones market was valued at USD 1.69 billion in 2025 and is anticipated to reach around USD 8.43 billion by 2035. LAMEA’s market growth is driven by regulators modernising drone rules and high-visibility public pilots (urban delivery corridors, utility inspections, events) that show commercial viability. Risk-based regulatory proposals and corridor plans reduce barriers for BVLOS and organised operations, while governments and smart-city projects in the Gulf and Latin America are actively deploying drone delivery and mapping pilots, creating near-term demand for AI analytics and autonomous navigation solutions.

Recent Developments:

The AI in drones market is segmented into UAV class, technology, operation, autonomy level, application, and region.

Mini UAVs currently dominate the AI in drones market due to their wide adoption across commercial, industrial, and public-sector applications. These drones offer an optimal balance between payload capacity, endurance, and cost, making them suitable for inspection, agriculture, mapping, surveillance, and public safety missions. Their compatibility with advanced AI features such as computer vision, real-time analytics, and autonomous navigation has further strengthened their dominance across both developed and emerging markets.

AI in Drones Market Share, By UAV Class, 2025 (%)

| UAV Class | Revenue Share, 2025 (%) |

| Micro UAVs (Below 2 Kg) | 21.4% |

| Mini UAVs (2–20 Kg) | 39.8% |

| Small UAVs (20–50 Kg) | 16.7% |

| Tactical UAVs | 22.1% |

Tactical UAVs represent the fastest-growing segment, driven primarily by rising defense modernization programs and increasing geopolitical tensions. These UAVs leverage advanced AI for intelligence, surveillance, reconnaissance (ISR), target identification, and autonomous mission execution. Governments are investing heavily in AI-enabled tactical drones to enhance battlefield awareness and reduce human risk, accelerating adoption and driving strong growth in this segment.

Computer vision dominates the technology segment as it forms the foundation of most AI-enabled drone applications. It enables core functionalities such as object detection, facial recognition, terrain mapping, obstacle avoidance, and image-based analytics. Industries including defense, agriculture, infrastructure inspection, and public safety rely heavily on computer vision for real-time decision-making, making it the most widely deployed AI technology in drone platforms.

Deep learning is the fastest-growing technology segment due to its ability to process large datasets and deliver higher accuracy in complex environments. DL models significantly improve pattern recognition, predictive analytics, and autonomous decision-making capabilities. As edge computing power increases and training models become more efficient, deep learning adoption is expanding rapidly, especially in autonomous navigation, swarm intelligence, and advanced surveillance applications.

Visual Line of Sight (VLOS) operations dominate the market as they are the most widely approved and regulated mode of drone operation globally. Most commercial and industrial drone deployments currently operate within visual range due to regulatory simplicity and lower safety risks. AI in VLOS drones enhances precision, automation, and data analytics, making this segment the largest contributor to overall market revenue.

AI in Drones Market Share, By Operation, 2025 (%)

| Operation | Revenue Share, 2025 (%) |

| Visual Line of Sight (VLOS) | 46.2% |

| Extended Visual Line of Sight (EVLOS) | 18.5% |

| Beyond Visual Line of Sight (BVLOS) | 30.1% |

| Others | 5.2% |

Beyond Visual Line of Sight (BVLOS) is the fastest-growing operational segment, driven by regulatory progress and demand for long-range and large-area missions. AI plays a critical role in enabling BVLOS operations through autonomous navigation, detect-and-avoid systems, and real-time decision-making. BVLOS adoption is expanding rapidly in logistics, infrastructure inspection, agriculture, and emergency response, making it a key growth driver for the market.

Remotely piloted, AI-assisted drones currently dominate the market as they offer enhanced efficiency while retaining human oversight. These systems use AI for navigation assistance, object detection, and data analysis, while operators maintain control for safety and compliance. This balance makes them widely accepted across commercial, government, and defense sectors, supporting their strong market presence.

AI in Drones Market Share, By Autonomy Level, 2025 (%)

| Autonomy Level | Revenue Share, 2025 (%) |

| Remotely Piloted (AI-Assisted) | 48.9% |

| Semi Autonomous | 31.4% |

| Fully Autonomous | 19.7% |

Fully autonomous drones are the fastest-growing segment, fueled by advances in AI algorithms, edge computing, and sensor fusion. These drones can perform missions without human intervention, making them ideal for large-scale surveillance, logistics, and defense applications. As trust in AI systems improves and regulations evolve, fully autonomous drones are expected to see rapid adoption and high growth rates.

Defense and security dominate the AI in drones market due to sustained government investment in surveillance, reconnaissance, and combat-ready autonomous systems. AI enhances mission effectiveness through real-time intelligence processing, target recognition, and autonomous operations. Continuous defense modernization programs and increasing focus on unmanned warfare ensure this segment remains the largest revenue contributor.

AI in Drones Market Share, By Application, 2025 (%)

| Application | Revenue Share, 2025 (%) |

| Defense & Security | 32.6% |

| Infrastructure & Industrial Inspection | 21.9% |

| Agriculture & Forestry | 15.4% |

| Logistics & Delivery | 9.8% |

| Public Safety & Emergency Response | 8.6% |

| Environmental Monitoring & Conservation | 5.1% |

| Smart Cities & Urban Management | 4.2% |

| Healthcare & Humanitarian Aid | 1.6% |

| Others | 0.8% |

Logistics and delivery represent the fastest-growing application segment, driven by demand for faster, contactless, and cost-effective transportation solutions. AI enables route optimization, obstacle avoidance, and autonomous flight, which are essential for scalable delivery operations. Growth is particularly strong in medical supply delivery, e-commerce, and remote-area logistics, supported by improving regulations and infrastructure.

Intel

DJI

DroneDeploy

Qualcom

By UAV Class

By Technology

By Operation

By Autonomy Level

By Application

By Region