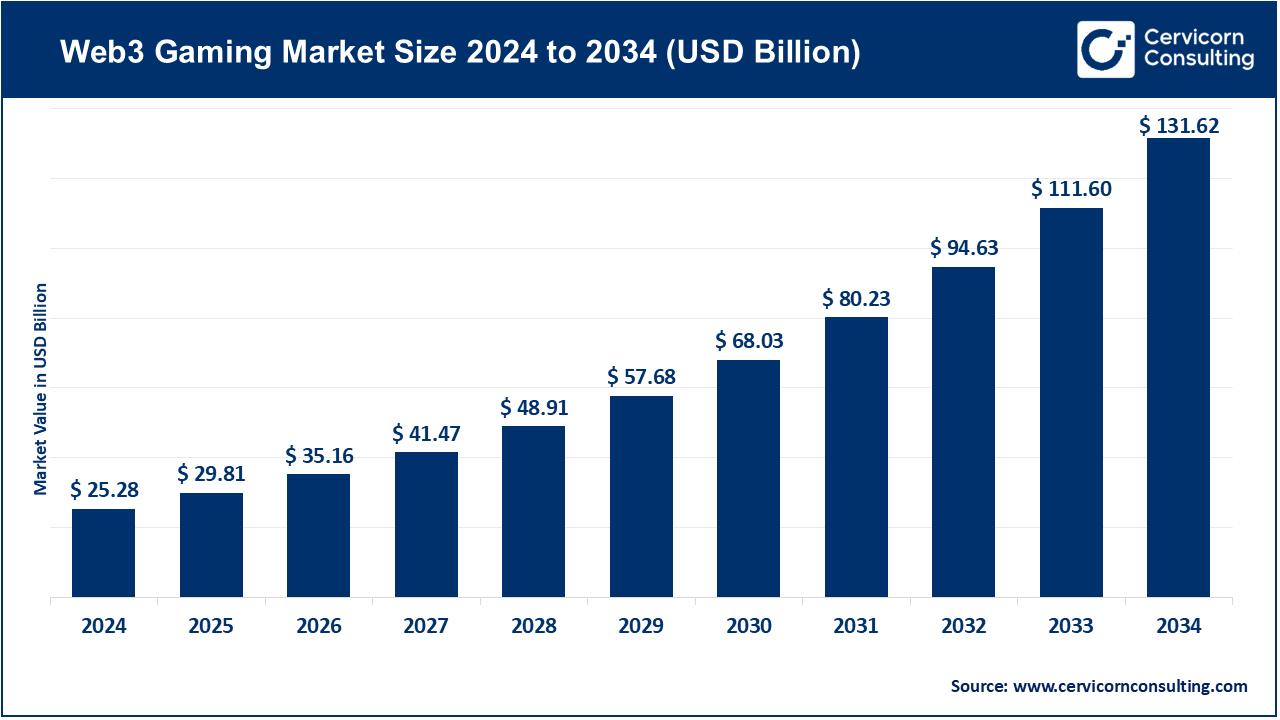

The global web3 gaming market size was valued at USD 25.28 billion in 2024 and is forecasted to reach around USD 131.62 billion by 2034, growing at a compound annual growth rate (CAGR) of 17.94% over the forecast period from 2025 to 2034. Rapid adoption of blockchain technology, NFTs, and play-to-earn models is pushing the web3 gaming market to new heights. The growth of the market is being driven by an increased demand for engaging digital content as more people gain access to the internet and smartphones. User engagement, monetization, and operational efficiency improvements fueled by smart contracts, tokenomics, and cross-platform compatibility innovations are also contributing to market growth. Dedicated development centers for blockchain games offer sophisticated gaming and secure decentralized ecosystems.

Web3 Gaming Market Definition

Web3 Gaming will adopt long-term growth strategies that include sector partnerships, innovation-focused game design, new blockchain integration, and adoption of eco-friendly technologies. The market is looking to digital ownership, technology responsible gaming, and immersive experience gaming which all center around game policy, regulation, and trade technology. These pointers all highlight web3 gaming as an evolving market ready for innovative strategies to grow and capture more of the market.

Report Scope

| Area of Focus | Details |

| Market Size in 2025 | USD 29.81 Billion |

| Expected Market Size in 2034 | USD 131.62 Billion |

| Projected CAGR 2025 to 2034 | 17.94% |

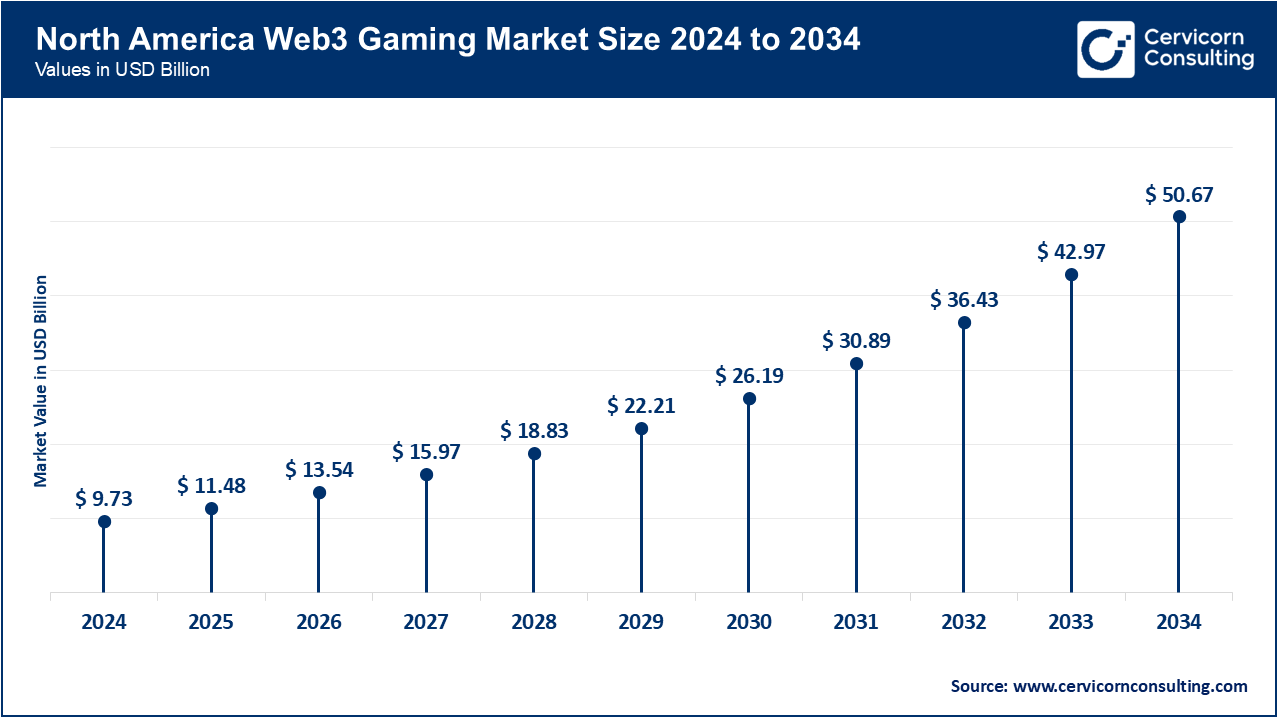

| Dominant Region | North America |

| Fastest Growing Region | Asia-Pacific |

| Key Segments | Game Type, Platform, Technology, Region |

| Key Companies | Gala Games, Immutable, The Sandbox, Axie Infinity (Sky Mavis), Mythical Games, Gamecrio, Whimsy Games, Kevuru Games, Unicsoft, Antier Solutions |

The web3 gaming market is segmented into several key regions: North America, Europe, Asia-Pacific, and LAMEA (Latin America, Middle East, and Africa). Here’s an in-depth look at each region.

North America is the world’s leader because of its advanced gaming ecosystems, active developer communities, and large amounts of venture capital. The region is also home to some of the biggest consumers and innovators in the world because of advanced cloud and blockchain technology, the use of virtual and augmented reality, and the digital payment infrastructures in the USA and Canada. The region also houses major gaming and media players in the esports market, and is integrated with gaming and entertainment technologies that monetize virtual events, NFT marketplaces, and metaverse experiences. From North America, large gaming studios, middleware providers, and blockchain infrastructures focus on climate-friendly, scalable AI game personalization, and token models, reinforcing North America’s position as the leader in enterprise-grade Web3 gaming.

Europe is a key market, particularly in clarifying regulations, data protection, and focusing on sustainable technologies. The UK, Germany, France, and the Netherlands, along with Poland, have been creative in blockchain technologies focusing on Web3, esports, and gaming, pushing high-quality user-centric Web3 titles. European gaming systems focus on regulations, integrating privacy wallets-first, and carbon-sustainable layer-2 systems, along with cross-domain interoperability. Europe also houses strong ecosystems centered around indie gaming, and collaborates privately around sponsored innovation increasing metaverse gaming and DAOs for gaming society access.

Asia-Pacific holds the title of the fastest growing market. This entire region is characterized by high mobile penetration, gamer density, and active crypto communities. China, South Korea, Japan, and India drive the bulk of the growth. China and South Korea focus on high-end PC and console games, as well as metaverse projects, while Japan emphasizes IP-driven franchises and Web3 titles. India leads mobile P2E gaming and social gaming adoption. In the Southeast Asian region, the Philippines, Indonesia, Vietnam, and Thailand are rapid adopters of P2E and mobile NFT games because of lower costs and social distribution. This region has large user bases, strong payment ecosystems, and localized content that drives the mainstream adoption of blockchain gaming.

Market Revenue Share, By Region, 2024 (%)

| Region | Revenue Share, 2024 (%) |

| North America | 38.50% |

| Europe | 28.70% |

| Asia-Pacific | 23.10% |

| LAMEA | 9.70% |

LAMEA is a new and attractive region, especially with the possibilities offered by mobile. LAMEA is characterized by rapid mobile adoption, youthful demographics, and increasing interest in tokenized economies. For Latin America (specifically Brazil, Mexico, and Argentina), the remittance-friendly payment flows and high mobile usage make the region a strong market for P2E and social Web3 titles. The Middle East’s UAE region is a metaverse and digital asset hub and has infrastructure and regulations in place (regulatory sandboxes) that entice studios and investors. In Africa (specifically Nigeria, South Africa, and Kenya), community mobile Web3 gaming and grassroots community-driven projects are starting to take off nationally. Even with a lack of infrastructure and regulations, the localization of monetization strategies combined with partnerships with international players provides the region the best prospects for growth in Web3 gaming after 2025.

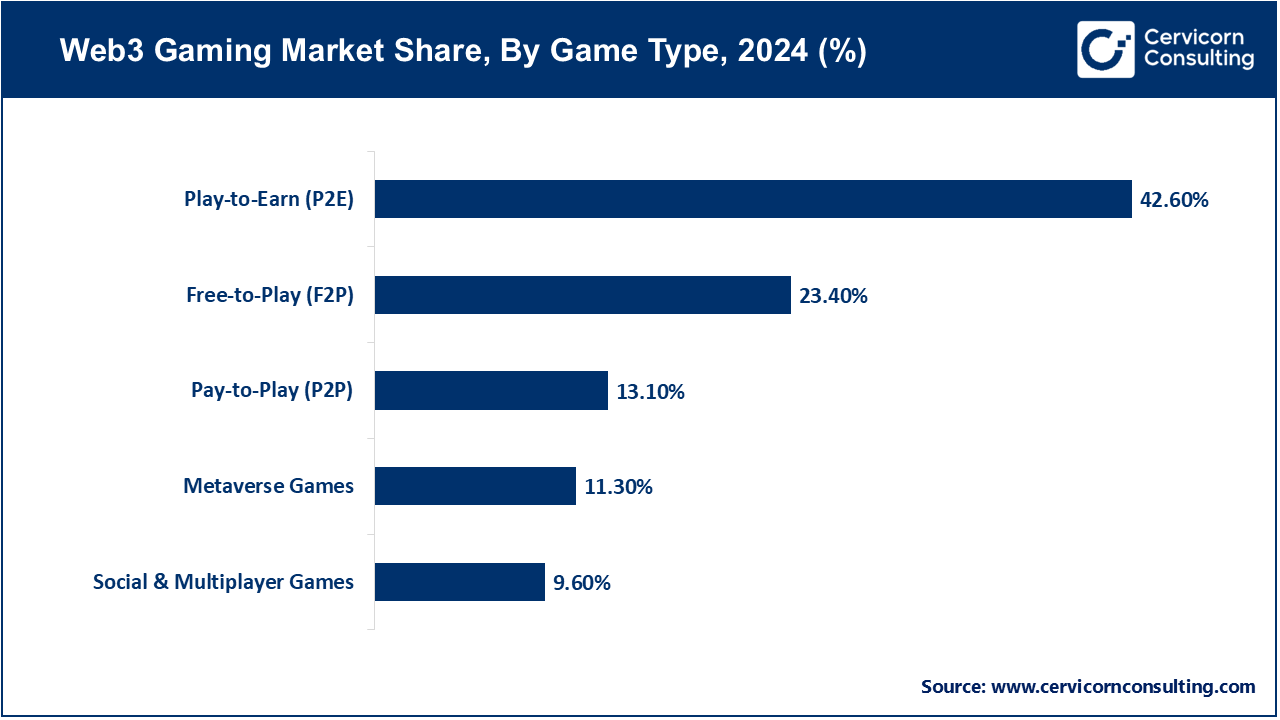

Play-to-Earn (P2E): Play-to-Earn games continue to be a core part of the Web3 Gaming ecosystem by letting players earn cryptocurrencies and NFTs while playing the games. As players participate in games, they earn blockchain based rewards and can trade in-game assets in the game's decentralized exchange. Although the P2E ecosystem experienced some initial hype, it currently faces the challenge of economic sustainability as it contains volatile economies and suffers from poor user retention. To combat this issue, innovative hybrid models incorporating P2E with other more engaging mechanisms like skill-based earning systems are starting to appear. Although Web3 gaming activities grew by 386%, as reported by Ainvest and DappRadar in April 2025, P2E funding decreased by nearly 10%, indicating a desperate need for more utility driven systems within the P2E ecosystem.

Free-to-Play (F2P): For mainstream users, the F2P Web3 games have made it easier to enter Web3 gaming by allowing users to play games without any initial payments or purchases. F2P games let users try the game before prompting them with optional NFT purchases or tokenized game participation. This model is crucial for onboarding traditional users who are risk-averse in terms of blockchain wallet creations and cryptocurrency purchases. This is evident in 2025 with the F2P Web3 games, Nifty Island and Parallel Colony, that incorporated AI-based narrative interactions and cross-game NFT avatar interchangeability to streamline the transition from traditional gaming to blockchain gaming.

Pay-to-Play (P2P): For advanced Web3 gamers, P2P games are increasingly popular because they offer premium content and exclusive ownership of NFTs and virtual assets. Such games are likely to offer special rewards, rare tokens, and one-of-a-kind experiences within the metaverse. More and more game studios are using DAO to oversee the in-game economies. As of May 2023, top Web3 game studios noted the growing popularity of subscription-based blockchain games in North America and Europe and the evolving gamer mindset of paying for immersive decentralized experiences.

Metaverse Games: Metaverse-based Web3 games are among the fastest-growing sectors in the gaming industry, integrating social interaction, virtual economies, and real-world assets. These games offer NFT-based ownership of virtual land, buildings, and avatars. WoD (World of Dypians) and Illuvium Zero, for example, attracted a lot of interest in September 2025. This was fueled by the expansion of interoperable metaverse ecosystems and targeted ads and commerce from global brands.

Social & Multiplayer Games: This segment comprises cooperative and multiplayer blockchain-powered community games. Gala Games and Immutable X focus on cooperative ecosystems with revenue-sharing and NFT-based identity systems. Meta's extension of Horizon Worlds into mobile and mixed reality devices increased the demand for socially interactive Web3 multiplayer games in October 2025.

PC: When it comes to Web3 Gaming, PCs still reign supreme. Web3 Gaming platforms provide superior processing power integrated with blockchain, and more powerful processing units with the ability to customize to individual needs. Developers tend to use PCs to implement NFT marketplaces, and host decentralized apps (dApps). As more people use PC wallets, blockchain SDKs, and other Web3 tools, the use of PCs remains prevalent in mature markets like the USA, Japan, or Germany.

Console: Although still emerging, Console Web3 Gaming is gaining traction, particularly due to cross-platform blockchain integration. Gaming giants like Sony and Microsoft are exploring blockchain technology to create NFT collectibles and achievements. Furthermore, Sony’s PlayStation Network is providing pilot programs for blockchain-integrated game tokens, showcasing Web3’s potential for integration into mainstream consoles by mid 2025.

Market Revenue Share, By Platform, 2024 (%)

| Platform | Revenue Share, 2024 (%) |

| PC | 35.40% |

| Console | 15.70% |

| Mobile Gaming | 39.80% |

| Cloud Gaming | 9.10% |

Mobile: Mobile Web3 Gaming is experiencing explosive growth and now is the dominant way due to the integration of simple mobile crypto wallets. Mobile-centric Web3 titles like Axie Infinity: Origins and Guild of Guardians are leading in this space, predominantly in the Asia-Pacific and Latin American regions. DappRadar reported in 2025 that over 65% of Web3 gamers accessed blockchain games on mobile, even more, highlighting the growth of this segment.

Cloud Gaming: Web3 platforms that rely on the cloud are lessening the need for high-end gaming hardware, allowing for decentralized gaming over the blockchain. Businesses are using smart contracts for streaming games in real time and monetizing the ownership of these games. The rollout of 5G networks and edge computing in North America and Europe by 2025 will create even more opportunities for gaming on Web3 with virtually no latency.

Blockchain Games: Blockchain technology is central to Web3 Gaming, providing the basis for decentralized ownership, traceable assets, and reward systems that are transparent and fair. Ethereum, Polygon, Solana, and Immutable X are the top four chains for Web3 developers. In 2025, the introduction of Layer-2 solutions and zero-knowledge proofs enhanced scalability and transaction speeds for game assets, and gas fees incurred during transfers were reduced by 60%.

NFT-Based Games: NFT technology in gaming offers interoperable, cross-game ecosystems, real monetizable ecosystems, and provable digital ownership. In-game economies for player-owners fueled the monetization of NFTs in games like Gods Unchained and Star Atlas. In 2025 and beyond, speculative trading of NFTs prompted tighter regulations, influencing game developers to extract value from gameplay rather than focusing on monetization.

Market Revenue Share, By Technology, 2024 (%)

| Technology | Revenue Share, 2024 (%) |

| Blockchain Games | 41.20% |

| NFT-Based Games | 30.50% |

| VR/AR Games | 18.60% |

| AI-Integrated Games | 9.70% |

VR/AR Games: Immersive technologies coupled with Web3 innovations present exciting new avenues for player engagement. Blockchain games that utilize AR/VR technology facilitate NFT interactions in real-time within augmented realities. In April 2025, Pentagone Games made history with the launch of PenXR, the world’s first Web3-enabled AR/VR headset, designed to bring mixed realities into decentralized gaming ecosystems.

AI-Integrated Games: Artificial Intelligence is changing Web3 Gaming by providing adaptable gameplay, dynamic NPCs, and predictive analytics for token economies. In games like Parallel Colony, AI adjusts to individual user preferences saved on the blockchain. By the year 2025, the AI-Web3 convergence will redefine the management of smart contracts in-game economies and the governance of communities.

Market Segmentation

By Game Type

By Platform

By Technology

By Region