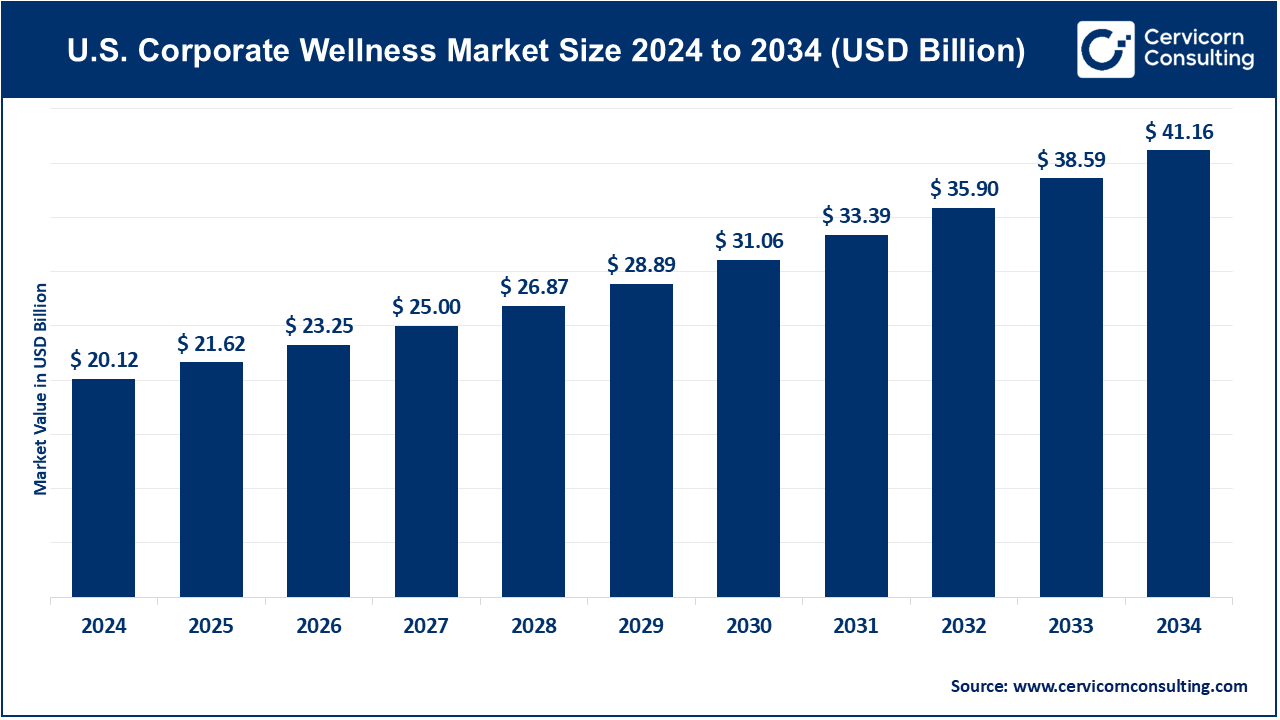

The U.S. corporate wellness market size was reached at USD 20.12 billion in 2024 and is expected to be worth around USD 41.16 billion by 2034, exhibiting at a compound annual growth rate (CAGR) of 7.41% over the forecast period 2025 to 2034.

The U.S. corporate wellness market is growing steadily, fueled by several important factors. One major driver is the rising prevalence of chronic health issues like obesity, diabetes, and heart disease, which have encouraged companies to adopt wellness programs to improve employee health and reduce healthcare expenses. Mental health awareness has also become a key focus, with many organizations offering support through counseling, stress management, and mindfulness programs. The adoption of digital tools such as mobile apps, fitness trackers, and virtual wellness platforms has made it easier for employers to implement, monitor, and personalize wellness programs, increasing participation and overall impact.

In addition, supportive government policies and workplace regulations are encouraging the development of wellness initiatives. These programs are being recognized not just as a health measure, but as a strategic investment in employee satisfaction and productivity. The shift toward a more holistic view of wellness, addressing both physical and mental well-being, has been amplified by the COVID-19 pandemic, which emphasised the need for comprehensive health solutions. As a result, more companies are embedding wellness into their workplace culture, seeing it as essential for reducing absenteeism, boosting morale, and creating a healthier, more engaged workforce.

What is Corporate Wellness?

Corporate wellness encompasses a range of programs and initiatives that organizations implement to enhance the physical, mental, and emotional well-being of their employees. These programs aim to create a healthier work environment, improve productivity, reduce absenteeism, and lower healthcare costs. Applications of corporate wellness include health risk assessments, fitness and nutrition programs, mental health counseling, smoking cessation support, stress management workshops, and ergonomic workplace design. Some companies also integrate digital wellness tools like mobile apps, wearable devices, and telehealth services to make wellness more accessible. Corporate wellness can be tailored to the specific needs of an organization and its workforce, often supported by data analytics to track progress and outcomes.

The modern workplace is increasingly recognising the importance of employee well-being, not only for the health and happiness of individuals but also for overall productivity and organisational success. To support their workforce, many U.S. employers are implementing various wellness programs. The following table details the adoption rates of specific wellness initiatives across the United States, providing a snapshot of the current landscape of employer-sponsored well-being efforts. This data can be valuable for understanding common practices and identifying areas where employee needs might be better addressed through workplace programs.

Table: Percentage of U.S. Employers Offering Select Wellness Programs

| Wellness Program | % of U.S. Employers Who Offer |

| General Wellness | 52% |

| Onsite Seasonal Flu Vaccination | 52% |

| Tobacco Cessation | 34% |

| Health Risk Assessments | 34% |

| Rewards for Completing Programs | 30% |

| Weight Loss | 25% |

| Stress Management | 25% |

| Preventive | 22% |

| Personal or Life Coaching | 21% |

| Health Insurance Premium Discount | 20% |

| Meditation | 18% |

The data reveals that foundational wellness offerings, such as general wellness programs and onsite flu vaccinations, have the highest adoption rates among U.S. employers. Programs focused on specific health behaviors like tobacco cessation and weight loss, as well as preventative care and stress management, are also relatively common.

Growth of Mental Corporate Wellness Services

Mental health services are gaining significant traction as companies recognize the impact of stress, burnout, and emotional strain on employee performance. Businesses are offering therapy sessions, mindfulness training, and stress management workshops to create a mentally supportive workplace.

Integration of Artificial Intelligence in Wellness Programs

Artificial intelligence (AI) is transforming corporate wellness by offering personalized and predictive health interventions. From virtual health coaches to real-time wellness tracking, AI helps tailor programs to individual needs, increasing engagement and effectiveness.

Adaptation to Remote and Hybrid Work Models

With remote and hybrid work becoming more common, wellness programs are evolving to meet employees where they are. Companies are delivering digital wellness resources that support health and work-life balance from home.

Focus on Women’s Health and Healthy Aging

Corporate wellness programs are increasingly inclusive, with specific attention to women’s health and aging populations. Programs now address menopause, fertility, and age-related health challenges, fostering a supportive and diverse work environment.

Report Scope

| Area of Focus | Details |

| Market Size in 2025 | USD 21.62 Billion |

| Expected Market Size in 2034 | USD 41.16 Billion |

| Projected Market CAGR 2025 to 2034 | 7.41% |

| Key Segments | Service, End-Use, Category, Delivery Model |

| Key Companies | Wellness Corporate Solutions, ComPsych, Virgin Pulse, EXOS, Privia Health, Marino Wellness, SOL Wellness, Vitality, Central Corporate Wellness, CXA Group Pte. Limited, Wellsource, Inc., Optum, Inc., Truworth Wellness |

Rising Employee Health Awareness

Escalating Healthcare Costs

High Initial Investment for Small Businesses

Lack of Participation and Engagement

Integration of Digital Health and Wearables

Growing Focus on Mental and Emotional Wellness

Measuring ROI and Effectiveness

Data Privacy and Compliance Issues

The US corporate wellness market is segmented into applications. Based on service, the market is classified into health risk assessment, fitness, smoking cessation, health screening, nutrition & weight management, stress management, and others. Based on end-use, the market is classified into small scale organizations, medium scale organizations, and large scale organizations. Based on category, the market is classified into fitness & nutrition consultants, psychological therapists, and organizations/employers. Based on delivery model, the market is classified into onsite and offsite.

Health Risk Assessment: The health risk assessments segment has dominated the market in 2024. Health risk assessments are a key service in corporate wellness programs, as they help identify potential health issues in employees before they become serious. Companies use these assessments to design personalized wellness plans and mitigate risks. These services are growing in demand as companies seek to manage employee health and reduce healthcare costs proactively.

Fitness: The fitness segment is driven by the increasing focus on physical health in the workplace. Organizations are offering gym memberships, on-site fitness facilities, and virtual fitness programs to employees. This trend has gained momentum as companies look to enhance employee well-being, reduce absenteeism, and improve productivity through physical activity.

Smoking Cessation: Smoking cessation programs are becoming an essential part of corporate wellness initiatives as more companies recognize the link between smoking and chronic health conditions. These programs aim to reduce smoking-related health issues, lower insurance premiums, and improve workplace morale. Services may include counseling, nicotine replacement therapy, and support groups.

Health Screening: Health screenings are a vital part of corporate wellness, helping companies identify and address health issues early on. Regular checkups for conditions such as hypertension, diabetes, and high cholesterol contribute to a healthier workforce and lower healthcare costs. Health screenings are gaining traction as preventive care becomes a priority for many organizations.

Nutrition & Weight Management: The growing focus on healthy eating and weight management is driving the expansion of nutrition services in corporate wellness programs. Companies are increasingly offering personalized nutrition plans, meal delivery services, and workshops on healthy eating to help employees maintain balanced diets and improve their overall well-being.

Stress Management: The stress management segment is expected to exhibit the fastest growth during the forecast period. With stress being a major concern in the workplace, stress management services are becoming increasingly popular. Programs that include mindfulness, yoga, meditation, and resilience training are being adopted to help employees manage stress, reduce burnout, and improve mental health. Companies are investing in these services to foster a more productive and healthy work environment.

Others: Other services include sleep management, ergonomic assessments, and chronic disease management, which are gaining attention in corporate wellness. These programs address specific health concerns and help employees maintain better overall health and well-being, further expanding the range of wellness options available.

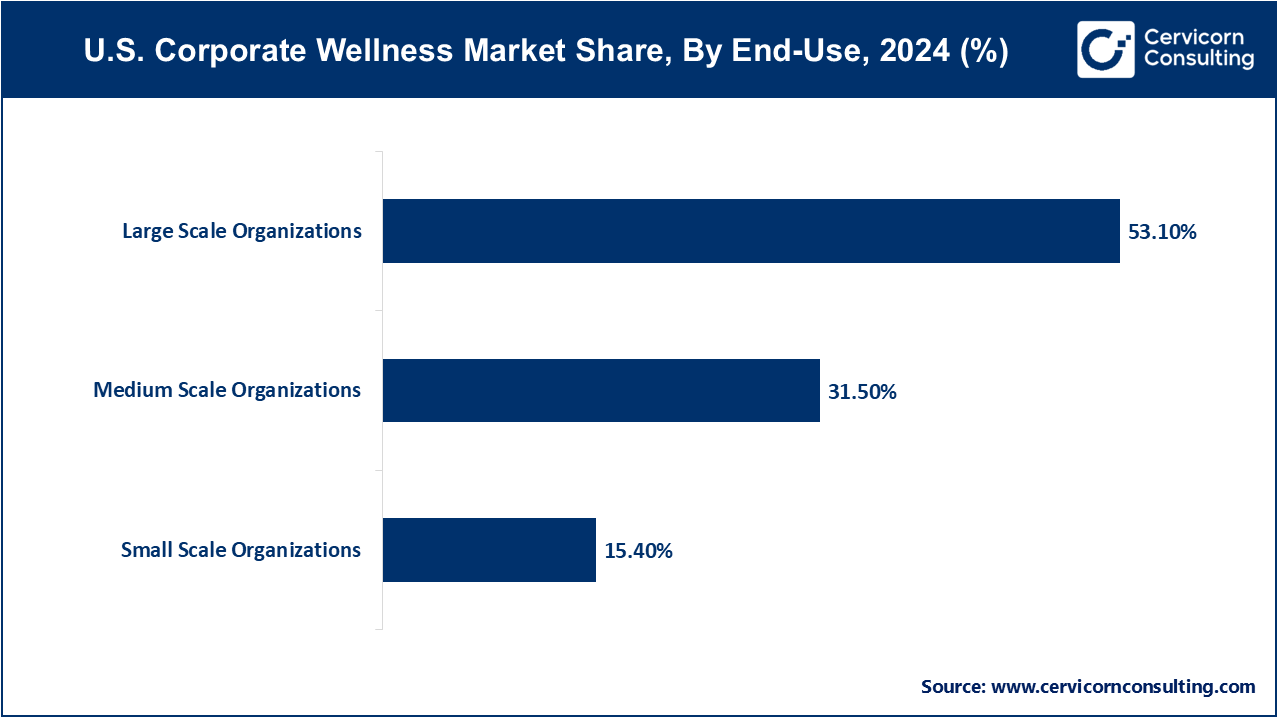

Large Scale Organizations: The large scale organizations segment dominated the market in 2024. Large organizations are the major players in the corporate wellness market, investing significantly in comprehensive wellness programs. These companies typically offer a wide range of on-site services like fitness centers, health screenings, and mental health support, aiming to improve employee health and increase engagement.

Medium Scale Organizations: The medium scale organizations segment is projected to register the highest CAGR during the forecast period. Medium scale organizations are more likely to integrate both in-house and external wellness services. They seek flexibility and cost-effectiveness in their wellness programs, often opting for hybrid models that combine on-site initiatives with digital solutions, catering to a wider range of employee needs.

Small Scale Organizations: Small scale organizations are increasingly adopting corporate wellness programs despite limited budgets. These businesses typically focus on affordable wellness options, such as digital health apps or third-party services, to improve employee well-being and retention without large upfront investments.

Organizations/Employers: The organizations/employers segment dominated the market in 2024. Some companies prefer to manage wellness programs internally through dedicated HR teams or health departments. These in-house programs allow for better integration into company culture, ensuring that wellness initiatives are tailored to the specific needs of employees. This segment continues to grow as companies seek to provide more personalized wellness services.

Fitness & Nutrition Consultants: The fitness and nutrition consultants segment is anticipated to witness a maximum CAGR during the forecast period. Fitness and nutrition consultants are vital to helping employees achieve personalized health goals. These professionals provide tailored fitness routines and nutrition advice to employees, contributing to overall wellness programs. This category is growing as more companies recognize the value of individualized health support in enhancing employee productivity and satisfaction.

Psychological Therapists: As mental health awareness grows, psychological therapists are becoming a core component of corporate wellness programs. These therapists offer counseling and therapy sessions to employees, addressing stress, anxiety, depression, and other mental health issues. The increasing demand for mental health support is driving the growth of this segment.

Onsite: The onsite segment dominated the market in 2024. Onsite wellness services, such as fitness centers, health clinics, and counseling rooms, are popular in large organizations that can afford the infrastructure. These services provide employees with convenient access to health and wellness resources during work hours, leading to higher participation and engagement rates in wellness programs.

U.S. Corporate Wellness Market Revenue Share, By Delivery Model, 2024 (%)

| Delivery Model | Revenue Share, 2024 (%) |

| Onsite | 58.20% |

| Offsite | 41.80% |

Offsite: Offsite wellness services, including partnerships with external gyms, telehealth providers, and wellness retreats, offer flexibility for companies with remote or hybrid work models. Offsite delivery is growing in popularity as it allows companies to provide wellness support to employees regardless of location, ensuring accessibility for a diverse workforce.

The U.S. corporate wellness market is highly competitive, with several key players offering diverse wellness solutions to improve employee health and productivity. Companies like Wellness Corporate Solutions, ComPsych, and Virgin Pulse are prominent, providing a wide range of services, including fitness programs, mental health support, and health screenings. EXOS and Privia Health specialize in personalized wellness plans and fitness solutions, while Marino Wellness and SOL Wellness focus on stress management and mental health services. Other players like Vitality, Central Corporate Wellness, and Optum, Inc. offer integrated wellness platforms, combining digital tools and personalized services. Truworth Wellness and CXA Group Pte. Limited cater to both small and large organizations, providing customizable wellness programs that meet the needs of a diverse workforce. The market is evolving, with these companies constantly innovating to meet the growing demand for comprehensive and flexible wellness solutions.

Market Segmentation

By Service

By End-Use

By Category

By Delivery Model