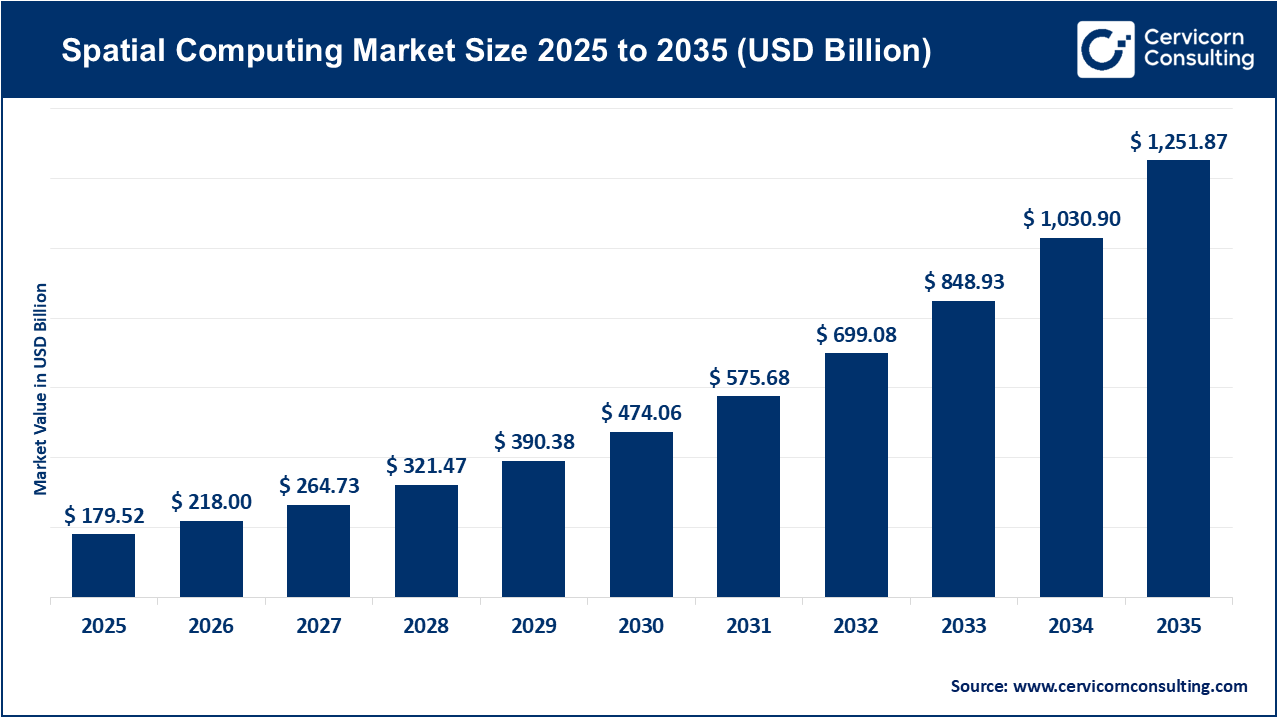

The global spatial computing market size was valued at USD 179.52 billion in 2025 and is expected to be worth around USD 1,251.87 billion by 2035, exhibiting at a compound annual growth rate (CAGR) of 21.4% over the forecast period from 2026 to 2035. The spatial computing market is experiencing accelerated growth as enterprises integrate immersive technologies into core operational and customer engagement workflows. Recent industry surveys indicate more than 65% of large organizations are actively investing in augmented and mixed reality capabilities. Adoption is expanding beyond pilots, driven by measurable efficiency improvements in design validation, remote collaboration, and experiential visualization use cases. Technology vendors report headset shipment volumes increasing over 40% year over year, reflecting growing commercial and industrial demand. This sustained growth trajectory is further reinforced by improving device ergonomics, enterprise-grade security features, and expanding developer ecosystems globally.

Key drivers of spatial computing adoption include workforce training transformation, digital twin deployment, and real-time spatial data visualization capabilities. Studies show immersive training solutions can reduce error rates by up to 30% compared to traditional instruction methods. Healthcare, manufacturing, and logistics sectors are leading adoption, supported by proven productivity gains and reduced operational downtime. Advances in artificial intelligence, sensor fusion, and edge computing are significantly enhancing environmental awareness and interaction accuracy. Consulting assessments indicate organizations leveraging spatial computing report stronger innovation velocity and faster decision-making cycles.

Surging Consumer Demand for AR and VR as a Market Growth Catalyst

Surging consumer demand for augmented and virtual reality is significantly driving spatial computing adoption, with more than 171 million people worldwide using VR technology across gaming, education, and entertainment in 2024. The global user base continues expanding as mainstream interest broadens beyond niche hobbyists, and accessibility improves through more affordable and ergonomic devices. Recent reports suggest AR/VR user penetration could approach over half of global digital consumers by the end of this decade, reflecting strong engagement growth worldwide. Increased demand for immersive experiences in entertainment, social platforms, and mobile AR applications is encouraging content creators and platform operators to invest heavily in tailored experiences. This consumer-led momentum is fueling broader ecosystem participation, as sustained usage and rising ownership rates reinforce technology investment and drive deeper innovation across hardware, software, and interactive content portfolios.

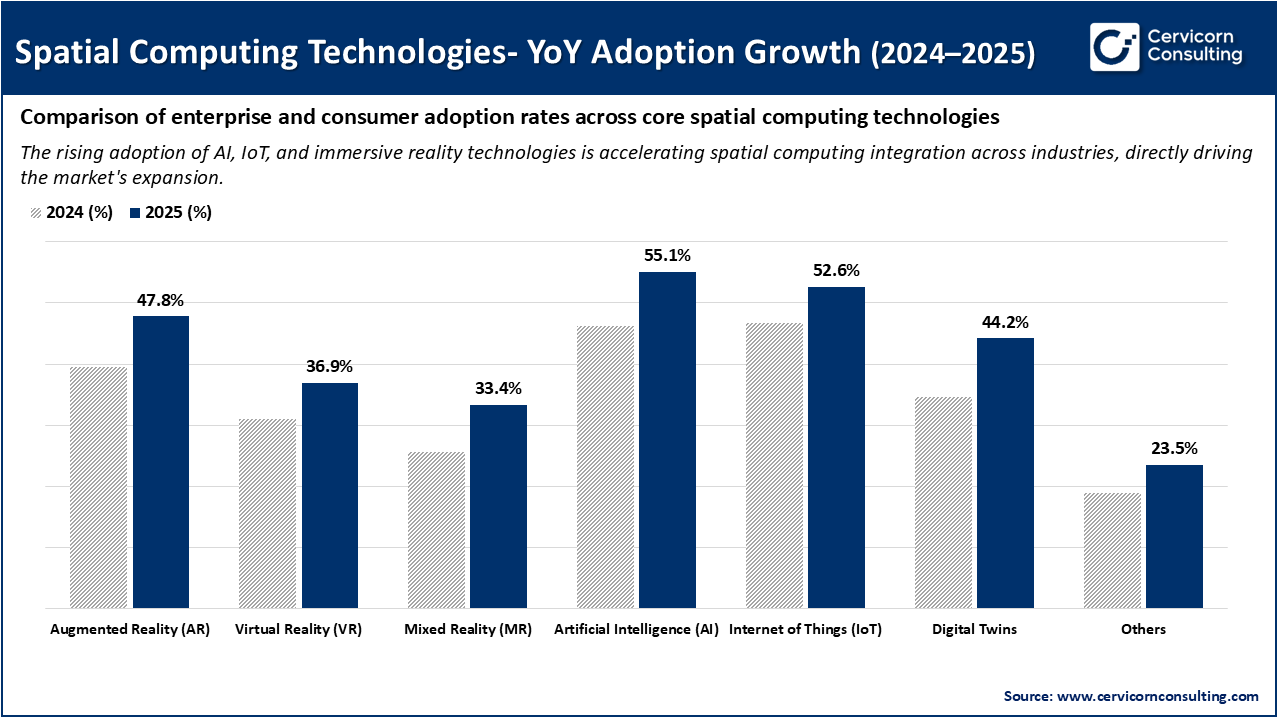

Spatial Computing Technologies - Year-on-Year Adoption Growth Analysis (2024-2025)

The chart illustrates accelerating year-on-year adoption across core spatial computing technologies, highlighting Artificial Intelligence and Internet of Things as the strongest growth catalysts between 2024 and 2025. Augmented Reality and Digital Twins also demonstrate notable increases, reflecting expanding enterprise use cases in training, visualization, and asset management. Mixed Reality and Virtual Reality show steady upward momentum, indicating improving hardware maturity and content availability. Overall, the adoption trends underscore how converging technologies are collectively strengthening spatial computing integration across industries, driving broader market expansion and investment activity.

1. Launch and Expansion of Niantic Spatial, Inc.

In May 2025 Niantic Spatial, Inc. was established as a dedicated spatial computing and geospatial AI company following the spin-off from Niantic.

This strategic restructuring, backed by significant initial funding, catalyzes enterprise-grade AR use cases beyond gaming into logistics, intelligent mapping, and immersive training. By providing advanced AI-powered spatial models and partnering with ecosystem players, Niantic Spatial accelerates real-world integration of spatial computing, expanding commercial demand and application diversity.

2. Android XR Operating System Launch

The Android XR operating system, launched in October 2025 by Google and Samsung, marks a major platform milestone in spatial computing infrastructure.

By offering a unified OS tailored for extended reality devices, Android XR reduces fragmentation and improves developer support, making it easier to build interoperable AR/VR applications. This milestone drives hardware and software ecosystem growth, attracts more developers, and supports broader adoption of spatial computing technologies across device categories.

3. Meta Ray-Ban Display Introduction

Meta’s release of the Ray-Ban Display AI smart glasses with integrated visual output in September 2025 highlights a shift toward mainstream wearable spatial computing.

This device blurs lines between classic eyewear and spatial computing platforms, making AR experiences more accessible to general consumers. By lowering entry barriers and increasing daily usability, it expands the user base, encourages new content creation, and stimulates consumer demand across lifestyle and productivity scenarios.

4. IEEE Spatial Computing for Metaverse Initiative

The IEEE Spatial Computing for Metaverse Initiative focuses on developing standards and reference implementations for spatial computing technologies.

Establishing compatibility and guidelines helps reduce integration friction across hardware and software components, addressing interoperability challenges. This encouraging framework supports industry collaboration and boosts investor confidence, which speeds up innovation cycles and supports larger-scale deployments of spatial computing solutions.

The spatial computing market is segmented into various regions, including North America, Europe, Asia-Pacific, and LAMEA. Here is a brief overview of each region:

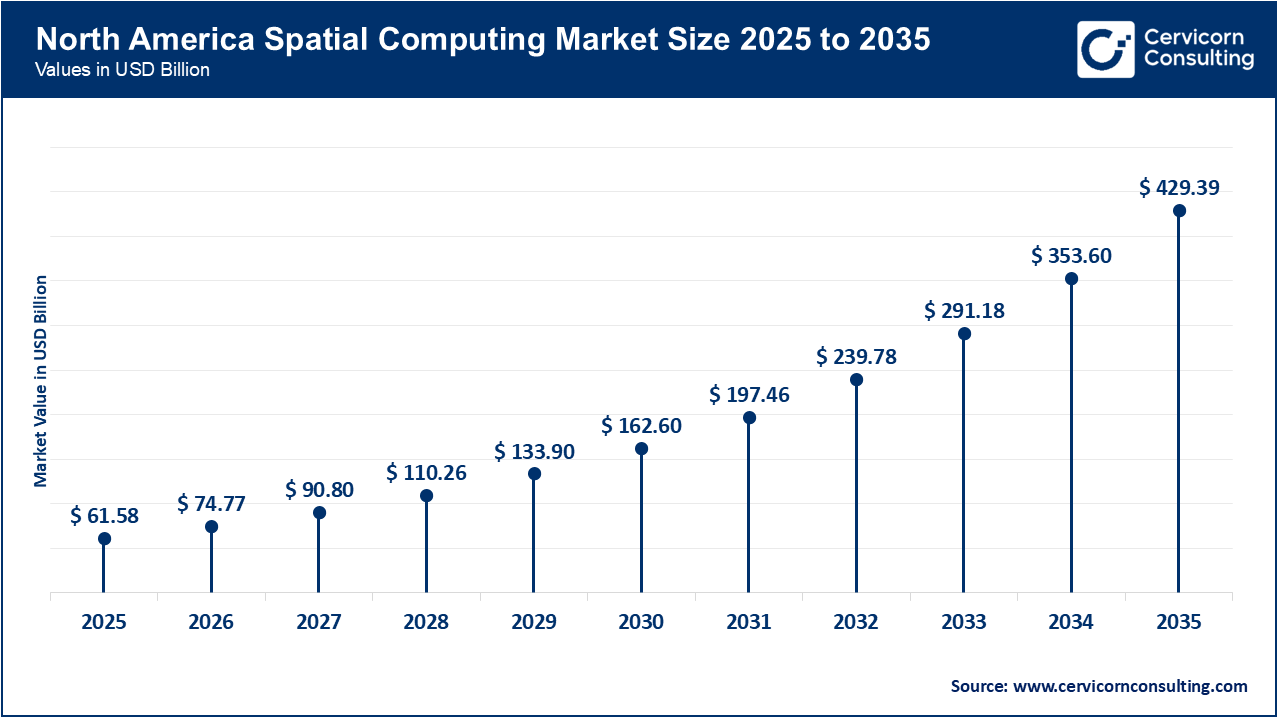

The North America spatial computing market size was valued at USD 61.58 billion in 2025 and is expected to hit around USD 429.39 billion by 2035. North America leads spatial computing adoption because defense, aerospace, and enterprise buyers fund large, repeatable deployments. U.S. military programs are expanding XR for tactical, flight, maintenance, and medical training, creating durable demand for ruggedized headsets and secure software stacks. In parallel, enterprise digital-twin workflows are moving into immersive review and collaboration, pulling hardware and platform ecosystems forward. The region’s deep venture capital, systems integrators, and hyperscale cloud capacity compress pilots into production rollouts faster than most markets.

Recent Developments:

The Asia-Pacific spatial computing market size was estimated at USD 44.52 billion in 2025 and is predicted to surpass around USD 310.46 billion by 2035. Asia-Pacific growth is accelerated by smart-city programs and infrastructure operators adopting digital twins and spatial analytics at metropolitan scale. Singapore’s government-led digital twin efforts illustrate how ports, logistics, and planning agencies convert geospatial data into operational decision tools. South Korea’s metaverse and XR strategy supports ecosystem-building through coordinated policy, skills, and industry programs. The region’s dense manufacturing base also drives AR-guided work instructions and remote assistance, reinforcing recurring software and services demand.

Recent Developments:

The Europe spatial computing market size was reached at USD 46.85 billion in 2025 and is forecasted to hit around USD 326.74 billion by 2035. Europe’s market is propelled by policy-backed digitization and city-scale modernization, which favor interoperable spatial platforms. EU programs fund advanced digital capabilities across governments and industry, lowering adoption friction for XR and digital-twin deployments. City-focused initiatives are pushing “CitiVerse” style applications, turning urban planning and citizen services into visible reference cases. Europe also benefits from a growing investment layer targeting “spatial AI” and immersive infrastructure, helping startups scale beyond pilots into regulated enterprise environments.

Recent Developments:

Spatial Computing Market Share, By Region, 2025 (%)

| Region | Revenue Share, 2025 (%) |

| North America | 34.3% |

| Europe | 26.1% |

| Asia-Pacific | 24.8% |

| LAMEA (Latin America, Middle East & Africa) | 14.8% |

The LAMEA spatial computing market was valued at USD 26.57 billion in 2025 and is anticipated to reach around USD 185.28 billion by 2035. LAMEA adoption is increasingly shaped by government digital-economy agendas and practical enterprise use cases in energy, infrastructure, and skills. Dubai’s Metaverse Strategy signals a policy push to attract investment, talent, and applications that rely on spatial data, AI, and IoT. In the Middle East, national geospatial and “digital twin” frameworks support large-scale planning and asset management programs. Across Africa, capability-building and workforce initiatives are expanding the developer base needed to sustain deployments.

Recent Developments:

The spatial computing market is segmented into component, technology, end user, and region.

The hardware segment dominates the spatial computing market, supported by strong demand for head-mounted displays, sensors, cameras, and advanced processing units. Enterprise deployments and consumer adoption rely heavily on continuous improvements in device performance, ergonomics, and spatial sensing accuracy. Major technology companies are investing aggressively in next-generation headsets and wearable devices, driving higher shipment volumes. Hardware remains foundational for ecosystem growth, as software and services adoption scales in parallel with installed device bases.

Spatial Computing Market Share, By Component, 2025 (%)

| Component | Revenue Share, 2025 (%) |

| Hardware | 63.7% |

| Software | 21.4% |

| Services | 14.9% |

The software segment is the fastest growing, driven by rising demand for spatial operating systems, development platforms, and application-layer solutions. Enterprises increasingly prioritize custom visualization, simulation, and collaboration software tailored to industry-specific workflows. Growth is further supported by expanding developer ecosystems, cloud-based spatial platforms, and AI-powered perception engines. As hardware penetration increases, recurring software licensing and platform monetization accelerate, strengthening long-term revenue sustainability.

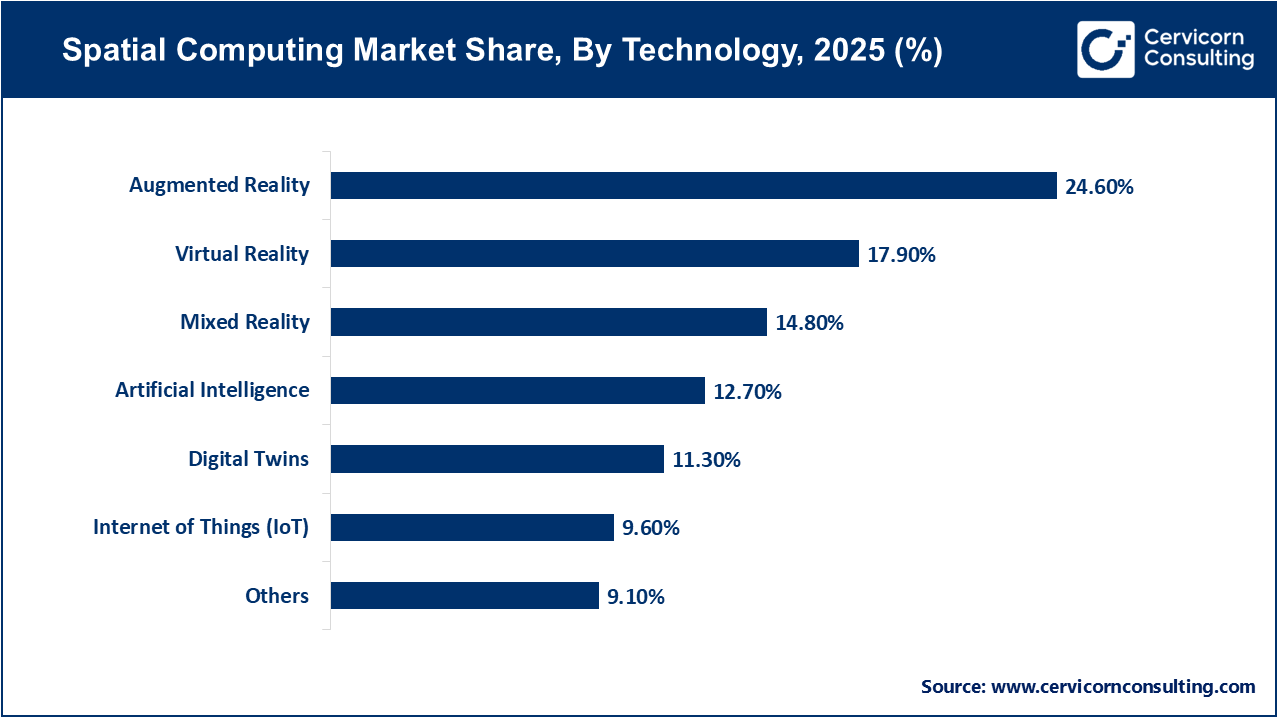

Augmented reality currently dominates the technology landscape due to its broad applicability across enterprise and consumer environments. AR enables contextual overlays without fully immersive experiences, making it more practical for training, maintenance, retail, and navigation use cases. Strong adoption across smartphones, smart glasses, and industrial devices supports sustained demand. Its lower deployment complexity compared to fully immersive systems reinforces AR’s leadership position within the spatial computing technology mix.

Digital twins represent the fastest growing technology segment, driven by increasing demand for real-time asset visualization and predictive analytics. Industries such as manufacturing, energy, and smart cities are rapidly adopting virtual replicas to optimize performance and reduce downtime. Integration with IoT sensors and AI analytics enhances decision-making accuracy. Government-backed infrastructure modernization initiatives further accelerate adoption, positioning digital twins as a high-growth pillar of spatial computing.

Gaming remains the dominant end-user segment, benefiting from strong consumer engagement and continuous content innovation. Immersive gameplay experiences, social interaction features, and expanding esports ecosystems support sustained adoption of spatial computing technologies. Major platform launches and exclusive content investments drive hardware sales and software usage. Gaming continues to serve as a primary commercialization channel, accelerating broader consumer familiarity with spatial interfaces.

Spatial Computing Market Share, By End User, 2025 (%)

| End User | Revenue Share, 2025 (%) |

| Aerospace & Defense | 8.9% |

| Automotive | 9.7% |

| Healthcare | 12.8% |

| Gaming | 16.6% |

| Consumer Electronics | 10.9% |

| Energy & Utilities | 6.4% |

| Education | 7.6% |

| AEC (Architecture, Engineering & Construction) | 7.1% |

| Information Technology | 7.9% |

| Government & Public Sector | 5.8% |

| Others | 7.3% |

Healthcare is the fastest growing end-user segment, driven by rising adoption of immersive training, surgical planning, and patient visualization solutions. Spatial computing enhances procedural accuracy, medical education, and remote collaboration among clinicians. Increasing acceptance of digital health technologies and supportive regulatory environments fuel adoption momentum. As healthcare systems focus on efficiency and outcomes improvement, spatial computing adoption is expanding rapidly across clinical and research applications.

By Component

By Technology

By End User

By Region