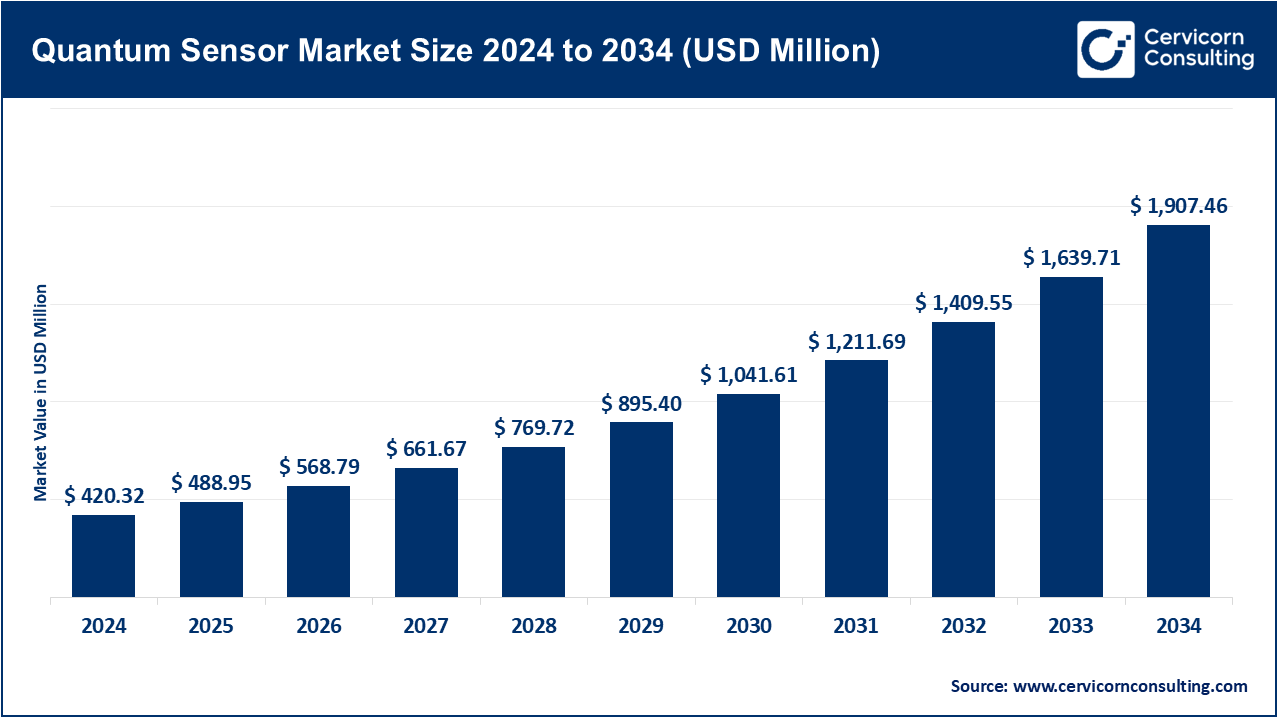

The global quantum sensor market size was valued at USD 420.32 million in 2024 and is expected to be worth around USD 1,907.46 million by 2034, growing at a compound annual growth rate (CAGR) of 16.32% over the forecast period from 2025 to 2034.

The demand of ultra-sensitive detection technologies is rapidly increasing in healthcare, automotive, defense, and environmental sectors which is propelling the growth of the quantum sensor market. Adoption of technologies such as in GPS-denied environments, MRI, and precision agriculture are enabling further innovation and adoption. Through quantum technologies, the next generation sensors can achieve unprecedented levels of sensitivity, accuracy, and miniaturization. Furthermore, Advanced quantum computers, atomic clocks, and cryogenic cooling systems are improving the performance of the sensors and their practical applications. Acceleration of the market growth is the outcome of government funding, joint ventures between academia and industry, and increased efforts towards commercialization. Strategic partnerships, prototype scalability, and R&D are the main foci of the key players. Therefore, industries are set to be transformed with high precision agus quantum enabled solutions and as a result, the quantum sensors market is evolving.

Report Scope

| Area of Focus | Details |

| Market Size in 2025 | USD 488. 95 Million |

| Expected Market Size in 2034 | USD 1,907.46 Million |

| Projected Market CAGR 2025 to 2034 | 16.32% |

| Preeminent Region | North America |

| Leading Growth Region | Asia-Pacific |

| Key Segments | Type, Platform, End Use, Application, Region |

| Key Companies |

ADVA, AdSense, Biospherical Instruments Inc., GWR Instruments Inc., Microchip, Microsemi Corp., Muquans SAS, Robert Bosch GmbH, Spectrum Technologies Inc., Thomas Industrial Network Inc. |

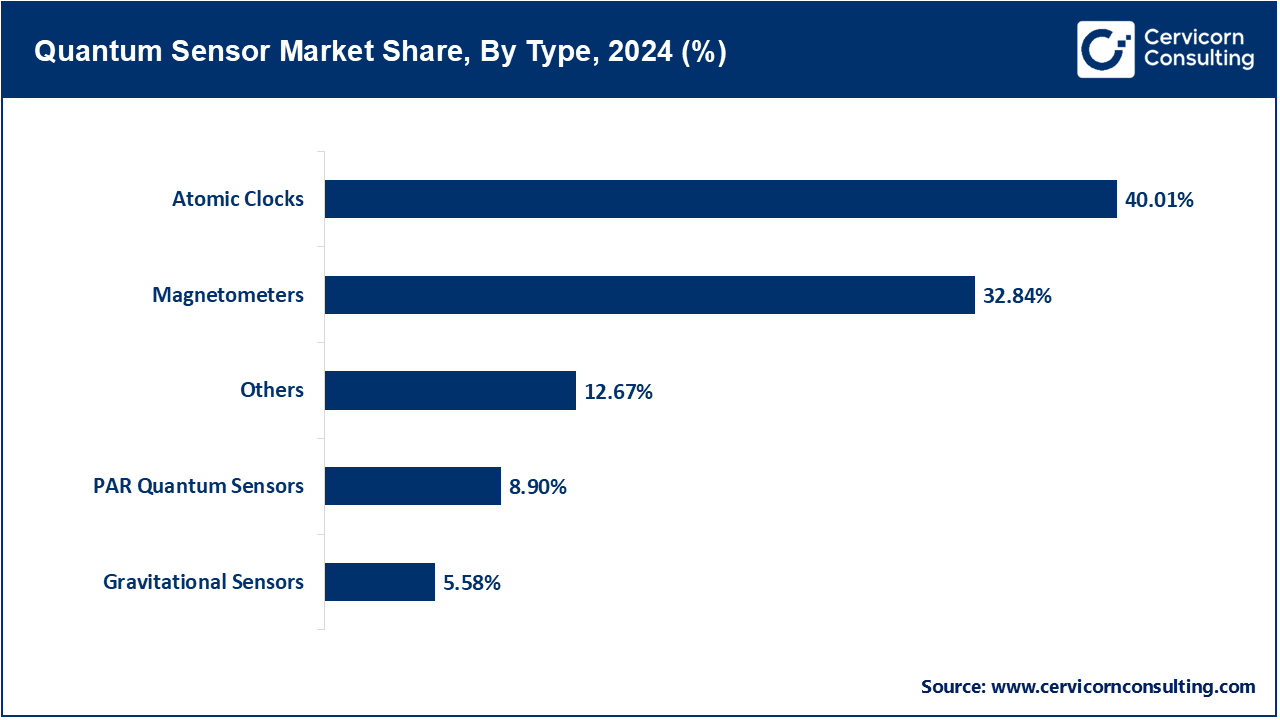

Atomic clocks: The atomic clocks segment has generated highest revenue share. The frequency of atomic transition makes atomic clocks important for advanced navigation and communications systems which require time precision down to nanoseconds. NIST is leading a consortium which in May 2023 announced the development of portable chip-scale atomic clocks which can be used in time sensitive field operations away from the lab. During validation, the prototype performed similarly to the laboratory systems in stability. Adoption is likely in the defense, telecommunications, and autonomous industries. Commercialization is expected in about two years.

Magnetometers: Exceptional sensitivity to magnetic fields enable their use in navigation, medical imaging, and exploration geophysics. In many applications, these sensors are capable of discerning changes that go undetected by other sensors. In October 2024, a quantum-enhanced magnetometer was tested on a diamond-hot-air-balloon for geological survey aircraft and was able to detect magnetic anomalies with unprecedented resolution. This will significantly improve the accuracy of data and thus bolster mineral exploration, infrastructure mapping, resource evaluation using quantum airborne surveys, and geophysical surveys. Industry experts believe enhanced adoption in resource mapping will enable widespread environmental monitoring.

Gyroscopes: Quantum gyroscopes use interference patterns both to measure and to quantify rotational motion, and, unlike classical GPS systems, provide drift-free orientation information. They are best suited for inertial navigation in the absence of GPS signals. In March 2025, Lockheed Martin performed drone flights using gyroscopes with QuINS quantum inertial navigation systems, confirming functionality. During extensive flights, the device maintained remarkable orientation accuracy. This milestone indicates more work can now be done toward true practical testing. The breakthroughs will enable further advances to be made for submarines and self-driving cars. Partners are currently setting schedules for possible commercial timelines.

Acoustic sensors: Acoustic quantum sensors can be used for materials characterization, monitoring phenomena below the water's surface, and observing the health of the structures due to their capability of detecting ultrasonic waves and other pressure variations. Research laboratories introduced a new diamond-based acoustic sensor in August 2022, which is capable of detecting fractures much earlier than they can be detected with existing methods. Its ability to detect micro-fractures months prior to ultrasound detection is unprecedented. Civil infrastructure testing has begun, and there is a rising demand for the technology in industrial preventative maintenance. Its adoption is anticipated shortly.

Neutral atoms: The neutral atoms segment has captured highest revenue share. In certain areas of measurement science, including gravimetry, laser-cooled and arrested neutral atoms are utilized for timekeeping and gravity measurement. These systems achieve exceptionally high accuracy due to the coherent atomic states. A startup I am aware of commenced in April 2024 with a groundwater detecting field-portable gravity sensor using interferometry on neutral atoms. Early testing revealed the system performed with centimeter-level resolution for detection. Pilot projects were subsequently initiated with agricultural agencies. This has potential to advance portable environmental sensor systems.

Nuclear magnetic resonance: NMR quantum sensors are used for chemical analysis, medical diagnosis, and material assessment through non-destructive high contrast and NMR-based atomic nuclei resonance sensing. It is possible to implement non-destructive, high-contrast, and high precision sensing with NMR. In November 2023, a spin-off company launched an NMR quantum sensor designed for real-time soil nutrient analysis and enabled on-the-site measurement of nitrogen and phosphorus content for farmers. Early field tests performed in Europe indicated a 5–10% improvement in yields. It is anticipated that the product will soon be embraced by Agri-Tech companies, enabling more sustainable agricultural practices.

Optomechanics: Light interacting with a mechanical system enables the detection of displacements, forces, and accelerations at quantum limits using an optomechanical sensor. The sensitivity of these sensors includes measurement of vibrations and in precision metrology. In January 2025, a research group created an optomechanical accelerometer for seismic monitoring which has a resolution of nano-g. This new device is a tenfold improvement over standard accelerometers. Currently, the device undergoes testing in earthquake-prone regions for early warning system applications while commercial partners conduct preliminary tests. This marks a major achievement in the evolution of quantum-enhanced optomechanical devices.

Aerospace & defense: The aerospace & defense segment held dominant position in the market. Quantum sensors in aerospace and defense include inertial navigation, gravimetry, and threat detection systems. They bolster precision and security in hostile or GPS-denied zones. In December 2024, DARPA awarded multiple contracts for demonstrator systems combining quantum gravimeters and inertial sensors for missile tracking. These systems are created with no dependency on satellites. This progresses further the development of defense sensing infrastructures. Prototypes that can be easily scaled are being constructed actively by industry stakeholders. This is expected to speed up the deployment of next-generation systems.

Agriculture & environment: Quantum sensors have widespread applications in monitoring soil moisture, groundwater, and other subsurface anomalies in precision farming which aids in optimizing resource allocation. Such sensors are useful in precision agri-environmental activities. In July 2024, portable quantum gravimeters were used by a governmental laboratory to track irrigation leakage and groundwater depletion. The results improved water-use planning in arid regions. Demand for pilot projects has now been requested by farmers and regulators. This marks a shift towards data-driven ecological conservation. Greater adoption in other regions is anticipated.

Oil & gas: Through advanced classical techniques, precision subsurface mapping, reservoir monitoring, and leak detection are offered to the oil and gas sectors through quantum sensors. Utilization of such sensors enables companies to address operational issues of sustainability, achieving equilibrium between profit-driven extraction and harm to the environment. In February 2023, one energy company utilized quantum gravimeters for offshore reservoir delineation and noticed subtle density changes that were previously overlooked. Now, the deep-water fields are being added to the test. Investors are closely monitoring the commercialization potential. Interest in quantum-based surveys is increasing in the industry.

Automation: In the field of industrial automation, quantum sensors enhance precision of robotics and predictive maintenance as well as quality control by monitoring minute mechanical or magnetic fluctuations. In March 2025, pilot programs utilizing quantum magnetometers to uncover concealed weld imperfections on automotive production lines surfaced. The systems were capable of identifying flaws prior to the emergence of visible issues. Manufacturers are scaling up trials on the plant floor. This marks an advancement toward automated quality assurance. Full implementation is expected in two years.

Others: This spans across healthcare diagnostics, subsurface imaging and surveying in mining, and even telecommunications, all of which make use of quantum sensors for imaging, subsurface surveying, and precision timing. One of the telecom operators tested a portable quantum clock intended for synchronizing 5G base stations in August 2023. The clock achieved its goals as it outperformed fiber-based timing systems. Initial testing in metropolitan areas is showing good promise. Now, the operator is implementing a broader network test. This expands the use cases for quantum sensors even more.

Environmental monitoring: Quantum sensors can monitor water levels, magnetic and seismic activities for better resource management regarding climate change. Their long duration precision measurements without drift calibration are unrivaled. In July 2024, national parks received quantum magnetic and gravity sensors for real-time monitoring of gas seepage and other geological processes during in-park geological remote sensing. Advanced notice systems for park managers have been implemented, allowing advanced warnings of some geological shifts. The program is expanding to other protected regions now. More governments have shown interest for such systems. From gas seepage monitoring to conservation, the possibilities are numerous. The sensors are applicable in disaster mitigation as well as conservation.

Quantum Sensor Market Revenue Share, By Application, 2024 (%)

| Application | Revenue Share, 2024 (%) |

| Environmental Monitoring | 21.70% |

| Medical Imaging | 16% |

| Precision measurement | 36.01% |

| LiDAR | 26.29% |

Medical imaging: New applications of quantum magnetoencephalography and low field MRI through quantum imaging offer improved sensitivity for advanced diagnostics. It holds promises for imaging at a lower size and cost. A biotech company issued a quantum sensor module for brain imaging MRI to be performed under portable settings and neurological assessments in the field were made possible. Preliminary clinical tests during stroke diagnosis have shown enhanced signal clarity which is attributed to the technology. Imaging and remote diagnostics are offered by some diagnostic centers now utilizing the technology. A paradigm shift in portable imaging is anticipated. More widespread use is anticipated for 2025.

Precision measurement: The precision measurement segment has accounted for highest revenue share. Applications of precision measurements are found in gravimetry, accelerometry, as well as timing tasks performed at a quantum level. These are important in industrial metrology, mapping, and calibration. A national metrology institute benchmarked a quantum gravimeter for calibrating classical sensors with a gapotian approach in February 2024. This complements data from other laboratories. Industry is now aligning measurement protocols using classical sensors, which marks a major milestone towards advancing global alignment for defining consistency and traceability. Widespread adoption is expected soon.

LiDAR: In photon counting based quantum LiDAR stealth imaging and low signature scans, power consumption and sensitivity are improved. Last year, a quantum LiDAR prototype was reported with record range performance by a startup. The device autonomously tracked and detected ranging obstackles. Autonomous vehicle companies began urban pilot tests. The new range performance has been demonstrated in limited visibility conditions, with the potential for further testing outside.

The quantum sensor market is segmented into several key regions: North America, Europe, Asia-Pacific, and LAMEA (Latin America, Middle East, and Africa). Here’s an in-depth look at each region.

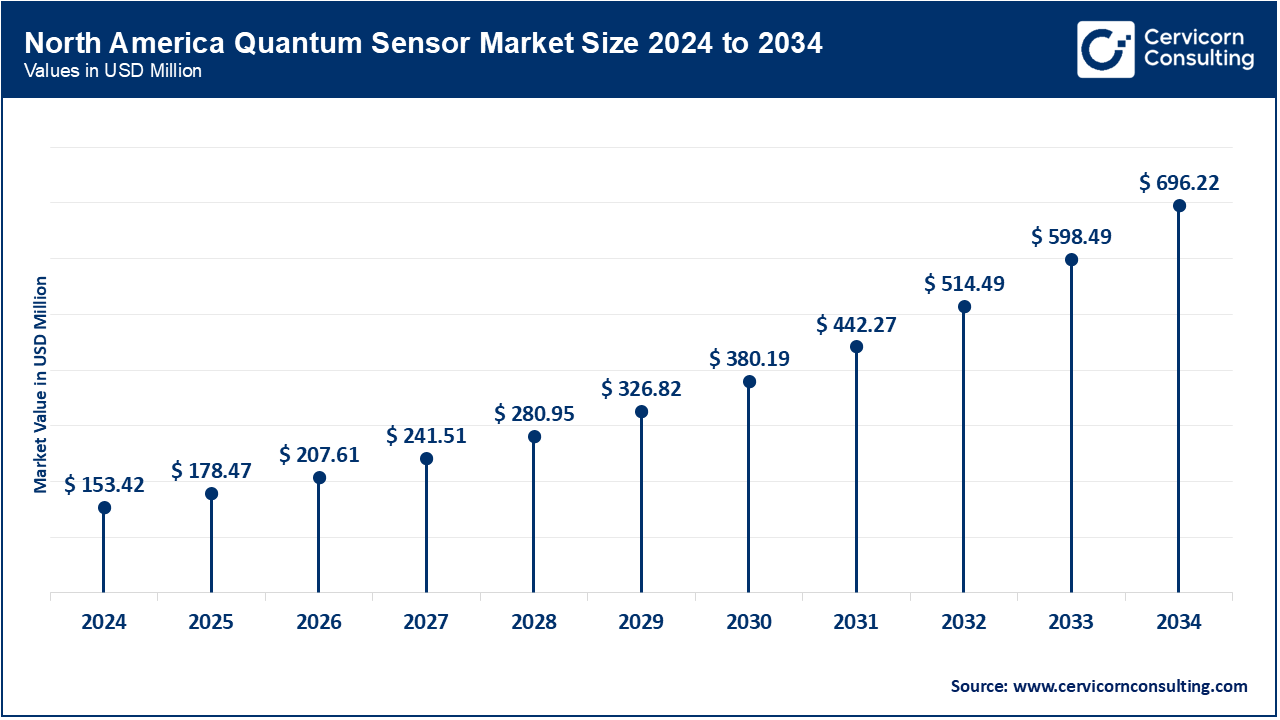

North America is the leading region due to having well-established R&D facilities, significant defense spending, and adoption in aerospace, healthcare, and industrial automation. The United States is still the leader, with Canada following, and with Mexico growing academic participation. In June 2023, the U.S. DOD obligated about $0.07 billion USD towards quantum sensor GPS-denied navigation and surveillance system enhancements. Canada was working on magnetometer commercialization for geological surveying. Mexico is increasing funding for academics in quantum technologies and their applications. North America is projected to persist as a center of strategy and commercial thrust for quantum technologies.

Europe region is receiving much attention, driven by EU policies complemented with industrial demand, and strong national programs from Germany, the UK, and France. Environmental and defense monitoring as well as autonomous mobility feature the technologies. In November 2022, the UK government committed over $0.13 billion USD to its National Quantum Technologies Programme, which includes sensors for agriculture and aerospace. Germany's Fraunhofer Institute started testing tunnel detection sensors and France launched a dedicated quantum navigation center. Russo-Italian and Dutch collaborations are working on environmental and atomic clock sensors. Europe is fiercely competitive in innovation due to cross-border cooperations.

China, Japan, and India are expanding their government spending initiatives, commercialization policies, and cross-sector research, making the Asia-Pacific Region one of the most advanced in the world concerning quantum sensors. China is the largest sensor user, supporting Japan and India's military and agricultural quantum investments. With its $0.09 billion USD funding of metro infrastructure projects using quantum gravimeters in February 2024, China continues to prioritize infrastructure spending. India started a national quantum accelerator program in 2023, while Japan conducted military test flights using magnetometers. South Korea and Australia are researching naval and automation factory applications. The region is poised in the long term.

Quantum Sensor Market Revenue Share, By Region, 2024 (%)

| Region | Revenue Share, 2024 (%) |

| North America | 36.50% |

| Europe | 32.40% |

| Asia-Pacific | 23.30% |

| LAMEA | 7.80% |

Research in energy, navigation, and the environment places LAMEA at the forefront of quantum sensor innovation. Early adopters and capacity builders include Brazil, UAE, and South Africa. Offshore oil deposit mapping using magnetometers is being funded by 0.012 billion usd by Brazil's national laboratory. In 2024, the UAE pledged 0.015 billion usd towards construction of a quantum sensor lab aimed at autonomous systems and defense, expanding previous commitments. South Africa is increasing pilot and academic frameworks in quantum gravimetry. Although the region is still emerging, it is showing strong strategic readiness.

The quantum sensor industry is driven by key players like ADVA, AdSense, Biospherical Instruments Inc., GWR Instruments Inc., and Microchip, who are advancing compact, high-precision sensing for defense, telecom, and environmental use. In Jan 2024, Microchip launched a next-gen atomic clock; GWR introduced a portable gravimeter in Mar 2023. ADVA expanded its quantum timing tech in North America in Jun 2022. Biospherical Instruments collaborated on marine quantum sensors, and AdSense launched a cloud-based magnetometer in Oct 2024. These firms are shaping the future of quantum sensing.

Market Segmentation

By Type

By Platform

By End Use

By Application

By Region