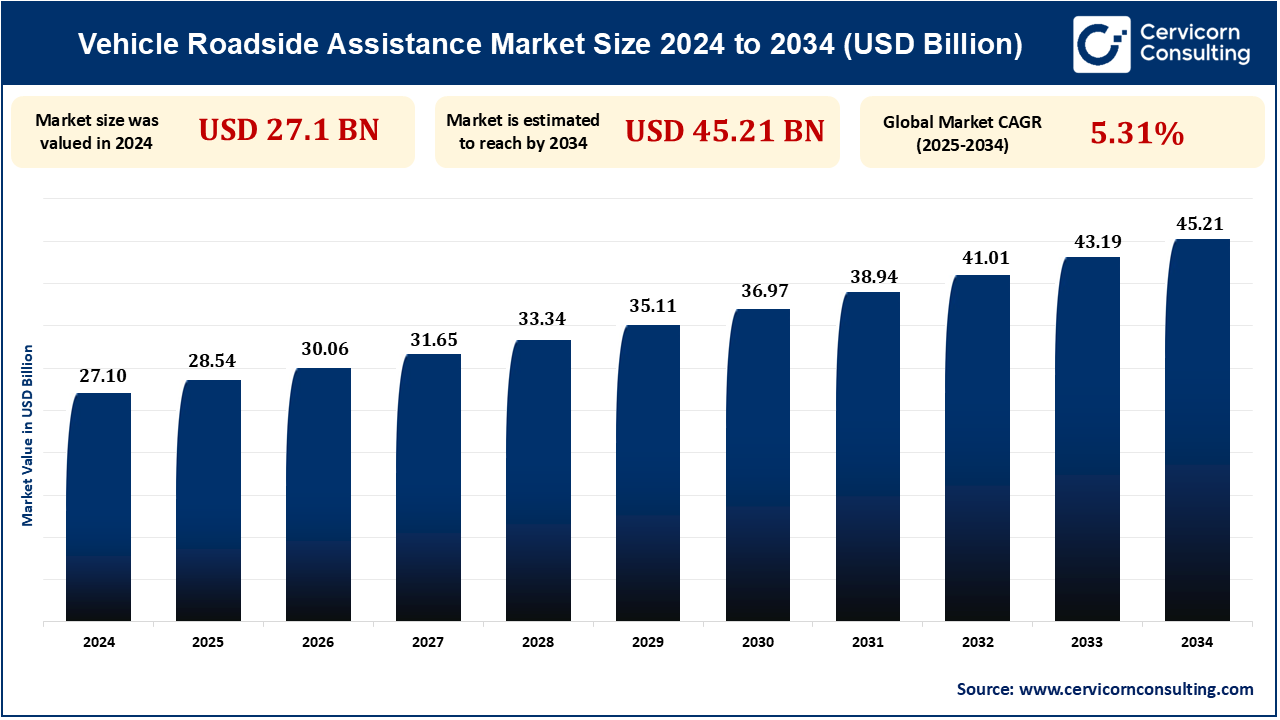

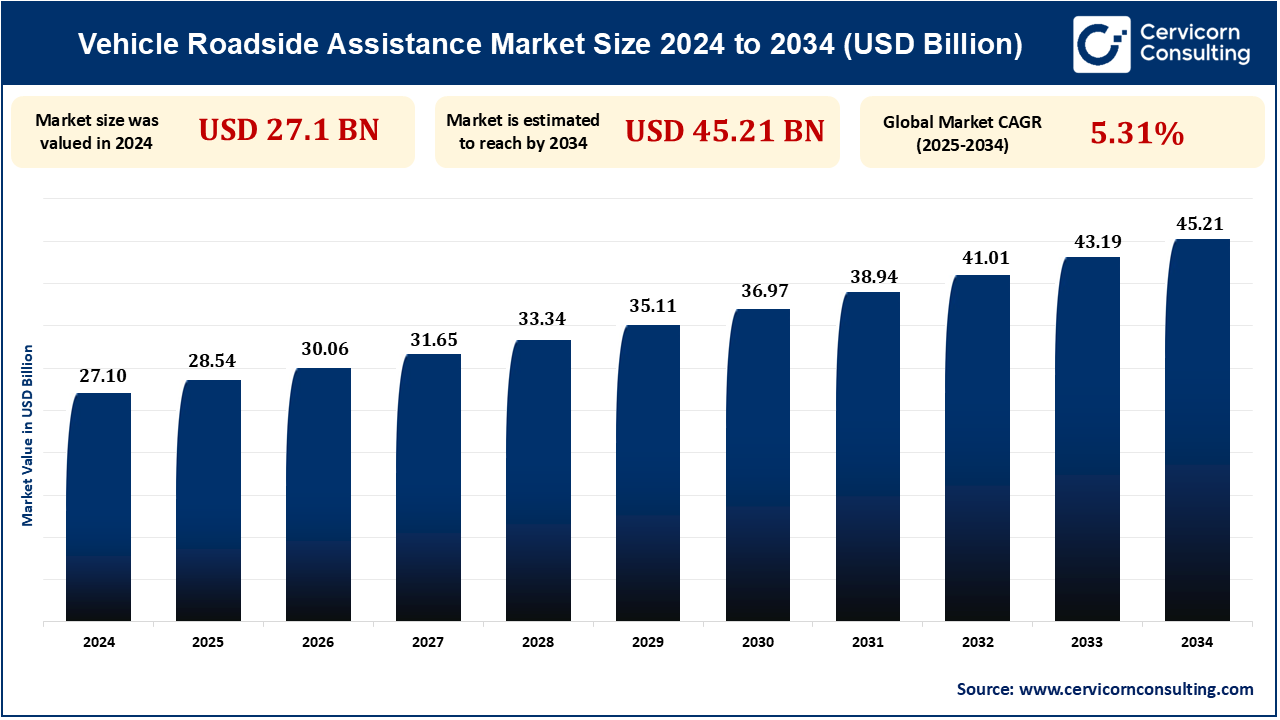

Vehicle Roadside Assistance Market Size, Trends and Forecast 2025 to 2034

In 2024, the global vehicle roadside assistance market size was estimated at USD 27.10 billion, and it is expected to grow to around USD 45.21 billion by 2034, registering a compound annual growth rate (CAGR) of 5.31% over the forecast period from 2025 to 2034. The vehicle roadside assistance market is driven by growing vehicle ownership, need for emergency convenience services, and innovative technology like mobile apps and GPS. Expanding service networks and insurance partnerships also drive expansion.

The vehicle roadside assistance market is all about rendering emergency services to drivers who undergo car breakdown or any other faults during travel. Services such as tire replacement, fuel delivery, jump-start, and towing form a part of the market. It serves individual users, fleet owners, and insurance providers through constant support available. It also makes use of technology like mobile apps and GPS for improving efficiency of services as well as customers' experience. As more and more people own cars and travel, the market continues to expand globally.

One of the key drivers for the vehicle roadside assistance market is increasing reliance on personal transport and road traveler expansion. With rising levels of car ownership across the globe, demand for reliable and fast emergency solutions has also grown. Furthermore, integration of technology through mobile apps and global positioning systems has enabled customers to get roadside assistance services at their fingertips within seconds. The ease and reliability provided by such services enhance market demand further. Such a pattern is supplemented by collaboration between insurers and service providers to increase coverage.

Vehicle Roadside Assistance Market Latest Investments

- In January 2023, ReadyAssist acquired SpeedForce for USD 0.10 billion in a cash and stock deal, aiming to establish India's largest chain of multi-brand 2W workshops by April 2024. This acquisition will expand ReadyAssist's network to 1,000 workshops and strengthen its roadside assistance services. The partnership plans to unify vehicle lifecycle services through ReadyAssist's Super App and will employ and train mechanics via the MECADEMY program.

- In May 2023, RunR Mobility, an Indian electric vehicle (EV) manufacturer, has partnered with ReadyAssist to enhance after-sales services for its customers. This collaboration will enable RunR Mobility clients to access a yearly maintenance plan for their B2B 2W EVs, including periodic servicing, roadside assistance, and warranty replacements. RunR Mobility will also gain access to ReadyAssist’s workshops equipped with EV servicing capabilities and skilled mechanics. ReadyAssist, known for its tech-enabled roadside assistance and doorstep solutions, aims to expand its customer base through this partnership.

- In November 2024, GoMechanic launched its 'Top Assist' roadside assistance program, offering 24/7 nationwide emergency support for car owners. Starting at an introductory price of ₹99, the program includes services like towing, flat tire repairs, jumpstarts, lockout assistance, fuel delivery, and medical assistance. GoMechanic aims to provide affordable, seamless coverage with rapid response times, addressing the need for reliable emergency support. The program covers over 3,000 cities and 20,000 pin codes and has already gained over one lakh subscriptions.

Vehicle Roadside Assistance Market Important Factors

Technological Advancements and Mobile Integration

Employment of advanced technologies, particularly cell phone software and GPS systems, has revolutionized roadside assistance services. Through use of these tools, service providers are able to offer real-time help so that drivers can immediately get assistance whenever they encounter emergencies while on the road. The innovation in technology has made it easy to perform roadside assistance, guaranteed its trustworthiness, and made it accessible to more consumers as individuals embrace smartphones for on-the-sprint services.

- In October 2023, Audi launched a 10-year Roadside Assistance program for cars sold from October 1, 2023, as an extension of its customer-centric philosophy. The service provides 24/7 coverage throughout India, ranging from on-site repairs to fuel delivery, spare keys, travel/accommodation arrangements, and vehicle custody. This move is to ensure that Audi customers have a hassle-free and seamless ownership experience.

Rising Vehicle Ownership and Demand for Emergency Services to Fuel the Market Growth

The steadily increasing number of vehicles on the road contributes directly to the growing demand for roadside assistance services. With an increase in the reliance on personal vehicles for daily use, the demand for fast and effective emergency aid has increased manifold. This is especially so as car ownership has increased across the world, paving the way for greater occurrences of breakdowns, accidents, and other roadside breakdowns calling for prompt help.

- In April 2023, the rising cost of living is causing many car owners to delay vehicle maintenance and repairs. Surveys have shown that a high percentage of drivers are delaying vital services such as oil changes and tire rotations because of money. In the UK, almost half of motorists have changed their maintenance practices, with many turning to independent garages for cheaper servicing. Repair costs are rising because of increased operating costs, taxes, and energy prices, which further fuel the problem. This is a troubling trend, as postponing maintenance will result in more costly repairs and potential safety hazards.

High Service Costs and Limited Coverage May Restrain the Market’s Growth

One of the major constraints in the vehicle roadside assistance sector is exorbitant service charges, which can deter customers from enrolling or using them frequently. Premium fees for emergency assistance could be too costly, especially in poor areas. Additionally, low coverage in rural or underdeveloped areas reduces the coverage and effectiveness of these services. This unaffordability and low coverage further hinder sector growth. Therefore, the market is plagued with challenges in connecting and appealing to a broader base of consumers.

- For instance, in April 2024, an Australian Finder survey indicated that 16% of motorists with roadside cover, about 0.18 billion individuals, might be wasting up to USD 105 each year, a total of USD 0.189 billion, since they would call someone other than their provider when broken down. The mean price of roadside cover is roughly USD 105.37 yearly, and NRMA had the highest customer satisfaction rating, standing at 4.5/5 with 94% of customers recommending the service.

Expansion of Electric Vehicle (EV) Roadside Assistance to Revolutionize Market Growth

As more electric vehicles (EVs) are being adopted, roadside assistance services can potentially grow their services for EV owners on a large scale. As more and more consumers switch to electric vehicles, the market for specialized services such as mobile EV charging and battery support will expand.The automakers can take advantage of the trend by including EV-specific features with their roadside assistance offerings to capitalize on a new and growing customer base.

- For example, in April 2023, Electric vehicle (EV) roadside assistance is the same as gasoline engines, including flat tires, accidents, and dead 12-volt batteries. Being out of power is a no-brainer issue for EVs, which is being solved by roadside assistance through towing to charging points or, more and more these days, mobile charging. AAA provides mobile EV charging in 15 cities and trip-planning apps, and companies like SparkCharge provide on-demand charging service.

Vehicle Roadside Assistance Market Scope

| Attributes |

Details |

| Vehicle Roadside Assistance Market Size in 2024 |

USD 27.10 Billion |

| Vehicle Roadside Assistance Market Size in 2034 |

USD 45.21 Billion |

| Vehicle Roadside Assistance Market CAGR |

5.31% from 2025 to 2034 |

| By Vehicle Type |

- Passenger Car

- Commercial Vehicle

|

| By Service Type |

- Towing

- Tire Replacement

- Fuel Delivery

- Others

|

| By Providers |

- Auto Manufacturers

- Motor Insurance

- Independent Warranty

- Automotive Clubs

|

| By Region |

- North America

- APAC

- Europe

- LAMEA

|

| Key Players |

- Veolia Environnement S.A.

- Suez S.A.

- Ecolab Inc.

- Xylem Inc.

- Danaher Corporation

- Pentair plc

- Aquatech International LLC

- Evoqua Water Technologies LLC

- Kurita Water Industries Ltd.

- 3M Company

- Calgon Carbon Corporation

- IDEXX Laboratories, Inc.

- GE Water

- Pall Corporation

- Trojan Technologies

|

Vehicle Roadside Assistance Market Regional Insight

Europe is Expected to Grow at the Fastest Rate During the Forecast Period

Some key factors, Europe will be most likely to witness the fastest growth in the vehicle roadside assistance market. Growth in automobile ownership, particularly with the increased demand for electric vehicles (EVs), results in greater demands for professional services. European customers are increasingly demanding quick and efficient roadside assistance made feasible by advancements in digital platforms such as mobile applications. At the same time, the increased need for value-added services and customized customer experience in countries like Germany, the UK, and France also propel this market growth.

- For instance, in May 2024, The AA will be the first UK roadside recovery firm to launch fully electric recovery cars into its fleet. The vehicles, unveiled at a Fleet Decarbonisation event, are the AA's "test and scale" plan to achieve a 2035 net-zero emissions target. New fleet additions include a Volvo FE Slidebed with a 170-mile range, an Iveco eDaily Powerload with remote loading, and an Iveco eDaily CRT van with a 160-mile range and a custom conversion for the safe deployment of recovery kit. Collectively, they are a significant step towards sustainable roadside assistance, with the benefits of reduced emissions and enhanced working capabilities.

North America Dominated the Vehicle Roadside Assistance Market in 2024

North America led the vehicle roadside assistance industry in 2024, fueled by significant levels of car ownership, widespread use of emergency services, and a strong service provider network. Developed infrastructure in the region, with mature digital platforms and mobile access to services, has entrenched its market leadership. Partnerships between insurance companies and roadside assistance providers have expanded coverage, giving greater access to consumers. In addition, the focus on customer convenience and safety has further solidified North America's dominance in the market.

- For example, in December 2023, The Auto Club Group (ACG), the second-largest North American AAA club with more than 0.13 billion members, registered a 48% year-over-year sales increase in 2022 by utilizing ON24's digital engagement platform. This shift from live events to digital and hybrid campaigns broadened ACG's reach, lowered costs, and improved sales follow-up. A recent Accenture survey discovered that 75% of partners are more likely to work with providers leveraging digital experiences to simplify business, citing ACG's front-runner position in digital transformation with customized digital events such as webinars and virtual travel summits.

Vehicle Roadside Assistance Market Segmental Insight

By Provider, the Auto Manufacturer Segment Led the Market

Automobile firms lead the vehicle roadside assistance industry by associating service with automobile sales, promoting customer satisfaction and loyalty. Most companies provide roadside assistance in the form of a warranty package or as an enhanced service. It has emerged as a premium selling point, particularly in areas that focus on convenience. Relying on technological tools such as mobile apps and GPS for real-time assistance aids its market leadership.

- For instance, in November 2023, BMW Group UK, in partnership with Allianz Partners, updated its Roadside Assistance Programme with a multibillion-pound investment, increasing its recovery fleet from 41 to 72 next-generation service vans. The vans are fitted with expanded storage for spare parts, the most up-to-date remote diagnosis systems, and High Voltage (HV) system-trained technicians to cover the entire BMW Group product range. The upgrade aims to improve customer experience by offering quicker and more efficient roadside assistance.

By Vehicle, the Passenger Vehicles Segment Led the Market

Passenger cars register the largest roadside assistance market share because they pervade roads in large numbers and have increasing bases of private users. With growingly complex late-model cars being equipped with mounting amounts of electronics and hybrid functionality, specialist environments are increasingly requested. This represents a leading anxiety for roadside assist operators because its volume is substantial and customers come to depend heavily on the operations.

- For instance, the Automobile Association of the Northern Territory rolled out a mobile electric vehicle (EV) charging van in November 2024 to assist EV drivers in the Darwin area. This new service will be an easier option for drivers who find themselves out of charge, achieving around 15 kilometers of range in approximately 20 minutes. This is sufficient to bring drivers to the nearest charging center, so it is a lower-cost, more convenient solution than towing. The service is built into AANT's current roadside assistance coverage, so there's no extra charge for members who require it.

Vehicle Roadside Assistance Market Major Breakthroughs

- In December 2023, Chubb Malaysia enhanced its claims and vehicle roadside assistance services by introducing two new digital platforms: the Chubb Claims Centre and MY Chubb Motor Assist. The Chubb Claims Centre is an intelligent online platform designed to streamline the claims process, allowing customers to process claims with a few clicks, upload documents, and access the platform on any digital device. MY Chubb Motor Assist provides 24/7 vehicle roadside assistance to Chubb's motor insurance customers, enabling them to share their location, select a preferred workshop, track tow trucks in real time, view towing costs, and receive updates on their vehicle's repair status. These initiatives reflect Chubb's commitment to using technology to improve customer experience.

- In March 2024, Okinawa Autotech, an electric two-wheeler manufacturer, has partnered with ReadyAssist to provide after-sales service and emergency roadside assistance to its customers. This collaboration ensures Okinawa customers receive quick support from ReadyAssist's mechanics 24/7 through a seamless app interface. This is ReadyAssist's eighth partnership in FY2024, reinforcing its position in the EV sector.

- In February 2025, Allianz Partners and SIXT Spain have partnered to provide roadside assistance to SIXT's rental vehicles. The agreement focuses on delivering specialized and high-quality customer service through Allianz Partners' network of professionals. Both companies aim to offer innovative, digital, and sustainable roadside assistance solutions that minimize environmental impact. Allianz Partners' Managing Director Iberia, Borja Díaz, and SIXT Spain's Vice President, Jaime Bigeriego, emphasized their shared values of service excellence and customer-centricity in this alliance.

Empower your strategy with expert insights, purchase this premium research@ https://www.cervicornconsulting.com/buy-now/2358

Ask here for more details@ sales@cervicornconsulting.com