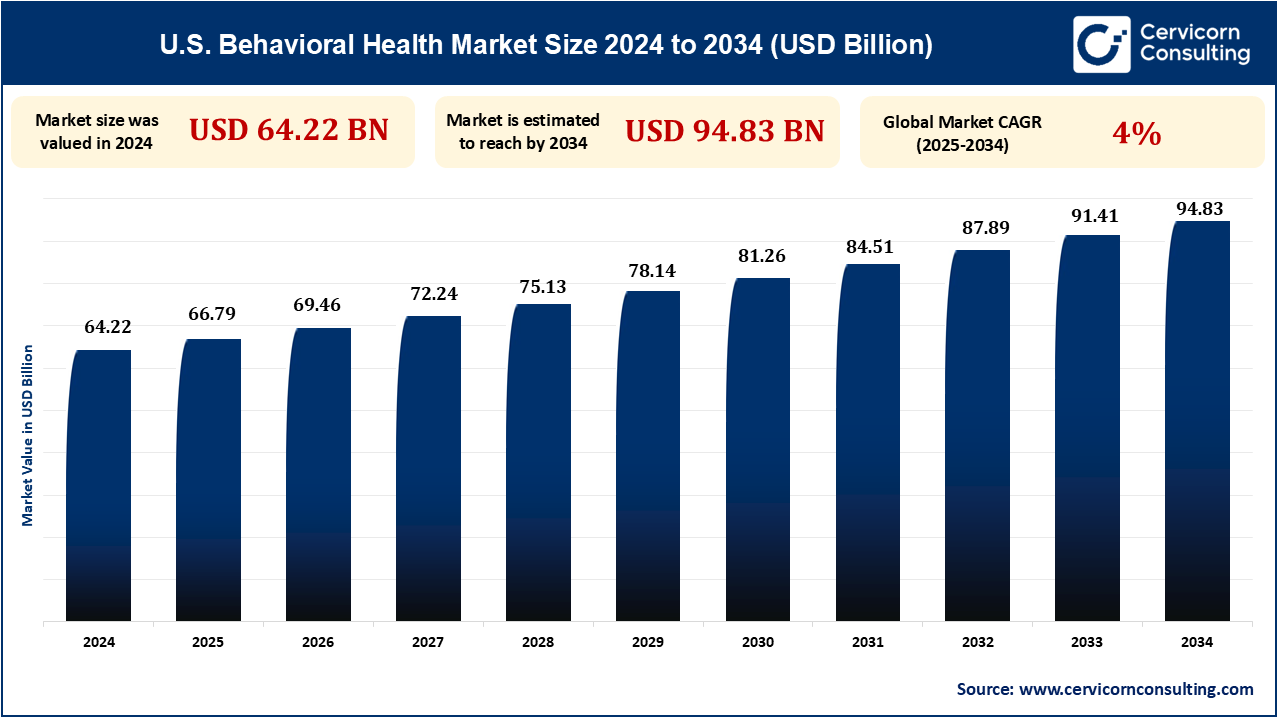

The U.S. behavioral health market size was reached at USD 64.22 billion in 2024 and is expected to be worth around USD 94.83 billion by 2034, exhibiting at a compound annual growth rate (CAGR) of 4% over the forecast period 2025 to 2034.

Behavioral health is growing exponentially with rising awareness and demand for mental health services, especially in light of the increased rates of stress, anxiety, and depression around the world. The COVID-19 pandemic accelerated this trend even further, calling attention to the need for effective and accessible mental health care. With increasingly more individuals coming in for help, there is a strong shift towards integrating behavioral health into primary care centers, digital health systems, and telehealth. The demand is driving the creation of new treatments, including therapy, medication, and preventive interventions, as well as policy innovation focused on increased access and reducing stigma around mental illness.

Telehealth is revolutionizing behavioral health by bridging the gap of provider shortages and enhancing access, especially for interventions such as ABA. The major trends are AI-powered personalized treatment, wearables-based remote monitoring, and VR/AR-based immersion therapy. Integrated ecosystem and caregiver support technologies are rising, with 5G leading connectivity. Regulation-guided increase in coverage and insurance reimbursement for mental health care has facilitated this transition. While there are issues with billing and cybersecurity, the market is expanding, with virtual mental health care poised to go mainstream by 2025. For instance, according to American Psychological Association (APA), in 2023, 82% of psychologists who provide therapy via telehealth reported similar or better outcomes compared to in-person sessions.

Combining primary care with behavioral health and the Collaborative Care Model (CoCM) enhances outcomes for patients, is cost-saving, and eliminates stigma. CoCM practices team management by a primary care provider with behavioral health managers and psychiatrists. Patient-centered, evidence-based, and accountable care is emphasized, especially for racial and ethnic minorities. The model works well for comorbidities such as depression, anxiety, diabetes, and hypertension. With healthcare moving toward coordinated care, CoCM will be the norm by 2025. Integration minimizes fragmentation and improves patient outcomes. For instance, according to National Institute of Mental Health, in 2024 Over 60% of U.S. primary care clinics have started integrating behavioral health services, a 40% increase from 2015.

The US is short of psychiatrists, with more than 0.15 billion individuals residing in areas that lack mental health professional services, exacerbated by the pandemic. The shortage is fueled by growing population, greater demand, and insufficient residency positions, with numerous psychiatrists approaching retirement age. Telemedicine, Collaborative Care Models, and e-consults are increasingly being employed to incorporate mental health care into the primary care environment. These initiatives expand the workforce and extend to underserved populations. Increasing residency positions and training the next generation of psychiatrists are also important strategies. Shortages will still constrain access to timely care in some areas, however.

The APA's 2023 Work in America Survey places focus on growing workplace mental well-being, with workers reporting feeling stressed and drained from sick work environments, bias, and lack of support. While workers are appreciative of companies that care about emotional well-being and work-life boundaries, they need to improve. The Surgeon General's Model requires such considerations as protection from harm, balance between work and life, and opportunities for growth for a healthy work environment. With more emphasis on employee mental health, workplace wellness programs will expand. This will lead to greater demand for behavioral health services across all sectors. Emphasis on employee well-being can reduce turnover and improve outcomes. For example, according to American Institute of Stress, 2024, 77% of workers experience work-related stress, leading to productivity losses of $300 billion per year in the U.S.

| Attributes | Details |

| U.S. Behavioral Health Market Size in 2024 | USD 64.22 Billion |

| U.S. Behavioral Health Market CAGR | 4% from 2025 to 2034 |

| U.S. Behavioral Health Market Size in 2034 | USD 94.83 Billion |

| By Service Type |

|

| By Disorder Type |

|

| By End-Users |

|

| Key Players |

|

Outpatient counseling service provides mental healthcare on an outpatient level, making it possible for patients to go about their routine life while continuing with therapy. This treatment is mostly used in the instance of mild mental illnesses or follow-up scenarios after inpatient care. Clients attend therapy sessions on a regular basis without having to spend a night in a facility or hospital. Outpatient therapy is conducted at centers like private practices, clinics, and community health centers. It's a cost-effective option compared to hospitalization, making it a popular treatment among most individuals. The growing demand for flexible and convenient care is driving the outpatient counseling market.

Excessive worry or fear is typically a hallmark characteristic of anxiety disorders, interfering in the ability to carry out one's daily functioning. Behavioral treatment for anxiety is accomplished through the use of therapy, cognitive-behavioral therapy (CBT), and medication management. Anxiety is among the most prevalent mental illnesses, with treatments tending to address symptoms and enhance coping skills. As awareness of anxiety disorders grows, more individuals seek professional help, fueling the market's growth. Increased stressors such as work pressures and societal issues have caused a rise in anxiety diagnoses. The increasing demand for short-term and long-term treatment is anticipated to persist.

Outpatient clinics offer convenient and low-cost behavioral health services for patients with less severe mental illnesses. Outpatient clinics provide counseling, therapy, and medication management on an outpatient basis, enabling the patient to resume daily activities. Services are typically offered by licensed therapists, psychologists, and psychiatrists in a less intensive environment than hospitalization. Outpatient clinics are a primary preference for patients who need ongoing care or follow-up treatment. The demand for convenient and affordable options is propelling the growth of outpatient clinics. Outpatient clinics are convenient and flexible and are necessary in offering continuous mental health care.

Empower your strategy with expert insights, purchase this premium research@ https://www.cervicornconsulting.com/buy-now/2349

Ask here for more details@ sales@cervicornconsulting.com