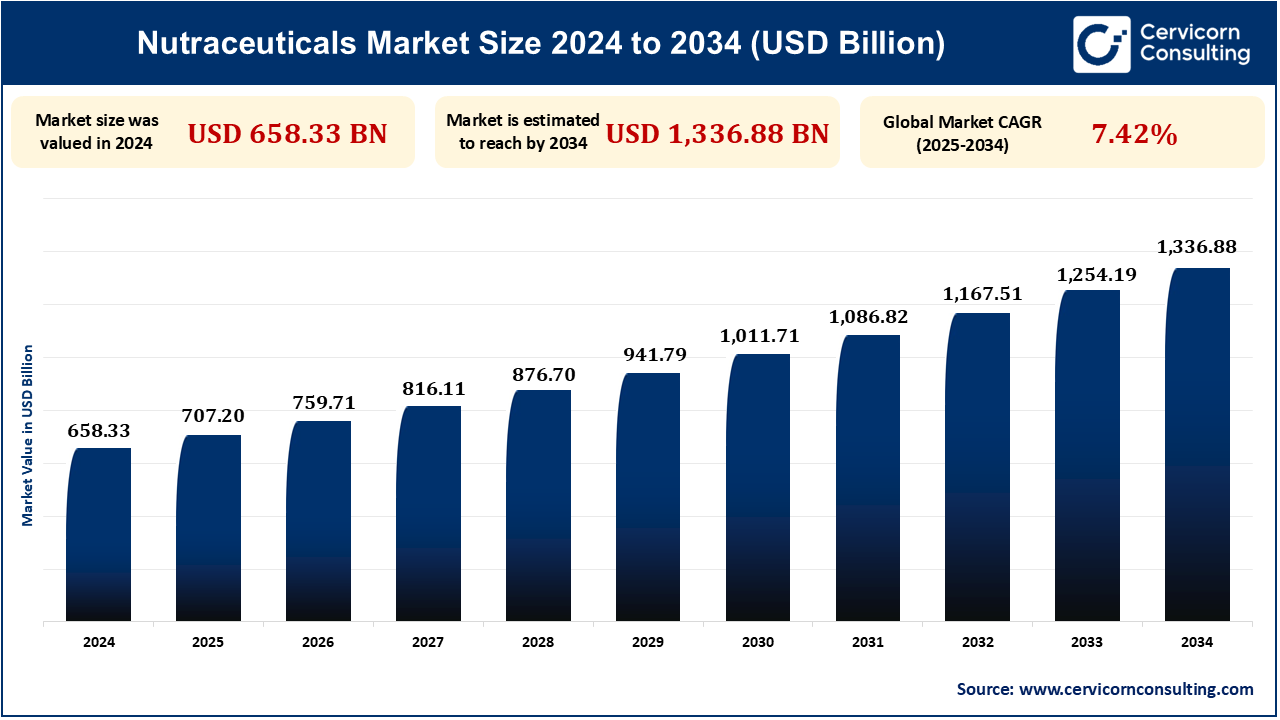

As of 2024, the global nutraceuticals market was valued at approximately USD 658.33 billion. It is projected to reach USD 1,336.88 billion by 2034, reflecting a compound annual growth rate (CAGR) of 7.42%.

Nutraceuticals are products that blend "nutrition" and "medicine" to offer extra health benefits. They go beyond basic nutrition. These can be foods or parts of foods with healing properties. Nutraceuticals aim to improve health, prevent diseases, or support treatments alongside normal medicine. Nutraceuticals may be obtained from natural resources such as plants, herbs, or animal products, but can also be made synthetically. Nutraceuticals stand in contrast to pharmaceuticals in terms of regulatory issues. In several countries, they are treated more simile to dietary supplements and have far less strict requirements regarding testing and approval than do drugs. However, places like the United States and Europe have rules to ensure safety and effectiveness. Although many nutraceuticals are safe, some can interact with other medicines or cause side effects.

There is a growing trend in creating nutraceuticals customized for each person. This depends on their genetics, lifestyle, and health conditions. As people focus more on preventing health issues, there is an increasing demand for nutraceuticals that help with long-term health. The nutraceuticals market is expanding quickly, blending the food and pharmaceutical industries. This growth is due to more people focusing on health, wellness, and preventing health issues. Nutraceuticals are food products or ingredients that offer extra health benefits besides basic nutrition. They can help improve health, reduce the risk of chronic diseases, or support the treatment of existing health conditions. Several factors drive this growth. These include an aging population, more people becoming health-conscious, and an increase in chronic diseases. There's also a shift towards taking care of one's health proactively. Because of this, the nutraceuticals market will keep growing as more people seek natural and preventive health solutions. The market is changing with new trends, such as personalized nutraceuticals and plant-based products. There's also a move towards integrating digital health technologies. These changes create many opportunities for businesses in the field. However, challenges exist as well. Maintaining the quality and consistency of nutraceutical products, especially those from natural sources, is difficult. Additionally, the market is becoming crowded with many companies offering similar products. This competition leads to pricing challenges and the need for companies to make their products stand out.

The demand for preventive medicine is greatly driven by growing health consciousness among consumers. This trend is, in turn, affecting consumers' perception of health and wellness, thereby enhancing the demand for functional foods, dietary supplements, and other nutraceuticals. According to the Global Wellness Institute, more than 70% of adults globally report using at least one type of nutraceutical product. With increasing incidences of chronic diseases globally, consumers have begun to be aware of the long-term health status that is governed by diet, lifestyle, and nutrition.

The immune health supplements are estimated to reach US$60 billion globally by 2027, driven by a heightened focus on immune prevention. Associating with the term 'preventive,' nutraceuticals have, therefore, been gaining more attention as consumers search for supplementation that supports heart health, gut health, joint health, and memory. The development of preventive healthcare is another area that has grown much interest among consumers. The survey featured in the report entitled 'State of Preventive Health in India' had observed that at least 40 percent of the respondents are highly inclined toward preventive health measures, indicating a considerable conversion toward health consciousness. Thus, stating that India's preventive healthcare market would touch US$ 197 billion by 2025. Also, in the last three years, over 40 preventative healthcare technology startups attracted nearly US$1 billion in funding while using digital technology to manage health and lifestyle. These companies utilize digital technologies to improve lifestyle and health management. There is also a rise in awareness about nutraceuticals, which are food products that offer health benefits. This understanding has boosted trust in certain nutraceutical brands and products.

Vitamins, minerals, protein powder, and probiotics have been recognized as the leading categories and are expected to account for 50% of the market share by 2027. The interest in health consciousness and preventive healthcare is driving the nutraceuticals market. People are turning more towards dietary supplements and functional foods that promote health benefits. Further, a survey indicated that 63% of consumers globally are willing to pay more for products with added health benefits. As awareness increases, more people are adopting a comprehensive approach to health, leading to a larger demand for nutraceutical products. As a result, the above-mentioned factors would lead to market growth by means of introducing innovative products, and a shift towards wellness-oriented offerings.

One of the significant constraints faced by the nutraceuticals market is having to abide by too stringent rules and regulations. The rules are different in every region, which makes it difficult for companies to operate smoothly. The regulations affect how nutraceutical products get developed, marketed, and sold by companies. In 2023, more than 20% of products reviewed by the US FDA were found to make claims that were either unauthorized or misleading. Therefore, companies must be mindful of what to advertise as the product's capabilities.

Manufacturers cannot claim products can treat, cure, or prevent complications unless they go through approval processes similar to medications. In Europe, the European Food Safety Authority (EFSA) approved a total of 1,345 health claims in 2023, but approximately 1,000 health claims have been rejected by EFSA over the last 5 years on the basis of insufficient scientific evidence. Companies must also face different and frequently complicated requirements for each region, and they need to employ rigorous testing methods to ensure their products are provided in a safe format and are compliant with safety regulations as well. In addition, they must also manage the risk of potentially negative side effects and recalls concerning the product.

In 2023, the FDA sent more than 150 warning letters to companies making supplements. These letters were mainly related to unverified health claims, incorrect labels, and contamination of products. Also, there were over 50 nutraceutical product recalls in the US alone in 2023. Although these regulations are in place to ensure consumer safety, they also present hurdles for manufacturers looking to expand quickly and innovate. As of 2024, China has introduced more stringent regulations for products containing traditional Chinese medicine (TCM) herbs, requiring companies to demonstrate both safety and consistency in product formulation. Companies that can navigate these regulatory challenges successfully will have a competitive edge, but those that struggle with compliance risks may face delays, increased costs, and loss of market opportunities.

As more individuals look for nutrition and supplements tailored to their personal health needs, the market is expected to expand. This growth is driven by the demand for unique products made specifically for each person's health situation. For example, in 2023, a McKinsey survey showed that about 49% of consumers want products customized to their specific health profiles. This shows a big shift towards people wanting more personalized health solutions. This leads to the growing demand for products designed just for an individual with their health. As people become more aware of their health and learn more about their own specific health needs, interest in products made just for them is increasing.

Personalized nutrition is actually a system within which an individual's unique genetics, lifestyle choices, eating habits, existing health conditions, and fitness goals are then converted into supplements or specific food items for the individual. A report by Euromonitor International in 2024 discovered that more than 40% of Europeans are interested in nutritional products within their requirements. These products utilize an individual's health conditions, such as blood test and microbiome analysis data, and then personalize the nutrition according to one's specific needs. Companies like 23andMe and AncestryDNA are also experiencing increasing activity.

Over half of their users choose follow-up services for in-depth insights into nutrition and health. This trend shows a growing interest in using personal health data to enhance individual well-being. These reports use genetic testing, body measurement data, and advanced computer technology to create new, personalized nutritional products tailored to individual needs. This has led to a growing preference for nutraceuticals that address specific health concerns rather than general health promises. As reported by Nielsen in 2023, the US market experienced a significant growth of 16% in DNA-based personalized supplements sales year on year. Besides, microbiome-based personalized nutrition app Zoe gained more than 100,000 users in the year 2023. Personalized nutrition is increasingly considered to be an important means to prevent the very causes of some lifestyle-related diseases like obesity, diabetes, and cardiac conditions, which today are gaining increasing attention. Further, a 2024 survey by McKinsey found that 70% of millennials prefer DTC models for personalized health and nutrition products, valuing the convenience and customization that online platforms provide. Thus, while personalized nutraceuticals keep their focus on the individualized needs of consumers, the industry becomes increasingly appealing to emerging technologies, upping demand for personalized health solutions.

| Attributes | Details |

| Nutraceuticals Market Size in 2024 | USD 658.33 Billion |

| Nutraceuticals Market Size in 2033 | USD 1,254.19 Billion |

| By Product Type |

|

| By Form |

|

| By Distribution Channel |

|

| By Application |

|

| By Region |

|

| Key Players |

|

North America, especially the areas of the United States and Canada, is expected to witness fast-paced growth during the next few years in the global nutraceuticals market. The US is expected to dominate the region, accounting for over 85% of the total North American nutraceuticals market. Factors such as increased health awareness, growing demand for functional foods and dietary supplements, and advancements in personalized nutrition are responsible for this growth. Personalized nutrition is expected to reach US$3.6 billion by 2027.

In North America, there has been a gradual shift toward preventive healthcare, wherein individuals are actively looking for ways to manage their health proactively to avoid suffering from chronic diseases. Such nutraceutical preparations like immune-boosting supplements, antioxidants, probiotics, etc., are fast catching up as the real contribution to health. Functional beverages (e.g., kombucha, cold-pressed juices, protein shakes) are expected to grow by 9.2% CAGR. Plant-based protein is growing rapidly, projected to account for 40% of the protein supplement market by 2026. The regulatory environment in North America is considered quite favorable to the nutraceutical industry. In the United States, the Food and Drug Administration (FDA) governs all these moments with the Dietary Supplement Health and Education Act (DSHEA) for the provisions regarding safety and labeling of product lines.

Other than that, funding in research related to proving the efficacy of nutraceuticals through NIH and other research institutes augments the credibility of this market. It has got an advanced technological infrastructure, a very strong per-unit disposable income, and a vast consumer base for health and wellness. All these combined pose numerous opportunities for the nutraceutical industry in this particular region. With supplements now seen as part of daily wellness routines, the market in North America is expected to surpass US$200 billion by 2030. Innovative companies taking advantage of the changes, such as natural products, personalized supplements, and the new e-commerce trend, will stand to gain much in this rapidly developing market segment.

The Asia-Pacific (APAC) region is becoming a key player in the global nutraceuticals market, propelled by various factors including increasing health awareness, enhanced disposable income levels, an increasing aged population, and the pace of urbanization. Consumers aged 25-40 are the most active purchasers of nutraceuticals, with a focus on immune support, energy, and mental wellness. This is an in-depth analysis of why the Asia-Pacific region will most likely lead the market in the coming years. With rapid urbanization in China, India, and Southeast Asia, the demand for nutraceutical products keeps rising.

Most notably, the urban dwellers have adapted a new lifestyle, which includes stress, obesity, digestive problems, and associated issues in addition to the increasing demand for functional foods and supplements. These challenges boost the need for functional foods and supplements, helping the nutraceutical market grow even further. With over 28% of Japan’s population aged 65 and above, there's a strong demand for supplements targeting age-related health concerns. Companies in the APAC region are continuously innovating to meet the evolving needs of consumers. In 2024-2025, there have been many developments in nutraceutical products that combine convenience and functionality, such as functional beverages, snack bars, ready-to-drink (RTD) products, and fortified foods.

The Asia-Pacific region is set to lead the global nutraceuticals market. This growth comes from more people being aware of health issues, a larger elderly population, and a strong interest in personalized nutrition. Personalized nutrition could generate over US$1.5 billion in revenue in Asia-Pacific by 2025. In this region, there is also a deep respect for herbal and traditional remedies, which is projected to grow by 9.0% CAGR. Additionally, the market is benefiting from new product developments, an increase in online shopping, and stronger government support.

Online sales are increasing significantly, especially in China, which accounts for over 45% of e-commerce nutraceuticals sales, and India. All these factors together are shaping the global nutraceuticals market. This is expected to open new avenues for growth for the nutraceuticals industry in the region, especially in rapidly growing emerging economies, thus carrying the APAC banner as a major regional driver of the global market in the years to come.

In 2024, dietary supplements were a key part of the market, largely due to people becoming more aware of health and wellness. The global dietary supplements segment in the nutraceuticals market is anticipated to reach US$220 billion by 2030. These supplements include products like vitamins, minerals, amino acids, herbal products, probiotics, and other special foods. Popular items within this segment include multivitamin supplements, fish oils, probiotics, and pure plant supplements. They are used by consumers who wish to treat certain health problems or improve overall nutrition.

People aged 50 or above are expected to make up about 40% of the total consumer base for dietary supplements by 2025. These customers have been especially attracted to supplements supporting joint health, heart health, and cognitive health. There's a growing trend towards supplements tailored for individual health needs, personal preferences, or genetic traits, leading to demand for more personalized products. In 2024, investment in the health sector, particularly dietary supplements, increased by 20%, bringing the total to over US$1.5 billion. Also, the convenience of online shopping has significantly boosted internet sales of these supplements. Given the rising consumer demand for health and wellness nutrition, it is likely that dietary supplements will continue to have the majority share of the nutraceutical market.

Proteins and amino acids are among the most in-demand ingredients in the nutraceuticals market. They are very popular in the health products market because more people care about their health and fitness. These nutrients are important for building muscles, controlling weight, and keeping the whole body healthy. They are necessary for many people, especially athletes and older adults. As the population ages, there will be a greater need for protein and amino acid supplements. This increased demand is expected to generate more than US$5 billion in sales by 2025. With an ever-expanding fitness culture and awareness toward muscle recovery, the demand for protein and amino acid supplements has also been on the rise.

On-trend, personalized protein and amino acid supplements are also beginning to flood the nutraceutical market with individual needs and lifestyles. Factors leading to growth in this market segment are the new plant protein solutions, innovative functional proteins, and special combinations of key amino acids. Supplements made from pea protein or hemp protein, also known as plant-based protein supplements, are anticipated to grow by 10-12% each year through 2027. This increase signifies the growing interest of the people in these alternatives as they seek different sources of protein for their diet. Therefore, companies that provide high-quality, eco-friendly, and personalized nutrition products are more likely to succeed. In addition, there was an increase of over 20% in venture capital funding in the proteins and amino acids sector in 2024, for total investments to reach nearly US$1 billion.

By end use, general health & wellness is the leading application for the nutraceuticals market. Products in this category exhibit functions ranging from improvement of overall well-being, treatment of chronic conditions, and assistance for daily health. It is anticipated that the aging population will contribute to the general health and wellness category by more than US$30 billion by 2025 due to a focus on cognition, joint support, and immunity products. Nowadays, more people are buying health products because they're eager to take charge of their health. Busy lives and stress can cause people to eat poorly. As a result, they often turn to dietary supplements to get the nutrients they miss from their diet.

By 2025, Millennials and Gen Z are likely to account for 25-30% of the general health and wellness market. This growth comes as these younger groups pay more attention to having enough energy and boosting their immune system. The increasing focus on preventive health care rather than curative has further generated demand for products that promote general health and prevent disease. Personalized health trends and natural ingredients will continue driving this segment into the limelight with a wide variety of products that can cater to distinct consumer needs.

Capsules & tablets are the major forms leading the nutraceuticals market. Capsules & tablets are the most popularly consumed and easiest nutraceuticals to dispense and stay stable, which is the primary reason for their popularity and acceptance. The capsules and tablets segment represents roughly 50-55% of the global nutraceuticals market. They are easy-to-swallow products, particularly for busy people in need of immediate and efficient solutions for their nutritional requirements. With the advent of modern technology, newer formulations have improved the capabilities of capsules & tablets with, for example, time release and enteric coating, to improve bioavailability to ensure supplements reach their intended sites in the body.

Vegetarian capsules are becoming increasingly popular because many people prefer capsules made from plants. By the year 2027, the market for these vegetarian capsules is expected to grow significantly, reaching a value of US$9.5 billion. Compared to other forms, such as liquids and gummies, capsules and tablets are usually more affordable. This cost-effectiveness makes them a popular choice for those who need to take supplements regularly over a long period of time. Growth will be supported by personalized nutrition and convenience, which are influencing consumer behavior, although capsules & tablets will remain the forms of choice for most nutraceutical users.

The leading segment in the nutraceuticals market by distribution channel is e-commerce. The main way people are buying nutraceuticals today is through online shopping. This trend has been growing rapidly because more folks are choosing to shop online, and there’s an increase in selling directly from brands to customers, known as direct-to-consumer sales. Shopping online makes it easy for people to look at and buy nutraceuticals comfortably from their homes, which is why many prefer this option.

Online platforms offer a wide range of nutraceutical products, along with customer reviews and detailed product information. At Amazon, sales in the category of health supplements reached US$15 billion in 2024, keeping its strong position in the market. Many companies that produce nutritional supplements have set up their online stores, enabling them to connect directly with consumers, which helps them establish stronger connections without relying on third-party sellers.

Companies are offering subscription boxes with customized nutrient packs based on individual health goals, which is gaining popularity in the e-commerce sector. The revenue from such means is expected to reach US$5 billion by 2027. As online shopping keeps expanding, brands will rely more on e-commerce but will also continue to have products in physical stores to reach more people and cater to different shopping preferences. E-commerce brands focusing on social media marketing are experiencing 20% higher sales.

Empower your strategy with expert insights, purchase this premium research@ https://www.cervicornconsulting.com/buy-now/2378

Ask here for more details@ sales@cervicornconsulting.com