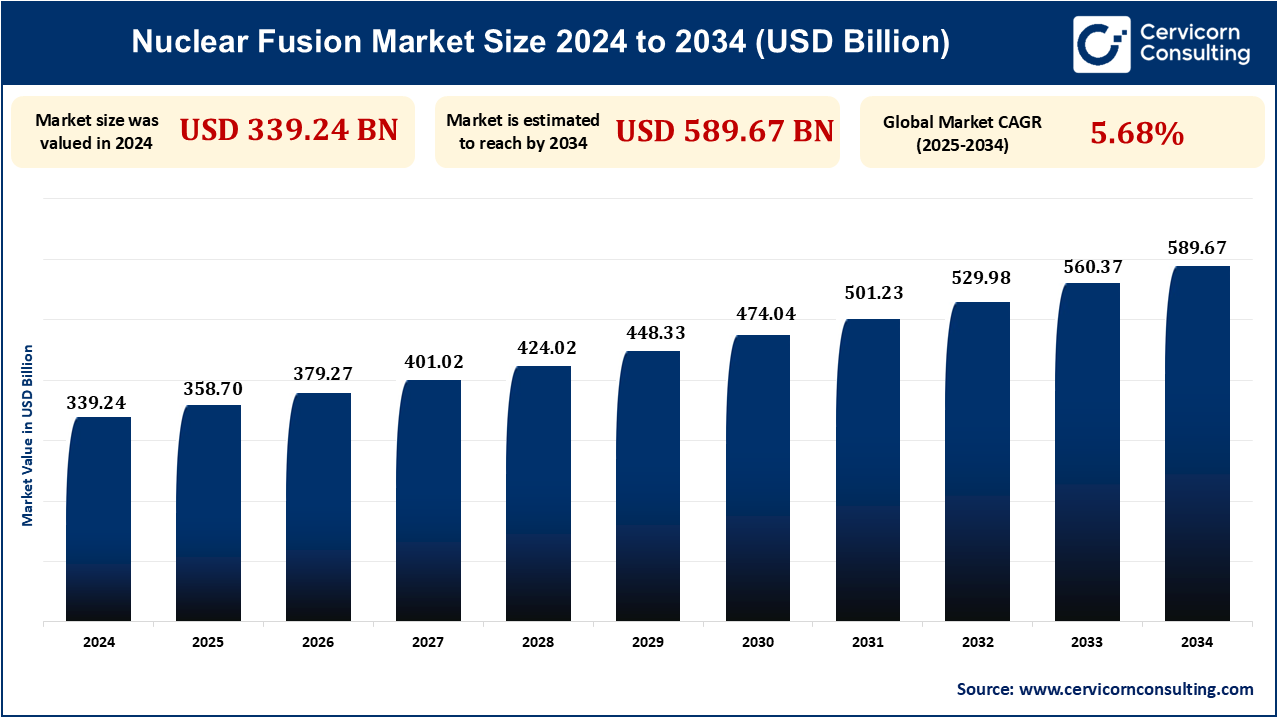

The global nuclear fusion market size is expected to be worth around USD 589.67 billion by 2034 from valued at USD 339.24 billion in 2024 and is exhibiting at a compound annual growth rate (CAGR) of 5.68% over the forecast period 2025 to 2034.

The nuclear fusion market is rapidly growing, as the world has increasing demand for clean and renewable energy solutions. With the globe looking for a substitute for fossil fuels, nuclear fusion holds the potential for a new energy production breakthrough, being a nearly infinite and carbon-emission-free power source. Financing from government and private investors alike, along with significant technological advancement, are all driving the world in taking fusion research and development forward. Fusion power holds the potential to revolutionize the energy industry in the shape of a clean, stable, and safe source of energy, which has generated widespread interest from authorities, scientists, and energy giants alike.

The U.S. Department of Energy (DOE) has already spent USD 49 million on 19 projects in basic fusion energy research. These projects cover major scientific gaps in fusion materials, nuclear science, and technology, investigating new magnet designs, plasma-resistant materials, and fuel cycle systems. Fusion power promises a clean, renewable source of energy with no long-term radioactive waste or carbon footprint. The projects, competitively peer-reviewed, will have a duration of no more than three years. The investment is evidence of the DOE's commitment to the advancement of fusion technology. In addition, the steady support of fusion startups shows faith in fusion as a future energy source.

Continuous advancements in superconducting magnets, plasma confinement, and high-power lasers are steadily making it economically viable. Nuclear fusion, where atomic nuclei are merged to create electricity, could potentially provide emission-free electricity. China is pouring in USD 1.5 billion, and companies like Microsoft plan to buy electricity generated by fusion by 2028. Recent achievements are net energy gain in fusion ignition and AI-controlled plasma. Although it is challenging to achieve long-term fusion conditions on Earth, the world needs international cooperation and public-private partnerships. Advances in plasma heating and magnetic fusion will be awaited in 2025 as startups involved in the business of fusion will try to realize net-positive energy output.

The ITER fusion reactor facility project in France is struggling, with fresh delays and an additional USD 5.4 billion cost overrun, taking its estimated budget to more than USD 27.3 billion. Originally plans were to reach the first plasma in 2025, but this has now been pushed to 2034 because of technical challenges, supply chain problems, and pandemic-driven disruptions. The cost has risen from USD 5.4 billion in 2006 to more than USD 21.8 billion, including inflation and redesigns that were needed on parts. These delays highlight the challenges involved with large-scale international research and development endeavors, yet the project's objective of proving the viability of fusion energy continues to be vital for future commercial reactors. Despite these challenges, the 35-nation consortium that supports ITER still offers funding, and private fusion projects are cropping up with expectations of moving more quickly than ITER.

Commercialized successfully, fusion energy would revolutionize the world's energy markets, and nations that mastered the technology would become super-exporters, just like today's oil-rich states. Japan is speeding up its fusion work, seeking to produce fusion power by the 2030s, a departure from its initial 2050 goal. Japan's initiative to look at fusion as a business opportunity in reducing carbon and ensuring energy security is the "Fusion Energy Innovation Strategy" that Japan introduced in 2023. Through the Moonshot Programme, partnership with the U.S., and investments in Tokamak Energy and TAE Technologies, among others, Japan will aim to be the global leader in the fusion industry. Its research direction, private sector presence, and innovation focus put it well placed to lead in fusion power. Sales opportunities in fusion power can drive new economics and geopolitics.

| Attributes | Details |

| Nuclear Fusion Market Size in 2024 | $ 339.24 Billion |

| Nuclear Fusion Market in 2034 | $ 589.67 Billion |

| Nuclear Fusion Market CAGR | 5.68% From 2025 to 2034 |

| Key Players |

|

| By Technology |

|

| By Fuels |

|

| By Application |

|

| By End-Use |

|

| By Region |

|

Asia-Pacific is emerging as a dominant force in the nuclear fusion business, and China, Japan, and South Korea are some of the countries leading the development of fusion power. China has been constructing fusion reactors at a fast pace, including the EAST (Experimental Advanced Superconducting Tokamak), while Japan is focusing on its JT-60SA project. South Korea's K-STAR fusion project is also in development towards commercial fusion power. Fusion is considered as part of the plans of these nations to manage growing energy demand and reduce carbon emissions.

North America, including the U.S., Canada, and Mexico, is at the forefront of the nuclear fusion sector with massive investment in fusion power research. The U.S. boasts some of the largest fusion research facilities in the world like the National Fusion Facility and the ITER project, which plays a major role in technological development. Canada is looking at nuclear power, including fusion, as a component of its overall clean energy strategy. Mexico also wants to use fusion as a possible way of meeting its increasing energy demands.

Inertial Confinement Fusion (ICF) is a method of compressing fuel pellets, generally made of deuterium and tritium, quickly with the high intensity of lasers or ion beams. Compression of the fuel drives it to the very high temperatures and pressures essential for fusion. The process seeks fusion by replicating stellar conditions. ICF promises a controlled and compact fusion process. Large-scale experiments like the National Ignition Facility (NIF) in the United States are utilizing ICF to explore the potential of fusion energy. Despite the technical setbacks, it is the top contender in the field of fusion.

Deuterium and tritium are the primary fuels used in nuclear fusion reactions due to their ability to produce a high energy yield. Deuterium is a stable hydrogen isotope, while tritium is radioactive and must be produced in reactors. When these isotopes are made to collide at extremely high temperatures, they fuse to form helium and release energy. The D-T reaction is the best-researched of all the fusion reactions because it has a relatively low ignition temperature compared to the other isotopes. Tritium, however, is uncommon and needs to be bred in the reactor, which is a drawback to mass production of fusion power. It remains the fuel of choice for most experimental fusion reactors.

Empower your strategy with expert insights, purchase this premium research@ https://www.cervicornconsulting.com/buy-now/2332

Ask here for more details@ sales@cervicornconsulting.com