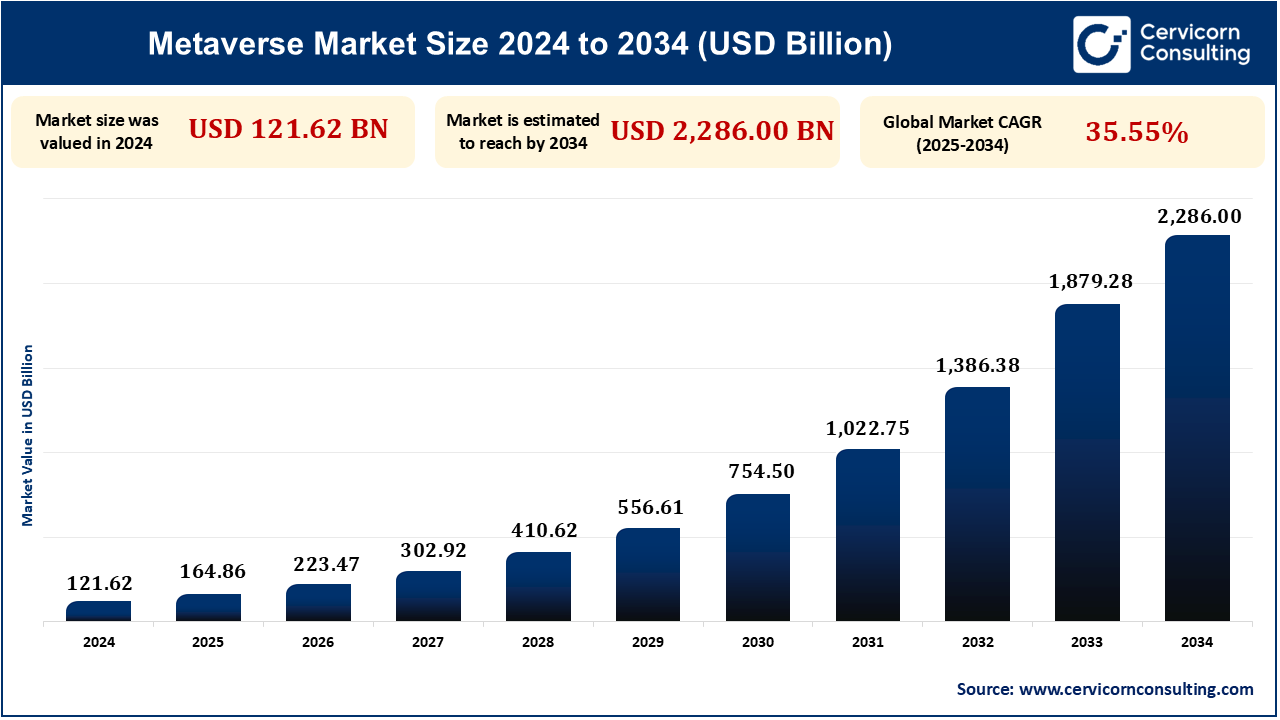

As of 2024, the global metaverse market was valued at approximately USD 121.62 billion. It is projected to surge USD 2,286 billion by 2034, reflecting a compound annual growth rate (CAGR) of 35.55%.

The metaverse is a collective, virtual shared space that is created by the convergence of virtually enhanced physical reality and persistent digital spaces, where people can interact with each other, digital environments, and objects in real-time. It encompasses a variety of immersive digital experiences, including virtual reality (VR), augmented reality (AR), and other interactive technologies. The idea of a metaverse is that it should not just consist of individual virtual worlds, but should serve as a unified and connected space in which applications, experiences, and services develop and communicate with one another. The metaverse could further define development into this new world of digital interactions, using what some describe as the incorporation of virtual reality, augmented reality, and interactive online spaces. This has extraordinary potential for disfiguring social connections, entertainment, work, and commerce. However, the large-scale adoption will depend on the eventual resolution of problems regarding technology, access, privacy, and regulation. It is viewed as a future-shaping dynamic in the Internet space and subsequently in human interaction in digital spaces as companies continue developing their platforms and technologies linked with the metaverse.

The metaverse market expands rapidly on the back of developments primarily in the fields of VR, AR, blockchain, AI, and cloud computing. The market spans diverse industries, including gaming, entertainment, socializing, education, health, and remote working. With businesses and consumers taking to it, the metaverse is expected to cross the trillion-dollar mark. The metaverse market, however, is growing at a rapid pace with mammoth investments pouring in from tech companies, gaming companies, and fashion brands. With the low price of VR/AR gear and the direction of digital assets toward mass adoption, the metaverse is all set to radically change social interactions, workspaces, entertainment, and e-commerce. Challenges such as privacy issues and high costs are there, but the market offers huge opportunities for businesses, creators, and users.

The major factor driving growth in the metaverse is increased implementation of virtual reality (VR) technology and augmented reality (AR). The global VR and AR market is anticipated to exceed US$ 300 billion by 2025. These technologies constitute the various aspects of the metaverse: they provide immersive and interactive environments that enhance the experience of realness in the virtual environments and digital economies that comprise the essence of the metaverse. As of 2024, there were an estimated 171 million VR users worldwide, and the number of active AR user devices reached approximately 1.73 billion. Further equipment development is such that VR headsets, AR glasses, and haptic feedback devices allow much more enhanced quality and experience methods used in the metaverse. Many companies are beginning to use VR/AR technologies for a variety of activities. These include gaming, socializing, training, and even shopping online. By the year 2026, it is anticipated that 50% of large companies will have adopted AR technology. They will use it for designing products, carrying out maintenance tasks, and collaborating on projects.

Cloud computing and the support of 5G network launch VR and AR technologies into adoption. While VR and AR technologies can store and stream vast virtual worlds and assets with cloud computing, the other half of 5 G technology offers the high-speed, low-latency connections that play a vital role in real-time interactive experiences with the metaverse. Real-time statistics from various platforms show that 70% of mobile AR users engage with AR apps at least once per week, with gaming and social media apps seeing the highest engagement. The rising acceptance of immersive technologies will lead to higher engagement in the metaverse, where new users, developers, and organizations will emerge. In the enterprise space, AR has seen an uptick, especially in industries like manufacturing, logistics, and healthcare, with a projected growth rate of 35% annually in the next 5 years. This is further expected to spur investment, content production, and innovation, raising the metaverse market.

One of the major restraints that the metaverse industry is suffering is the cost associated with development, the infrastructure required to support development, and the adoption process. The enormous potential has not been realized because of the huge investments required to create immersive worlds, and the exorbitant costs of accessing or maintaining the needed hardware or software. A very big part of the metaverse consists of expensive pieces of technology-related functionality, including VR headsets, AR glasses, haptic feedback devices, and performance computing ones.

Developing a moderately complex AR app can cost between US$ 50,000 and US$ 200,000, depending on the platform, features, and backend integration. Designing VR training simulations necessary for enterprise use would cost anything from about $250,000 upwards, especially for those solutions that include photorealistic environments or AI-driven interactivity. Consequently, very few clients and organizations want to invest in such high-end equipment. Since metaverse adoption is tied to such expensive hardware, many users and companies do not seem to want to invest, which is a factor in causing hindrance to the overall market growth. Overall, as of 2025, just 14% of businesses have fully adopted AR/VR solutions in all their departments due to high hardware and integration costs. Another barrier organizations need to consider when thinking about introducing an AR/VR solution relates to the subsequent employee training costs, with average onboarding costs for AR/VR tech users in the workplace estimated to run between US$ 5,000 and US$ 15,000 per user.

The creation and maintenance of Metaverse environments are capital-intensive in terms of software, cloud computing, and networking infrastructure. Hence, small and mid-sized enterprises usually do not have the resources to invest in the development of Metaverse applications, which becomes a barrier to entry. A lot of hype exists around the metaverse, but in reality, exorbitant hardware, infrastructure, and development costs present extremely high barriers for both the commercial and consumer sectors. The average annual budget for businesses adopting AR/VR solutions in 2025 is estimated to be between US$ 300,000 to US$ 1 million for large-scale implementations in sectors such as manufacturing, logistics, and healthcare. Therefore, such aforementioned factors are likely to hinder the metaverse market growth.

The rise of virtual real estate and the digital assets economy presents a major opportunity in the metaverse market. This online space allows people, businesses, and creators to engage in buying, selling, and trading various virtual items. These items include land, NFTs (Non-Fungible Tokens), and a wide range of other virtual goods. This concept is gaining more attention because it is a favorable space for both investment and innovation. On popular metaverse platforms, the monthly buying and selling often reaches between US$100 million and US$150 million. These figures can rise even higher when platforms roll out new features or hold large virtual events. Virtual real estate like digital land on metaverse platforms such as Decentraland, The Sandbox, and Somnium Space is a budding asset class attracting individual investors and big corporations alike. 50% of Fortune 500 companies have virtual real estate footprints—used for branding, digital retail, recruitment, or community building. Just as physical real estate has been a traditional asset, virtual land in metaverse worlds is increasingly being recognized as a lucrative investment option.

Due to the advent of NFTs (Non-Fungible Tokens), the metaverse is now home to unique digital assets-called unique due to the characteristics imparted by their NFTs. NFTs-with the potential to denote anything from virtual art to fashion to music to in-game items-have evolved as the essence of the economy in the metaverse. NFT volume has rebounded in 2025, with trading volumes reaching US$ 2.2 billion in Q1 2025, led by gaming and metaverse-integrated assets.

The metaverse is expected to draw millions of users who come together in a perceived space to be entertained, work, or socialize; hence, it would also provide a great opportunity for businesses to build their virtual presence. Brands are spending big, an estimated US$ 1.6 billion on metaverse advertising in 2025, which is expected to grow to US$ 5 billion by 2028. This opens up new streams of revenue and engages customers. Thus, with acceleration in adoption and participation, industries will be presented with massive growth and innovation opportunities for market growth.

| Attribute | Details |

| By Technology |

|

| By Platform |

|

| By Product |

|

| By Application |

|

| By End User |

|

| By Region |

|

| Key Players |

|

North America is growing quickly in the market due to several important reasons more primarily due to the United States and Canada, which incubate great innovation, investment, and adoption of metaverse technologies. The metaverse gaming market in North America is projected to reach US$ 12.2 billion by 2025, with a user base expected to grow to approximately 112.8 million by 2030. The metaverse development in North America is supported by its strong technological backbone. Big tech companies, such as Meta (previously known as Facebook), Microsoft, Google, and Apple, are heavily investing their money and efforts into important areas of the metaverse, such as AR, VR, and blockchain technologies.

In North America, virtual events are becoming more popular through platforms like Decentraland and The Sandbox, which create online spaces in the metaverse. These platforms host a variety of events like virtual concerts, exhibitions, and social gatherings. In 2024, there were over 50 million attendees at metaverse events in North America, resulting in a revenue of over US$250 million from the sold virtual tickets, merchandise sales, and brand sponsorships. People in North America also have a lot of money to spend, and many businesses are starting to use metaverse technologies. The total investment in enterprise-level metaverse technologies (such as virtual meeting spaces and collaborative platforms) in North America is projected to exceed US$ 10 billion in 2025. This combination leads to the fast expansion of the metaverse. As more companies discover the metaverse and more people enter virtual worlds, North America will continue to grow and lead in the global metaverse market.

In 2024, the Asia-Pacific region is expected to lead the metaverse market. This is because technology is advancing quickly, and governments are giving strong backing. Additionally, there are a large number of people using the metaverse in the region. User penetration was projected to be 14.6% in 2024 and is expected to increase to 38.6% by 2030. The market is undergoing rapid expansion across sectors involving gaming, online shopping (e-commerce), education, financial services, and digital tourism experiences. In 2024, the money spent by brands on virtual environments and digital ads in the Asia Pacific reached US$ 2.5 billion, which is expected to increase in the coming years.

Big companies like Tencent, Alibaba, Sony, and Samsung are driving technological advancements, aided by government support in countries like South Korea and India. The South Korean government, recognizing the potential of the metaverse, has committed to investing US$1 billion in its infrastructure in 2025. This investment will prioritize enhancing areas such as education, healthcare, tourism, and business through the metaverse, showing a clear vision for the future of digital interaction in the region. This is part of their bigger plan called the Digital New Deal. The region is developing rapidly in 5G, AI, and VR/AR, all essential for becoming a digital technology powerhouse by 2025. A huge inflow of private investments toward metaverse development is pouring into the Asia Pacific region. The funding comes from venture capitalists and technology companies that invest in newly formed metaverse start-ups and platforms for project development. It is expected that by 2025, companies that use the metaverse in this region will reach a business value of US$ 8 billion. More and more businesses will use virtual environments for designing products, hiring staff, and interacting with clients.

The collaboration of large tech companies, ambitious start-ups, and tech-savvy consumers is helping the region create a highly connected and immersive digital environment. The APAC region has a predominantly young user base, with 55% of users aged 18-34 participating in metaverse platforms. Combined with rapid digital changes, the Asia-Pacific region is playing a major role in shaping the future of the metaverse.

The software segment is the leading market segment in 2024. Software solutions are hugely in demand since they facilitate building, connecting, and scalability for the Metaverse experience. Most sophisticated software platforms are relied upon to create immersive virtual environments, user interfaces, and decentralized systems. As of 2024, US$ 7 billion was invested in metaverse-related software companies, with a large portion of that funding directed at developing VR/AR software, game engines, and blockchain infrastructure. Software tools such as Unreal Engine (Epic Games) and Unity can provide the best foundation for building immersion into 3D worlds that can be realized on the metaverse.

The need for virtual reality (VR) and augmented reality (AR) applications is rising quickly, which has led to more interest in using blockchain technology for things like virtual assets and applications such as NFTs, owing to which the software segment is growing fast. The VR and AR software market is expected to grow by 35% each year for the next 5 years, and is expected to be worth over US$80 billion by 2030. As more businesses and consumers are getting involved in the Metaverse, there is a growing need for more and better software and high-quality tools. It is also anticipated that by 2025, more than 60% of companies will adopt Metaverse platforms for purposes such as virtual collaboration, conducting training sessions, and enhancing their marketing strategies. The adoption of VR/AR software for enterprise solutions is expected to increase by 50% within the next 5 years. Therefore, the software segment is another big growth driver that drives the demand for more interactive, immersive, and scalable virtual environments.

The centralized metaverse held the largest share of the platform segment in the metaverse market. These platforms are typified by one organization or one group being in control of the metaverses, whereby one can have the user experience somewhat regulated. Such platforms are owned and run by one company that provides the infrastructure and manages the user experience. The centralized metaverse segment is expected to reach nearly US$ 130 billion by 2030. Usually, these platforms provide a moderated space for social interaction, games, and entertainment. In these worlds, users can meet to chat, play games, attend events, and socialize. The enterprise adoption of centralized metaverse solutions is projected to contribute approximately 15% of the total market share, generating US$ 12 billion in 2025.

Meta, Microsoft, and Epic Games are using tools and gear like VR headsets to enhance their platforms and ensure everything works smoothly. These major tech companies are heavily investing money into Metaverse platforms. By 2025, Meta might control about 45% of the centralized metaverse market, while Microsoft could have around 20%. This big financial investment gives them a strong position, allowing them to quickly grow and improve their technologies.

The virtual reality (VR) held the largest share of the technology segment in the metaverse market. VR dominates due to its ability to provide fully immersive digital experiences, making it the backbone of many Metaverse applications, including gaming, social interaction, training, and virtual commerce. VR provides a truly immersive experience in that users are made to feel that they enter a present world virtually and engage with it. This feature makes an engaging and realistic experience.

The market for VR accessories, such as controllers, haptic gloves, and tracking systems, is expected to grow at 30% CAGR, reaching US$ 2.5 billion by 2025. VR fits naturally into gaming and entertainment, two of the most important applications found in the Metaverse. Training simulations, virtual meetings, and design processes are increasingly being mediated through VR, and this trend is growing especially in the areas of health, automotive, and manufacturing, to name a few.

Over 30% of Fortune 500 companies are expected to use platforms like Spatial for virtual meetings and collaborative work in the next 3 years. Immersion is something that VR perfectly offers, allowing it always to remain on the cutting edge of technology. Gaming, training, and socializing have become its loftiest ideals and therefore its greatest attractions, encouraging a legion to enter its realm. In 2025, Meta is expected to sell over 20 million units of Quest headsets, capturing approximately 40% of the global VR headset market.

The largest share of applications in the metaverse market is accounted for by gaming & entertainment. This industry has led all others due to the early adoption of immersive virtual environments, its very effective revenue generation models, and increased customer engagement. Most recently, gaming became the earliest beneficiary of metaverse environments, where users can dwell, compete, or create within an immersive universe. The metaverse's gaming and entertainment segment has attracted over US$ 3 billion in venture capital funding over the past two years, with a focus on platforms that blend gaming, entertainment, and social interaction. Great gaming worlds such as Fortnite, Roblox, and Decentraland host millions of participants in their virtual experiences, where players build up virtual communities, experience real-life events, and partake simultaneously in multiple experiences. In 2025, Roblox’s revenue from virtual items, in-game purchases, and user-created content is projected to surpass US$ 6 billion and reach over 250 million monthly active users. A huge percentage of metaverse games have their multiplayer games ready for active socializing with friends and in communities by being blended into real-time social media engagement with gaming activity. Subscription-based services in gaming and entertainment within the metaverse are projected to reach US$ 4 billion by 2025.

Empower your strategy with expert insights, purchase this premium research@ https://www.cervicornconsulting.com/buy-now/2377

Ask here for more details@ sales@cervicornconsulting.com