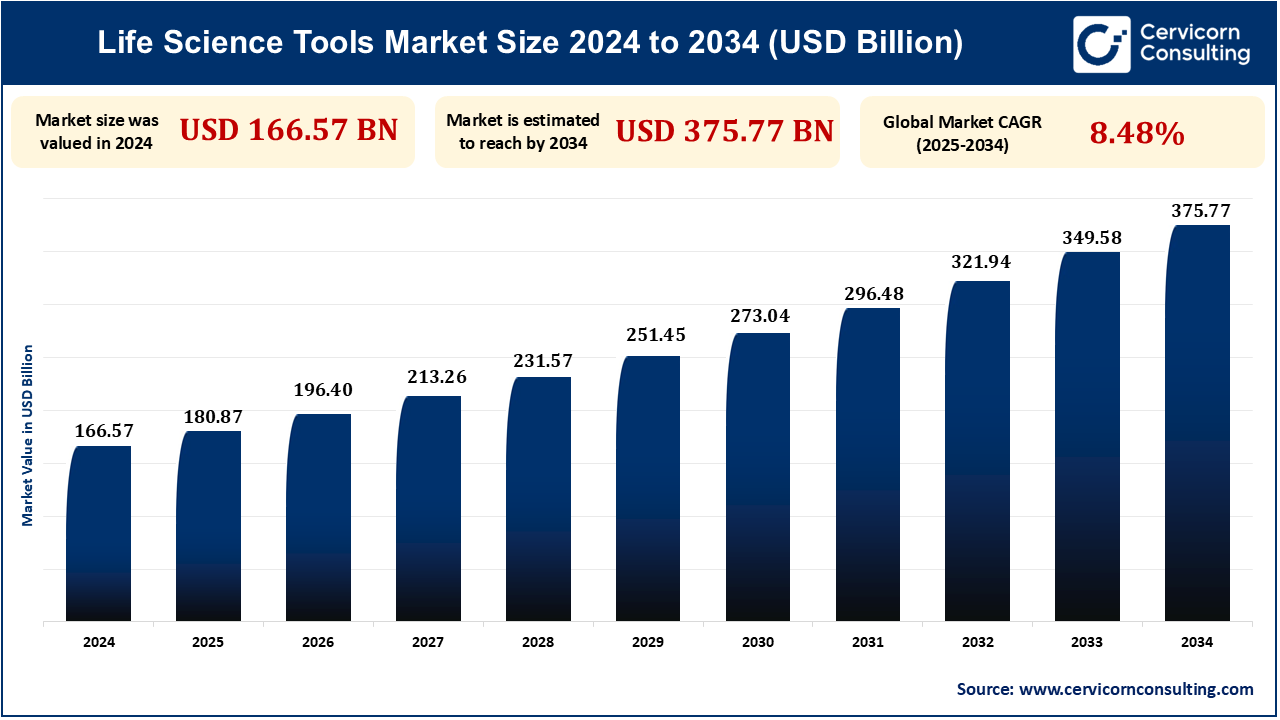

The global life science tools market surged to a value of USD 166.57 billion in 2024 and is poised to reach an impressive USD 375.77 billion by 2034, expanding at a robust CAGR of 8.48% over the forecast period 2025 to 2034, driven by rapid advancements in biotechnology, diagnostics, and personalized medicine.

The life science tools market is growing at a rapid rate due to advancements in cell biology, genomics, and proteomics. Increasing demand for personalized medicine and increasing investment in CRISPR technologies, NGS, and mass spectrometry is propelling the market. Life science research institutions and biopharma companies are adopting the new tools to stimulate drug discovery and precision diagnostics.

Furthermore, growth in automation, artificial intelligence (AI) and cloud analytics-based solutions being adopted in laboratories is also redesigning experimental process and data analytics. Private institutes and governments alike are accelerating funding of life sciences research, leading to the accelerated expansion of life science laboratory devices and consumables. The pharmaceutical sector's boom for biologics and biosimilars is also opening doors for analytics solutions that promise quality and compliance. For instance, according to a January 2021 article by mAbxience, 27 monoclonal antibodies have been approved for the treatment of various types of cancer. Additionally, the increasing FDA approvals of monoclonal antibodies for diagnostics and cancer therapy are expanding the applications of biologics. For instance, in January 2022, the FDA approved Tebentafusp-tebn, a monoclonal antibody for the treatment of metastatic uveal melanoma. Government support, along with the growing demand for novel therapeutics, is expected to drive market growth.

Genomics and proteomics are rapidly advancing, enabling us to learn more about genetic architectures, protein functions, and disease processes. Next-generation sequencing (NGS) and mass spectrometry have transformed biomedical research by enabling greater accuracy, lowering costs, and facilitating greater accuracy in diagnosing diseases. These technologies are the basis of personalized medicine, drug discovery, and biomarker discovery. With continued research, new approaches continue to emerge, and genomic and proteomic studies become more efficient and cost-effective. For example, Illumina's NovaSeq X Series has dramatically sped up whole-genome sequencing, lowering costs while increasing throughput. Researchers apply this technology to conduct extensive genetic studies, which propel oncology, rare disease research, and precision therapeutics development. For instance, the cost of sequencing a human genome has plummeted from over $3 billion in 2003 to less than $1,000, enabling rapid and affordable genomic sequencing. Moreover, the UK Biobank's proteomics initiative aims to analyze thousands of proteins in 300,000 blood samples, facilitating a deeper understanding of disease mechanisms and potential drug targets.

CRISPR and other gene-editing technologies have opened new doors to genetic research and therapeutics. The technologies allow for specific DNA editing, which makes it possible for scientists to fix genetic mutations, design targeted drugs, and improve agricultural biotechnology. Gene editing is becoming increasingly utilized for the treatment of genetic diseases, cancers, and infectious diseases, revolutionizing medicine. In spite of the ethicists' worries, CRISPR treatments are being more and more licensed for the clinic. Vertex Pharmaceuticals and CRISPR Therapeutics, for example, have marketed Casgevy, the initial CRISPR treatment for sickle cell disease and β-thalassemia. The new treatment is a milestone in genetic medicine, showing the power of gene editing to cure genetic diseases.

Life science equipment, such as sequencing machines, mass spectrometers, and robotic automation platforms, is extremely expensive. The very high cost of these technologies, coupled with consumable, maintenance, and personnel costs, discourages their uptake, most significantly in small-scale research organizations and developing economies. Despite their promise, cost is a major impediment to extensive adoption. For instance, NovaSeq sequencers of Illumina, although revolutionary, require enormous initial costs, making them impossible for smaller research laboratories to afford. Such a cost factor inhibits the growth of genomic research in lower-income regions, slowing down innovation in precision medicine.

Increased need for personalized medicine is propelling the use of life science tools that support patient-specific genetic profiling and targeted therapies. Improvements in biomarker discovery and liquid biopsies are making more targeted drug development, enhancing treatment efficiency. The use of AI and big data analytics in personalized medicine is also continuing to improve patient outcomes and clinical decision-making. For example, Foundation Medicine's genomic profiling tests enable oncologists to choose the best targeted therapies for a patient based on the biology of their cancer. This is revolutionizing the practice of cancer treatment by providing patients with the best drugs for therapy. The increasing availability of genetic testing has facilitated the development of targeted therapies. For instance, in 2023, personalized medicines accounted for 38% of all new molecular entities approved by the FDA, up from 21% in 2014, indicating a growing focus on tailored treatments.

| Attribute | Details |

| Life Science Tools Market Size in 2024 | USD 166.57 Billion |

| Life Science Tools Market Size in 2034 | USD 375.77 Billion |

| Life Science Tools Market CAGR | 8.48% from 2025 to 2034 |

| By Technology |

|

| By Product |

|

| By End-use |

|

| By Region |

|

| Key Players |

|

Asia-Pacific is the fastest-growing market for life science tools due to increasing biopharmaceutical industries, increasing government initiatives, and increasing healthcare investments. China, Japan, India, and South Korea are establishing their biotechnology and pharmaceutical industries more robustly through R&D investments and infrastructure development. China, in specific, is heavily investing in genomics, CRISPR technology, and stem cell research. The increasing need for low-cost diagnostics and personalized medicine is also propelling market growth. For example, BGI Genomics, a Chinese market leader, is making headway in genomic sequencing technologies, low-coverage whole-genome sequencing becoming increasingly available for research and clinical use.

North America has a lead in the life science tools market, driven by strong investment in biotechnology, pharmaceutical research and development, and academic research. Sophisticated healthcare infrastructure, high levels of genomic and proteomic technology adoption, and major market players contribute to regional growth. The U.S. leads in innovation, with government support coming from NIH and other agencies funding life science research. Canada is also developing its biotech industry, with an emphasis on drug discovery and regenerative medicine. The rising need for precision medicine and research tools made possible by AI also drives market growth further. For example, Thermo Fisher Scientific's recent investments in North American manufacturing plants are increasing the region's life science capabilities.

Genomic technology refers to instruments and methods employed to probe DNA, RNA, and genetic variation to define biological processes and disease mechanisms. This category includes next-generation sequencing (NGS), polymerase chain reaction (PCR), microarrays, and CRISPR-based gene editing. Genomic advancements are revolutionizing precision medicine, allowing early disease diagnosis, targeted treatments, and customized treatment regimens. Genomic technology has wide application areas in cancer research, the diagnosis of rare diseases, and agri-biotechnology. Decline in the sequencing cost and improvement in bioinformatics are enhancing the role of genomic technology in research as well as in clinical practice. For example, Illumina's NovaSeq X Plus has improved sequencing speed and accuracy by orders of magnitude, driving genomic research and drug development further.

Biopharmaceuticals use life science tools intensively in drug discovery, development, and production. Biopharmaceuticals facilitate early-stage screening, biomarker discovery, toxicology screening, and clinical trial research. The increasing demand for biologics, cell and gene therapies, and personalized medicine is driving the adoption of innovative life science technologies. Biopharma firms invest heavily in genomics, proteomics, and artificial intelligence-led drug development to reduce the time-to-market for new therapeutics. For example, Amgen's use of CRISPR and next-generation sequencing is streamlining precision medicine development, increasing the effectiveness of targeted therapies.

Empower your strategy with expert insights, purchase this premium research@ https://www.cervicornconsulting.com/buy-now/2355

Ask here for more details@ sales@cervicornconsulting.com