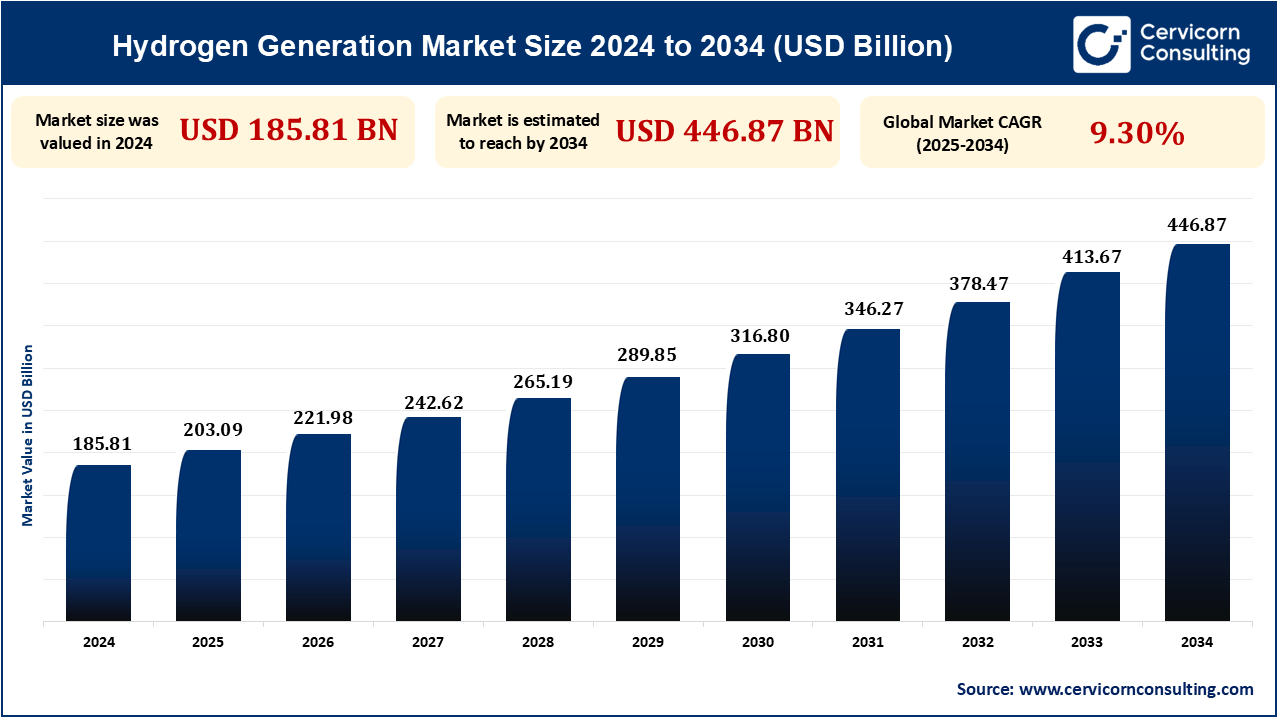

The global hydrogen generation market size was reached at USD 185.81 billion in 2024 and is expected to be worth around USD 446.87 billion by 2034, exhibiting a compound annual growth rate (CAGR) of 9.3% over the forecast period 2025 to 2034.

Hydrogen generation is rising exponentially as the demand for sustainable and clean energy sources surges. While renewable energy sources such as wind and solar power grow, hydrogen offers a good way of energy storage for excess energy. Advances in technology on electrolysis and green hydrogen production are on the decline when it comes to costs, yet efficiency is rising. Hydrogen generation is the pivot of decarbonization of transport and industrial manufacture. Its prospective use as an energy carrier on multiple fronts energizes its acceptance. By the year 2025, the generation of hydrogen is projected to be the column in shifting the world to sustainable energy use in the future.

For instance, China has by far the largest operational capacity for green hydrogen production worldwide. As of 2023, electrolyzers with a combined capacity of 117,000 metric tons per year had been installed around the country.

NREL's Wind2H2 project, with Xcel Energy, illustrates hydrogen generation from a wind turbine and photovoltaic (PV) array. A 100-kW Northern Power Systems and a 10-kW Bergey wind turbine supply electricity, which is applied in stacks of electrolyzers to dissociate water to produce hydrogen and oxygen. The produced hydrogen is either stored for use at a fueling station or used to generate electricity during peak demand. Situated in Boulder, Colorado, the project hopes to enhance system efficiency and save costs to compete with conventional energy. System integration, variable renewable energy performance in electrolyzers, efficiency upgrade, and operating experience are key areas of interest for research. The trend enhances the growth of green hydrogen hubs in areas rich in renewable resources, supporting the industrial sector's reduction of carbon footprints as well as being a backup to grid stability.

Japan is competing to be a global leader in hydrogen technology, accounting for 24% of hydrogen-related patents between 2011 and 2020.Nippon Steel, Kawasaki Heavy Industries, and JR East are taking the lead in hydrogen use in steel production, shipping, and trains. It has invested over USD 98 billion in hydrogen activities, to reach 0.12 billion tons of annual use of hydrogen by 2040. While the pace is picking up, economic viability is the challenge that needs to be fulfilled via public-private partnerships at an affordable cost for hydrogen energy. Clean hydrogen production and hydrogen fuel cells are crucial in clean energy transition and reducing the consumption of fossil fuels. Hydrogen also offers an energy storage solution, enhancing the reliability of renewables.

U.S. Department of the Treasury and IRS have released final regulations on the Section 45V Clean Hydrogen Production Tax Credit, providing certainty and clarity to investors and the clean hydrogen industry. The regulations create opportunities for hydrogen production from a wide range of sources, such as renewable natural gas and coal mine methane. Projects will be required to meet prevailing wage and apprenticeship standards to qualify for the full credit. Protections for electrolytic hydrogen and hydrogen production based on methane are added to make the data accurate and sustainable. The Department of Energy will upgrade the 45VH2-GREET model to be used for tax credit calculation purposes. The policies seek to eliminate economic obstacles and drive innovation and innovation to facilitate the mass adoption of hydrogen energy solutions.

IRENA recognizes hydrogen as being applied towards realizing the 2050 net-zero emission target, contributing 10% of mitigation and 12% of final energy demand. Hydrogen is primarily obtained from fossil fuels at the moment, and green hydrogen contributes only 1% worldwide. Hydrogen is extremely convenient to utilize in the production of derivatives like ammonia and synthetic fuel, enabling international trade of clean energy However, technical obstacles such as high production costs, poor infrastructure, and energy losses impede progress. Cost-effectiveness using traditional production technologies must be ensured to raise the market. Firm policies for various uses of hydrogen must be established to ensure long-term success.

Hydrogen fuel cells are powering energy resilience with clean backup power and microgrid support, especially in weather-impacted areas. The power is small-scale applications like wireless towers and large-scale applications like data centers without diesel generators. Hydrogen-fueled microgrids, like in Western Australia and California, provide islanding capability and reduce fossil fuel reliance. They provide clean, reliable power during outages. Hydrogen as an instrument of energy resilience will be revenue-generating and market-pivotal. Hydrogen is employed increasingly as a low-carbon, clean alternative for traditional back-up systems.

| Attributes | Details |

| Hydrogen Generation Market Size in 2024 | USD 185.81 Billion |

| Hydrogen Generation Market Size in 2034 | USD 446.84 Billion |

| Hydrogen Generation Market CAGR | 9.3% |

| By Technology |

|

| By Application |

|

| By System |

|

| By Source |

|

| By Region |

|

| Key Players |

|

North America is also one of the best places for hydrogen production, led by the U.S., Canada, and Mexico. The U.S. is focusing on blue and green hydrogen, with the advantage of its natural gas reserves and renewable energy resources. Canada is working on green hydrogen production by making use of its massive hydroelectricity and wind energy. Mexico, although in the midst of building its hydrogen infrastructure, is extremely robust in its industrial base and renewable potential. The regional hydrogen market is expanding with expanded industrial uses, including refining and ammonia production. These nations will build hydrogen utilization and infrastructure fairly heavily.

The Asia-Pacific, with member countries such as China, India, Japan, and South Korea, is working fast to enhance hydrogen production. China is turning to hydrogen as it will balance its huge industrial base as well as its transition to green energy. India looks at hydrogen as vital in enhancing its energy security and greening its power as well as transportation sectors. Japan is still leading in hydrogen fuel cell technology as well as infrastructure construction for hydrogen. South Korea is turning to hydrogen to assist it in making the transition to clean energy and lowering emissions. There is a huge potential market here because of high industrial needs and high rates of urbanization.

The most prevalent method of hydrogen production is Steam Methane Reforming (SMR), in which steam is mixed with methane at high temperatures to generate steam and carbon monoxide. It is widely applied due to its low cost and efficiency, mainly where natural gas is highly concentrated. Nevertheless, the SMR process is characterized by high CO2 emissions, which are a green gas. SMR with CCS can potentially lower such emissions. Technology does exist but induced by necessity to be cleaner to the environment. SMCR is still the dominant form but threatened by modification in quest for sustainability.

Hydrogen is applied extremely extensively in petroleum refining, particularly in hydrocracking and desulfurization, where it enables the cracking of crude oil into desirable products like gasoline, diesel, and jet fuel. Hydrogen is consumed in huge quantities by refineries to strip sulfur and impurities from fuels to make them acceptable under regulatory standards. Most of the hydrogen employed in refineries is manufactured through SMR. Nevertheless, the demand for hydrogen in refineries is compelling cleaner ways of producing hydrogen. Green hydrogen, through the electrolysis process, may decrease the carbon intensity of refining activities. The petroleum industry is still a significant sector for the application of hydrogen, and shifting to cleaner sources is becoming more crucial.

Coal is employed as a feedstock for producing hydrogen by gasifying coal, where it becomes converted into syngas (hydrogen and carbon monoxide). While cheap in certain places where coal availability is high, coal-derived hydrogen possesses an extremely high carbon intensity. The process is energy intensive and releases substantial CO2 emissions unless accompanied by CCS technologies. Coal-derived hydrogen is regarded as a less sustainable alternative than natural gas or water electrolysis. Nevertheless, it is still applied in regions where coal is locally available and there is strong hydrogen demand. Mitigation of coal gasification emissions is being investigated through the incorporation of CCS.

Empower your strategy with expert insights, purchase this premium research@ https://www.cervicornconsulting.com/buy-now/2344

Ask here for more details@ sales@cervicornconsulting.com