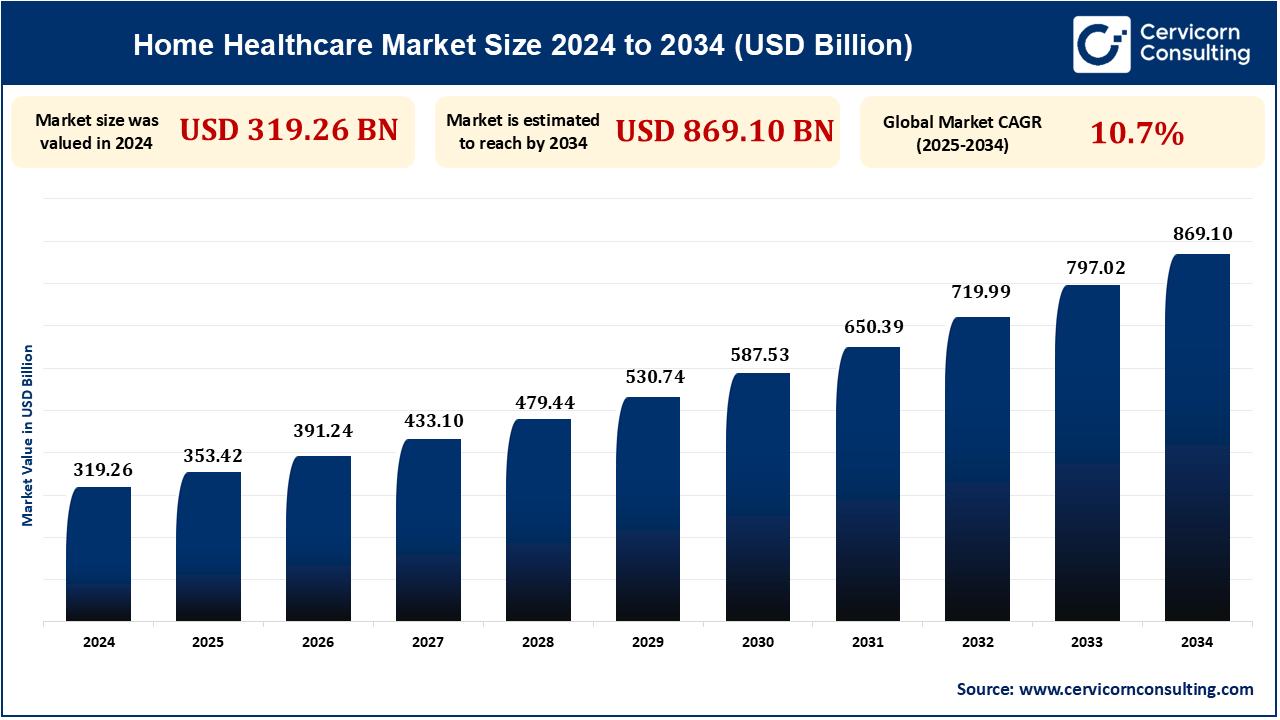

The global home healthcare market size was reached at USD 319.26 billion in 2024 and is expected to exceed around USD 869.10 billion by 2034, exhibiting at a compound annual growth rate (CAGR) of 10.7% over the forecast period 2025 to 2034.

Home care is increasing exponentially with many geriatric patients, healthcare costs, and technological innovations. With increasingly more people preferring to be treated at home rather than in hospitals or nursing homes, home nursing, physical therapy, and telemonitoring services are gaining popularity. This shift is not only providing a more personalized and comfortable care experience but also reducing healthcare costs. With technologies such as telemedicine and wearable health monitors, home care is becoming more efficient and convenient, so it will continue to grow its percentage of the healthcare market.

Home health monitoring devices, such as blood pressure meters and glucose meters, are enabling patients to control chronic conditions in the comfort of their homes. Singular Wings Medical is working on a non-invasive continuous glucose monitor (CGM) based on ECG data to estimate blood glucose levels. The BEATINFO sensor captures ECG data, which the BEATINFO Health app processes using machine learning. This device forecasts high, medium, and low glucose levels with about 80% accuracy. Unlike other CGMs, it doesn't involve the insertion of a sensor beneath the skin. The product will arrive in two years, although validation is continuing. A pilot program demonstrated a 15% decrease in hospital readmissions through remote monitoring.

As the world is aging, more demand is generated for home care services, specifically for elderly patients who prefer home care to treatment in health centers. As 10,000 Americans turn age 65 each day, the governments are preparing for increased needs for services, affordable housing, and transportation in order to promote aging in place. The federal government has released guidelines to promote healthy aging and age-friendly communities that address needs of accessible communities, age-friendly work environments, and long-term care services. Affordability, aging in place, and transportation are the concerns in Pennsylvania and New Jersey. In Japan, a program focused on in-home healthcare aims to reduce reliance on overburdened hospital systems. This population trend is certain to drive continued expansion in the market. The ageing population will go on to determine healthcare trends worldwide.

Home-based care, telemedicine, and specialty care are in short supply in rural areas. The use of telehealth is revolutionizing rural hospitals by bridging gaps of specialists and geographic barriers to facilitate teleneurology and telepsychiatry remote consultation. This facilitates more rapid treatment and reduced unnecessary transfers. Financial constraints such as high upfront costs, low patient volumes, and reimbursement difficulties prevent wider adoption. Policy reforms, such as modified reimbursement schemes, subsidized infrastructure, and increased broadband connectivity, are needed to unlock the full potential of telehealth. These challenges being addressed will draw on expanding market potential and improve healthcare accessibility to rural communities.

The alliance of Choice Health at Home and Resilient Healthcare offers a major opportunity within the home health market. With the combination of Choice Health at Home's experience in community care and Resilient's advanced digital health technologies, including operational management software, a 12-lead ECG device, and 24/7 remote patient monitoring, this combination bridges the gap between traditional home healthcare and the higher-acuity needs of hospital-at-home programs. This model, which unites hospitals, technology, and home providers, can potentially enhance the quality and availability of hospital-level care in the home, positioning the partnership well to capitalize on the growing market for at-home healthcare services. As hospital-at-home services become more common, this innovation is a good bet for market growth.

| Attributes | Details |

| Home Healthcare Market Size in 2024 | USD 319.26 Billion |

| Home Healthcare Market Size in 2034 | USD 869.10 Billion |

| Home Healthcare Market CAGR | 10.7% from 2025 to 2034 |

| By Service Type |

|

| By Equipment/Technologies |

|

| By Indication |

|

| By End Users |

|

| By Region |

|

The Asia-Pacific region is witnessing high growth in the home healthcare market led by Japan, China, and India's humongous and aging population. With a growing rate of chronic disease, patients in the region predominantly opt for home care to prevent overburdening hospital systems. The utilization of telemedicine and mobile health platforms is also expanding the accessibility of healthcare services, particularly in rural areas. Growing awareness about home care services and improvements in healthcare infrastructure are also contributing to the growth in the market. Technology advancements, such as wearable health devices, are also making home healthcare services better.

North America is the leader in the home healthcare market due to its large elderly population and preference for in-home care. It has a well-established healthcare infrastructure, widespread use of technology, and good support from government-funded schemes like Medicare and Medicaid. Demand for home healthcare services is also underpinned by increasing chronic illness and the escalating demand for post-surgical services. Telehealth services too have become extremely popular, enabling patients to access services remotely. The well-established healthcare system in the region makes way for the integration of home healthcare services with hospitals and outpatient facilities. Therefore, North America continues to be the largest and fastest-growing market.

The "Device" category in the home healthcare industry is the medical device employed to track, diagnose, or treat a patient at home. The devices may be as simple as a thermometer or as advanced as ECG monitors and oxygen concentrators. During 2023, wearables and remote monitoring devices got evolved to track health in real-time, allowing patients to control chronic diseases like diabetes or hypertension from the comfort of their homes. By 2024, home medical devices increased demand as health systems focused on cost-saving measures. Devices tend to be employed together with telehealth services for extended care. The growth of this segment is influenced by advances that improve the comfort and convenience of patients while lowering hospital visitations.

Home healthcare rehabilitation services are physical, occupational, or speech therapy services offered to patients at home. The services are usually required after surgery, injury, or illness to regain independence. Home-based rehabilitation grew more popular in 2023, particularly among older adults undergoing surgeries such as hip replacements. By 2024, in-home rehabilitation programs had grown to include virtual therapy, which allowed patients to easily do therapy from home. Ease, convenience, and reduced charges than inpatient rehabilitation facilities are the advantages of undergoing rehabilitation in the home environment. With greater demand for rehabilitation services at home, technology-powered solutions such as virtual reality therapy will be leveraged to drive healing.

Empower your strategy with expert insights, purchase this premium research@ https://www.cervicornconsulting.com/buy-now/2342

Ask here for more details@ sales@cervicornconsulting.com