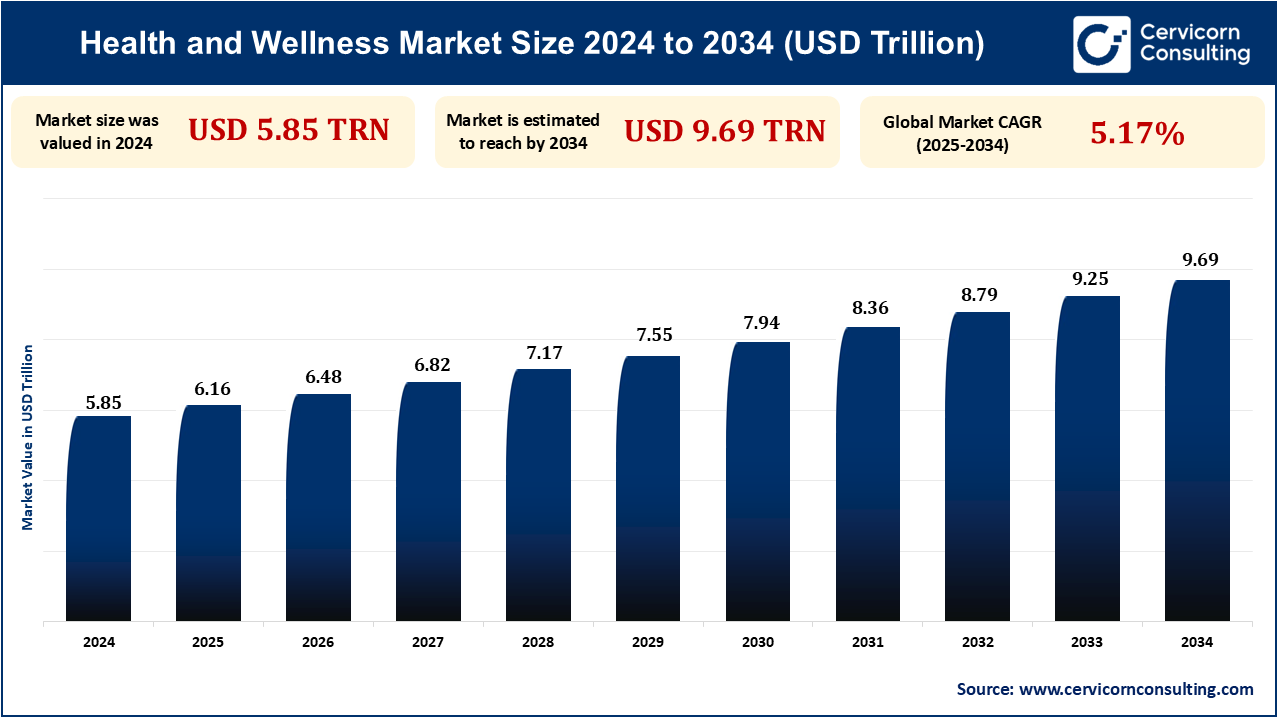

The global health and wellness market was valued at USD 5.85 trillion in 2024 and is projected to grow significantly, reaching approximately USD 9.69 trillion by 2034, at a compound annual growth rate (CAGR) of 5.17% during the forecast period from 2025 to 2034.

The health and wellness industry is expanding exponentially on account of an increase in consumer awareness of preventive healthcare, an upsurge in demand for organic and natural products, and the incorporation of digital health technology. The paradigm shift towards wholistic wellness, encompassing mental health, nutrition, and fitness, has fueled the rise of wellness products and services. These health-conscious industries are being driven with consumers requesting functional foods, personalized supplements, and physical training such as never before.

In addition, the growing incidence of chronic conditions, lifestyle diseases, and an aging population are fueling the demand for healthcare innovation. Wearable technology, telemedicine, and AI diagnostics are also becoming widely available as they mature. Wellness tourism, vegan diets, and government-supported sustainable healthcare solutions are also accelerating the market growth even more. For instance, according to survey nearly half (48%) of employees say their mental wellbeing declined in 2022, and 28% said they are miserable in their workplace. 60% of employees also reported feeling emotionally detached at work.

Personal nutrition is becoming extremely popular as consumers seek gene-based, lifestyle-based, and health-based personalized diet recommendations. As new advancements occur in nutrigenomics and artificial intelligence-enabled health reporting, consumers can purchase personalized dietary guidance, supplementation guidance, and exercise regimens. Biometric data, gut typing, and genomic analysis are used by companies to develop customized health solutions. It is driving functional foods, vitamins, and meal preparation services with individual nutrient deficiencies, weight management intentions, and prevention of chronic illnesses. As customer demand for precision health increases, companies have been investing more in research and technology to introduce increasingly scientifically driven, data-driven offerings, which are making wellness a personalized affair driving an important segment of the market. For instance, in 2023, the Nutrition Business Journal reported that sales of personalized supplements would reach $1.15 billion at the end of 2024, which was 15 times the estimate in 2017.

Consumers are increasingly looking to functional foods and plant-based diets for the support of overall health, immunity, and the control of chronic disease. Functional foods like probiotics, adaptogens, and protein foods are increasingly being used in daily diets for the support of gut health, the control of inflammation, and brain function. In addition, transitioning to plant-based diets is made easy by sustainability concerns, ethical lifestyle, and food choice. Easing demand for alternatives to meat, plant food, and nutricious foodstuffs is restructuring the foods and beverages market. Suppliers are making research about alternate proteins, fermentation products, and botanics as an opportunity to combat the rising cohorts of health-focused and eco-sensitivity-driven buyers. For instance, according to GFI.org, in 2023, the market was worth $8.1 billion. This growth has been driven by products that appeal to mainstream consumers by mimicking the taste, texture, and functionality of conventional animal products.

Consumers increasingly seek advanced skincare treatments to combat age, pollution, and diseases in the skin. Active ingredients such as hyaluronic acid, peptides, retinol, and vitamin C now command more popularity in skincare products as they were discovered to hydrate, soften wrinkles, and revive the skin. The demand for non-invasive anti-aging and skin rejuvenation treatments such as microcurrent machines, LED light therapy masks, and derma rollers is also growing as individuals seek out non-surgical beauty solutions. It is fueled by increasing consumer awareness, social media, and technologic innovation in dermaceuticals. Demand for scientifically based, dermatologist-approved skincare products is so robust that it can propel the health and wellness market, especially the beauty and personal care category, firmly.

In many developing countries, there is still a lack of awareness about the benefits of wellness-focused lifestyles, functional foods, and preventive healthcare. Traditional dietary habits, limited health education, and economic constraints prevent large populations from adopting wellness products and services. Additionally, poor healthcare infrastructure and low digitalization slow the uptake of AI-driven health solutions, as well as wearable technology. While these cities in emerging economies are gaining interest in wellness trends, rural pockets are making them unaffordable and inaccessible. Bridging this divide requires education campaigns, government interventions, and value wellness solutions across demographic segments.

Increasing incidence of lifestyle chronic diseases such as diabetes, obesity, cardiovascular disease, and hypertension is driving demand for preventive health and wellness products. Sedentary lifestyle, poor diet, and undue stress are causing these diseases, and consumers are turning towards nutritional supplements, functional foods, and exercise programs. Preventive measures such as routine check-ups, wellness consulting, and tailored nutrition programs are being promoted by governments and healthcare organizations. The shift from curative healthcare to preventive healthcare has provided a thrust to the sale of mental well-being programs, wearable health monitoring devices, and organic food, making chronic disease management one of the key growth drivers for the health and wellness market.

| Attribute | Details |

| Health and Wellness Market Size in 2024 | USD 5.85 Trillion |

| Health and Wellness Market Size in 2034 | USD 9.69 Trillion |

| Health and Wellness Market CAGR | 5.17% from 2025 to 2034 |

| By Application |

|

| By Distribution Channel |

|

| By Age Group |

|

| By Region |

|

| Key Players |

|

The Asia-Pacific is the fastest-growing health and wellness market, driven by increasing disposable income, urbanization, and enhanced awareness of preventive healthcare. China, India, Japan, and South Korea are some of the nations that have witnessed high demand for nutraceuticals, herbal wellness, and alternative medicine. Ayurveda, Traditional Chinese Medicine (TCM), and acupuncture are well integrated into mainstream wellness practices. The new fitness culture, social media influencer-led health trends, and the development of e-commerce are also driving sales. Additionally, the Indian and Chinese governments are also promoting yoga, meditation, and mental wellness programs in large numbers, making the region a hub for holistic health innovations.

North America is the health and wellness leader, supported by increasing health-consciousness, robust disposable incomes, and well-developed healthcare infrastructure. The United States and Canada are leaders in the take-up of organic foods, fitness technologies, and preventive healthcare products. Increasing demand for mental well-being programs, tailored nutrition, and functional foods is driving market growth. The area is inhabited by leading wellness brands, gyms, and telemedicine companies, and digital health services are easily accessible. Moreover, government campaigns for fitness and overall well-being are driving market expansion. The high incidence of chronic conditions like obesity, diabetes, and cardiovascular diseases is also increasing demand for preventive and personalized health solutions. For instance, in August 2024, MegaFood launched a new line of Superfood Mushroom supplements, formulated with clinically studied botanicals and 100% fruiting body mushrooms to enhance focus, immune health, energy, and stress relief. This innovation marks the first clinically tested dietary supplement mushroom for stress relief, underscoring the brand’s commitment to scientifically backed wellness solutions.

The beauty and health category of the beauty and personal care market includes skincare, haircare, oral care, and cosmetics to enhance overall well-being. Buyers are heading clean beauty much more, using organic, vegan, cruelty-free, and dermatologist-tested ingredients that do not contain harsh chemicals like parabens and sulfates. Anti-aging treatments, hydrating boosters, and skin microbiome-friendly items are most sought after. Further, advanced beauty equipment with technology, like LED face masks, facial rollers, and microcurrent, is becoming popular for non-invasive skincare solutions. The growing popularity of customized beauty products, made according to the specific needs of the skin, is further boosting growth in this segment.

The offline channel consists of pharmacies, supermarkets, specialty wellness shops, and health clubs where shoppers can test products prior to purchase. Brick-and-mortar locations remain a choice for many shoppers for health and wellness products for reasons of trust, professional recommendation, and on-hand availability. Pharmacies are important for selling nutraceuticals, OTC wellness products, and vitamins, and health clubs serve as retail destinations for sports nutrition and performance-enhancing supplements. Upscale beauty and wellness retail outlets also offer one-on-one skincare consultations and trials of wellness products, and thus offline retail is a must-have segment for consumer interaction.

Empower your strategy with expert insights, purchase this premium research@ https://www.cervicornconsulting.com/buy-now/2351

Ask here for more details@ sales@cervicornconsulting.com