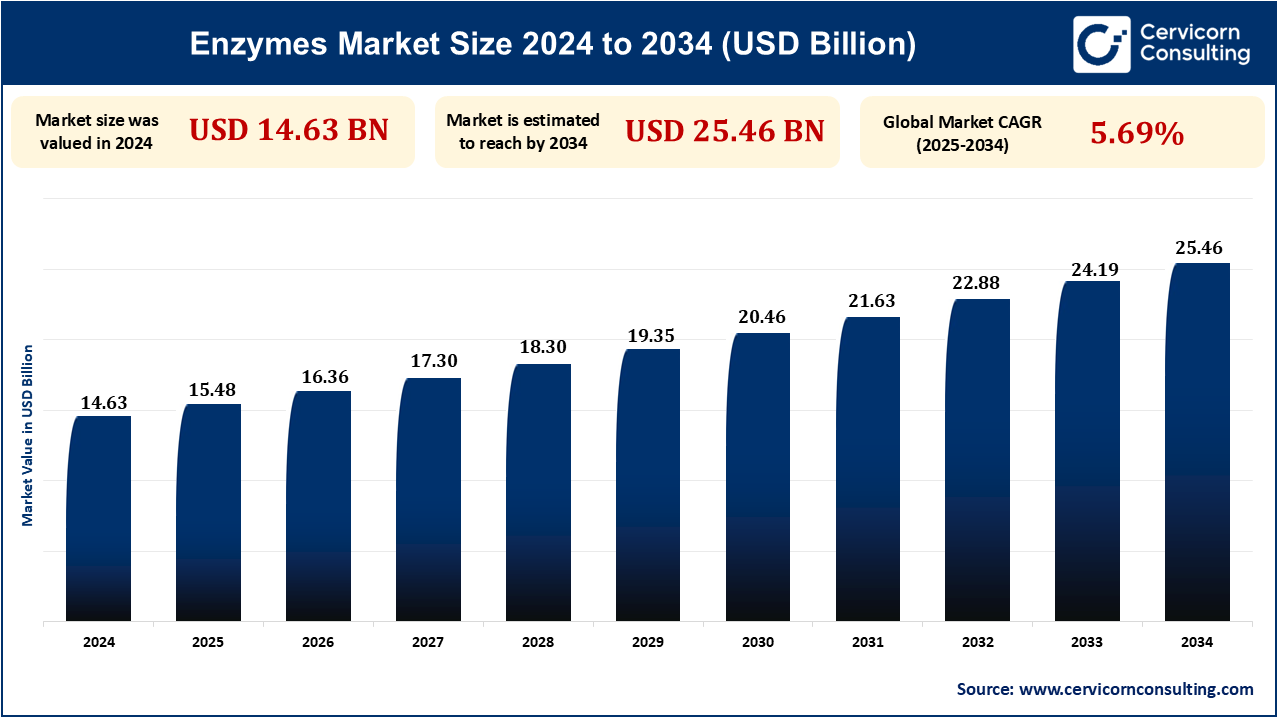

As of 2024, the global enzymes market was valued at approximately USD 14.63 billion. It is projected to reach USD 25.46 billion by 2034, reflecting a compound annual growth rate (CAGR) of 5.69%.

Enzymes are biological catalysts that quicken the rates of chemical reactions in living organisms without being consumed in the reaction. They are usually proteins, but some RNA molecules can act as catalysts. Enzymes are essential for numerous biochemical processes, such as digestion, energy production, and DNA replication. Enzymes are the center of life, and perform many functions from digestion and metabolism to treatment of disease and applications in industry. Their capability to accelerate reactions makes them indispensable, and increasingly in technology. The global enzymes industry is expanding quickly due to increasing demand across food & beverages, pharmaceuticals, biofuels, animal feed, textiles, and biotechnology. A focus on sustainability and advancements in biotechnology is driving growth in the industry, along with increased industrial automation.

The global enzymes market is likely to grow steadily in the next few years, due to the rising use of biocatalysts, technology improvements, and a wider range of enzyme applications in several global industries. As companies look for cleaner, safer, more sustainable, and cost-effective options, enzymes are becoming increasingly vital across manufacturing, agriculture, and healthcare. The rising awareness that consumers prefer to purchase sustainable and eco-friendly products is driving the greater adoption of enzymes in sectors like bioenergy, detergents, and food & beverages. Enzymes do offer a more sustainable path towards better alternatives to chemical reaction processes. The leading companies in enzyme development, which include Novozymes, DSM-Firmenich, DuPont, and Codexis, are extending the frontiers of their professional practices in food, pharmaceuticals, and biofuels. The future looks optimistic with emerging paths for AI-driven enzyme design and eco-friendly applications.

The key driver for the enzymes market would be the increasing demand from the industries, and as markets get more and more sensitized about environmental impacts, regulations, and their worldwide call towards sustainable solutions. According to recent surveys, around 56% of global manufacturers are focusing on sustainability initiatives, with enzymes being a key element of their green strategy. Such factors have increasingly gained an important role in the last few years. There is a rising trend in industries adopting enzymes as they are thereby moving toward greener processing than traditional chemical approaches. Astute Analytica's analysis indicates that North America, as the largest enzyme producer, is expected to generate around US$ 3 billion in revenue by 2029, primarily due to advanced biotechnology infrastructure and supportive policies.

Enzymes are those biological catalysts that help in speeding up chemical reactions without harming chemicals, thereby reducing energy consumption, waste generation, and the use of poisonous materials. A larger number of consumers are becoming conscious of the environmental and health impacts of their purchased items, thus creating market demand for products that are produced sustainably. The market for enzymes used in baking, dairy, and brewing is projected to grow by 8% annually, with a notable preference for enzymes derived from sustainable sources. The push toward green chemistry is also trending in industries because using enzymes can provide selective and efficient reactions in processes with complex molecules, resulting in higher product yields and reduced by-products and waste. Brazil utilizes enzymes in over 400 operational bioethanol plants, underscoring their importance in biofuel production. As bio-based enzymes provide a cleaner, more efficient, and environmentally friendly alternative to traditional chemical processes, it is anticipated that this driver will continue to shape the market, ultimately resulting in growth and opportunity for innovation in the future.

A high cost of production and processing can be seen as a bottleneck in the enzymes market. While there are many advantages of using enzymes, such as sustainability, energy efficiency, and better process performance, producing and then commercializing them is highly expensive. Enzyme production costs account for about 40-50% of the total cost of production for industries using them, indicating that cost reduction remains a key challenge for wider adoption. Thus, this becomes a cost barrier for both the manufacturers and the end-user, especially where coping with cost is a key feature in the industry.

Enzymes are produced mostly through fermentation by microbial organisms, which require certain growth conditions apart from the usual nutrients and conditions of specialized fermentation processes. Fermentation contributes 30–50% of enzyme production costs. But the raw materials needed for producing enzymes by fermentation, including sugars, nitrogen sources, and growth factors, are mostly expensive. Thus, the added costs of enzymes could lead to the overall final cost of the enzyme turning out to be higher than if they were produced by employing a traditional chemical catalyst. A major cost driver is the purification process, which can account for up to 50–80% of total production costs. On top of that, creating newer, better, and more efficient enzymes demands significant investments in research and development. This, of course, will ultimately increase the costs that buyers face when it comes to commercialization.

The process of finding, isolating, and fine-tuning the right enzymes to meet specific needs can take years and require a substantial number of resources. Making upfront investments in R&D increases costs, which would eventually be passed through to consumers and thus would have rendered certain kinds of enzymes less accessible for use, especially in price-sensitive markets such as detergents, animal nutrition, and biofuels. Global investment in enzyme biotechnology R&D surpassed US$ 1.5 billion in 2023, with a strong focus on reducing production costs. There are many benefits associated with using enzymes, such as sustainability and efficiency, but there is a great cost in production and processing that is a major barrier to market entry. Overcoming such cost hurdles by innovation as well as achieving higher economies of scale with potential financial incentives will be the keys to unlocking the full potential of the enzyme market.

The enzymes market is where the pharmaceutical and healthcare sectors are seeing growth. That growth is being driven by the increasing demand for enzyme-based formulations, biopharmaceuticals, and disease diagnostics. The global market for pharmaceutical enzymes, which includes all types of enzymes used in the production, synthesis, and diagnostics in the pharmaceutical industry, was valued at US$ 9.6 billion in 2020 and is expected to grow at a CAGR of 7.2% over the next decade. As biotechnology improves, enzymes are becoming more important in creating medicines, targeted treatments, and personalized healthcare.

Enzymes are increasingly used in making drugs because they help reactions happen very precisely. This precision leads to medicines that are purer and produced in larger amounts. The method of using enzymes, known as biocatalysis, is growing because it's cheaper and eco-friendly and is used in about 40% of new drug production since it cuts the costs by 20-30% compared to older methods. There's a rising demand for enzyme-based tests to diagnose diseases like chronic and infectious diseases, as well as metabolic disorders, all over the world. The demand for enzymes is also growing to make biopharmaceuticals, such as protein-based drugs, monoclonal antibodies, and gene therapies. The enzyme L-asparaginase is widely being used for the treatment of cancer as it has proven to be highly effective. The usage has been increased by 15% in the last five years, especially in the treatment of leukemia. Pharmaceutical companies are investing significant money and effort into discovering and developing new enzymes for medical purposes. As fields like biotechnology and medical science continue to advance, the role of enzymes is set to become increasingly crucial.

Enzymes are vital for creating new medications, diagnosing various diseases, and providing personalized medical treatments suited to individual patients. Additionally, they are used in enzyme replacement therapies to restore enzymes that may be missing or deficient in the body. Furthermore, the increasing research in clinical enzyme-based drug delivery systems is expected to grow by 30% in the by-2030. The convergence of scientific discoveries, increased occurrence of chronic diseases, and increased funding for pharmaceutical companies and the healthcare ecosystem will keep the pharmaceutical and healthcare sectors pushing the enzyme market forward for years into the future.

| Attribute | Details |

| Enzymes Market Size in 2024 | USD 14.63 Billion |

| Enzymes Market Size in 2033 | USD 24.19 Billion |

| Enzymes Market CAGR | 5.69% |

| By Type |

|

| By Source |

|

| By Reaction Type |

|

| By Product |

|

| By Application |

|

| By Region |

|

| Key Players |

|

The North American enzymes market is set to grow rapidly due to technology advancements, bio-based products demand, pharmaceutical and healthcare applications growth, and strong industrial enzyme adoption across multiple industries. Simultaneously, consumers are tending toward natural and sustainable products, which compel industrialists to adopt enzyme-based solutions for cleaner and efficient plant processes. As the largest enzyme producer, North America contributes significantly to the global market, with revenues approaching USD 3 billion. This is supported by advanced biotechnology infrastructure and favorable policies.

North American governments have been efficient facilitators of the growth of the biotechnology sector and have initiated investments and incentives for R&D that support enzyme-based solutions. The US and Canada are at the top of the growth agenda, reinforced by massive investments in biotechnology, favorable regulation of sustainable solutions, and increasing consumer awareness. The US holds the largest share of the market, accounting for over 70% of the total regional revenue, primarily due to high demand in pharmaceuticals, food processing, and industrial biotechnology. It can be surmised that the fastest growth of global enzyme markets will be witnessed within the North American continent due to investments in biotechnology, sustainability, pharmaceuticals, and industrial enzyme applications. Enzymes used in food and beverage production in North America are estimated to account for 30-35% of the total enzymes market share. Thereby, the innovations, regulatory support, and the transition toward bio-based solutions in the region will keep on propelling its growth in the ensuing periods.

In the foreseeable future, the measures taken in the Asia-Pacific region are expected to place it high on the ladder of the world's enzymes market because of activities and developments that see the rapid growth of diverse industries, including food & beverage, pharmaceutical, and biofuels. The pharmaceutical enzymes market in APAC is expected to reach US$ 1.3 billion by 2028. Further, Asia, with its enormous population, rapid industrialization, and rising disposable incomes, is poised to lead the global enzyme market. APAC's food and beverage industry is very robust, and enzymes are used for various specific processes in the production of dairy, meat products, bakery, and beverage items.

The food and beverage enzymes market in Asia Pacific is estimated to reach US$ 2.8 billion by 2030. Convenience, processed foods, and dietary supplements are increasing public demand, and this augments the use of enzymes. Rapid industrialization and urbanization in countries like China and India have led to increased demand for enzymes, with purchases exceeding USD 1 billion for food processing and industrial applications. It is becoming an innovation hub for biotechnology research; particularly, countries like China, India, and Japan are leading in possible enzyme-related R&D efforts. Development is being done on enzymes to use for agricultural applications, such as crop protection and soil quality enhancement.

The market for agricultural enzymes, particularly in animal feed and crop production, is projected to grow at a CAGR of 8.1% through 2030, driven by the need for improved livestock feed and crop yield enhancement. The use of enzymes in animal feed is growing steadily, with the market expected to reach US$ 1.2 billion by 2030, driven by increased demand for high-quality animal nutrition products in China and India. Besides, the government in the Asia-Pacific region promotes enzymes with incentives for eco-friendly and bio-based technologies. This is seen in the promotion of green energy, biofuels, and sustainable food production. As such, a combination of economic development, industrialization, and increased attention toward sustainable practice will work in making APAC the dominant region in the enzymes market.

In the 2024 enzymes market, amylases captured the largest share by type as they are used widely across different industries. The food and beverage industry is home to some of the most prevalent enzymes, as they play an important role in the conversion of starches into sugars. Because of their significant use and importance in these areas, amylases maintained a leading position in the market. The food & beverage sector accounts for over 45% of the global amylase demand and is expected to reach US$ 1.5 billion by 2030.

In addition to being widely used in biofuels to transform starches into fermentable sugars, they are also found in detergents to degrade starchy spots. The use of amylases in the biofuels sector is expected to reach US$1.2 billion by 2030. People around the world are now focusing more on renewable energy sources, which has sparked an increased interest in making ethanol and biofuels. At the same time, there's a trend of people consuming more processed foods and drinks, such as ready-to-eat meals and beverages like beer. These products require the use of amylases during their production. As a result, the demand for amylases is growing, and they are being used in a wider range of industries.

The food & beverages segment led the enzymes market in 2024. Enzymes play an important role in food processing, including baking, brewing, dairy, meat, and juice processing industries. The market for enzymes in food & beverages is expected to reach US$ 5.2 billion by 2030. More than that, society has been demanding functional foods, fortified foods, as well as dietary supplements containing enzymes to improve the nutritional value and to facilitate digestion. The use of enzymes in baking is expected to grow at a CAGR of 7.2% due to the increasing consumption of bread, cakes, cookies, and other bakery products, particularly in emerging markets.

Consumers want more ready-to-eat processed food items, and manufacturing this requires enzymatic processing for texture, preservation, and flavor enhancement. The urges of consumers towards lactose- and gluten-free products acted as a significant influence, from where specific enzymes, lactase and amylases, have been used in processing. The dairy enzymes segment is expected to reach US$ 1.5 billion by 2030. Hence, with the growing food & beverages sector, enzymes are utilized more for improving the quality of products and operational efficacies, resulting in the largest highly regarded category in the field of enzyme applications.

With their unmatched effectiveness, low cost, and application in different fields, the microorganism-derived enzymes segment accounted for a majority of the market share in 2024. Total enzyme production in 2023 reached 120 million tons, with microorganisms contributing 85 million tons. Microbial enzymes are produced largely through large-scale fermentations using microorganisms such as bacteria, fungi, and yeast. Compared to extracting enzymes from animals or plants, this technique is cost-effective. In 2023, approximately 25 million tons of biomass were processed using carbohydrases for biofuel production. Cultivating microorganisms in controlled environments guarantees high enzyme yield and purity, thus making them ideal for significant commercial applications.

Advancement in biotechnology and genetic engineering technologies has improved the capability of microbial enzymes and has also enhanced their efficiencies while producing complex enzymes tailored to various applications. The ever-expanding industries such as food and beverages, biofuels, detergents, and pharmaceuticals continue to increase their reliance on microbial enzymes. In 2023, the pharmaceutical sector utilized approximately 25 million tons of microbial enzymes. Therefore, the microbial enzymes segment is the leading source in the enzymes market, thanks to its cost-effectiveness, scalability, high efficiency, and versatility in applications across industries such as food processing, biofuels, pharmaceuticals, and detergents.

In the year 2024, the liquid enzymes segment accounted for the largest share of the market because of their versatility in application, easy applicability, and broad acceptance among various industries. The liquid enzyme segment held a significant market share of approximately 40-45% in 2023. Liquid enzymes are mixed in solutions, which makes them work faster and more effectively than any other form.

In 2023, production reached around 45 million tons. The food &beverages industry, along with biofuels and detergents, were the largest users. As industries switch to eco-friendlier and more sustainable means of production, liquid enzymes are far more attractive due to biodegradability and lesser environmental impact. Therefore, the need for fast, eco-friendly and process-efficient solutions will continue to favor liquid enzymes in the market.

Empower your strategy with expert insights, purchase this premium research@ https://www.cervicornconsulting.com/buy-now/2373

Ask here for more details@ sales@cervicornconsulting.com