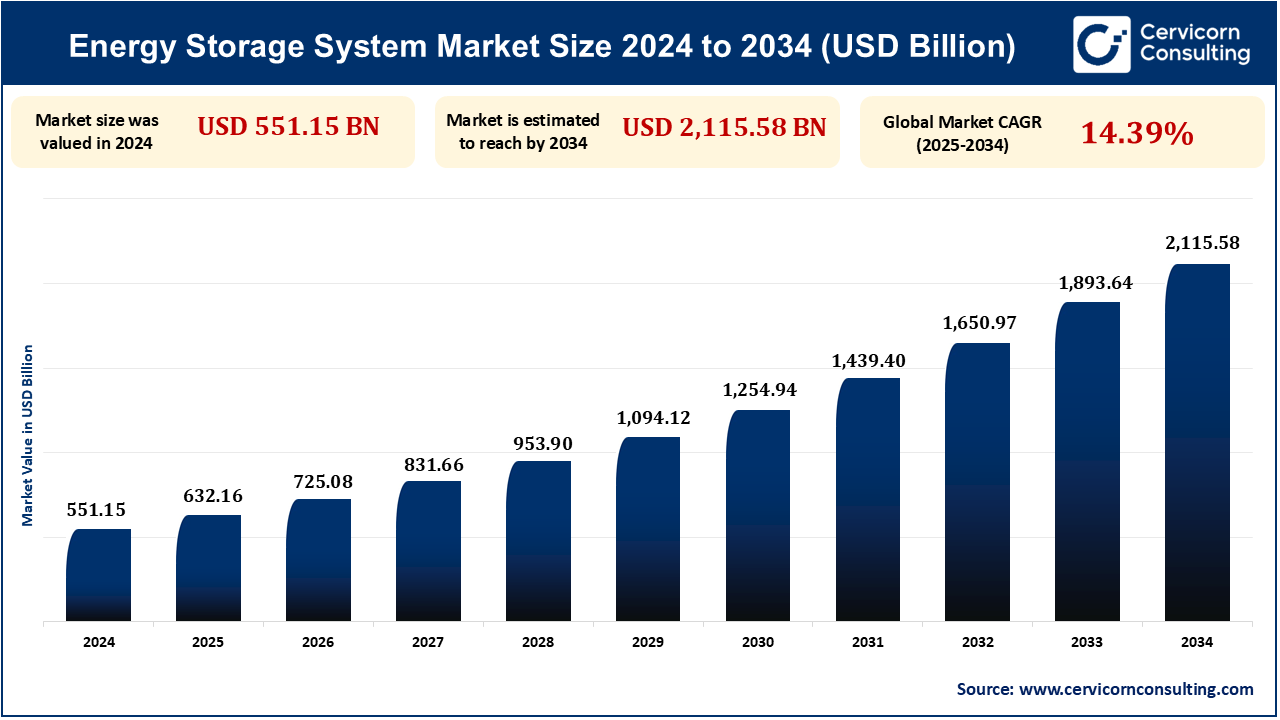

The global energy storage system market size was measured at USD 551.15 billion in 2024 and is anticipated to reach around USD 2,115.58 billion by 2034, growing at a compound annual growth rate (CAGR) of 14.39% from 2025 to 2034. The increasing need for clean energy sources is propelling the energy storage system market as it assists in balancing intermittent power generation. Energy storage technologies enhance the reliability and stability of the grid and provide a stable power supply. Technological advancements are enhancing efficiency and lowering the cost. Green policies and government incentives also support market growth.

The energy storage system market is concentrated on technologies that store energy to be used after a period of time, providing stable and steady supply of power. ESS technology is required to integrate renewable power sources like wind and solar power into the grid. Such systems include batteries, pumped hydro, and other types of storage technology. Market drivers are demand for grid stability, energy efficiency, and clean energy solutions.

One of the main drivers of the energy storage system market is the growth in the use of renewable energy sources. Since solar and wind power generation is intermittent in nature, energy storage systems help to store excess energy for later consumption, maintaining a constant power supply. Improved efficiency and declining costs have been driven by technological advancements in battery storage. Governments across the globe are providing incentives to promote clean energy solutions. These drivers are stimulating the global demand for ESS solutions.

The increase in renewable energy sources such as solar and wind fuels the need for energy storage systems (ESS). The systems, e.g., batteries, capture excess energy during high production and supply it during low production to provide grid stability and raise the proportion of renewables in the energy mix.

In November 2024, according to, Mercom Capital the global corporate funding in the energy storage segment doubled more than twice to $15.4 billion in the first half of 2024, a growth of 117% compared to USD 7.1 billion in H1 2023. Funding was through venture capital (VC) investments, debt financing, and public market financing, with lithium-ion battery firms receiving the most VC funding. Maxvolt Energy raised USD 1.5 million to create quick-charging lithium-ion batteries and set up recycling facilities in India.

Advancements in technology, battery storage system innovations, and energy management software have enhanced energy storage solutions in efficiency and cost affordability. Development of lithium-ion and solid-state battery technology and, in turn, plummeting costs of manufacture have transformed the affordability and availability of energy storage across both commercial use at homes as well as at an industrial scale. These lowering costs are inspiring increasing uses by various sectors.

In November 2024, Canadian Solar is investing nearly USD 712 million to construct a battery manufacturing plant in Shelbyville, Kentucky, which will employ 1,572 workers. This facility will produce large-scale batteries for utilities and other customers to store energy and support the electric grid. Production is slated to begin in late 2025. Governor Andy Beshear highlighted this investment as a step toward making Kentucky the battery capital of the United States.

One of the central impediments to the large-scale utilization of energy storage systems is a high initial cost. Although costs are falling, the capital required for deploying large-scale storage systems, particularly battery storage technologies, is still a major hurdle. This high capital expenditure may discourage small and medium-sized businesses or household consumers to adopt these systems.

For instance, in February 2021, Highview Power raised a Growth Capital funding round, raising over USD 70 million, taking their total funding to over USD 145 million. Investors were Sumitomo Heavy Industries (SHI), Janus Continental Group (JCG), and TSK, among others, and contributions from founding investors. This investment finances Highview Power's international expansion of its CRYOBattery long-duration energy storage projects, with a pipeline of over 4GWh in the U.S., Europe, and Latin America. JCG will license Highview Power technology in Africa, and TSK will undertake energy storage developments in Spain, the Middle East, and South Africa.

The increasing energy storage demand is driving opportunities for recycling batteries as well as increasing the sustainability of storage technologies. With the battery production and waste concerns regarding its environmental impact, businesses are now investing in recycling technology to tap valuable materials as well as avoid wastage. This shift offers new business avenues for companies focused on creating more sustainable energy storage solutions.

For example, in February 2025, Li-Cycle is partnering with major Battery Energy Storage System (BESS) companies in the U.S. to provide lithium-ion battery recycling services. In 2024, Li-Cycle recycled battery feedstock equivalent to over 100 MWh from BESS partners, a 33% increase from the previous year, with BESS accounting for approximately 27% of the company’s recycling feedstock in the fourth quarter. The U.S. energy storage market is expected to nearly double from 34.4 GWh in 2024 to 67.5 GWh in 2028 and Li-Cycle supports domestic energy independence by recovering critical materials.

| Attributes | Details |

| Energy Storage System Market Size in 2024 | USD 515.15 Billion |

| Energy Storage System Market Size in 2033 | USD 1,893.64 Billion |

| Energy Storage System Market CAGR | 14.39% from 2025 to 2034 |

| By Technology |

|

| By Application |

|

| By End Use |

|

| By Region | North America APAC Europe LAMEA |

| Key Players |

|

North America is likely to witness robust growth in the energy storage system (ESS) market thanks to various drivers, such as the rising demand for renewable energy, high government incentives, and innovations in battery storage technologies. The region's high emphasis on curbing carbon emissions and boosting energy security is spurring investments into energy storage solutions. The implementation of ESS is important for the improvement of grid stability and the facilitation of the integration of intermittent renewable energy sources, like wind and solar power, into the grid.

Asia Pacific (APAC) dominates the energy storage system market due to aggressive renewable energy expansion, government policies, and advancements in technology. China, Japan, and India are aggressively funding ESS to incorporate solar and wind power. Owing to solid infrastructure, competitive production, and clean energy regulations, APAC will continue to lead the market.

Pumped storage is a hydroelectric form of energy storage, employs two reservoirs of unequal elevation. Excess power pumps water to the higher reservoir during periods of low electricity demand. When there is higher demand, the water stored is released to generate electricity by means of turbines. It is important for stabilizing the grid, providing rapid, bulk energy storage to stabilize supply and demand. For example, in August 2022, several of the U.S.'s pumped storage hydropower facilities are competing to be the first new facility constructed in decades, with Eagle Mountain, Gordon Butte, and Swan Lake emerging as contenders based on already having operating permits granted by FERC. Eagle Mountain (1,300 MW in California) is scheduled to be completed by June 2027, with Gordon Butte (400 MW in Montana) and Swan Lake (393 MW in Oregon) also moving through the development and licensing stages. The Goldendale Energy Storage Project (1,200 MW in Washington) is also a contender, having filed a final license application in 2020 with the construction projected for 2025-2027.

Utilities sector is one of the major driving industries in energy storage, which targets bulk applications like grid support, power security, and renewable integration. Utilities employ energy storage to manage peak demand, minimize energy losses, and act as a behind-the-meter support for solar and wind power. Systems like batteries and pumped hydro store excess energy and provide energy at peak demand, driving up ESS uptake. For instance, California reached more than 10,000 megawatts of battery storage capacity in April 2024, a 1,250% increase from 2019. This is a critical step toward the 100% clean electricity goal by 2045, and it becomes viable to store and use more renewable sources of energy such as solar power. Battery storage is essential for maintaining a reliable power grid, and recently, battery discharge exceeded 6,000 MW, becoming the largest power source at one point during the day. The state is projected to need 52,000 MW of energy storage capacity by 2045.

Stationary energy storage systems are fixed installations designed to support grid infrastructure, renewable energy, and backup power. These systems, such as batteries, flywheels, and pumped hydro storage, are used in commercial, industrial, and utility-scale applications to store and manage large amounts. They are essential for supplying and balancing demand, bringing renewables onto the grid, and serving as backup power during emergencies. For example, in October 2024, Batteries are critical to ensure grid stability in the UK, which installed 4.7GW/5.8GWh of storage by 2023. Lithium-ion batteries are used for short-term storage, and redox-flow and sodium-ion batteries and hydrogen are being explored for long-term applications. For decarbonizing the power system by 2030, the UK is dependent on energy storage, grid interconnection, and demand-side response. Energy storage systems, both front-of-the-meter and behind-the-meter, enable supply, stability, and flexibility. Worldwide, there is a target to install 1,500 GW of storage by 2030 to support the renewable energy transition.

Empower your strategy with expert insights, purchase this premium research@ https://www.cervicornconsulting.com/buy-now/2371

Ask here for more details@ sales@cervicornconsulting.com