The electrolyzer industry is witnessing high growth rates owing to the increasing global focus on green hydrogen production as a key solution for decarbonization. Governments worldwide are implementing incentives, subsidies, and policies to promote hydrogen adoption, such as the U.S. Inflation Reduction Act and the EU Green Deal Industrial Plan. The declining cost of renewable energy sources, particularly wind and solar, has also enhanced the feasibility of hydrogen production at large scale by electrolysis.

In addition, steel, chemicals, ammonia, and refining industries are also now looking to green hydrogen in order to meet carbon neutrality objectives. Advances in Proton Exchange Membrane (PEM), Alkaline, and Solid Oxide Electrolyzers are enhancing efficiency and scalability. Investment by large energy companies and partnerships for hydrogen infrastructure development are also fueling market expansion, setting electrolyzers at the foundation of the clean energy revolution.

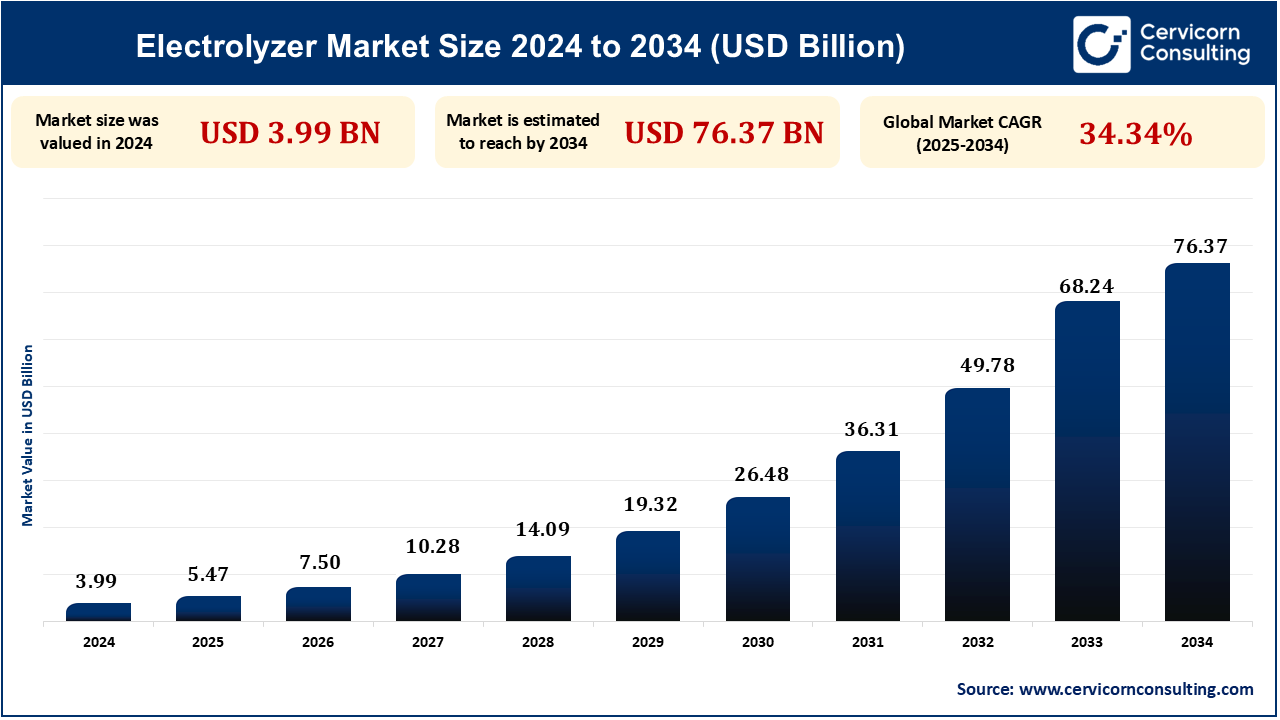

The global electrolyzer market size was reached at USD 5.47 billion in 2025 and is expected to be worth around USD 76.37 billion by 2034, exhibiting at a compound annual growth rate (CAGR) of 34.34% over the forecast period 2025 to 2034.

Key Takeaways

The increasing emphasis on carbon neutrality and the shift toward renewable energy sources are driving the demand for green hydrogen. Electrolyzers are also getting widespread adoption towards producing green hydrogen as businesses opt out of fossil fuel-based grey hydrogen towards a cleaner substitute. Germany, Japan, Australia, and the United States are launching large-scale projects for green hydrogen with backing by governments as well as investments made by the private sector. The growth of hydrogen hubs and collaboration with solar and wind farms further enhance electrolyzer demand. Moreover, green hydrogen is also increasingly becoming a vital component in industrial processes, transportation, and electricity generation, making electrolyzers a primary technology to reach decarbonization objectives and establish a cleaner energy system.

The market of electrolyzers is experiencing rapid technological advancement, high efficiency, low cost, and system life. Innovation in Proton Exchange Membrane (PEM), Alkaline, and Solid Oxide Electrolyzers (SOE) is enabling the generation of increased levels of hydrogen at a lower energy consumption. Future electrolyzer generation will try to minimize dependence on rare earth resources such as platinum and iridium and optimize system scalability towards commercialization. Moreover, high-pressure electrolyzer advancements are enabling direct compression of hydrogen, minimizing the requirement for extra storage infrastructure. Firms are also combining AI and IoT to monitor and optimize in real-time, enhancing operational efficiency. These technologies are enabling electrolyzers to reach cost parity with blue and grey hydrogen, making them more attractive for mass adoption. For instance, in 2024, Bloom Energy developed a high-efficiency solid oxide electrolyzer, achieving up to 45% greater efficiency than conventional alkaline electrolysis.

Electrolyzer systems entail high initial capital investment, thus adoption for small and medium-sized businesses is problematic. Installation costs, balance-of-plant, and electrolyzer stack costs remain relatively high for the current grey hydrogen production processes. Although economies of scale and technology advancements are slowly reducing costs, the initial cost remains a significant barrier. Additionally, combining electrolyzers with renewable energy sources involves a high degree of infrastructure development, hence further increasing capital requirements.

The international shift towards clean energy and carbon zero is substantially propelling the electrolyzer market. With nations committing to net-zero carbon by 2050, demand for clean hydrogen as a substitute energy source is picking up at an incredible pace. Electrolyzers facilitate zero-emission hydrogen when supplied with renewable energy, and hence, they are an integral part of the clean energy revolution. Sectors like power generation, transport, and manufacturing are gradually embracing hydrogen to displace fossil fuels. Corporate sustainability strategies and carbon pricing policies are also compelling companies to incorporate green hydrogen into their operations, further driving the demand for electrolyzers. For instance, The U.S. Department of Energy’s Hydrogen Shot initiative aims to reduce green hydrogen production costs to $1 per kg by 2031, driving electrolyzer deployment.

| Attributes | Details |

| Electrolyzer Market Size in 2025 | USD 5.47 Billion |

| Electrolyzer Market CAGR | 34.34% from 2025 to 2034 |

| Key Players |

|

| By Type |

|

| By Capacity |

|

| By Application |

|

| By Region |

|

Asia-Pacific is the fastest-growing electrolyzer market owing to rapid growth in electrolyzer adoption, led by China, Japan, South Korea, and Australia, through investment in infrastructure and hydrogen production. China, the world's biggest hydrogen producer, is expanding PEM electrolyzers for industrial and transportation applications. Japan is focusing on fuel cell cars, hydrogen power generation, and international hydrogen trade under its basic hydrogen strategy. South Korea will be investing in a fuel cell and hydrogen refueling station-based hydrogen economy. Australia is headed towards being a green hydrogen export hub by leveraging its abundance of renewables through megascale electrolyzer projects.

North America is a leading market for electrolyzers, with government policies, integration of renewable energy, and building hydrogen infrastructure driving the pace. The United States has the majority market share, with initiatives like the Clean Hydrogen Strategy and Roadmap supporting large hydrogen projects. Canada is also developing its hydrogen economy, with Quebec and Alberta as the key areas where abundant availability of renewable energy resources aids green hydrogen output. The region is witnessing growth in hydrogen refueling stations, industrial applications, and power-to-gas projects. Plug Power, Cummins, and Bloom Energy are some of the organizations investing in electrolyzer production and deployment, accelerating the transition to a hydrogen economy.

The 500 kW to 2 MW range corresponds to mid-scale electrolyzers, which are commonly applied in industrial pilot plants, hydrogen fueling stations, and small power generation. They provide a compromise between cost and scalability, making them suitable for renewable energy integration and distributed hydrogen production. They are typically installed with solar and wind farms to take advantage of excess energy for hydrogen production. Furthermore, this segment is also picking up momentum in local transport hubs where hydrogen fuelled buses and trucks need in-town refuelling facilities. Their flexibility makes them capable of powering numerous industrial and energy storage applications, positioning them as one of the biggest drivers in the shift towards green hydrogen.

Power generation through hydrogen is also on the rise as nations attempt to decarbonize the power supply. Hydrogen is generated with electrolyzers for combustion in fuel cells and gas turbines as a cleaner source than natural gas. Hydrogen can also be stored and converted back into electricity from fuel cell power plants to facilitate energy storage and balancing of the grid. Another key trend is the evolution of combined cycles that utilize hydrogen fuel, especially in high-penetration renewable electricity economies. Germany and Japan are leaders in investment in hydrogen power generation plans in an effort to achieve their net-zero emissions targets.

Alkaline electrolyzers are the most prominent and widespread technology used in hydrogen production, utilizing liquid electrolyte alkaline as a potassium hydroxide. Alkaline electrolyzers are inexpensive and offer long operating cycles, with which they can be used for large-scale hydrogen production. They are less effective than PEM electrolyzers and take longer to start up. NEL Hydrogen and McPhy Energy are two of the leading alkaline electrolyzer manufacturers, supplying industrial hydrogen production solutions.

Empower your strategy with expert insights, purchase this premium research@ https://www.cervicornconsulting.com/buy-now/2323

Ask here for more details@ sales@cervicornconsulting.com