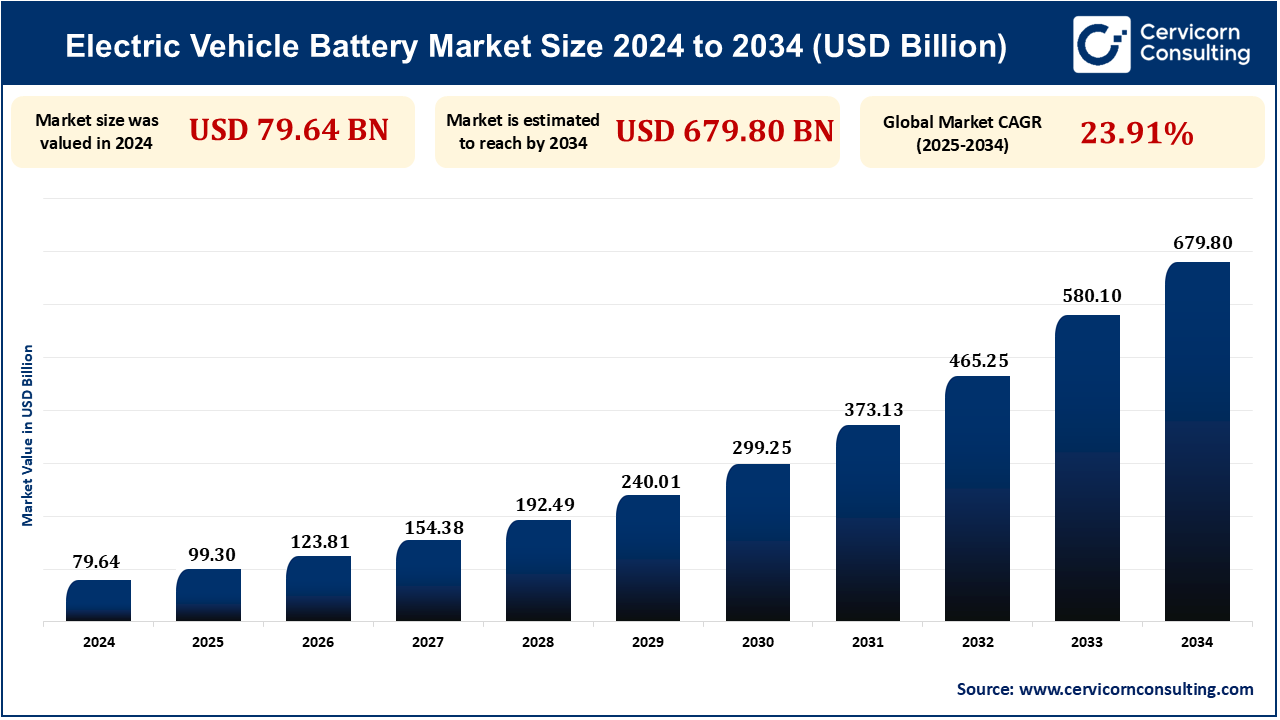

The global electric vehicle battery market size was measured at USD 79.64 billion in 2024 and is anticipated to reach around USD 679.80 billion by 2034, growing at a compound annual growth rate (CAGR) of 23.91% from 2025 to 2034. Increased demand for green mobility, government incentives, and growing emission control policies. Reduced cost of production and innovations are also part of it. Consumer awareness regarding environmental impact continues to drive the shift towards electric vehicles.

The electric vehicle battery market is involved with the production, development, and supply of electric vehicle batteries. It is concerned with optimizing battery performance, energy density and cost benefits. The industry is driven by innovation in battery technology and increased demand for clean transportation. It also reacts to regulatory demands for cleaner energy supplies and lower carbon emissions.

A significant driver for the electric vehicle battery market is higher demand for environmentally friendly transport mediums. Government policies, stringent emissions regulations, and the imperative to be sustainable are significant contributory factors. Development in the energy efficiency of batteries and the drop in prices is also propelling the market forward. Growing education among consumers towards environmental causes is also hastening the switch towards electric cars.

The need for more stringent emissions standards and government incentives for EVs is the most important factor in the EV battery market. Governments worldwide are offering incentives, tax credits, and subsidies to encourage EV usage and reduce the reliance on fossil fuels. These incentives help to speed the shift to cleaner energy alternatives to the advantage of the EV battery industry.

In February 2025, The Union Budget 2025, exempts 35 capital goods from Basic Custom Duty (BCD) to boost electric vehicle (EV) battery production in India. This involves raw materials such as lithium-ion battery waste, cobalt powder, lead, and zinc to reduce the cost of manufacturing. The move is likely to increase local manufacturing, generate employment, and make India a stronger player in the international EV market. Industry captains have appreciated the step, which favors clean tech and encourages EV uptake.

Improvements in battery technology, such as enhancements in energy density, charging times, and total lifespan, are propelling the development of the EV battery market. As efficiency increases in batteries, the price of EVs reduces, thus becoming more affordable for consumers.

In July 2024, Tesla has an extensive network of gigafactories worldwide, situated at important locations in Nevada, Fremont, Shanghai, Berlin, Texas, and New York, promoting EV and battery research. The Fremont Factory rolls out top-seller models like the Model S and Model 3, and has a capability of 650,000 cars a year. Tesla is further pushing batteries with the 4680 cells and even exploring sodium-ion technology. Nevada Gigafactory is all about clean energy, and the manufacturing centers in Shanghai, Berlin, and Texas are substantial in size. There is even a proposed Gigafactory in Mexico for future budget cars.

One of the significant restraints in the electric vehicle (EV) battery sector is that raw material cost, particularly for lithium, cobalt, and nickel, upon which batteries essentially rely, remains extremely high. The prices also increased due to supply chain disturbances, geopolitical tension, and greater demand due to the growth in the EV industry. This may make batteries more expensive overall, thereby making EVs costly and hindering their mass adoption.

For instance, in April of 2025, Lithium prices fell precipitously from their peak in 2023 because supply accelerated and demand weakened, affecting the likes of SQM with a 40.9% reduction in profit. Lithium demand is still solid, however, as EV demand grows with accelerating adoption spurred on by European emissions policies and Chinese subsidies. The U.S. has uncertainty over EV policies, whereas countries such as Australia, Chile, and Argentina are increasing production, while the U.S. fortifies domestic production through executive orders and funding.

Emerging battery recycling technology is a major prospect within the electric vehicle (EV) battery market. With increasing electric vehicles on roads, the number of second-life EV batteries is increasing, thus providing a platform to recycle these batteries and gain precious materials such as lithium, cobalt, and nickel. Battery recycling reduces raw material dependency, reduces manufacturing costs, and supports sustainability practices in the energy and automotive sectors.

For instance, in December 2024, Iondrive is targeting battery recycling with Deep Eutectic Solvents, a greener and less expensive way to recover key metals from spent batteries. Having demonstrated lab-scale technology, ION targets a pilot plant in Europe after raising USD 6 million from institutional investors. The market cap of the company after the raise is USD 16 million, with an enterprise value of USD 7 million. Placed to profit from the EU's drive for local recycling and minimum recycled metals in batteries, ION is seeking to take advantage of the USD 100 billion battery recycling industry by 2040.

| Attribute | Details |

| EV Battery Market Size in 2024 | USD 79.64 Billion |

| EV Battery Market Size in 2033 | USD 580.10 Billion |

| EV Battery Market CAGR | 23.91% from 2025 to 2034 |

| By Battery Type |

|

| By Propulsion |

|

| By Battery Form |

|

| By Vehicle Type |

|

| By Material Type |

|

| By Battery Capacity |

|

| By Battery Component |

|

| By Region |

|

| Key Players |

|

North America is set to see the fastest growth in the electric vehicle (EV) battery market fueled by increasing EV uptake, strong government policies, and massive investments in battery production. The United States is driving this with measures such as tax credits, enhanced emissions regulations, and initiatives aimed at building the domestic EV and battery supply base, with the region becoming the linchpin in the EV universe in the world.

Asia Pacific was the leader in the EV battery market in 2024 with a strong EV and battery manufacturing base. South Korea, Japan, and China are at the forefront with humongous investments in EV technology and battery manufacturing. China is the largest EV market, led by state subsidies and a highly developed supply chain for battery materials. These make the region the world's leading battery-producing hub and largest EV battery exporter.

Lithium-ion batteries are in great demand for electric vehicles (EVs) due to their high energy density, long life cycles, and light weights. They are efficient in use, have greater range, and are faster charging compared to the other batteries. They are manufactured from materials like lithium cobalt oxide and are robust in nature, able to withstand numerous charge cycles.

For example, in December 2024, Lithium is critical to the expanding EV market, where 80% of demand for lithium-ion batteries in 2023 comes from vehicles. Demand will quadruple by 2030, but there are challenges in expanding mining and refining, meeting environmental concerns, and diminishing dependence on China, which holds 60% of the world's refining capacity for lithium. EVs are reducing pollution and dependence on fossil fuels, with annual sales likely to pass 40 million units by 2030. The world leader in EV production is China, while the United States and Europe prefer local manufacturing and environmental sustainability. Emerging economies are also embracing electric vehicles (EVs), specifically smaller, more affordable ones.

Passenger automobiles are cars and light trucks used in the transportation of people and households, both conventional internal combustion engine (ICE) cars and electric vehicles (EVs). The development of electric passenger vehicles (EPVs) is driven by demand for cleaner, energy-efficient transport. EPVs provide zero emissions, reduced operation costs, and enhanced environmental performance, and they are pivotal in the transition to sustainable transportation. For example, in September of 2024, Global EV sales are growing rapidly with lower prices, improved technology, and government incentives. In 2022, 10% of worldwide passenger car sales were completely electric, including Norway at 80%. Main drivers of growth are robust policies, incentives, and charging facilities. In order to achieve climate targets, EV sales need to reach 75%-95% by 2030 with an annual growth rate of 31%. China's subsidies have reduced battery prices, and Norway's sustained promotion of EVs has made them economically viable. The rest of the world should follow with policies, additional chargers, and economical EV models.

Empower your strategy with expert insights, purchase this premium research@ https://www.cervicornconsulting.com/buy-now/2370

Ask here for more details@ sales@cervicornconsulting.com