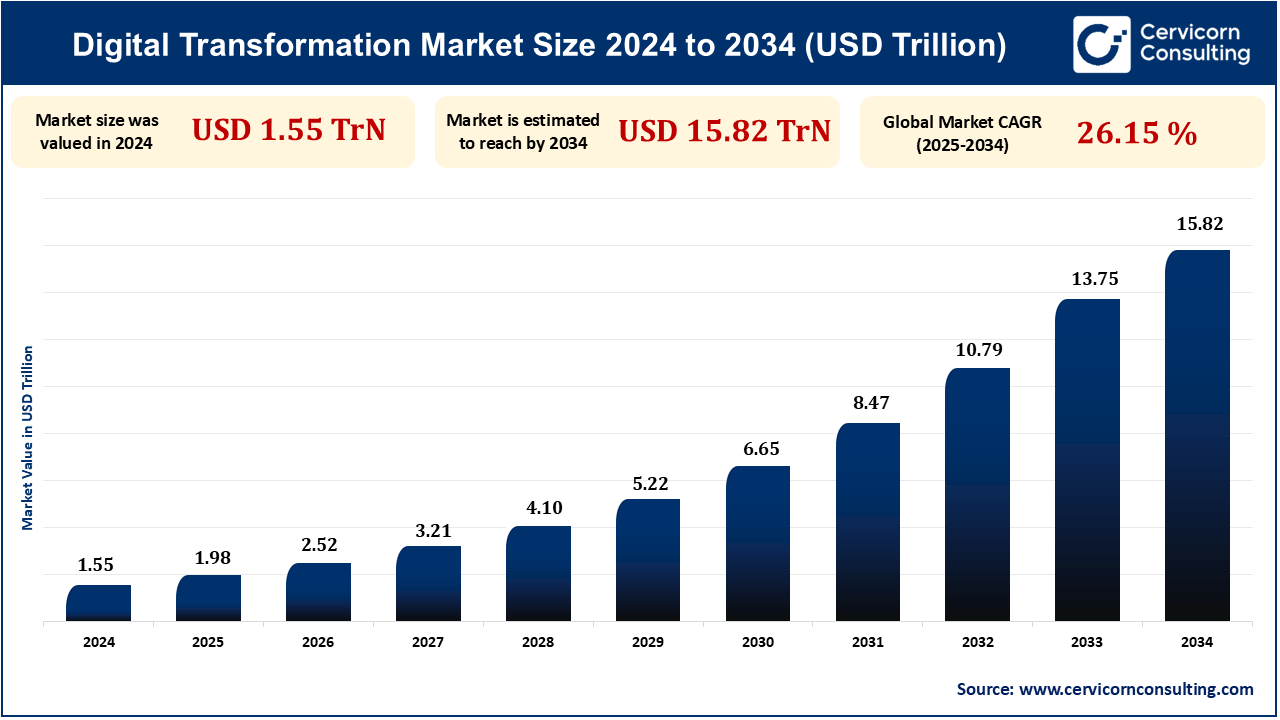

The global digital transformation market size is calculated at USD 1.98 trillion in 2025 and is expected to surge around USD 15.82 trillion by 2034, exhibiting at a compound annual growth rate (CAGR) of 26.15% over the forecast period 2025 to 2034. The digital transformation market is expanding swiftly as organizations in all industries are adopting new technologies to enhance effectiveness, enrich customer experience, and promote innovation. Cloud computing, Internet of Things (IoT), artificial intelligence, and big data analytics adoption is driving the transformation, and this is empowering companies to rationalize operations, enhance decision-making, and remain competitive in an ever-more digitalized world. As businesses invest more in digital-first strategies to address the needs of changing consumers and stay aligned with shifting market dynamics, the market for digital transformation is likely to grow at an equally strong rate over the next few years.

Government stimulation and regulation are driving global digital evolution, with policies and investment spurring innovation. The EU's Digital Decade strategy targets 80% of digitally skilled citizens by 2030 (currently 54%) and 20 million ICT professionals (currently 4%). Although 70% of SMEs are digitally active, 41% utilize cloud computing and 8% use AI. E-government usage is 42%, and online shopping is favored by 75% of EU citizens. The European Commission report indicates USD 179.4 billion to be spent on digitalization, with USD 217.5 billion required for complete gigabit and 5G coverage. Countries such as Spain, Portugal, and Germany have mixed progress, highlighting the necessity of investment in digital skills, education, and security for successful change.

The increasing need for digital solutions is fueling digital transformation, and companies are embracing digital technologies such as cloud computing, artificial intelligence, and data analytics to enhance productivity and customer interaction. MSMEs operating in the health, education, and agriculture sectors can boost up to USD 161 billion in productivity by 2030 with cloud adoption, creating jobs, and facilitating sustainable development goals, according to a report authored by Accenture on behalf of AWS. While issues such as cybersecurity and digital skills are still present, AWS has initiatives to assist MSMEs in overcoming them, with digital solutions taking the forefront in development across industries.

Growing internet infrastructure and mobile penetration, powered by the deployment of 5G, are propelling digital transformation with greater real-time communication and greater utilization of IoT, cloud computing, and analytics. Improved data rates, reduced latency, and greater bandwidth of 5G enable new applications such as autonomous vehicles and remote surgery, in addition to enabling greater quantities of connected devices. South Korea and Puerto Rico are leading the way regarding 5G availability, since China achieved a countrywide 5G coverage milestone by August of 2023 and intends to achieve 90% penetration to more than 480 million subscribers in June of 2023. Adoption of 5G will definitely rise to touch 4.6 billion subscribers by 2028, and nearly 70% of businesses are going to leverage 5G to drive operational efficiency and customer experience.

High initial investment in digital transformation, such as cloud infrastructure, AI, and IoT, acts as a stumbling block for most organizations. PYMNTS Intelligence in a report with American Express finds that 60% of small companies are plagued by cash flow because of legacy processes and slow payments, with close to one-third still using manual payment systems. While SMBs are increasingly embracing more digital options such as instant payments, AP automation, and analytics based on artificial intelligence, complexity and expense will be a barrier. Vendors of technology are expected to develop less expensive, scalable options, but significant expenses will still limit some companies' adoption of the digital.

The deployment of 5G networks is boosting connectivity, speed, and data transfer capacity, allowing companies to implement IoT and AI-based solutions. Globe Telecom widened its 5G network in the Philippines, reaching 97.90% outdoor coverage in Metro Manila and 92.36% in major cities in Visayas and Mindanao as of the end of 2023, covering more than 5.8 million devices. Globe also established 5G roaming alliances with 156 international partners in 82 destinations, including new partnerships in Asia and Africa. This expansion makes 5G poised to power next-generation digital solutions in industries such as healthcare, automotive, and logistics.

| Attributes | Details |

| Digital Transformation Market Size in 2025 | USD 1.98 Trillion |

| Digital Transformation Market Size in 2034 | USD 15.82 Trillion |

| Digital Transformation Market CAGR | 26.15% |

| Key Players |

|

| By Offering |

|

| By Technology |

|

| By End Users |

|

| By Region |

|

Asia-Pacific, dominated by nations such as China, India, Japan, and South Korea, is quickly going through a digital shift led by technological upgradation and economic growth. Smart city investments, e-commerce, and technologies such as cloud computing, AI, and IoT are all contributing to the region. To remain competitive, both giant corporations and small enterprises are embracing digital solutions. Higher use of the internet and state initiatives that facilitate innovation are critical drivers of growth that are pushing the growth of digital services within the region.

North America, including the United States of America, Canada, and Mexico, is leading the way in digital transformation because of technological advancements, cloud migration, and artificial intelligence. Segments like retail, healthcare, and banking are changing at a very high pace with strong IT infrastructure. Sound internet penetration, government push initiatives, and focus on data security are the cornerstones of digital solutions to organizations. Huge investments in digital services and automation fuel market growth. The shift to virtual work and digital services have also fueled greater digital adoption.

Cloud computing provides on-demand utility computing resources like storage, databases, and software over the internet. It reduces the utilization of physical infrastructure, and it is scalable and cost-effective. Companies can remotely access resources, enabling remote collaboration and work. Such big platforms as AWS and Google Cloud provide scalable solutions for various business needs. Cloud computing saves on operational efficiency and inspires innovation. It is one of the prime enablers of digital change, allowing companies to be nimble.

Telecom and IT are leading the digital revolution with the application of AI, big data, and cloud computing to provide services. Telecommunications service companies are using AI for the capabilities of customer care, network optimization, and predictive maintenance. Cloud technologies are providing scalable infrastructure to fulfill increasing customer needs. Digital services like 5G, IoT, and edge computing are transforming the telecom sector. Analysis of big data helps telecommunication providers to reflect back on customers' usage and influence service propositions. Technology companies are using digital transformation to build solid operations, deliver innovative solutions, and expand.

On-premises deployment is the traditional way through which organizations own their IT infrastructure in-house. It provides absolute control over their hardware, security, and data. While on-premises solutions provide greater control and flexibility, they are delivered in the guise of high initial charges and maintenance expenses. On-premises solutions are widely utilized by most organizations for sensitive applications in which data privacy is involved. However, the model is being increasingly displaced by cloud solutions, as they are scalable and economical. On-premises is still important in industries with rigorous regulatory compliance and data sovereignty.

Large organizations are generally the biggest consumers of digital transformation technology, taking into account the size of their operations and range of their requirements. They apply technologies such as AI, cloud technology, and IoT to enhance processes, develop the customer experience, and innovate. Large companies make investments in enterprise-level solutions to ensure scalability and global access. They have independent departments and budgets that are devoted to digital transformation projects to streamline their operations and expand their digital presence. They are large enough to spend money on R&D and roll out new technologies department by department. They are the pace-setters who drive market expansion and lead the charge of digital revolutions because they are so very large.

Empower your strategy with expert insights, purchase this premium research@ https://www.cervicornconsulting.com/buy-now/2329

Ask here for more details@ sales@cervicornconsulting.com