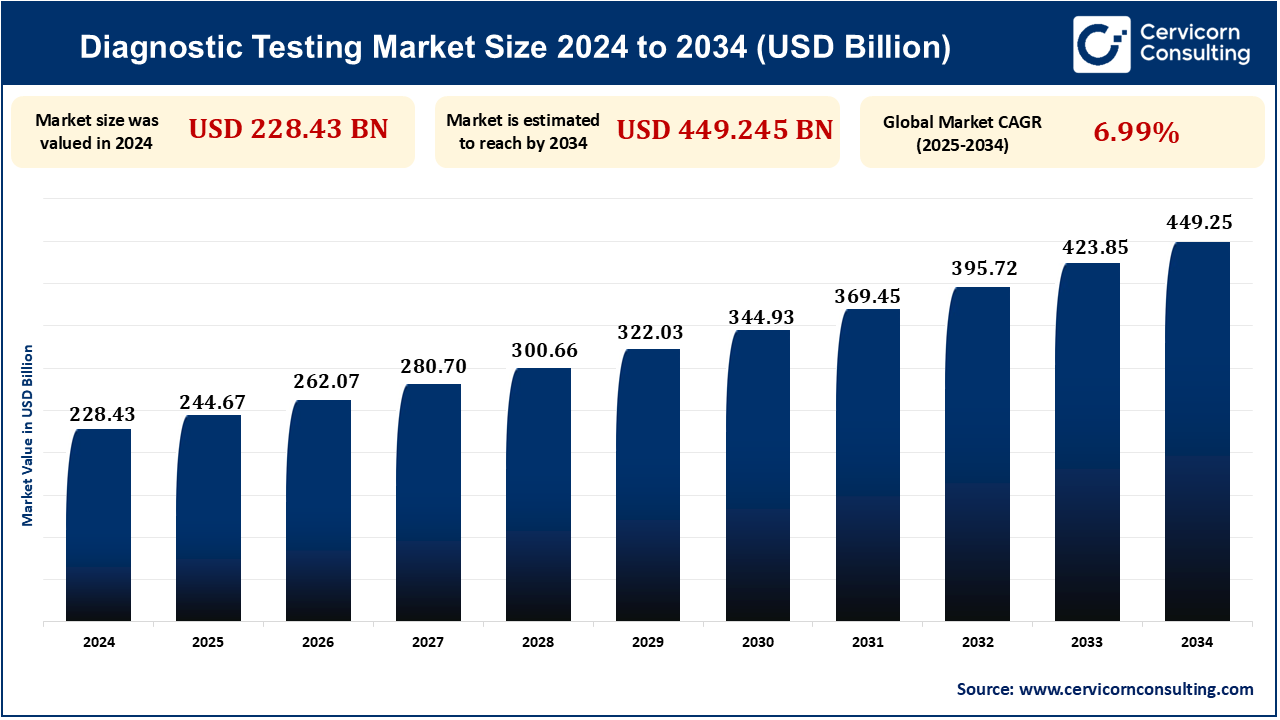

As of 2024, the global diagnostic testing market was valued at approximately USD 22.83 billion. It is projected to reach USD 449.25 billion by 2034, reflecting a compound annual growth rate (CAGR) of 6.99%.

Healthcare professionals across sectors such as dentistry employ diagnostic testing through a series of medical examinations and procedures to detect and monitor various health conditions. The dental profession utilizes diagnostic testing as an indispensable instrument to uncover oral diseases and abnormalities while formulating effective treatment plans. Technological advancement converts these tests into more accurate, less intrusive, widely available implements which have a double gain for the patients and the dental profession itself. Diagnostic testing essentially refers to the industry that manufactures and delivers medical tests to confirm the diagnosis of a disease and its condition monitoring to assist in treatment planning. The healthcare sector overall along with dental diagnostics experienced substantial market expansion driven by technological advancements and rising demand for early detection and personalized treatment. The growing recognition of preventive healthcare drives people to choose diagnostic tests to identify conditions at an early stage and prevent serious health issues.

The diagnostic testing market is predicted to grow steadily. This is mainly because of advancements in technology, the development of personalized medicine, and the increasing importance placed on detecting diseases early. In dentistry, there are exciting innovations like AI-powered diagnostic tools, saliva-based tests, and easy-to-use point-of-care solutions. These advancements will make dental diagnostics more accessible, efficient, and accurate. The market is also expected to embrace mobile health technology and telemedicine more, which means people worldwide will find it easier to get diagnostic tests from wherever they are.

In the diagnostic testing market, one of the biggest drivers is fast-paced technological advancement. The role of technological innovation is most pronounced in altering the diagnostic arena by increasing the accuracy, efficiency, and accessibility of diagnostic tests. AI-enabled tools have come to be very much a part of diagnostic testing, particularly in imaging and medical diagnostics. They can go through enormous volumes of data, analyze an imaging result, and detect patterns that might be missed by human clinicians. The advancement of AI and other technologies pertaining to point-of-care, genetic testing, wearable health gadgets, and improved imaging systems is therefore generating diagnostic solutions that are more accurate, accessible, and efficient. Such innovations have helped improve disease detection and better treatment outcomes, with a focus on preventing diseases, thereby making the healthcare system more ambulatory. Thus, all these technological advancements substantially intervene in the growth of the diagnostic testing market.

One big challenge in the diagnostic testing market is the high cost of advanced technologies. While these technologies help the market grow, they also come with high costs for development, production, and use. Tools like high-resolution imaging systems, next-generation sequencing (NGS) platforms, and AI-powered diagnostic software require a lot of money. Such exorbitant costs have deterred the use of such tools by low- and middle-income countries or rural areas with tight healthcare budgets. Rising costs of diagnostic testing lead to higher spending on healthcare, which can be devastating for both providers and patients. This is especially challenging in places with limited health insurance, where patients pay for advanced tests out-of-pocket. Additionally, diagnostic technologies have to follow strict rules from the FDA in the US or the CE in Europe. These rules require meeting safety and technical standards and passing clinical trials. The cost of complying with regulations can be enormous for a company that is trying to enter new markets or launch a new technology. The resulting high costs slow down market growth as access and adoption and access slow down in some locations, particularly in developing countries. This is likely to put a financial burden on health care providers and patients, particularly in the case of personal payments for these technologies.

The increasing demand for home-based diagnostic testing and point-of-care solutions is a critical opportunity within the diagnostic testing market. Growing health-conscious consumers, alongside an emphasis on preventive healthcare, would ultimately increase the demand for easy diagnostic testing in the home. This stipulates that end-users or consumers seek fast, easy, and accurate results rather than driving long distances to reach healthcare facilities. This is, therefore, getting much more popular for home diagnostic testing kits in a number of conditions such as multiple tests ranging from COVID-19 to diabetes and cholesterol as well as pregnancy tests. Due to the affordability offered by home diagnostic tests and POC solutions as rational yet cost-effective alternatives to laboratory tests, healthcare will become affordable for patients and providers alike. Cost-effective solutions for diagnostic tests are crucial in several low- and middle-income countries, where a very wide range of users would not be able to reach healthcare facilities. The strong pronounced consumerism for comfort and preventive health care should possibly add to growth in the diagnostic testing markets and thus urge for several innovations that could come in more personal, efficient, and accessible healthcare. Therefore, emerging needs for home-based testing and POC solutions create an opportunity for the diagnostic testing market.

| Attributes | Details |

| Diagnostic Testing Market Size in 2024 | USD 228.43 Billion |

| Diagnostic Testing Market CAGR | 6.99% from 2025 to 2034 |

| By Type |

|

| By Application |

|

| By End-Users |

|

| By Region |

|

| Key Players |

|

The fastest growth in the diagnostic testing market will be recorded in North America due to the underlying technological advancement, growing prevalence of diseases, strong healthcare infrastructure, and government policies that favor growth. This rapid growth is observed across almost every segment of diagnostics, including DNA testing, point-of-care testing (POCT), molecular diagnostics, and imaging technologies. Moreover, new diagnostic tests are being approved with almost accelerated speed in North America, especially for Molecular Diagnostics, Genomics, and AI-based testing topics, by government agencies like the FDA (Food and Drug Administration) and Health Canada. With constant investments in R&D to create innovative diagnostic solutions and strong healthcare infrastructure, the presence of all the major diagnostic corporations such as Abbott Laboratories, Quest Diagnostics, Labcorp, Thermo Fisher Scientific, Danaher Corporation, and Illumina adds fuel to market growth. With telemedicine, AI, and personalized medicine gaining increasing importance, North America remains at the forefront of developing new diagnostic technologies. This improves patient care as well as allows for early disease diagnosis.

The Asia-Pacific will be the strongest contender in the diagnostic testing market in the years to come, with the possible increasing population, increased healthcare needs, increased healthcare infrastructure investments, and the growing adoption of advanced digital technologies as some of the factors that will support driving this change. In addition, the quick rise in the spectrum of chronic diseases such as diabetes, cardiovascular diseases, and cancers is contributing fuel to the fire for the diagnosis and monitoring in this region. All these reasons boost the adoption of diagnostic testing within the Asia-Pacific region. AI-based diagnostics, molecular diagnostics, point-of-care testing (POC), and wearable health have much interest globally especially among institutes in the Asia-Pacific region. This includes the validations of point-of-care testing, which is most suitable for use in the Asia-Pacific region, where speed and accessibility in diagnostics are needed. Many governments in the APAC region are focusing on improving healthcare access, particularly in rural areas, through subsidies, health camps, and mobile diagnostic units. These initiatives are designed to improve healthcare outreach and increase public access to diagnostic testing. Furthermore, countries like China, India, Japan, and South Korea are at the forefront of this shift, contributing significantly to market growth.

The clinical chemistry tests segment dominated the largest market share in 2024. Clinical chemistry tests dominate the diagnostic testing market due to their broad application and essential role in disease diagnosis and management. Blood and urine analysis are generally considered clinical chemistry tests for certain biomarkers, enzymes, hormones, or electrolytes. Every chemistry result can assist in diagnosing diseases such as diabetes, kidney diseases, liver diseases, cardiovascular diseases, or hormonal imbalances. With the growing demand for regular health check-ups and the increasing prevalence of chronic diseases, clinical chemistry tests are expected to maintain their leadership in the market for the foreseeable future. Further, the increased emphasis on personalized medicine, early detection, and regular screening will enhance the market for these tests in the coming years.

The infectious diseases segment held the largest share. This includes tests for the detection of viral, bacterial, fungal, and parasitic infections. This type of test has gained an enormous reputation due to the COVID-19-initiated widespread use of diagnostic tests, however, infectious disease diagnostic tests have long been proven useful for HIV, hepatitis, influenza, tuberculosis, malaria, and sexually transmitted diseases. High prevalence rates of infectious diseases, technological advancements in diagnostics, and increasing efforts for global pandemic preparedness shall ensure dominance for this market in the future. As time progresses, the burgeoning need for rapid testing and early detection makes infectious disease diagnostics one stroke less than a global healthcare system priority, especially for new and emerging infections.

A set of differential diagnostic services is rendered at the hospitals & diagnostic laboratories, making this segment the major contributor to the market. These institutions are exemplary centers for diagnostic testing where a fair share of clinical diagnostic tests is done-including blood tests, imaging, genetic tests, and microbiology cultures. The high volume of tests and the wide variety of comprehensive diagnostic services make hospitals & diagnostic labs with the largest end-user share. Hospitals & diagnostic laboratories will remain core in the diagnostics testing environment, given increasing global demand for early spot detection of disease, management of chronic disease states, and advanced diagnostics techniques. Furthermore, as healthcare becomes more specialized, hospitals will continue to invest in advanced diagnostic technologies, further increasing the strength of this leading segment.

Empower your strategy with expert insights, purchase this premium research@ https://www.cervicornconsulting.com/buy-now/2393

Ask here for more details@ sales@cervicornconsulting.com