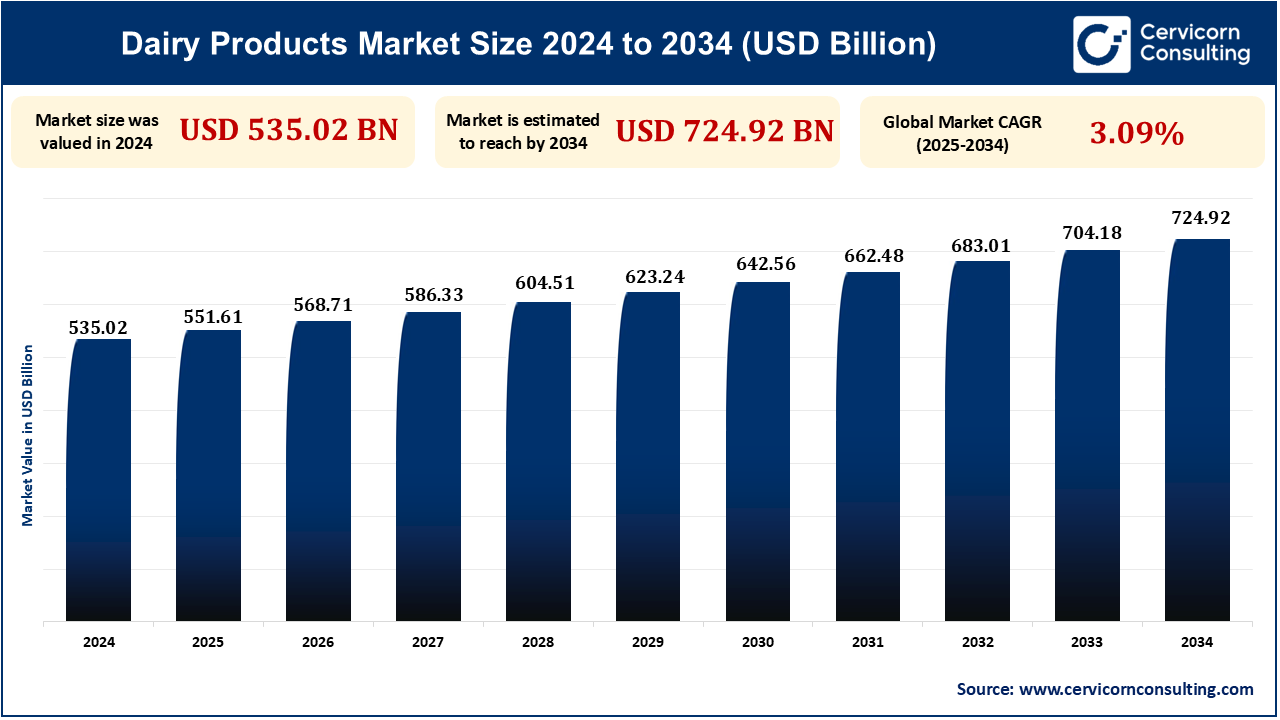

The global dairy products market size was measured at USD 535.02 billion in 2024 and is anticipated to reach around USD 724.92 billion by 2034, growing at a compound annual growth rate (CAGR) of 3.09% from 2025 to 2034. The dairy products market is driven by growing health awareness, demand for nutritious food, and innovation in plant-based alternatives. Strong distribution and web store further enhance market availability.

The dairy products market is about the production, distribution, and use of dairy products including milk, cheese, yogurt, butter, and other allied products. The market serves traditional dairy as well as plant-based alternatives, fulfilling increasing consumer interest in health-oriented choices. The market is driven by consumer tastes, nutrition trends, and technological innovations in dairy processing. Having a global presence with robust reach, it gains from spreading retail chains and growing knowledge of the health advantage of dairy consumption.

One of the most important driving forces behind the dairy products market is increasing consumer knowledge of the health benefits from consuming dairy. As consumers become more concerned with eating well, dairy foods are gaining greater value due to their nutritional content, such as protein, calcium, and vitamins. Such a change in consumer demand has resulted in rising demand for regular dairy foods as well as enriched, fortified ones. Additionally, the increasing popularity of functional foods and dairy snacks also contributes to the growth in the market.

Regional Insights

Product Insights

Distribution Channel Insights

Health Consciousness and Nutritional Benefits

One of the key drivers in the dairy industry is health awareness and growing consciousness about dairy nutritional value benefits. Dairy foods such as milk, yogurt, and cheese are a rich source of protein, calcium, and vitamins; hence, as more consumers search for healthy food, the growing trend of healthy eating adoption is driving demand for dairy products globally.

For example, in July 2022, Danone launched a Dairy & Plants Blend infant formula, the first of its type, for flexitarian and vegetarian diets. It blends 60% non-GMO soy protein and 40% dairy protein with lactose and provides a less intense plant flavor. The carbon footprint of this formula is 30% less as it contains plant-based components and fully recyclable packaging. Initially launched in the Netherlands under the brand name Nutrilon, it will then be launched in other markets under the brand name Aptamil.

Rising Demand for Plant-Based Alternatives to Fuel the Market Growth

There is an increasing demand for plant-based milk alternatives because consumers are opting for plant-based diets for reasons of health, the environment, and for being lactose intolerant. This has resulted in the manufacture of plant-based dairy as companies spend capital on alternatives to the traditional dairy options such as almond milk, oat milk, and plant-based cheese.

In January 2024, Oatly debuted two new varieties of oatmilk: Unsweetened Oatmilk with no sugar grams and a mere 40 calories per serving and Super Basic Oatmilk featuring only four ingredients—water, oats, sea salt, and citrus zest fiber—and the cleaner label alternative. Both are part of Oatly's shift toward meeting varying consumer tastes and powering the shift from dairy to oat milk as consumers increasingly demand more plant-based.

Cost Challenges Amid Inflation May Restrain the Market’s Growth

Cost challenges during inflation describe increasing raw material, energy, and supply chain expenses, which squeeze profit margins for dairy and plant-based businesses. To mitigate these hikes, companies tend to increase retail prices, which may dampen demand, particularly in price-sensitive markets. Managing inflationary pressures and staying competitive remains a major challenge.

For example, in March 2022, Oatly's losses rose in 2021 due to rising costs, inflation, and spending on manufacturing capacity, resulting in a Q4 net loss of USD 79.8 million and USD 215 million for the year. The setbacks entailed issues with a new US plant, the COVID-19 lockdowns, expensive logistics, a recall, and increasing R&D expenses. Oatly still managed to report 53% revenue growth to USD 643.2 million amidst these errors and is aiming at 2022 revenue of $880 million to $920 million with a focus on growth over profitability.

Dairy Farmers of America Invests in Sustainable Dairy Farming to Revolutionize Market Growth

Dairy Farmers of America (DFA) is investing in sustainable agriculture in order to improve environmental stewardship. The efforts focus on emissions reduction, water savings, and waste minimization. DFA aims to promote more sustainable dairy production while responding to growing consumer demand for sustainability. This positions DFA as a leader in dairy sector sustainability.

For instance, in September 2022, Dairy Farmers of America (DFA) obtained up to USD 45 million in financing from the U.S. Department of Agriculture (USDA) under its Partnerships for Climate-Smart Commodities program. The financing will aid the DFA in its efforts to scale up and promote the uptake of climate-smart farming practices among its farmer-owners. The project will pursue strategies to minimize greenhouse gas emissions, maximize carbon sequestration, and increase environmental sustainability across DFA's supply chain.

| Attribute | Details |

| Dairy Products Market Size in 2024 | USD 535.02 Billion |

| Dairy Products Market Size in 2033 | USD 704.18 Billion |

| Dairy Products Market CAGR | 3.09% from 2025 to 2034 |

| By Product Type |

|

| By Distribution Channel |

|

| By Region |

|

| Key Players |

|

Europe will see the highest growth in the market for dairy products, boosted by increasing demand for dairy substitutes, innovation in dairy technology, and health-oriented diets. The region's robust production infrastructure, sustainability focus, and interest in functional and plant-based dairy products, combined with increased disposable incomes, will stimulate market growth.

The Asia Pacific region dominates the global market of dairy products in consumption and production with the largest share. This is stimulated by a large population, rising disposable incomes, and growing demand for dairy products, especially in China and India. Urbanization, Western-style diets, and the growing middle class further solidify the region's leadership in the dairy market.

The Milk had the largest share of the most important market in 2024. Milk is the most widely consumed dairy food and a leading dairy segment. It is a part of the daily diet and the basis for other dairy foods like cheese, butter, yogurt, and sweets. The milk industry keeps expanding with enhanced health consciousness, expanding population, and as a protein, calcium, and other nutrient source. For instance, in February 2025, domestic milk production in China declined in 2024 after fast growth for self-sufficiency, with additional declines expected in 2025 due to low farm gate prices and high costs of production. Despite all these problems, home demand for dairy is forecast to grow modestly by 1.2% in 2025. The import volumes returned in late 2024, and net imports are projected to grow by 2% in 2025, mainly from the EU and New Zealand. However, an import boom is not in the offing, and geopolitical concerns remain.

Supermarket/Hypermarket had the most common market share in 2024. Supermarkets and hypermarkets are the major distribution channels for dairy, providing convenience, competitive prices, and a wide variety of products, including regular, premium, organic, and lactose-free products. With their extensive geographical coverage and high traffic, they are the major sales drivers for dairy products. For example, in October 2025, other European supermarkets and Lidl International seek to raise the sales of plant-based food by 20% by the year 2030, while Lidl Germany projects a 20/80 split between plant-based and animal proteins. Dutch retailers have an even more ambitious 60/40 target. Though U.S. Lidl is included in the worldwide goal, no country has a goal for this since customers are not similarly oriented nationwide. It is motivated by sustainability, business opportunities, and consumer consciousness, although constraints are changing government policies and organizational dedication.

Empower your strategy with expert insights, purchase this premium research@ https://www.cervicornconsulting.com/buy-now/2369

Ask here for more details@ sales@cervicornconsulting.com