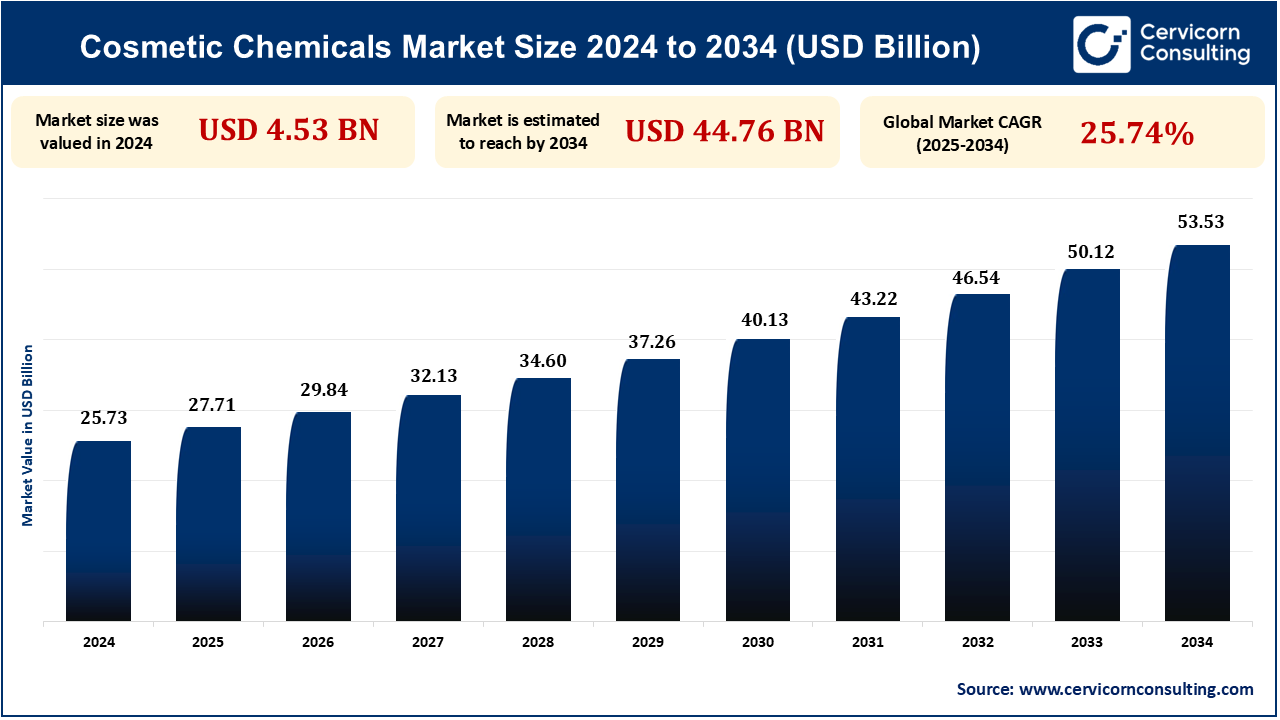

The global cosmetic chemicals market size was measured at USD 25.73 billion in 2024 and is anticipated to reach around USD 53.53 billion by 2034, growing at a compound annual growth rate (CAGR) of 7.60% from 2025 to 2034. Growing demand from consumers for beauty and skincare products. Major trends involve increased use of natural and organic ingredients, as well as innovation in sustainability and anti-aging. Industry growth brings regulatory regimes and ecological issues into play as well. R&D is the priority for major players to meet changing consumer needs.

The cosmetic chemicals market is involved in the manufacture and supply of chemicals utilized in personal care and beauty products. They encompass preservatives, emulsifiers, surfactants, and active ingredients. The market serves skincare, haircare, makeup, and fragrance industries. The market is shaped by consumer trend, safety measures, and sustainability.

The significant driving factor for the cosmetic chemicals market is the consumer inclination towards natural and organic skincare products. With more health-concerned consumers, there is a demand for products containing safer, environmental-friendly ingredients. This consumer inclination compels brands to come up with innovative, low-synthetic chemical-formulated products. Moreover, raising awareness about personal skin care and well-being also accelerates the growth of the market. Increasing regulatory standards also promote the use of safer, more sustainable ingredients, increasing consumer confidence.

Key Takeaways

Demand for Natural and Organic Ingredients

Customers now demand products with natural, organic, and eco-friendly ingredients. This is due to increasing health awareness, well-being, and ecological awareness, which is prompting beauty companies to focus on green and skin-friendly products.

L'Oréal and Evonik invested in a USD 0.038 billion funding transaction with Abolis Biotechnologies in September 2024. Abolis Biotechnologies is a French-headquartered biotech company that focuses on microorganism technology. The investment is fueling a three-way agreement aimed at creating more sustainable, bio-based ingredients in the cosmetics field. The tie-up will enable Abolis to enhance its biomanufacturing and microbiome capabilities, accelerating the shift toward more sustainable manufacture. In alignment with L'Oréal's sustainability goals, the alliance aims to make innovations happen faster in the creation of innovative, sustainable beauty solutions.

Technological Advancements in Cosmetic Ingredients to Fuel the Market Growth

Biotechnology, nanotechnology, and green chemistry advancements are transforming cosmetic ingredient formulation. These technologies allow for the manufacture of more effective, safer, and more environmentally friendly cosmetic products, which empower companies to gain a competitive edge in the market.

In April 2023, Givaudan has completed its acquisition of Amyris Inc.'s cosmetic ingredients portfolio, boosting its leadership in biotechnology and sustainable beauty solutions. The deal strengthens Givaudan’s Active Beauty business with bio-fermented ingredients and leverages Amyris's technology for high-performance ingredients. The acquisition is expected to accelerate sales growth and support the beauty industry’s shift to sustainable production, contributing approximately USD 30 million to Givaudan’s 2022 proforma sales.

However, Stringent Regulations and Compliance Issues May Restrain the Market’s Growth

The market for cosmetic chemicals is heavily challenged by strict regulations of the safety and application of chemical ingredients in cosmetic products. The governments of various countries in the world impose strict regulations to ensure consumer health, which could boost the cost of production and limit the usage of specific ingredients. These regulations hinder product development and innovation.

For instance, in July 2024, Global PFAS regulations in cosmetics are becoming more stringent as a result of health and environmental issues. France will be having a ban in 2026, and the EU is contemplating a wider ban. Other regions of the globe, including the UK, US, and Canada, are debating or implementing controls, though some, such as Colorado and the UK, believe current controls are sufficient. The industry is having difficulty re-formulating products, but research into safer alternatives like silicon-based materials and natural waxes is in progress. While there is a push towards sustainability, there is no one solution worldwide because there are conflicting opinions about the impact of PFAS making it difficult.

Rising Demand for Anti-Aging and Skin Care Products to Revolutionize Market Growth

With the aging population across the world and customers becoming increasingly concerned about personal care, there is a huge surge in the demand for skincare and anti-aging products. This opens a window of opportunity for cosmetic chemical companies to create sophisticated ingredients and formulations that focus on skin health, hydration, and rejuvenation for both young and mature customers.

For example, in July 2024, L'Oréal has formed a long-term partnership with biotech firm Debut to develop sustainable ingredients for its beauty and personal care brands. The collaboration will focus on using innovative bio-based technologies to enhance product formulations, aligning with L'Oréal's sustainability and innovation goals to meet growing consumer demand for eco-friendly beauty solutions.

| Attributes | Details |

| Cosmetic Chemicals Market Size in 2024 | USD 25.73 Billion |

| Cosmetic Chemicals Market CAGR | 7.60% from 2025 to 2034 |

| By Product |

|

| By Application |

|

| By End-User |

|

| By Distribution Channel |

|

| By Region |

|

| Key Players |

|

The Asia Pacific region is anticipated to experience the highest growth rate in the cosmetic chemicals market due to rapid urbanization, increasing disposable income, and a growing focus on personal grooming. The rising demand for beauty and skincare products, particularly in countries like China and India, coupled with the region's young population and a shift toward e-commerce, are expected to drive market expansion during the forecast period.

North America accounted for the highest percentage of the market for cosmetic chemicals, fueled by high demand from consumers for high-end and innovative haircare, skincare, and personal care products. The U.S., in specific, dominates the market due to its high-level manufacturing technologies, high disposable income, and increasing trend toward sustainable and clean beauty.

Moisturizers and emollients are important cosmetic ingredients that provide hydration, smoothness, and elasticity to the skin. Their use has increased with greater consumer awareness of skin care health and more focus on daily hydration. For instance, in February 2023, BASF showcased its sustainable personal care solutions, including innovations like Postbiolift for youthful-looking skin and Phytocine, inspired by Traditional Chinese Medicine, for hydration and anti-aging. The firm also introduced environmentally friendly UV filters like Z-COTE Sheer and EcoSun Pass, and skin protectants like Mimiskin and Fresicle A. BASF emphasized its commitment to R&D, sustainability, and the necessity to keep up with growing demand in China.

Skincare dominates the cosmetic chemicals market, followed by aging, personal health, and preventive issues. Anti-aging, moisturizing, and sun protection product sales, along with new-generation products like serums and creams, are fueling this segment. For instance, in May 2024, Galderma plans to combat the "Ozempic face" using its Sculptra skin treatment and other fillers to restore facial volume by stimulating collagen production. The company has started clinical studies on Sculptra and Restylene for patients using GLP-1 drugs, with results expected by year-end. Meanwhile, Novo Nordisk, maker of Ozempic, is set to release first-quarter results, with analysts projecting USD 0.75 earnings per share and USD 9.13 billion in revenue, maintaining a Moderate Buy rating on its stock.

Empower your strategy with expert insights, purchase this premium research@ https://www.cervicornconsulting.com/buy-now/2367

Ask here for more details@ sales@cervicornconsulting.com