The artificial intelligence (AI) chips market is witnessing rapid expansion as AI-driven applications gain ever-growing acceptance across industries like healthcare, automotive, finance, and consumer electronics. The surging need for intensive computing, deep learning, and neural network computing has driven explosive growth in proprietary artificial intelligence chips, including GPUs, TPUs, and neuromorphic processors. Additionally, increasing demand for AI chips in computing and edge computing applications, and their deployment in internet of things (IoT) devices are also driving the demand for optimized and power-efficient AI chips, driving market growth.

In addition, semiconductor manufacturing improvements and the move to smaller, higher-performance nodes are improving AI chip performance and efficiency. Governments and businesses are significantly investing in AI infrastructure, research, and development, speeding up innovation in chip architecture. The growing presence of AI in cloud computing, autonomous systems, and cybersecurity solutions is also fueling market growth. As the adoption of AI keeps growing, the need for purpose-built AI chips will continue to be high, defining the future of computing and automation.

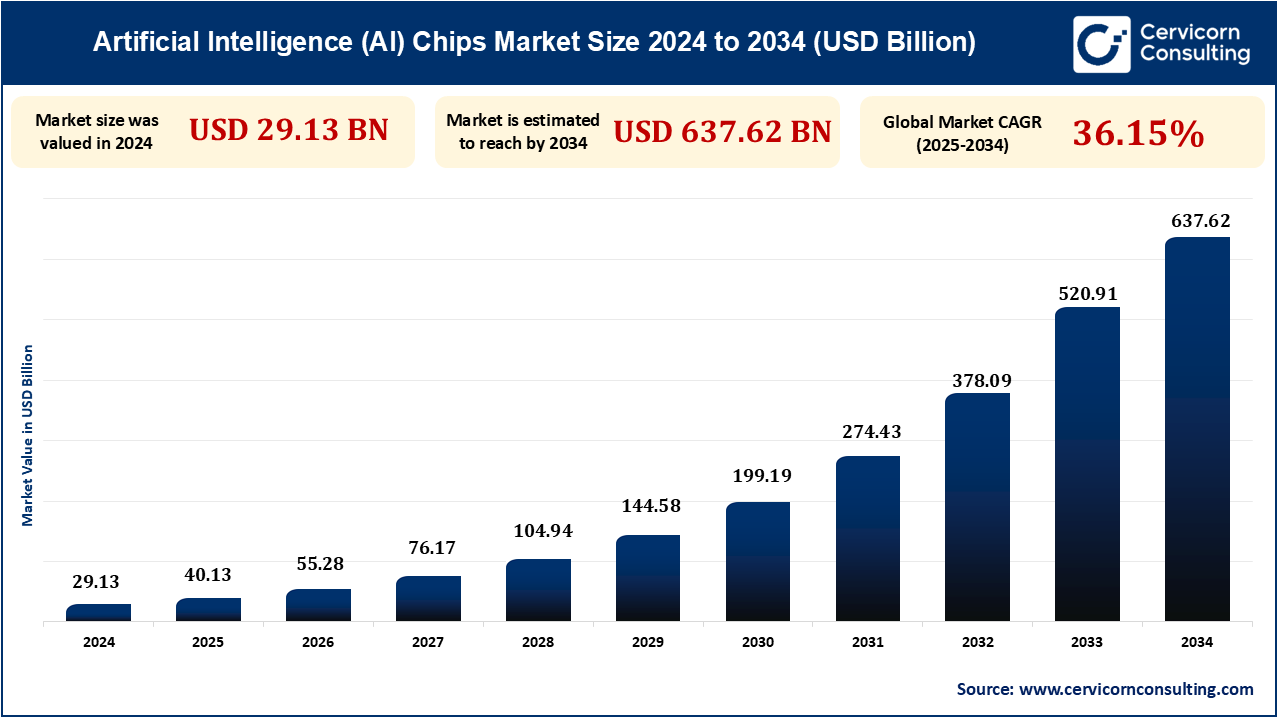

The global artificial intelligence (Al) chips market size was reached at USD 40.13 billion in 2024 and is expected to surge around USD 637.62 billion by 2034, exhibiting at a compound annual growth rate (CAGR) of 36.15% over the forecast period 2025 to 2034.

With the proliferation of IoT devices and the demand for real-time computation, edge AI chips are on the rise. Edge AI chips enable AI computation to be carried out locally in devices rather than relying on cloud servers, saving latency and ensuring privacy. All these – autonomous vehicles, smart security systems, and fitness tracking devices – are using edge AI chips to provide decisions in real-time. Intel, NVIDIA, and Qualcomm are investing heavily in coming up with power-efficient edge AI processors to allow firms to deploy AI-driven solutions with minimal reliance on cloud infrastructure.

Cloud computing providers are continuously improving AI chip architectures to host massive AI workloads. Cloud-native AI chips, such as GPUs and TPUs, are powering deep learning, NLP, and big data analysis. Google, AWS, and Microsoft Azure are some of the organizations that are investing in AI-driven cloud services, providing enterprises with scalable AI processing capability. With ongoing advancements in AI applications, cloud-based AI chips are evolving to support real-time AI inference, autonomous systems, and enterprise AI models, driving the need for high-performance cloud AI accelerators.

The manufacturing of AI chips is capital-intensive with significant investment in research, development, and production. The manufacturing of AI chips is a complex process involving high-end semiconductor manufacturing processes that demand top-of-the-line facilities and skilled labor. Small and medium-sized enterprises are generally not capable of competing because of the massive amount of capital outlay involved in producing AI chips. With increasing sophistication in AI chips, keeping costs low while improving performance is a challenge for most players in the industry.

AI adoption is being fast-tracked in emerging markets, and they are providing high growth opportunities for AI chip makers. Governments of the Asian-Pacific, Latin American, and African countries are growingly interested in AI-driven programs in healthcare, education, agriculture, and smart infrastructure. Increased digital transformation, government incentives within the public sector, and technology ecosystem building are propelling AI chip installations in emerging markets. In addition, growing penetration of smartphones, adoption of cloud computing, and AI-driven automation in industries further boosts the demand for AI processors. With more adoption of AI by governments and industries in emerging economies, AI chip vendors have tremendous opportunities to access these new high-growth markets.

| Attribute | Details |

| AI Chips Market Size in 2025 | USD 40.13 Billion |

| AI Chips Market CAGR | 36.15% from 2025 to 2034 |

| Key Player |

|

| By Chip Type |

|

| By Technology |

|

| By Processing Type |

|

| By Application |

|

| By Industry Vertical |

|

| By Region |

|

North America is a front-runner in AI chip market due to robust investment in AI research, sophisticated semiconductor manufacturing, and mass-scale deployment in industries. Robust leadership of tech players such as NVIDIA, Intel, and AMD creates the momentum for AI chip manufacturing. Robust cloud infrastructure of North America, robust demand for AI-based applications, and autonomous vehicle, healthcare, and cyber security developments boost market growth. Government policies, including grants for AI research and AI adoption policies, also enhance the industry. The U.S. dominates the market because it has the most AI startups, research centers, and massive AI deployments in industries such as finance, healthcare, and defense. Canada is also advancing in AI chip manufacturing, especially in AI-based automation and robotics.

The Asia-Pacific market is experiencing a boom in the AI chip sector, led by the top semiconductor players, rising adoption of AI, and government support for AI research. China, Japan, South Korea, and Taiwan are leading the market with Huawei, TSMC, and Samsung being the top AI chipmakers. Growing AI applications demand of the regional consumer electronics market and investments in intelligent infrastructure propel market growth. Increased focus by China on AI chip-based automation, surveillance, and smart cities is fueling the demand for AI chips. AI chips are adopted by Japan and South Korea to be used in robotics, autos, and industry, thus establishing the regional AI ecosystem.

GPUs are increasingly being utilized in AI due to the fact that they support parallel processing, enabling them to execute complex calculations. GPUs were traditionally used for graphics rendering but are currently an essential component of deep learning, neural networks, and high-performance computing systems. They are best suited for training AI models and real-time inferencing, hence an integral part of applications such as autonomous vehicles, gaming, and AI research. AI GPU market leaders NVIDIA and AMD own the market, intensely competing to drive speed, power efficiency, and scalability to accelerate AI-based solutions for industries like healthcare, finance, and science simulation.

A System on Chip (SoC) integrates different processing units like CPUs, GPUs, and AI accelerators into a single chip. SoC technology is widely used in mobile phones, automotive AI, and IoT devices with benefits of small size, high efficiency, and low power consumption. System on Chip (SoCs) enable real-time artificial intelligence processing in smartphones, drones, and home automation systems. Apple, Qualcomm, and Huawei are among the companies designing AI-based SoCs for edge AI capability to include, image recognition, speech processing, and autonomous driving.

AI chips are revolutionizing automotive and transportation technology by making self-driving cars, driver-assistance systems (ADAS), and intelligent traffic management a reality. AI chips compute data from LiDAR sensors, cameras, and radar to enhance the perception and drive of a vehicle. AI enables predictive maintenance and optimizes fleet management for performance. In autonomous cars, AI-based systems make instant decisions to maintain safety and performance. Moreover, AI-based mobility solutions improve public transport, logistics, and ride-sharing platforms. Tesla, Waymo, and NVIDIA are pioneering the development of AI chips, propelling the shift towards self-driving transport and minimizing road accidents.

Empower your strategy with expert insights, purchase this premium research@ https://www.cervicornconsulting.com/buy-now/2325

Ask here for more details@ sales@cervicornconsulting.com