Ambulatory Surgery Centers Market Size, Trends and Forecast 2025 to 2034

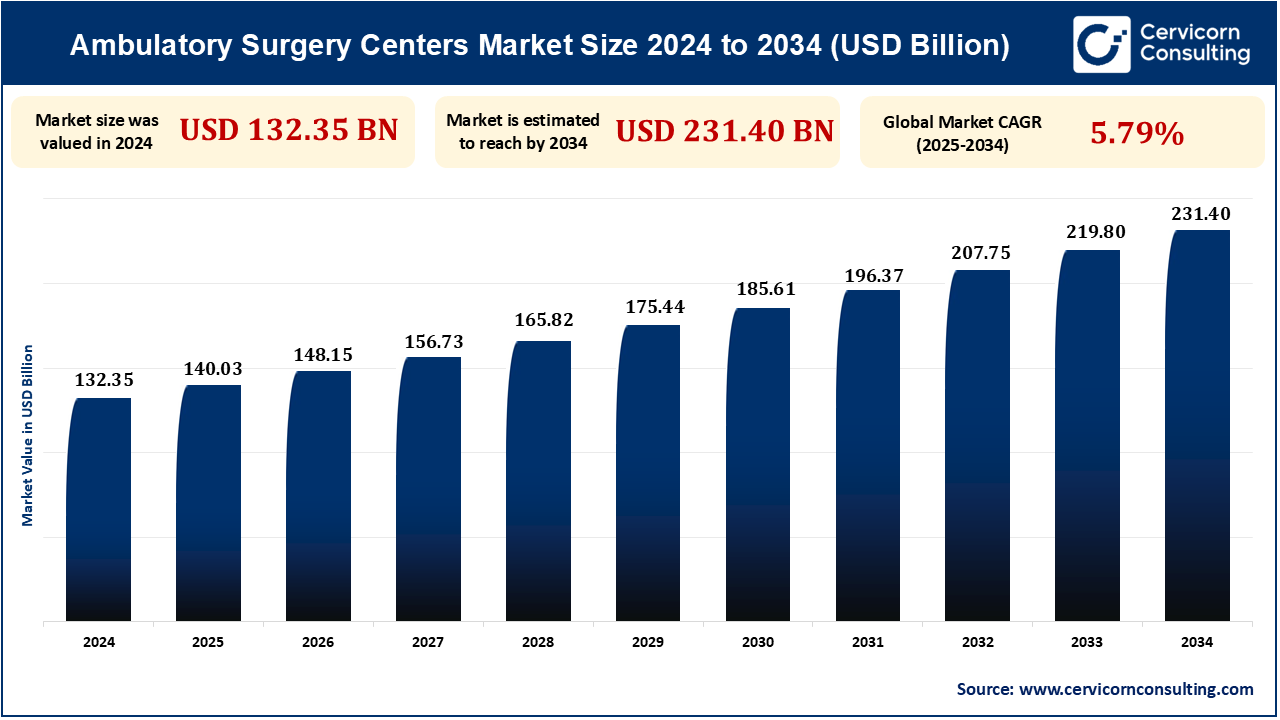

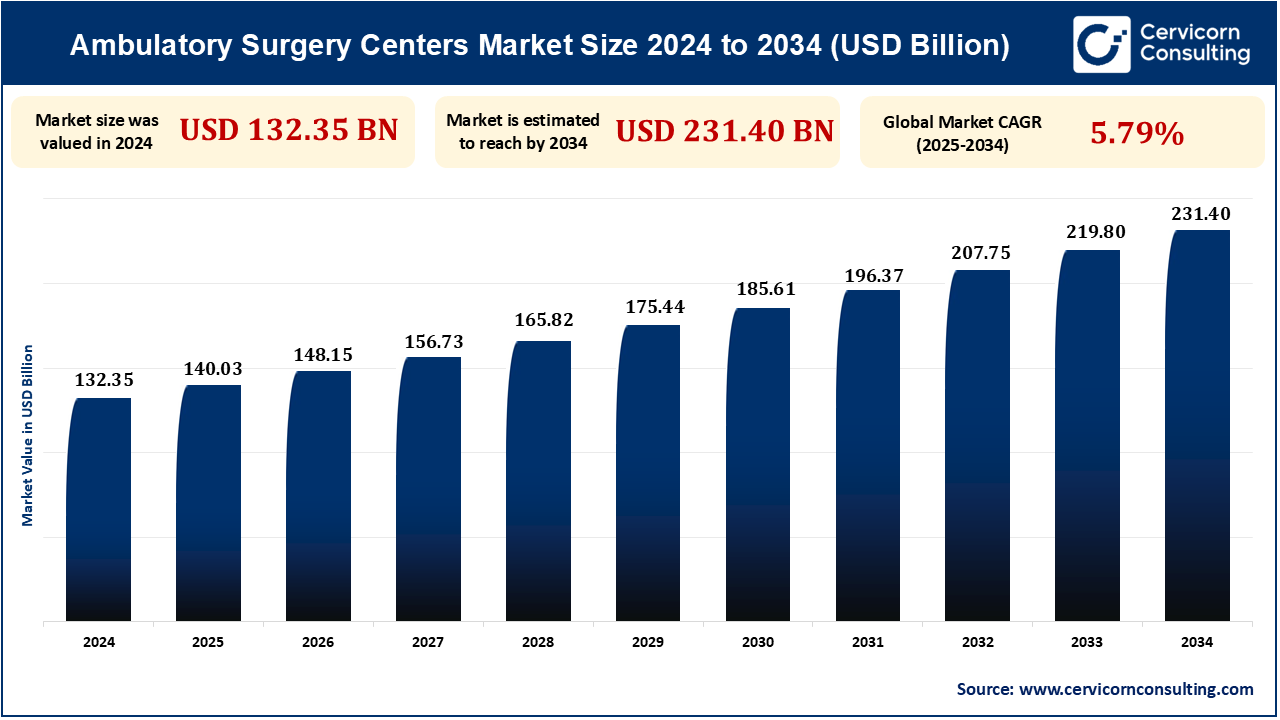

The global ambulatory surgery centers market size was measured at USD 132.35 billion in 2024 and is anticipated to reach around USD 231.40 billion by 2034, growing at a compound annual growth rate (CAGR) of 5.79% from 2025 to 2034. The ambulatory surgical centers (ASC) market is fueled by cost-efficient outpatient care, advances in medical technology, and the shift towards value-based care. Both the aging population and increased incidence of chronic disease also drive up the demand for outpatient surgical services.

The ambulatory surgery centers market addresses healthcare centers that offer same-day surgical care, such as diagnostic and preventive services. ASCs provide patients with an alternative to hospital-based operations, offering reduced-cost, high-quality treatment for a variety of procedures such as orthopedic, ophthalmic, and plastic operations. The centers concentrate on outpatient services, with the ability to return home on the same day, making them an appealing option to both patients and healthcare professionals. The market is also growing as a result of medical technology advancements, increased outpatient care preference, and cost savings.

Among the major growth drivers for the ambulatory surgery centers market is the growing need for cost-efficient, outpatient surgery. ASCs provide high-quality care at reduced costs than hospital-based settings, making them a preferred choice for patients and healthcare providers alike. The cost savings, coupled with advances in medical technology and increased focus on value-based care, continue to fuel the market's growth.

Ambulatory Surgery Centers Market Latest Investments

- Sutter Health is investing USD 1 billion to develop a flagship campus in Emeryville, Northern California, over 12 acres in February 2025. The campus will have a 335,000-square-foot medical center with up to 200 beds and different services, including labor and delivery, ICU, emergency services, and neonatal services. It will also feature an ambulatory care complex with specialties, imaging, and laboratory services, which will open by 2028. The entire medical center is to be completed between 2032-2033. Sutter will hire 190 clinicians and expand its behavioral health services at its Berkeley campus, with the Alta Bates campus to be redeployed once the Emeryville center is open.

- The State Health Planning & Development Agency, in October of 2023, approved the Cullman Regional proposal to construct a multispecialty ambulatory surgery center (ASC) in Hartselle. It came after approving a freestanding emergency department, which is expected to be open in 2024. The ASC, opening in 2026, will have four operating rooms, one procedure room, and 10 bays for surgery. The ASC will provide outpatient surgery services at reduced costs. Healthcare professionals will man the center.

- In July 2024, AdventHealth Daytona Beach is spending USD 220 million on an expansion project, due for completion by fall 2026. The project will increase 104 inpatient beds, four surgical suites, and more than 240,000 square feet of space. It comprises vertical additions on two towers, boosting the bed capacity of the hospital to 466 and operating rooms to 22. The addition will also improve ICU and progressive care beds, including dedicated units for cardiovascular and neuro-ICU, as well as enhanced support services and imaging capabilities.

Ambulatory Surgery Centers Market Key Takeaways

- North America led the market in 2024, accounting for the highest revenue share of 41.2%, driven by advanced healthcare infrastructure and increased adoption of outpatient services.

- The Asia Pacific region is showing strong momentum, generating a 20.74% revenue share in 2024, and is expected to maintain significant growth due to rising healthcare investments and expanding access to medical services.

- By center type, the single-specialty segment captured the largest market share at 60% in 2024, owing to its cost-efficiency and targeted treatment offerings.

- The multi-specialty segment is projected to register the fastest compound annual growth rate (CAGR) during the forecast period.

- Based on services, the treatment segment dominated in 2024, accounting for 76.26% of total revenue, as a result of growing outpatient procedures and minimally invasive treatments.

- The diagnosis segment is anticipated to grow at a notable CAGR over the forecast period, driven by early detection initiatives and the rising prevalence of chronic diseases.

- By ownership, the physician-owned segment held the largest revenue share of 61% in 2024, attributed to greater autonomy and operational efficiency.

- The hospital-owned segment is expected to expand at the fastest pace during the forecast period, as hospitals continue to broaden their outpatient care networks to improve service delivery and profitability.

Ambulatory Surgery Centers Market Important Factors

Aging Population and Rising Prevalence of Chronic Diseases

The increasing number of elderly individuals and the rising prevalence of chronic diseases such as diabetes, heart disease, and arthritis are driving the demand for surgical procedures, many of which can now be performed in ASCs. This demographic shift results in a greater need for outpatient surgeries that are cost-effective and require shorter recovery times.

- In February 2024, a study by the CDC of chronic disease prevalence in US Zip Code Tabulation Areas (ZCTAs) revealed that the southeastern United States is concentrated with chronic disease. The research showed that the areas with the highest disease incidence also have issues of socioeconomic concern, such as lower income, home value, education level, and higher levels of being diagnosed as uninsured. These areas also have inappropriate access to healthcare and transportation. The report highlights the need for specific resources and policies to counterbalance such imbalances and improve health outcomes.

Government Initiatives and Reimbursement Policies to Fuel the Market Growth

Government incentives toward outpatient care, such as beneficial reimbursement policies for ASCs, are driving market growth. Medicare and Medicaid reimbursement rate adjustments have made ASCs a sought-after alternative for healthcare providers, as they provide quality care at reduced costs.

- In March 2023, The Ambulatory Surgery Center Association (ASCA) spoke for more than 6,000 Medicare-certified ASCs, promoting their place in healthcare, patient access, and government cost savings. ASCA hosts a National Advocacy Day in Washington, DC, where members visit Congress, and promotes facility tours and community events to highlight the care ASCs deliver. ASCA also has a nonpartisan political action committee, ASCAPAC, dedicated to representing the interests of the ASC community.

Regulatory and Reimbursement Challenges May Restrain the Market’s Growth

One of the most important ASC market limitations is the evolving regulatory environment and level of reimbursement. ASCs have to abide by strict federal and state regulations that are costly and time-consuming. Medicare and private payer reimbursement rates for certain procedures also may not be high enough to cover all costs of services rendered, limiting profitability and further growth.

- For instance, in February 2025, Cardiovascular ambulatory surgery centers (ASCs) are increasing rapidly with advantages such as same-day discharge, greater efficiency, and cost-effectiveness. But they have challenges like demands for sophisticated technology, expert personnel, and selective patient choice. High upfront costs and slow early procedure volumes raise questions about financial sustainability. Successful ASC development requires strategic planning, technology investment, and patient safety emphasis. Despite these challenges, cardiovascular ASCs have a bright future in medicine, where learning and adaptation are key to success.

Strategic Partnerships and Investments to Revolutionize Market Growth

Private equity firms and health systems are increasingly making investments in ambulatory surgery centers (ASCs) as part of acquisitions and joint ventures. This alignment enables expansion of outpatient surgical services, optimizes operations, and enables low-cost quality care, propelling growth in the ASC market.

- For instance, ChristianaCare and Atlas Healthcare Partners have entered into a joint venture in August 2024 to build ambulatory surgery centers (ASCs) in Delaware, Pennsylvania, New Jersey, and Maryland, emphasizing cost-effective, high-quality care. Although the number of centers and timeline are not revealed, ChristianaCare has a surgery center and has a two-way ownership in two others. Atlas has ASC development experience, entering into partnerships with nonprofit health systems. This fits ChristianaCare's strategy for growing its regional footprint, including micro-hospitals in Philadelphia.

Ambulatory Surgery Centers Market Scope

| Attribute |

Details |

| Ambulatory Surgery Centers Market Size in 2024 |

USD 132.35 Billion |

| Ambulatory Surgery Centers Market Size in 2034 |

USD 231.40 Billion |

| Ambulatory Surgery Centers Market CAGR |

5.79% from 2025 to 2034 |

| By Application |

- Orthopedics

- Pain Management/Spinal Injections

- Gastroenterology

- Ophthalmology

- Plastic Surgery

- Otolaryngology

- Obstetrics/Gynecology

- Dental

- Podiatry

- Others

|

| By Ownership |

- Physician Owned

- Hospital Owned

- Corporate Owned

- Others

|

| By Center Type |

- Single-Specialty

- Multi-Specialty

|

| By Services |

|

| By Region |

- North America

- APAC

- Europe

- LAMEA

|

| Key Players |

- Surgery Partners, Inc.

- Envision Healthcare Corporation

- United Surgical Partners International, Inc.

- HCA Healthcare, Inc.

- Ambulatory Surgical Centers of America, Inc.

- Tenet Healthcare Corporation

- Mednax, Inc.

- HealthDrive

- Nueterra Capital

- Beverly Hills Physicians

- AscellaHealth

- Surgical Care Affiliates, Inc.

- OrthoCarolina

- Amsurg Corp.

- Centers for Specialty Care Group

|

Ambulatory Surgery Centers Market Regional Insight

Asia Pacific is Expected to Grow at the Fastest Rate During the Forecast Period

The Asia Pacific region is expected to experience the highest growth in the ambulatory surgery centers (ASC) market over the forecast period owing to the development of healthcare infrastructure at a rapid pace, growing medical tourism, and rising demand for cost-saving outpatient care. India, China, and Thailand are seeing a high demand for minimally invasive procedures, backed by a growing middle class and increasing insurance coverage. Moreover, government support to boost surgical facilities in rural and semi-rural regions, coupled with augmented investments from the private health sector, is spurring the growth of ASCs. The area is also supported by an expanding number of qualified surgeons and the advancement of technology, further spurring the use of outpatient surgical procedures.

North America Dominated the Ambulatory Surgery Centers Market in 2024

North America led the ambulatory surgery centers market in 2024, mainly because of a well-developed healthcare system, high patient awareness, and extensive use of advanced surgical technologies. The mature regulatory environment in the region facilitates the operation and reimbursement of ASCs, which makes them a preferred choice for both providers and patients. The U.S., in fact, has a large number of accredited ASCs that provide specialized services in orthopedics, ophthalmology, and gastroenterology. Also, favorable healthcare policies, rising incidence of chronic diseases that need outpatient interventions, and the rising trend towards value-based care have contributed to increased utilization of ASCs. Cost-effectiveness, reduced hospital stays, and enhanced patient outcomes further support the dominance of North America in the global ASC market scenario.

Ambulatory Surgery Centers Market Segmental Insight

By application, the orthopedics segment led the market

The orthopedics application segment drove the ambulatory surgery centers (ASC) market due to the high number of joint replacements, arthroscopies, and fracture repairs increasingly being done in an outpatient setting. Improvements in minimally invasive surgical techniques, anesthesia, and post-surgery pain control have made orthopedic surgery safe and cost-effective without requiring lengthy hospital stays. Further, the increased population of elderly individuals and rising incidence of musculoskeletal disorders and sports injuries have significantly increased demand for orthopedic procedures. ASCs are a cost-effective and accessible solution over hospital-based treatments, with faster recovery and fewer risks of infection. These aspects in concert support the predominance of the orthopedic segment in the ASC market scenario.

By services, the treatment segment dominated the market

The treatment segment led the ambulatory surgery centers market by services due to increased demand for outpatient surgical procedures and interventional procedures in other medical specialties. Due to the increase in chronic diseases such as cardiovascular diseases, gastrointestinal diseases, and urological diseases, there has been enhanced demand for therapy that is efficiently delivered without inpatient admission. These procedures like endoscopies, catheter placements, and cataract procedures are now performed on a regular basis in ASCs because of their cost savings, shorter recovery times, and favorable patient turnover. Also, advances in technology make it possible for an increasing number of treatments to be conducted in outpatient facilities, hence fueling the dominance of the treatment segment in this industry.

By center type, the single-specialty segment dominated the market

The single-specialty segment led the ambulatory surgery centers market by center type because of its operational efficiency, efficient allocation of resources, and concentrated expertise in providing high-quality care for a limited medical specialty. Such centers enjoy lower overhead costs and easier regulatory compliance than multi-specialty facilities. Surgeons and staff under one specialty are extremely accustomed to working with specialized procedures, which translates into better outcomes and patient satisfaction. Specialty groups like gastroenterology, ophthalmology, and orthopedics have been extensively used in single-specialty ASCs due to their predictable caseload and predictable demand. Besides, investors and healthcare providers increasingly employ single-specialty models due to their profitability, scalability, and management simplicity in the outpatient care market.

Ambulatory Surgery Centers Market Major Breakthroughs

- In March 2024, Surgery Partners Inc. surpassed USD 3 billion in revenue through organic growth, margin improvement, and strategic M&A, with a focus on high-acuity cases like orthopedics, particularly a 50% growth in total joint procedures. The company added seven surgical facilities and opened eight new ones, investing nearly USD 0.04 billion, with plans for further expansion in 2025. Despite a non-binding acquisition proposal from Bain Capital, Surgery Partners remains focused on expanding its outpatient services, improving efficiency, and securing favorable contracts for continued growth.

- In November 2023, Thoma Bravo, a private equity firm, completed its USD 1.8 billion acquisition of NextGen Healthcare, with NextGen shareholders receiving USD 23.95 per share in cash. As a result, NextGen's stock will be removed from the Nasdaq exchange. NextGen CEO David Sides expressed enthusiasm for the partnership, citing Thoma Bravo's operational expertise and a shared vision of achieving better healthcare outcomes.

Empower your strategy with expert insights, purchase this premium research@ https://www.cervicornconsulting.com/buy-now/2360

Ask here for more details@ sales@cervicornconsulting.com