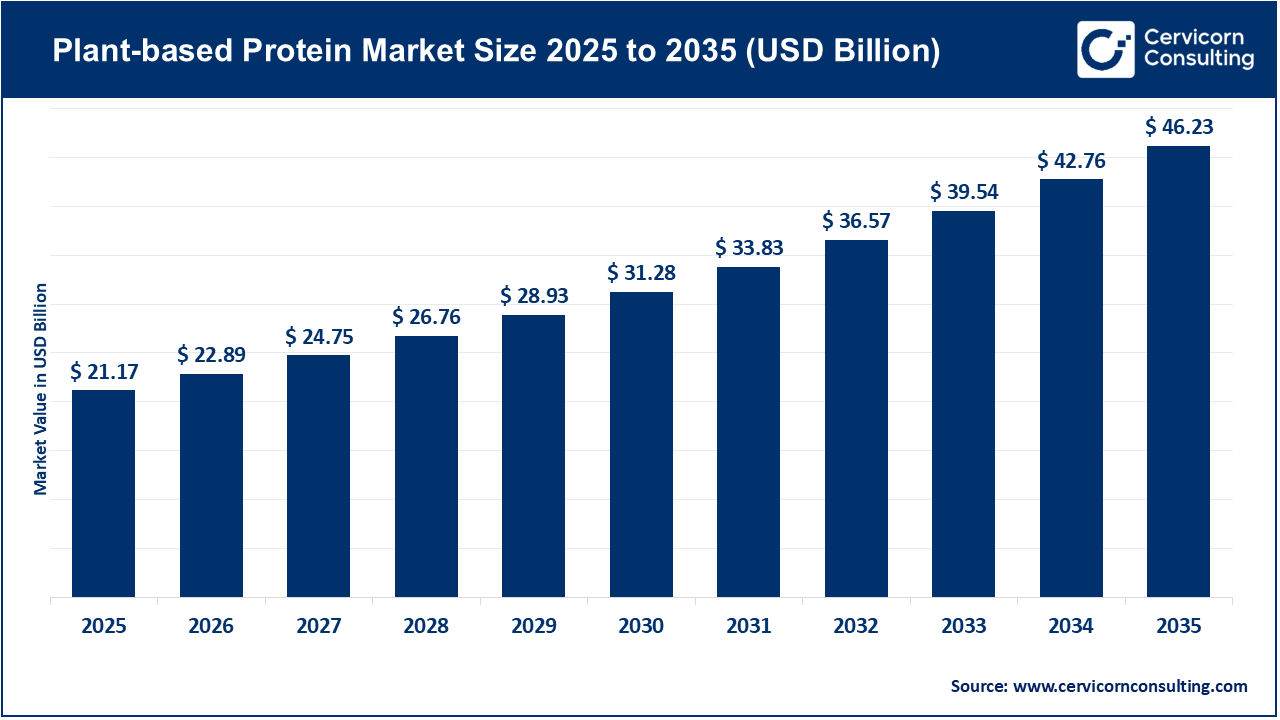

The global plant-based protein market size was estimated at USD 21.17 billion in 2025 and is expected to be worth around USD 46.23 billion by 2035, exhibiting at a compound annual growth rate (CAGR) of 8.1% over the forecast period from 2026 to 2035. The plant-based protein market is growing rapidly, driven by changing dietary habits, a growing focus on sustainability, and greater acceptance in the food industry. A significant portion of protein consumers are now flexitarians, with around 40% to 45% of adults in key markets like the United States and Europe cutting down on meat and choosing plant-based proteins. This trend is driven by higher health awareness, as more people look for high-protein and cholesterol-free diets. Plant proteins also use much less land and water compared to animal proteins. Therefore, food and beverage companies are adding plant-based proteins to a wide range of products, such as meat and dairy alternatives, bakery items, and snacks, which is helping to drive the growth of the market.

From a production perspective, the market is benefiting from greater availability of raw materials and advancements in processing technologies. Global output of pulses, including peas, lentils, and chickpeas, which are essential for plant protein extraction, has surpassed 90 million tonnes in recent years. This ensures a reliable supply of feedstock for manufacturers. Pea protein production, in particular, has recorded double-digit growth in several regions, supported by the establishment of new wet and dry fractionation facilities. At the same time, fermentation-based protein production is expanding quickly, with many new pilot and commercial plants launched since 2020 to enhance yield, functionality, and taste. These technological improvements are lowering cost barriers and supporting wider adoption of plant-based proteins across both consumer and food-service sectors.

Rising Flexitarian and Vegan Population Driving the Plant-Based Protein Market

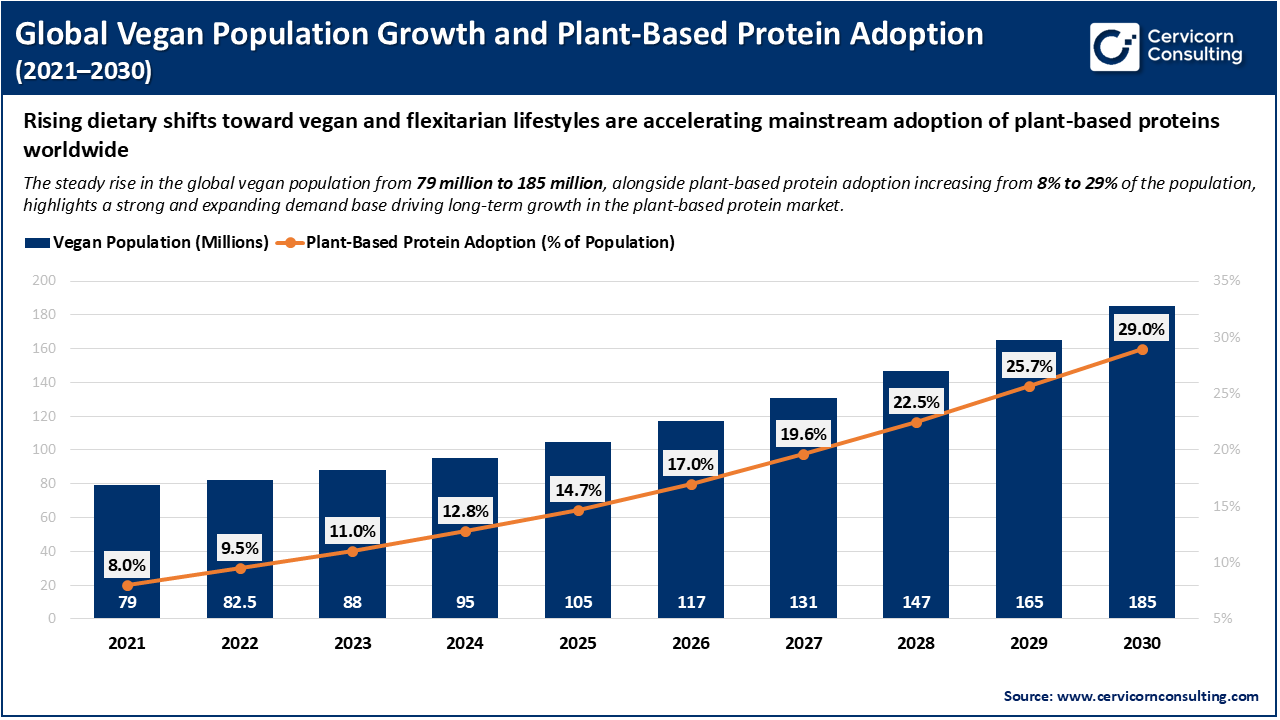

The rising flexitarian and vegan population is significantly driving the growth of the plant-based protein market. As more consumers reduce their meat intake, particularly in the U.S. and Western Europe where around 42%–45% of adults now identify as flexitarian, the frequency and variety of plant-based protein consumption is increasing. It is observed that the global vegan population is rising by 8%–10% each year, especially among younger adults aged 18–34. Retail data shows that flexitarian households purchase plant-based protein products 30%–40% more often than non-flexitarian households, which suggests a shift from occasional to regular use. The foodservice sector is also adapting, with over 60% of quick-service and casual dining chains in developed markets now including at least one plant-based protein option, compared to less than 30% ten years ago. This shift in dietary habits is encouraging manufacturers to expand production, introduce a wider range of protein sources such as pea, soy, fava, and chickpea, and enhance product quality. As a result, plant-based proteins are becoming a regular part of mainstream diets, moving beyond their previous status as a niche alternative.

The chart shows a strong upward trend in the global vegan population and plant-based protein adoption from 2021 to 2030. The vegan population is expected to rise steadily from about 79 million in 2021 to around 185 million by 2030. At the same time, plant-based protein adoption is projected to increase more sharply from 8% to nearly 29% of the global population. The faster growth in plant-based protein adoption is mainly driven by the rising number of flexitarian and health-conscious consumers. This trend is significantly boosting the mainstream adoption of plant-based proteins and increasing their importance in global diets.

1. Expansion of New Plant-Based Manufacturing Facilities

The plant-based protein market in North America and Europe is experiencing significant growth, mainly due to rising investments by global food companies in new and expanded production facilities for dairy and meat alternatives in 2024 and 2025. These investments are increasing manufacturing capacity, reducing lead times, and improving supply reliability. As a result, plant-based protein products are becoming more widely available in both retail and foodservice channels. As a result, these factors are expected to broaden consumer access and accelerate the adoption of plant-based products.

2. Launch of Country-Level Plant Protein Cluster Initiatives (e.g., India)

Initiatives such as the Plant Protein Cluster Initiative, which operates in several Indian states, aim to develop regional hubs for plant protein ingredients and encourage collaboration among processors, growers, and technology providers. These organized efforts between the public and private sectors play a significant role in improving the supply of raw materials, accelerating innovation in processing, and attracting investment into local plant-based protein industries. By establishing structured development programs, these initiatives are expected to help both startups and established food companies overcome barriers to scaling up production, which will increase total output and further expand the range of plant protein products available to consumers.

3. Government Funding for Oilseeds and Pulses to Support Protein Extraction Research

Government support in key agricultural markets significantly contributes to the advancement of oilseed and pulse crop development. For instance, India has implemented programs aimed at increasing production and enhancing research in processing, with a particular focus on plant protein extraction. Such policies have resulted in a greater supply of feedstock for plant-based proteins and have stimulated research into improved extraction technologies. As a result, higher protein yields and reduced production costs are being achieved. Government initiatives are therefore essential in maintaining a stable supply of high-quality plant protein ingredients, thereby supporting the expansion of both domestic and export markets.

4. New Product Innovations and Labeling Guidance (e.g., FDA Draft Guidance)

In the United States, regulatory actions such as the FDA's draft guidance on labeling plant-based alternatives have made it possible for companies to market plant-based protein products alongside traditional animal-based foods. This regulatory clarity, combined with advancements in product formulation like next-generation whole-cut plant proteins and improved sensory profiles for meat and dairy alternatives, is accelerating market adoption. Better labeling and higher product quality are making it easier for consumers to choose these products, which is expanding their presence in retail channels. As a result, the demand for plant-based proteins is rising and the market is expected to see continued growth.

Report Scope

| Area of Focus | Details |

| Market Size in 2026 | USD 22.89 Billion |

| Market Size in 2035 | USD 46.23 Billion |

| CAGR 2026 to 2035 | 8.10% |

| Dominant Region | North America |

| Fastest Growing Region | Asia-Pacific |

| Key Segments | Source, Type, Form, Application, Distribution Channel, Region |

| Key Companies | Glanbia Plc., Kerry Inc., Archer-Daniels-Midland Co., Royal Avebe UA, Cargill Inc., Burcon NutraScience Corporation, Corbion, E.I. du Pont de Nemours & Co., Cosucra Groupe Warcoing, CHS Inc., Ingredion Inc., AGT Food & Ingredients Inc., Tate & Lyle Plc., Roquette Frères |

The plant-based protein market is segmented into North America, Europe, Asia-Pacific, and LAMEA. Here is a brief overview of each region:

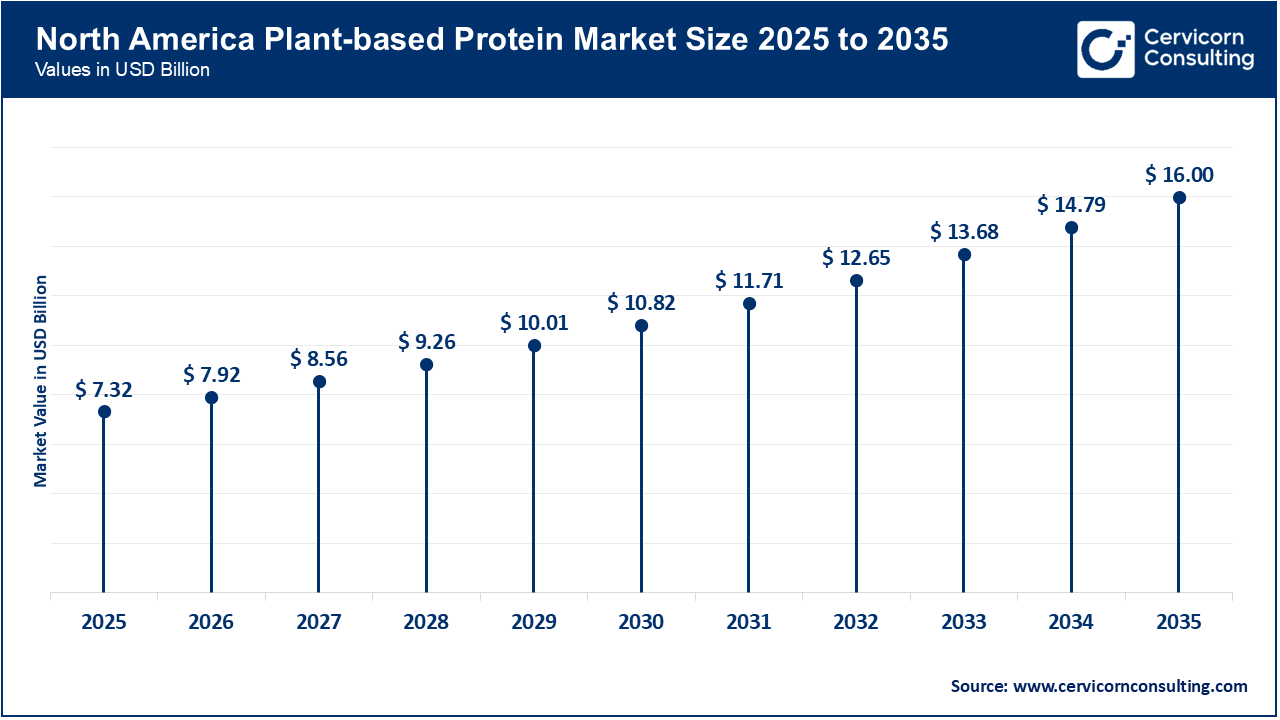

The North America plant-based protein market size was valued at USD 7.32 billion in 2025 and is expected to record around USD 16 billion by 2035. North America is leading the market, mainly due to high consumer health awareness and the growing popularity of vegan and flexitarian diets. The region benefits from advanced nutritional knowledge and easy access to plant-based protein products through both retail stores and online platforms. Many established brands in North America are focusing on clean-label and performance-based products. As a result, North America held a significant share of the global market in 2025, especially in protein supplements and meat and dairy alternatives, as more consumers look for lactose-free and sustainable options.

Recent Developments:

The Asia-Pacific plant-based protein market size was recorded at USD 5.59 billion in 2025 and is predicted to hit around USD 12.20 billion by 2035. The Asia-Pacific region is the fastest-growing market, mainly because of rapid urbanization, higher disposable incomes, and changing dietary habits focused on health and preventive nutrition. China and India are leading this growth. In China, government support for food diversification and increasing health awareness are boosting the plant protein market. In India, the high consumption of pulses and legumes is driving demand for plant-based protein. Other countries like Japan and Australia are also developing new functional and fermented plant-based products.

Recent Developments:

The Europe plant-based protein market size was reached at USD 6.16 billion in 2025 and is forecasted to reach around USD 13.45 billion by 2035. The Europe is mainly driven by strong sustainability policies, strict regulatory frameworks for vegan certification, and the rising consumer demand for environmentally responsible foods. Western European countries are leading in promoting plant proteins by implementing food standards that focus on organic and clean-label products. National action plans to reduce emissions from animal agriculture are also supporting the market growth. These factors have increased the adoption of plant-based proteins in both mainstream supermarkets and specialty organic stores, attracting consumers who are concerned about ethical and ecological issues.

Recent Developments:

Plant-based Protein Market Share, By Region, 2025 (%)

| Region | Revenue Share, 2025 (%) |

| North America | 34.6% |

| Europe | 29.1% |

| Asia-Pacific | 26.4% |

| LAMEA | 9.9% |

The LAMEA plant-based protein market was valued at USD 2.10 billion in 2025 and is anticipated to reach around USD 4.58 billion by 2035. The LAMEA region is growing due to increasing awareness of sustainable food options, the rising urban middle-class population, and government food security strategies that focus on diversifying protein sources. In Latin America, especially in Brazil, there is a growing presence of plant-based products in retail stores and increasing investment from regional food companies. In the Middle East and Africa, the younger population and rising health awareness are supporting the demand for plant-based proteins, although the market is still less mature compared to developed regions.

Recent Developments:

The plant-based protein market is segmented into type, form, application, distribution channel, and region.

Soy protein is currently leading the market, primarily because of its complete amino acid profile and high protein content. These characteristics make it a preferred choice across food, feed, and industrial sectors. The strong emulsification, water-binding, and texturizing properties of soy protein are significantly contributing to its widespread use in meat substitutes, bakery products, dairy alternatives, and animal feed. Furthermore, the presence of well-established global supply chains, cost-effective production, and large-scale soybean cultivation are projected to sustain the growth of soy protein, particularly in processed foods and B2B ingredient markets.

Plant-based Protein Market Share, By Source, 2025 (%)

| Source | Revenue Share, 2025 (%) |

| Soy Protein | 41.8% |

| Wheat Protein | 19.6% |

| Pea Protein | 24.3% |

| Others | 14.3% |

Pea protein is experiencing the fastest growth rate in the market, largely due to the rising demand for allergen-free, non-GMO, and soy-free protein alternatives. Its neutral taste and clean-label attributes are supporting its increasing application in meat analogues, dairy alternatives, and sports nutrition products. Additionally, expanding investments in pea processing and the growth of pulse cultivation are expected to further accelerate the adoption of pea protein, especially among health-conscious and flexitarian consumers.

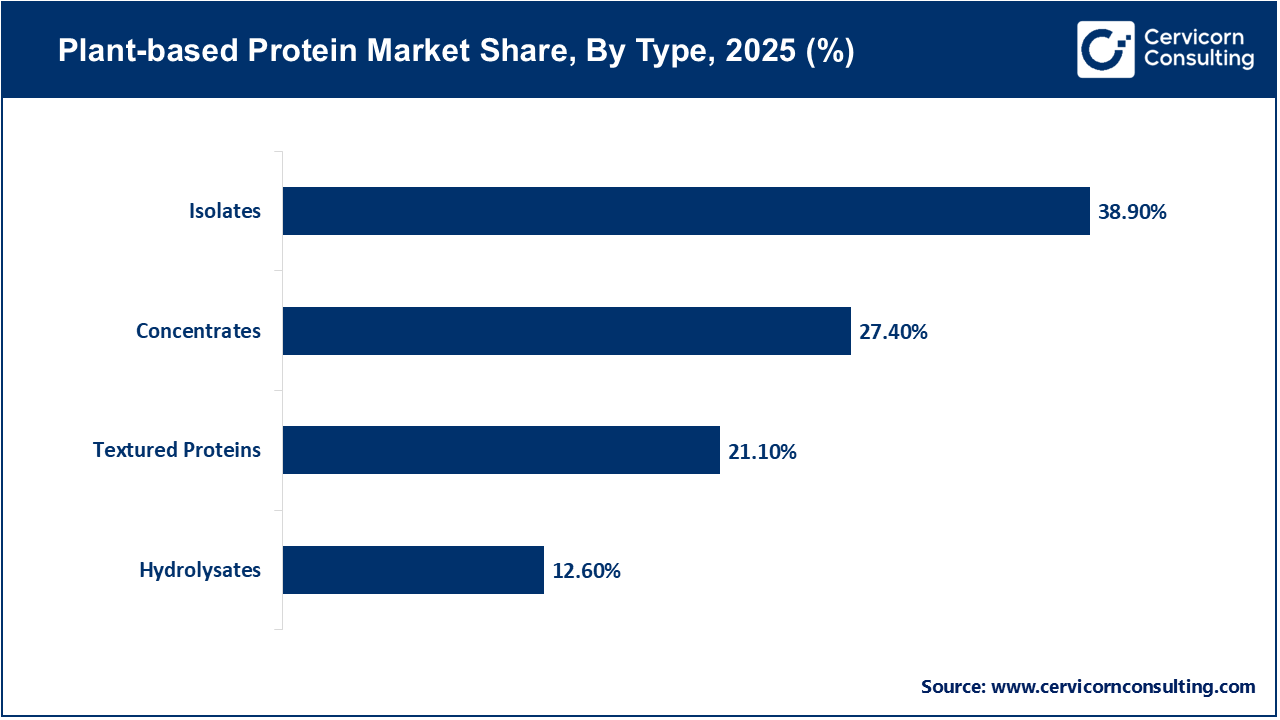

The significant presence of protein isolates in the market can be attributed to their high protein content, exceptional purity, and broad functionality across a range of food and beverage applications. As the demand for meat alternatives, dairy substitutes, and sports nutrition products continues to rise, manufacturers are increasingly relying on protein isolates to achieve the required protein density and precise formulation. The consistent quality and dependable performance of these isolates position them as the preferred choice for companies aiming to deliver premium and performance-focused products.

Textured plant proteins are experiencing the fastest growth in the market, mainly because of the increasing demand for realistic meat substitutes. The fibrous structure of textured plant proteins closely resembles animal meat, which makes them essential ingredients in products such as burgers, sausages, nuggets, and ready meals. The expansion of plant-based meat offerings by foodservice and retail brands, along with advancements in extrusion and processing technologies, is significantly driving the demand for textured plant proteins.

The food and beverage segment is significantly contributing to the growth of the market, as it represents the largest share of consumption. The increasing demand for meat substitutes and dairy alternatives is mainly driven by a shift toward flexitarian diets and a greater emphasis on sustainability in food choices. The integration of plant-based proteins into bakery, beverages, and nutritional products is further strengthening the position of this segment in both retail and foodservice channels.

Plant-based Protein Market Share, By Application, 2025 (%)

| Application | Revenue Share, 2025 (%) |

| Food & Beverage | 64.7% |

| Animal Feed | 21.5% |

| Cosmetics & Personal Care | 7.1% |

| Pharmaceuticals | 6.7% |

The sports and nutritional supplements segment is projected to experience the fastest growth within the market. This trend is attributed to increasing health awareness, the expansion of fitness culture, and rising demand for plant-based performance nutrition. The use of plant proteins in protein powders, ready-to-drink beverages, and functional foods is being driven by consumers who prefer dairy-free and easily digestible options. Additionally, this segment benefits from premium pricing, repeat purchases, and growing demand among younger and urban consumers.

B2B distribution holds the largest share in the market because plant-based proteins are mainly supplied as ingredients to food manufacturers, beverage companies, and animal feed producers. The presence of large-volume contracts, long-term supply agreements, and steady demand from industrial users helps to ensure stable revenue for suppliers. This distribution channel plays a crucial role in scaling up production and supporting innovation for a wide range of downstream applications.

Plant-based Protein Market Share, By Distribution Channel, 2025 (%)

| Distribution Channel | Revenue Share, 2025 (%) |

| Business-to-Business (B2B) | 52.8% |

| Supermarkets/Hypermarkets | 25.6% |

| Specialty Stores | 12.1% |

| Online Retail | 9.5% |

Online retail is the fastest-growing distribution channel, mainly due to the increasing penetration of e-commerce and the growth in direct-to-consumer sales of plant-based protein products. More consumers are choosing to buy protein powders, meat alternatives, and functional foods online because of the convenience, wide product variety, and the availability of subscription models. Digital platforms help brands to educate consumers, introduce new products quickly, and build customer loyalty, which is expected to further drive the growth of this channel.

By Source

By Type

By Form

By Application

By Distribution Channel

By Region