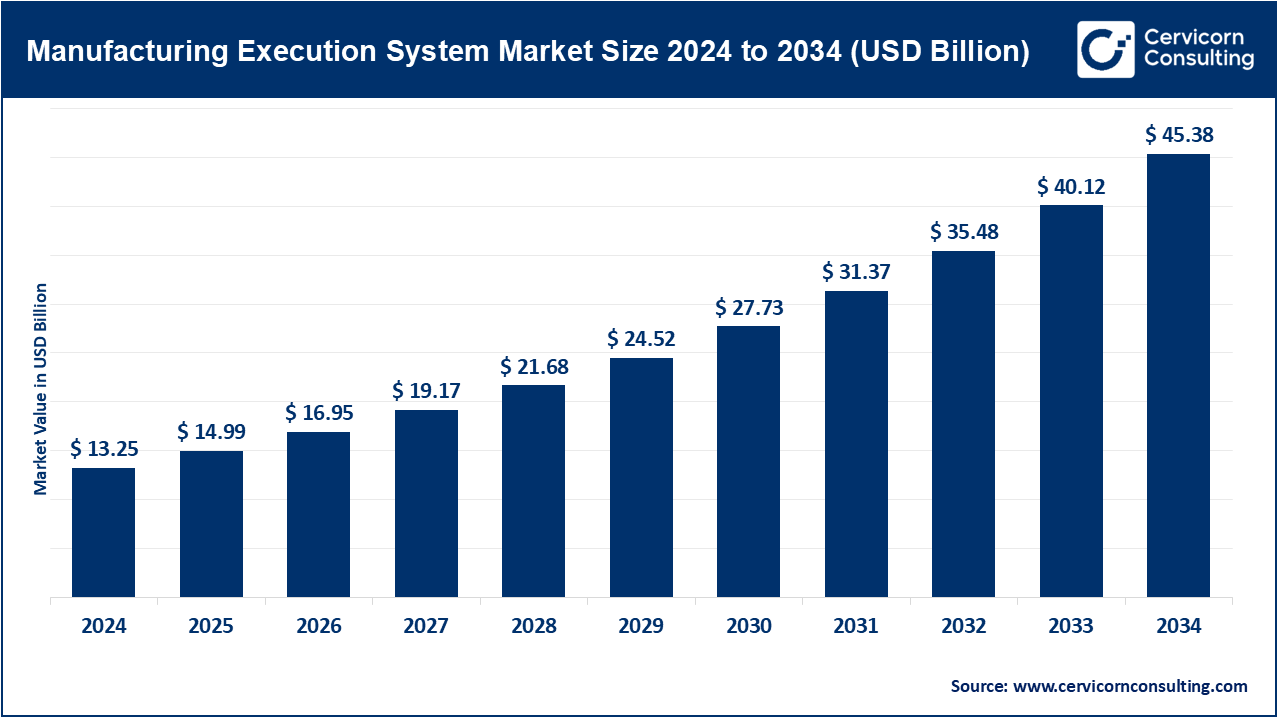

The global manufacturing execution system (MES) market size was accounted for USD 13.25 billion in 2024 and is expected to hit around USD 45.38 billion by 2034, expanding at a compound annual growth rate (CAGR) of 13.10% over the forecast period from 2025 to 2034.

The manufacturing execution system (MES) market is undergoing significant change as increasingly more industries wish to optimize production processes, increase efficiency, and adopt digital manufacturing practices. MES goes between ERP systems and shop floor operations. It allows for manufacturing activities to be monitored, controlled, and synchronized in real time for everything from decision-making to higher product quality to lower downtime to even supporting regulatory compliance-a core part of any smart factory setup.

The major driver for the MES market is high demand for automation and digitalization across manufacturing verticals, namely automobiles, aerospace, electronics, pharmaceuticals, and food and beverages. With entities ramping up competition, manufacturers have started employing MES solutions to minimize production cycles, traceability, and human error. Also, the integration of MES with IIoT, cloud, and AI is driving the business, as it ensures scalability, predictive analytics, and resource optimization. Also, the evolution of Industry 4.0 has been spiking investments in intelligent production systems that have high responses and adaptability to market demands.

There exist challenges in the MES market despite its advantages. High implementation costs and complexities in integrating with existing legacy infrastructure form some of the barriers, especially when dealing with SMEs. Oftentimes, there is a need for extensive MES customizations, which could prolong implementations and cause higher operational interruptions. Plus, given that there are no fixed standards, those solutions out there compete on interoperability and that really puts a wrench in whatever longevity the devices might have had.

The challenge is even more pronounced because of the shortage of professionals capable of running the MES environment and interpreting the generated data. This skills-gap can put hard limitations on how much any given MES solution can be exploited and delay ROI realization. There are cybersecurity concerns arising against the tides also, more so as the MES platforms get interconnected through cloud and IoT frameworks.

Report Scope

| Area of Focus | Details |

| Market Size in 2025 | USD 14.99 Billion |

| Expected Market Size in 2034 | USD 45.38 Billion |

| Projected CAGR 2025 to 2034 | 13.10% |

| Dominated Region | Asia-Pacific |

| Key Segments | Component, Deployment Mode, Function, End-Use Industry, Region |

| Key Companies | Emerson Electric CO., General Electric Company, Oracle Group, Siemens AG, ABB LTD, Dassault Systems, Oracle Corporation, QAD Inc., Critical Manufacturing, MES Solutions GmbH, Rockwell Automation Inc |

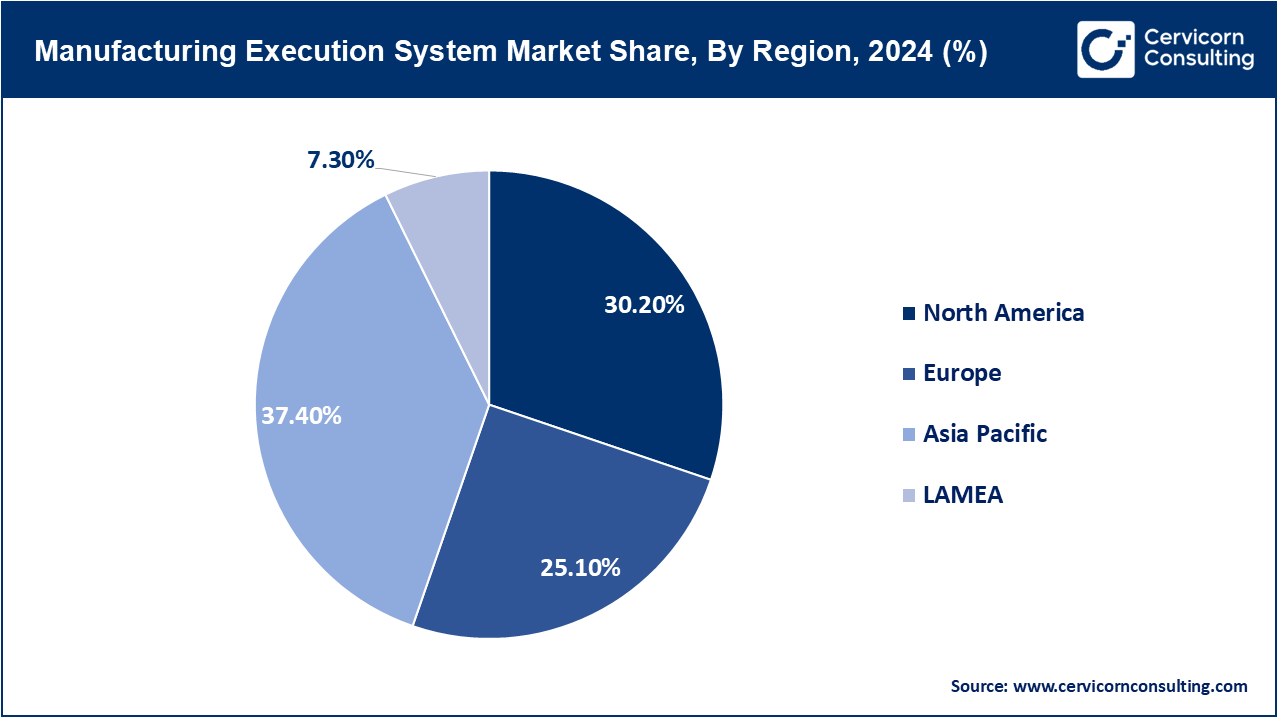

The MES market is segmented into several key regions: North America, Europe, Asia-Pacific, and LAMEA (Latin America, Middle East, and Africa). Here’s an in-depth look at each region.

North America represents a huge MES market, being supported by companies from advanced manufacturing industries and early technology adopters of automation and digital technology. The US holds the palm in the region with automotive, aerospace, and pharmaceutical industries that depend heavily on MES to ensure compliance, traceability, and operational efficiency. Smart factory ecosystems and IoT-enabled systems have created encouragement for enterprises to pick up the pace of modernizing their production infrastructure. Additionally, FDA and OSHA regulatory requirements require the presence of solid production monitoring where MES systems become key. With constant R&D expenditures, deep-rooted IT infrastructure, and the presence of global MES solution providers, the North American market is evolving further.

MES has a wide degree of use in this mature market with a well-developed industrial arrangement and essentially focused on efficiency, quality, and regulatory compliance. Germany, France, Italy, and the UK, with very wait industries, are constantly engaged in the optimization of production operations. Manufacturers in Europe hold product quality, environmental concerns, and operational waste as of utmost importance. Therefore, MES platforms have gained attention as a tool for the management of factory performance, on-the-fly human errors, and regulatory compliance. Particularly well ahead are the food and beverage, automotive, and pharmaceutical industries in the application of MES for maintaining hygiene, batch production tracking, and workforce tracking. There is also a keen interest by European manufacturers in augmenting supply chain agility, and MES grants the ability of changing to shifting demand while retaining time and quality parameters. The collaborative culture of software vendors, technology consultants, and vertical-domain consultants in Europe hugely helps the region remain well on the road to successful MES deployments. Further, the continuous investment into automation-friendly infrastructure allows MES to be easily integrated into companies’ workloads. All these development factors are helping the region to keep a competitive edge in the global manufacturing arena.

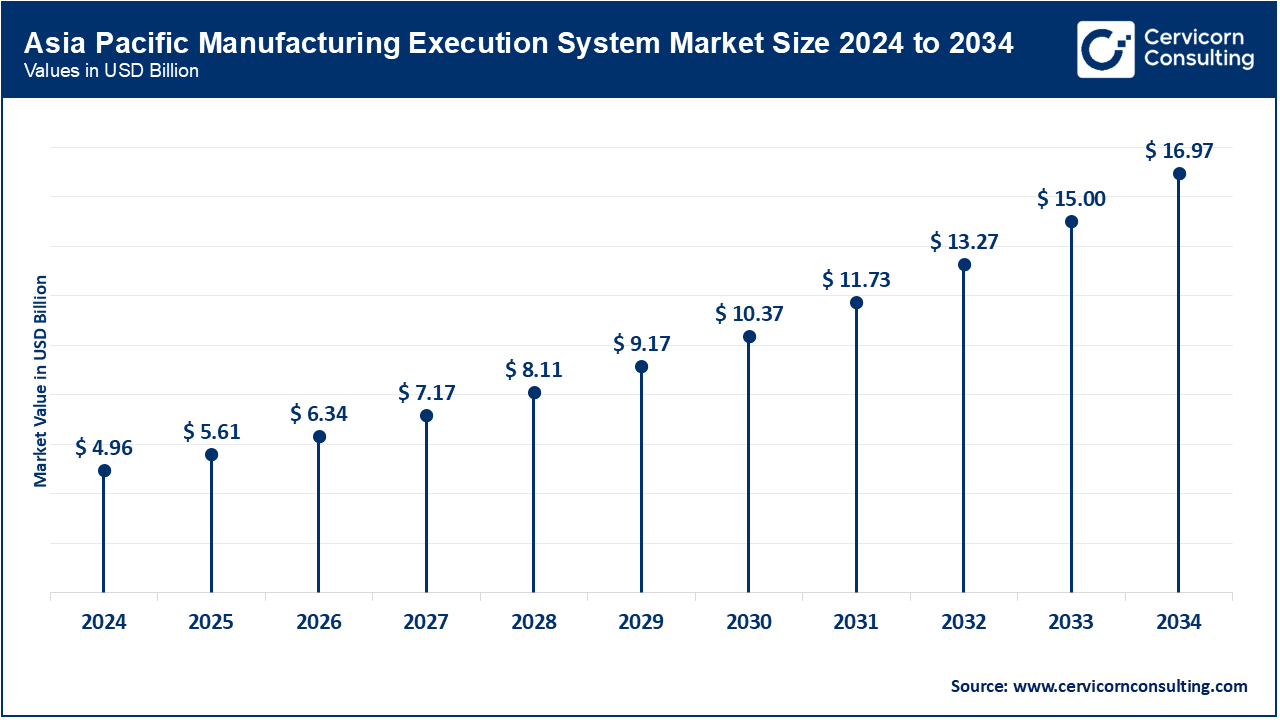

Asia-Pacific leads the MES market owing to its dynamic manufacturing ecosystem. Countries like China, Japan, South Korea, and India are home to numerous factories spread over a plethora of industries such as electronics, automotive, pharmaceuticals, and consumer goods. There is a trend for the modernization of production plants in these countries to be compliant with global quality and safety guidelines. The adoption of technology in factories has been favoured by endorsement from these governments and public-private partnerships. Companies are looking for improved yield efficiency and lesser manual errors, and MES real-time solutions provide a centralized platform to implement construction processes. Moreover, rise in export-oriented manufacturing has created publicity for the need of traceability, compliance, and operational transparency, which MES platforms offer. An environment in which MES implementations can mature has been provided by a large talent pool coupled with a robust IT infrastructure. Enterprises in this region are paying more attention to the competitive advantage that manufacturing execution systems offer, such as short down time, scheduling, or inventory control. All these factors together has proved to be extremely advantageous for the adoption and growth of MES in Asia-Pacific.

LAMEA thus emerged as developing markets for MES solutions, with the level of adoption steadily growing. In Latin America, increasingly complex industrial activities are going on in countries like Brazil and Mexico, while being scrutinized against the demand for better production oversight and data-based decision-making. MES systems are being introduced to enhance production control, increase efficiency, decrease unplanned downtime, and monitor the entire production cycle to maintain consistency between production batches. Nonetheless, limited infrastructure, shortage of skilled human resources, and high initial technology cost can be barriers to wider MES adoption. Manufacturing is nowadays becoming more important in the Middle Eastern region through national modernization plans, particularly in countries like Saudi Arabia and UAE, where efforts are being made to have factories go through a digital upgrade with MES being considered the primary tool for complex operations management. It is still early days of MES deployment in Africa; however, with industrial parks and export-oriented manufacture picking pace, there is growth potential. Across LAMEA, organizations have slowly started to appreciate the advantages that MES can provide with scheduling, compliance tracking, and real-time monitoring of actual operations. With the increased digital literacy and investment in IT infrastructure, LAMEA could simply be a region to witness steady MES deployment in the next few years for areas keen to build a positive operational edge and production reliability.

Software: The segment for software dominates the market because of the operation of providing digital transformation to the manufacturing industries. MES software acts as a central system that allows interconnection, observation, and control of complex manufacturing processes in real time. It lets one schedule production, allocate resources, maintain quality, manage documents, and analyse performance. Manufacturers are thus deploying MES software increasingly to view shop floor operations; minimize downtime; ensure compliance; and maximize overall equipment effectiveness (OEE). The emergence of smart factories and IoT integration with Industry 4.0 activities has given a demand for cloud-based and modular MES software solutions. Further, it is also worth mentioning that these MES platforms are being augmented with AI and machine learning to offer predictive analytics and support automated decision-making. Industries such as automotive, pharmaceuticals, electronics, and food & beverage are big adopters. The software segment is again growing as manufacturers seek MES solutions that are scalable and customizable to equip themselves for an ever-changing industrial landscape.

Manufacturing Execution System Market Revenue Share, By Component, 2024 (%)

| Component | Revenue Share, 2024 (%) |

| Software | 57.80% |

| Service | 42.20% |

Services: The services segment is projected to expand at a fastest CAGR over the forecast period. The services segment include successful implementation and optimization services so that this portion of MES solutions remains viable. These include consultancy, integration, support, training, and maintenance. Consultants must guide companies in the assessment of current operations and design of tailored solutions for MES roadmaps. Systems integration must ensure trouble-free deployment with ERP, SCADA, and PLC systems that are already in place. Support, training, and maintenance are provided to ensure the highest level of adoption and operational efficiency after deployment. Through increased complexity of MES platforms and ever more industry-specific solutions, there has been a rise in the demand for professional services, especially among small and mid-sized manufacturers who lack in-house IT expertise. Also, the Managed Services and remote support model is gaining traction with the rise of cloud-based MES. Vendors are also supporting subscription-based service models integrating continuous system updates, cybersecurity, and regulatory compliance. The service component increases the value of MES software, assuring that it is implemented, maintained, and aligned with businesses goals. The digital transformation impetus for manufacturers will empower this very important segment to grow, offering critical knowledge and technical support throughout the MES life cycle.

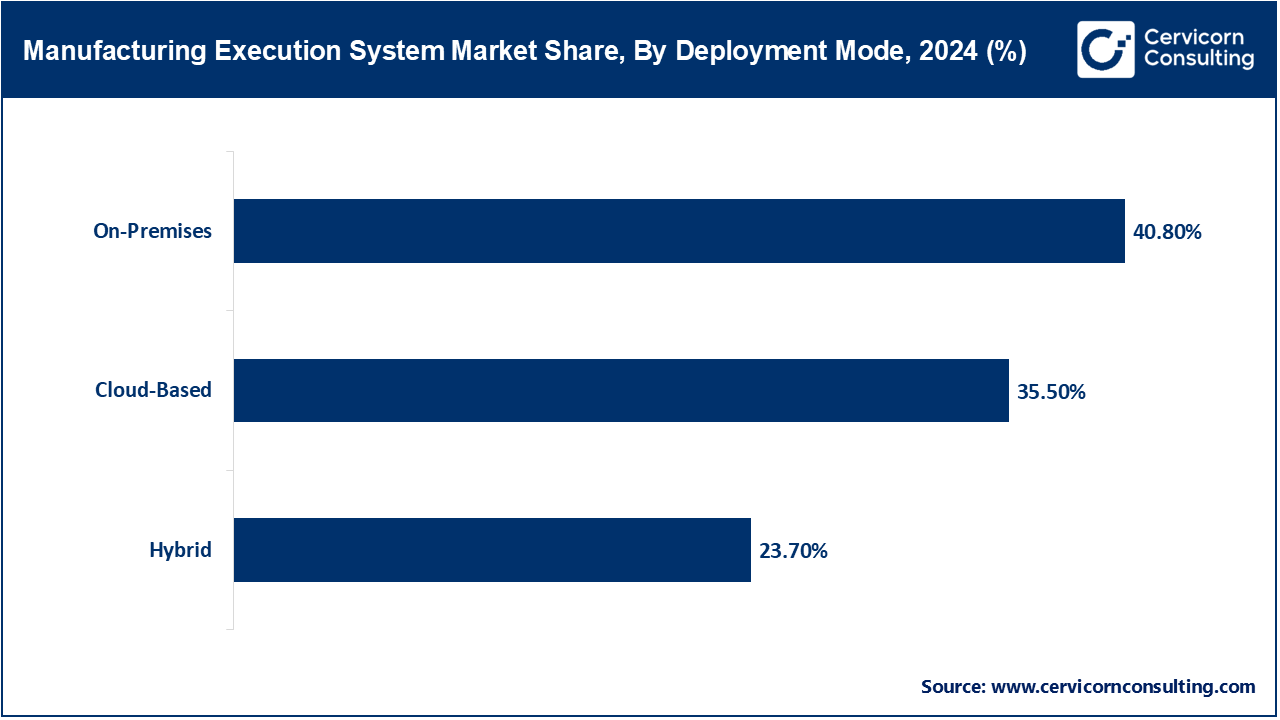

On-Premises: The on-premises segment is considered the dominant in the market. It involves the installation of MES software locally within the organization's IT infrastructure so that companies can hold on to the system and data. This model is mostly preferred in industries where data sensitivity, security, and regulatory compliance are critical. Such industries include automotive, aerospace, pharmaceutical, and defence. These production processes must be tightly regulated, demand high system uptime, and be well-integrated into a very complex and often proprietary legacy system. On-premises MES solutions are famous for their reliability, performance, and deep customizations that can be incorporated for each manufacturer's unique workflow. Large small to medium-sized companies, however, prefer to follow this model since it negates dependence on internet connectivity and third-party hosting so-called external risks. Deep analytics and process monitoring in real-time are still possible here, and these are crucial for the optimization of manufacturing performance. Though under the rise of cloud and hybrid systems, on-premises is still considered relevant because of its robustness, data sovereignty issues, and compatibility with other existing enterprise applications like ERP and SCADA systems. On the other hand, it involves a greater upfront cost and upkeep with the prices of dedicated IT teams. However, enterprises exhibiting high performance with a desire for increasing stability and control would still opt for the on-premises.

Cloud-Based: The cloud-based segment is projected to register the fastest CAGR during the forecast period, driven by the growing demand for scalability and flexibility- plus low cost. Here, the MES software and data reside on servers located remotely and are managed by third-party cloud vendors. Thin clients access them remotely through the internet. This mechanism spells various advantages: low capital expenditure, faster implementations, remote access, and automatic updates. These perks make it a hot selling point with SMEs and startups. The cloud-based MESs let manufacturers scale up or scale down their operations while adjusting to alterations in production volumes without investing in IT infrastructure. Interaction in real-time across globally dispersed facilities is enabled so that decision makers can make swift decisions backed by genuine production information. This model also facilitates the integration of cloud-native Industry 4.0 tools such as AI, IoT, and digital twins that essentially promote further activities of predictive maintenance, quality control, and supply chain agility.

Hybrid: In essence, the Hybrid deployment mode offers an auspicious balance between on-premises and cloud-board MES systems, increasingly adopted in manufacturing. This model allows manufacturers to keep those applications that require secrecy and criticality on local servers, while cloud services can manage less-critical tasks such as analytics, reporting, or remote monitoring. Essentially, a hybrid MES will be a terrific choice when manufacturers want to move away from a legacy setup toward a modern cloud-oriented ecosystem. The hybrid MES platforms foster the flexibility required to transfer workloads slowly to the cloud, while still preserving the investment already made in local infrastructure. It caters to situations where control and data residence in real-time are a must but can also play a hand in fast-tracking innovation in the cloud. Hence, manufacturers can fine-tune the resource dynamics, slash operational expenses, and realize higher system resilience, while their workloads are split and distributed across the environments. A hybrid model works well for multinationals that encounter diverse operational requirements, regulatory environments, and levels of IT maturity across their regions. It helps support business continuity as well, given that data is synchronized across platforms and will be readily available in case of any systems failure on a local scale. In comparison, the hybrid mode requires more complex integration and IT management but follows Industry 4.0 strategies through MES deployment in a modular and adaptive manner. Its adoption is bound to grow with the maturing of digital transformation initiatives around the globe.

Production Tracking: Being MES's most dominant function, production tracking offers real-time visibility and control over manufacturing operations. Through this functionality, manufacturers can observe production activities anywhere from raw materials to finished goods, collecting valuable data from every step of the process. Usage of production tracking enables manufacturers to pinpoint inefficiencies, bottlenecks, or equipment downtime in real-time and consequently take corrective actions quickly so that resources may be optimally utilized. The increasing avidity for lean manufacturing, allied with Industry 4.0 technologies- IoT sensors, artificial intelligence- has created more interest in the adoption of the latest production tracking systems. These, in turn, help track systems to trace, maintain compliance, and assure-quality systems, while simultaneously improving schedules and lowering wastes. Therein lies the increased importance of production tracking in decision-making for manufacturers that seek to keep up with the competition. Hence, production tracking is the essence of MES platforms within automobile, electronics, pharma, and consumer goods sectors.

Quality Management: Since manufacturing execution systems focus on product consistency, quality management within MES schemes is intended to comply with various industry standards and minimize defects during the manufacturing operation. This module can introduce checks and inspections at various points in manufacturing processes and can act in real time when an inspection departs from set requirements. Quality management modules within MES help manufacturers maintain compliance with ISO standards, FDA regulations, or any other quality assurance system; therefore, they are of utmost importance in highly regulated domains, namely pharmaceuticals, aerospace, and food processing. MES automates the quality control process such that it can accurately capture defect data and trigger corrective action to eliminate the causes of the defect with a reduced scope for manual intervention. It also keeps a complete audit trail for improved traceability, and compliance, and triggers alerts when variations begin to drift away from specification, significantly reducing the risk of expensive product recalls. With heavy emphasis on delivering defect-free products and protecting brand image, today every company is sinking money into MES with good quality management functionalities. As standards become increasingly stringent worldwide, this segment has maintained steady growth.

Document Management: Document management lies at the very core of MES functions and guarantees proper and timely creation and handling of production-related documentation. The system aims at serving as a single point of document control for all manufacturing-related documents, such as work instructions, SOPs, machine manuals, safety protocols, and compliance reports. Such a feature eradicates discrepancies that plague paper-based systems, thus offering better traceability and version control of the documents. A system within MES, with impeccable document management capability, ensures that manufacturers can get relevant operators working with the latest officially approved documents throughout production, fostering consistency in operations as well as compliance to standards. In regulated industries such as pharmaceuticals, medical devices, and aerospace, where compliance with such regulations as FDA 21 CFR Part 11 assumes primacy, document management becomes a sine qua non for continued existence. Given increasing complexities in product design and manufacturing processes, there is hence a more pronounced need for structured document control. Hence, smoother audits, collaboration, and training are supported amongst production teams.

Inventory Management: Inventory management in MES platforms, plays a major role in making sure that the materials flow and are available throughout the production process in time. It enables factories to keep track of an inventory of raw materials, components, WIP, and finished goods in real-time. Based on an integration with ERP and warehouse systems, MES-based inventory management allows supply-chain visibility across the entire chain. This ensures that the right materials flow through the system at the right time, preventing any unfair delays caused by a stockout or by overstocking that stop the production line. Automated inventory tracking is made possible through warehouse MES for everything involved, including barcode scanning or RFID tagging tracking. This technical advantage enhances the accuracy of inventory control and decreases chances for human error through manual handling. An enhanced inventory control system within an MES now paves the way for JIT manufacturing strategies to reduce excessive holding and storage costs of inventory. It also plays an important role in traceability, especially where batch-level or lot-level tracking is required. Therefore, as manufacturers continuously look to improve their processes and develop philosophies to reduce waste, efficient inventory management within MES becomes one of their principal enablers for efficiency and agility in the supply chain.

Others: The other category of MES encompasses a wide range of further functions such as performance analysis, equipment management, maintenance planning, labour tracking, and energy monitoring. These functions do contribute a great deal towards optimization of plant performance and operational excellence, though rarely are these directly targeted. For example, the equipment and maintenance management functions are designed for predictive maintenance to minimize unplanned downtime and maximize asset life. Labor tracking is for measuring worker efficiency and the assessment of labour cost optimization. Energy monitoring helps with sustainability by highlighting any areas that are wasting energy. Performance analytics tools provide dashboards and KPIs based on which management makes data-driven decisions. As the trends in smart manufacturing keep growing in strength, manufacturers are looking for MES solutions with capabilities that encompass the full suite and go beyond the core ones. These other functionalities, while they may be considered optional from industry to industry, exert significant influence when working together in an integrated MES platform to provide manufacturers better control, compliance, and competitiveness.

Automotive: The automotive segment has generated the highest revenue share. MES is very flourishing in the automotive sector to manage the production activities involved in vehicle manufacturing. It is used for monitoring, at the line level, an inventory, quality control, and maintenance of equipment. Keeping in view Industry 4.0, manufacturers have started employing MES systems emphasizing flexibility and automation, particularly for the manufacturing of electric vehicles and autonomous vehicles. Automotive companies use MES systems to comply with stringent safety and environmental laws and implement lean manufacturing techniques. Further, it reduces production stoppage, supports predictive maintenance, and increases traceability needed for warranty, recall management, etc. Since vehicles are now technology-based and consumer expectations are very high, MES becomes the glue between shop floor systems and enterprise systems such as ERP. The demand for customized vehicles coupled with a heightened urgency for shorter time-to-market steers fastest MES implementation in this sector, thereby, making automotive the one end-industry with maximum MES implementations.

Pharmaceuticals & Life Sciences: In the pharmaceutics and life sciences domain, MES ensures compliance with stringent regulatory requirements such as FDA's 21 CFR Part 11, EU GMP Annex 11, and GAMP guidelines. Active maintenance of EBR reduces the risk of traceability being questioned and human error. It eliminates any loss of real-time view of production that good quality control and regulatory reporting can never tolerate. MES activities of enforcing SOP-Production On-Shop Floor; Recipe Management and Workflow control in all stages of manufacturing are some of the key areas where pharmaceutical manufacturers utilize. With the increasing demand for personalized medicine, vaccines, and biopharmaceuticals, MES has positioned itself as a strategic investment into an engineering environment characterized by precise and flexible manufacturing. Further, MES is on the upward trajectory, thanks to the growing inclination toward digitalization within pharma manufacturing, a trend fostered by the need to boost productivity, cut down on wastes, and support continuous manufacturing. The COVID-19 pandemic, however, has reiterated that manufacturing continuity requires the support of advanced MES solutions.

Food & Beverages: MES is considered in food and beverage industries to handle complex production workflows, thereby setting quality control and meeting standards regarding food safety and hygiene. MES-based systems ensure that manufacturers can track their raw material ingredients, batches, and packaging processes, being able to trace all the processes of producing a particular food material, from raw materials to end products. When allergen management, contamination control, and expiration tracking come into the picture, that is an area of extreme importance. MES also helps manufacturing units with respect to the international standards like HACCP, FSMA, and ISO 22000. Since the industry faces an increase in consumer demand for diverse, healthy, and sustainable food products, MES helps in quick changeovers on the production line along with recipe management. It allows for resource optimization, reducing downtime and waste via accurate data analytics and automation. The interweaving of the MES with supply chain and inventory systems promotes just-in-time production and delivery. With food and beverage manufacturing currently undergoing digital transformation, MES plays a key role in ensuring efficiency, agility, and compliance.

Electronics & Semiconductors: The MES is the driving force behind the entire electronics and semiconductor industry production processes, where high-volume, high-precision, fast-paced productions are associated. Due to the complicated and delicate nature of the electronic components, these industries demand tight process control, real-time monitoring, and zero-defect manufacturing. MES tracks wafers, circuits, and components in detail through all the production stages. It also provides real-time visibility of yield rate, process deviations, and equipment working. With the coming of IoT, 5G, and AI-powered devices, manufacturers want to adopt very agile production systems, and MES enables fast product changes and upgrades. MES also integrates with automatic testing and inspection systems to minimize rework or scrap. In these times where times to market really represents a cutting-edge competitive edge, an MES system fills the space between design, engineering, and production. Deployment continues to gain momentum in this industry with smart manufacturing adoption high and huge demand for electronic products in automotive, healthcare, and consumer goods.

Aerospace & Defence: MES are chosen by the aerospace and defence industries to support highly regulated, complex, long-cycle manufacturing operations. These industries involve tailor-made components and assemblies that require stringent tolerances and quality standards. MES is supposed to allow adherence to government regulations, industry standards (e.g., AS9100), and customer specifications enforced to complete with traceability and real-time documentation. MES supports efficient work order management, quality assurance, and configuration control. A&D manufacturers implement MES to monitor materials' genealogy, inspection records, and workforce performance records. Being the safety, reliability, and risk mitigation concerned sector, MES is efficient in controlling mistakes, improving product lifecycle management, and maintaining supply chain accountability. It also integrates engineering changes into production with minimal disruption. The growing demand for next-generation aircraft and defence systems forces MES toward flexibly data-driven manufacturing, where companies are squeezed for time and money without compromising production quality.

Market Segmentation

By Component

By Deployment Mode

By Function

By End-Use Industry

By Region