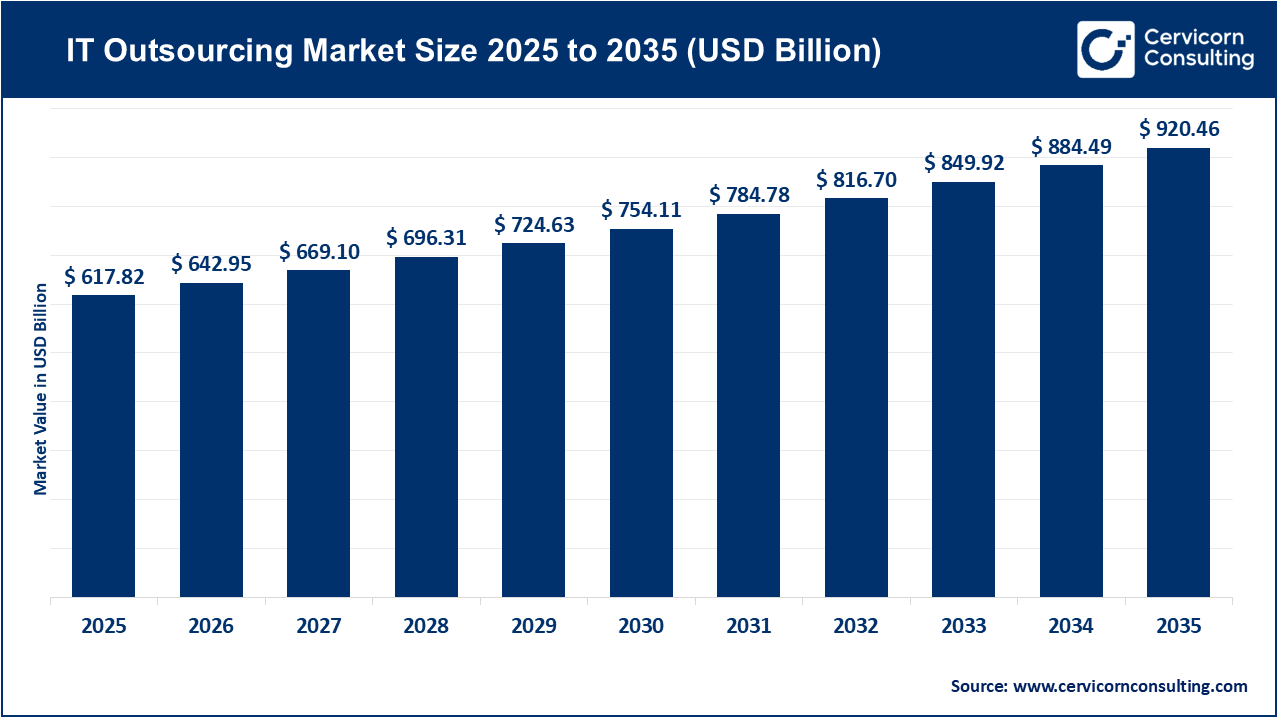

The global IT outsourcing market size was valued at USD 617.82 billion in 2025 and is expected to be worth around USD 920.46 billion by 2035, growing at a compound annual growth rate (CAGR) of 4.1% from 2026 to 2035. The growth of IT outsourcing market is pointed owing to the expansion of edge computing, increasing adoption automated engineering services and modernization of cloud-native applications across the globe.

IT Outsourcing Market: Changing the Landscape of Business Processes

As we enter in the near era of business processes, the relevance of IT outsourcing across the globe continues to rise; especially considering the ongoing transformation of artificial intelligence, machine learning and overall digitization. The IT outsourcing market involves delegating IT processes involved in various landscapes to third-party providers. These services usually revolve around software development, application maintenance, web hosting and continuous IT support.

According to the report published by Gartner, an estimated 70% of enterprise data was projected to reside on cloud in 2024. Considering the rising prominence of cloud computing, the IT outsourcing market is observed to expand owing to the investments done in specialized RPA and ML technologies. As organizations are leveraging their customer data, the trend is seen to offer a boom to the market.

As 2025 shuts, the IT outsourcing landscape is set to witness notable expansion, driven by the growing dependence of enterprises on specialized external service providers to manage their technology functions. Organizations that strategically adopt outsourcing models can unlock significant value in the form of higher operational efficiency, improved scalability, and access to advanced technical capabilities that may not be available in-house.

What are IT Outsourcing Trends in 2026?

Regulatory Analysis for IT Outsourcing Market

Cervicorn Consulting has undertaken an in-depth evaluation of the regulatory environment shaping the IT outsourcing sector, enabling a clear understanding of how evolving policies and data security standards:

| Country | Regulatory Support |

| Poland | Released incentives for investments to attract IT/tech R&D |

| Brazil | Ordered regional grants for emerging digital transformation support at state levels |

| India | Started PLI scheme for sectoral incentives in electronics and IT; reduced capex burden |

| Philippines | Started PEZA incentives for BPO investments and export promotion |

| Vietnam | Ordered R&D relief and regional investment incentives |

| United States | Initiated state R&D tax credits for attracting IT and data centers. |

Focus on Responsible Outsourcing Practices with Regulations

As data privacy and supply chain ethics are becoming concerns, following responsible outsourcing practices has become crucial across the globe. Regulated industries such as healthcare, BFSI and government require vendors that are embedded with responsible practices that include data handling, human rights and security. As key players and investors start focusing on valuing environmental, social and governance (ESG) compliance, it makes operations more attractive for partnerships and long-term business deals; acting as a major driver for the IT outsourcing market.

Lack of Control on Management & Quality

The overall process of IT outsourcing market comes with a core downside of challenge that is lack of control on management and quality. When critical processes such as software development, cybersecurity, customer support or data management are handled externally, companies depend heavily on the vendor’s internal management practices, training standards, team allocation and quality-assurance protocols.

Moreover, misalignment in communication and delivery timelines can lead to inconsistent output that fails to match the quality standards of the client organization. Concerns are heightened in industries like finance, telecom, and healthcare, where sub-standard quality can cause compliance failures, security risks or customer dissatisfaction.

Rising Demand of Generative AI-based Services

Where the world is turning on the benefits of generative AI and its models, these services and offerings act as a major opportunity for the IT outsourcing market too. Business process outsourcing such as IT services are currently emphasizing on the need to provide more sophisticated customer experience. Generative AI shines here as it automates the process of routine operations by lowering costs and offering better quality.

'By using custom AI-agents for tasks such as code analysis, automatic refactoring, business-rule extraction and testing automation, enterprises reportedly saw up to 80% reduction in time and cost compared to manual modernization workflows.'

Additionally, companies offering IT services (outsourcing) are currently focusing on enhancing the scalability and capabilities with the help of generative AI. Automated code generation, chatbots and software testing are few other instances that are being embedded with gen-AI in multiple outsourcing processes. Whereas increased efficiency, access to real-time statistics, cost reduction and improved services are benefits observed by outsourcing companies that have adopted gen-AI in the past year.

Recent Strategies by Major Shareholders in IT Outsourcing Market:

| Company | Strategies | Investments |

| Accenture | Planned to re-center on AI by publishing a large-scale upskilling program for AI adoption | Approx. 6.6 billion deployed across 46 strategic acquisitions. |

| Tata Consultancy Services | Announced a public push towards AI as a service for AI transformation in IT services | Completed series of acquisition in 204-2025 to boost cloud engineering |

| Infosys | Made efforts on making enterprises AI-enabled with reskilling between 2024-2025 | Targeted acquisitions during 2025 to enhance product engineering and vertical capability |

| Cognizant | Accelerated AI & cloud investment while highlighting AI-led platform investments | Started acquisitions to boost industry capabilities and AWS service applications |

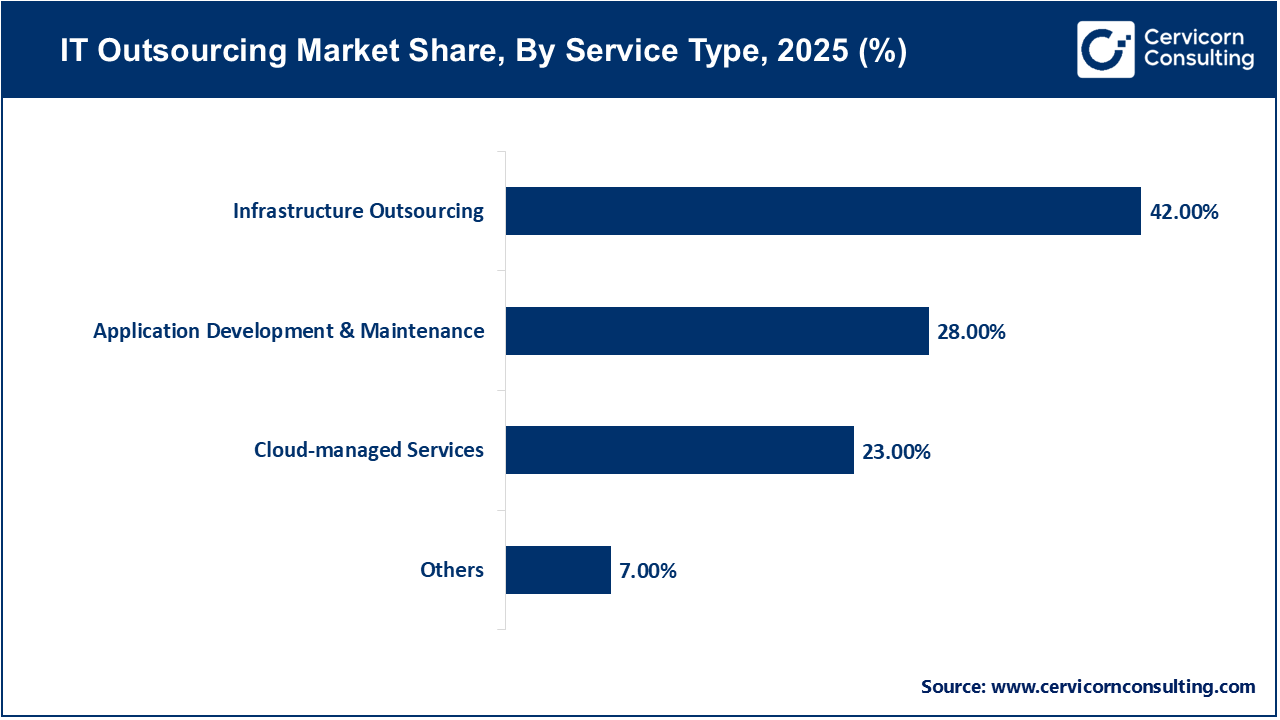

In 2025, the infrastructure outsourcing segment dominated the IT outsourcing market as enterprises increasingly shifted towards cloud-based infrastructure, data center management and network management services. The demand was driven by the need for scalability, cost control and business continuity especially as companies modernized legacy systems and migrated to hybrid and multi cloud environments.

Organizations relied heavily on outsourcing partners to ensure uninterrupted IT operations, achieve automation in infrastructure management and strengthen cybersecurity across distributed networks. Strong adoption was seen across industries including BFSI, retail, manufacturing and technology where business continuity and secure data management were core priorities.

The application development and maintenance segment is projected to record the fastest growth as businesses accelerate digital platform upgrades and adopt emerging technologies such as AI, automation and cloud native software. The rapid need for modernization of legacy applications, deployment of mobile first customer solutions and continuous delivery models is pushing enterprises to outsource specialized development talent.

The large enterprises segment dominated the market in 2025 as multinational organizations continued to outsource IT processes to enhance operational efficiency, manage complex global IT infrastructures and support enterprise wide digital transformation strategies. Large corporations have broader outsourcing budgets and demand end to end services such as infrastructure management, cybersecurity, consulting, application development and managed services. With the constant need to remain technologically competitive while reducing IT overheads, large enterprises partnered with outsourcing firms to improve productivity, mitigate risks and integrate emerging technologies including AI and big data analytics.

IT Outsourcing Market Share, By Organization Size, 2025 (%)

| Organization Size | Revenue Share, 2025 (%) |

| Small & Medium Enterprises | 32% |

| Large Enterprises | 68% |

The small and medium enterprises segment is expected to grow at the fastest rate as smaller businesses increasingly adopt outsourcing to access skilled IT expertise without investing heavily in in house teams. SMEs are turning to outsourcing partners for services such as cloud migration, cybersecurity support, SaaS application development, digital marketing technology deployment and IT support services.

Cost optimization, rapid technology adoption and reduced hiring challenges are key growth drivers for SMEs outsourcing. Additionally, pay as you go outsourcing models and managed service partnerships are making IT outsourcing more accessible and scalable for smaller organizations.

The offshore outsourcing segment dominated in 2025 due to the substantial cost advantages and access to large pools of technically skilled professionals across countries such as India, the Philippines, China, Poland and Vietnam. Enterprise demand for 24x7 support, multilingual capabilities and specialized development skills encouraged the adoption of offshore outsourcing across both technology focused companies and traditional enterprises. Offshore partners also provided competitive advantages in digital engineering, cybersecurity and application modernization which fostered continued segment leadership.

IT Outsourcing Market Share, By Sourcing Location, 2025 (%)

| Sourcing Location | Revenue Share, 2025 (%) |

| Onshore | 26% |

| Near Shore | 15% |

| Offshore | 59% |

The nearshore outsourcing segment is projected to grow at the fastest rate as businesses increasingly value geographical proximity, overlapping time zones and cultural alignment. Companies in North America are expanding their partnerships with service providers in Latin America while European enterprises are working more closely with outsourcing teams in Eastern and Southern Europe. Nearshore outsourcing allows for simplified collaboration, improved project communication and smoother compliance with regional data protection standards. Hybrid working models and demand for real time development support are further accelerating nearshore adoption across enterprises.

The BFSI segment dominated the market in 2025 due to the sector’s ongoing need for secure and scalable IT infrastructure, legacy modernization, risk management platforms and regulatory compliance solutions. Banks, financial institutions and insurance companies increased their outsourcing of IT services to accelerate the rollout of digital banking platforms, automate customer services, streamline cross border transactions and strengthen cybersecurity protocols.

Major outsourcing growth in BFSI was observed in regions such as North America and Europe where digital first banking and financial automation are expanding rapidly followed by Asia Pacific which is witnessing fast adoption of mobile banking services and real time payments systems.

IT Outsourcing Market Share, By End-user, 2025 (%)

| End-user | Revenue Share, 2025 (%) |

| BFSI | 28.40% |

| Healthcare | 16.20% |

| Telecommunication | 19.80% |

| Retail & E-commerce | 14.10% |

| Manufacturing | 12.90% |

| Others | 8.60% |

The retail and e commerce segment is expected to record the fastest growth as companies intensify investment in digital shopping experiences, supply chain automation, personalized marketing and omnichannel platforms. Outsourcing is increasingly helping retailers deploy AI driven recommendation systems, secure payment gateways, last mile delivery solutions and customer analytics tools.

The strongest growth is forecasted across Asia Pacific where online shopping penetration is accelerating rapidly alongside continued expansion in North America and Europe as brands enhance logistics, customer experience and marketplace technology capabilities.

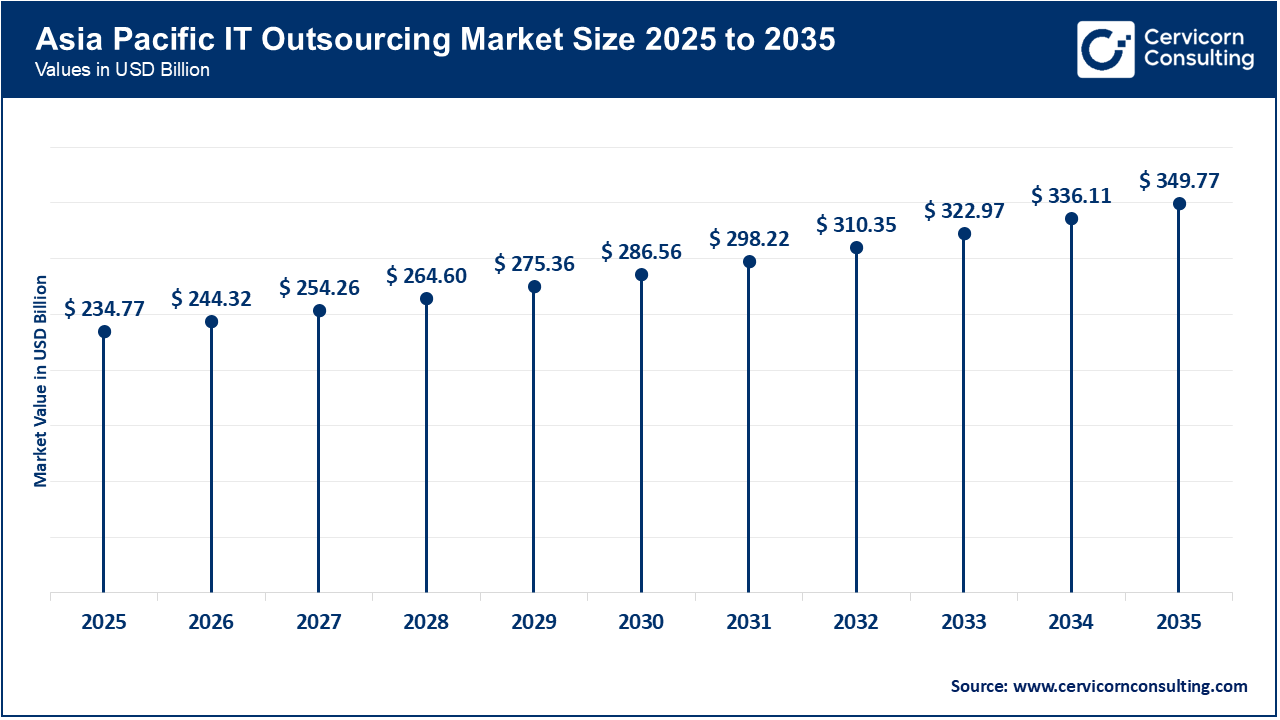

Asia Pacific held the largest share of the IT outsourcing market in 2025, India and China are observed to act as major shareholders in the upcoming period. According to the experts, the IT outsourcing market in China has seen 30% (approximate) growth every year. Moreover, Vietnam, Philippines and India are observed to gain momentum in the upcoming period with the rising government support, tech-savvy boom and set attraction of major MNC’s in these countries.

Additionally, presence of vast operation centers, skilled professionals for IT services, availability of cost-effective solutions and easy access to resources have contributed to the dominance of Asia Pacific in the market. Whereas rapid adoption of AI and ML as well as inclination towards cloud computing and favorable policies in Asian countries create a driving factor for the market to expand in the region.

India’s IT Outsourcing Market Overview:

India has captured a large share in IT outsourcing market in recent years. The overall presence of multinational companies and leading IT firms headquartered in Indian cities carry a significant factor for the market. The Digital India Initiative started by Indian government plays a highlighted role in the expansion of IT services outsourcing. In 2024, the Indian government uplifted the total investments done for digital infrastructure in order to implement advanced technologies.

As the global demand for IT outsourcing continues to grow, players in Indian IT outsourcing ecosystem are observed to focus on core competencies within the space. Arobit Business Solutions, Infosys, Wipro, HCL Technologies, Accenture and Mindtree are major players considered in the Indian marketplace.

IT Outsourcing Market Share, By Region, 2025 (%)

| Region | Revenue Share, 2025 (%) |

| North America | 30% |

| Europe | 25% |

| Asia-Pacific | 38% |

| LAMEA | 7% |

For year 2024, North America held a considerable share of the IT outsourcing market and is observed to expected to grow at a rapid rate in the upcoming years. Being a prime adopter of cloud modernization and AI models, North America has always demanded seasoned providers of IT solutions. In recent times, Unites States has seen substantial growth in domestic and nearshore outsourcing stations, utilizing specialized providers within the country.

Measurable Success in U.S. Market

A major driver is the ongoing IT skills shortage in the American workforce, which pushes companies to partner with outsourcing providers offering expert capabilities in areas like cloud engineering, DevOps, automation, and cybersecurity. Additionally, the rise of hybrid and remote work models has made cross-border IT collaboration more seamless and scalable. Large enterprises and mid-sized businesses across sectors, including BFSI, healthcare, retail, and

Asia-Pacific

North America

Europe

Recent News in IT Outsourcing Market: Launches, Acquisition & Many More

By Service Type

By Organization Size

By End-user

By Region