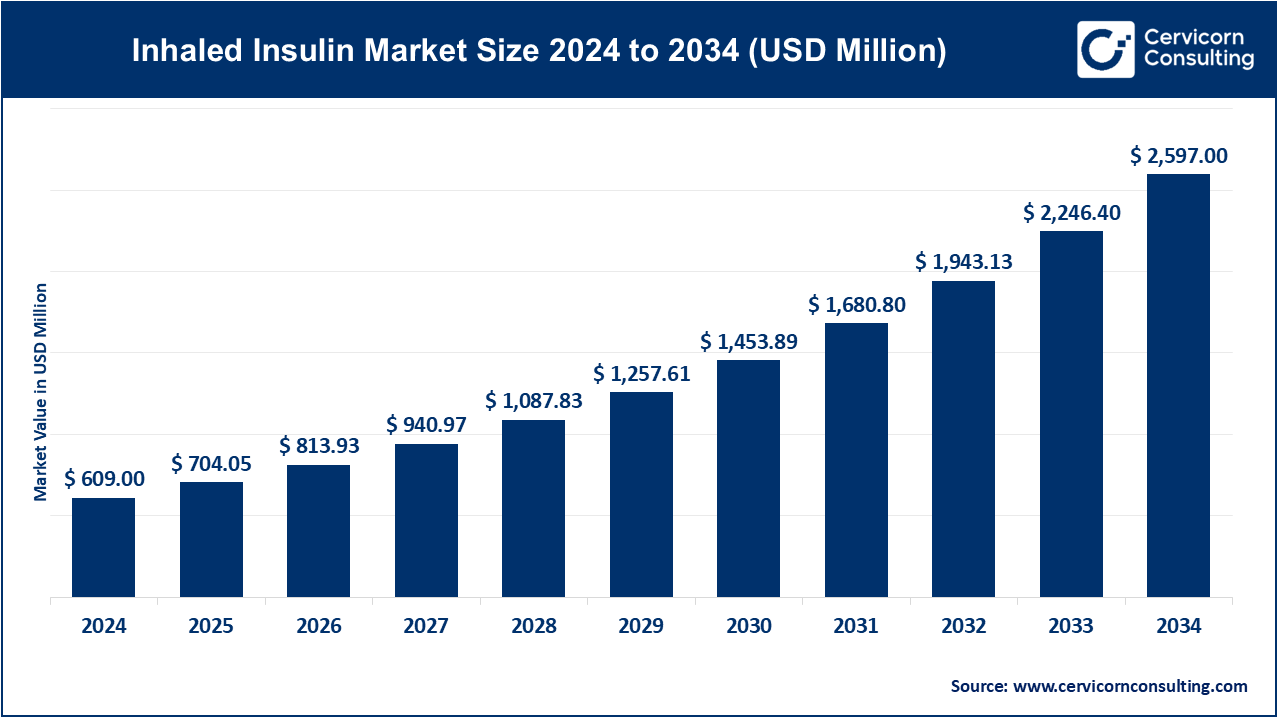

The global inhaled insulin market size was valued at USD 609 million in 2024 and is expected to be worth around USD 2,597 million by 2034, exhibiting at a compound annual growth rate (CAGR) of 15.60% over the forecast period 2025 to 2034. The inhaled insulin market growth is primarily driven by the increasing global burden of diabetes, specifically type 2 diabetes, that is rising due to reasons like physical inactivity, overweight, and age. With the number of patients suffering from diabetes still on the rise, the demand for alternative delivery methods of insulin that enhance patient compliance and quality of life is also on the increase. Inhaled insulin is a needle-free, quick-acting option that is strongly accepted by patients with needle phobia, specifically those who need mealtime insulin but are not willing to take injections. Such an option that is so patient-friendly has a very high adoption potential, specifically for outpatient and home care.

Moreover, advancements in pulmonary drug delivery technologies, favorable regulatory actions, and increasing investments in diabetes care research are further fueling market growth. MannKind Corporation, for example, is raising awareness and expanding access to inhaled insulin therapy, such as Afrezza, which is becoming more and more acceptable as a replacement for traditional insulin injections. Moreover, healthcare professionals and patients alike are becoming more and more accepting of adopting innovative drug delivery systems that provide faster onset of action and improved post-meal glucose control, thereby fueling market growth.

What is an Inhaled Insulin?

Inhaled insulin is an inhalation formulation of rapid-acting insulin delivered through an inhaler device directly into the lungs, capable of entering the circulation via pulmonary absorption. It is primarily used to manage blood glucose in type 1 and type 2 diabetic patients, especially for mealtime. This drug delivery system offers a needle-free alternative to traditional subcutaneous injections of insulin, enhancing patient comfort, compliance, and quality of life. Inhaled insulins like Afrezza are clinically approved and are characterized by their rapid onset of action, more closely mimicking natural insulin response for meals.

Some of the Clinical Research Findings pertaining to the Inhaled insulin:

Expansion into Pediatric Use

Technological Advancements in Inhaler Devices

Positive Clinical Outcomes Supporting Efficacy

Report Scope

| Area of Focus | Details |

| Market Size in 2025 | USD 704.05 Million |

| Expected Market Size in 2034 | USD 2,597 Million |

| Projected CAGR from 2025 to 2034 | 15.60% |

| Dominant Region | North America |

| Fastest Growing Region | Asia-Pacific |

| Key Segments | Product Type, Indication, Distribution Channel, End User, Region |

| Key Companies | MannKind Corporation, Nektar Therapeutics, Pfizer, Aradigm Corporation, Alkermes, Sanofi, Novo Nordisk, Eli Lilly and Company |

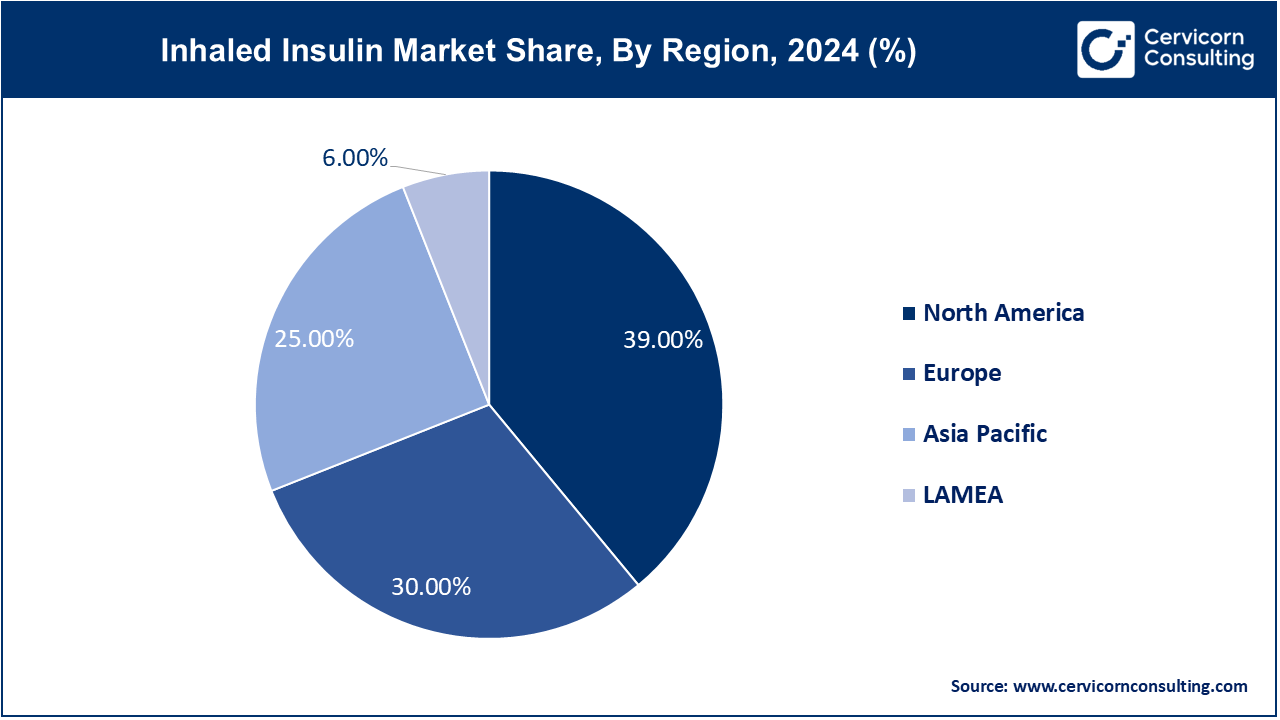

The inhaled insulin market is segmented into various regions, including North America, Europe, Asia-Pacific, and LAMEA.

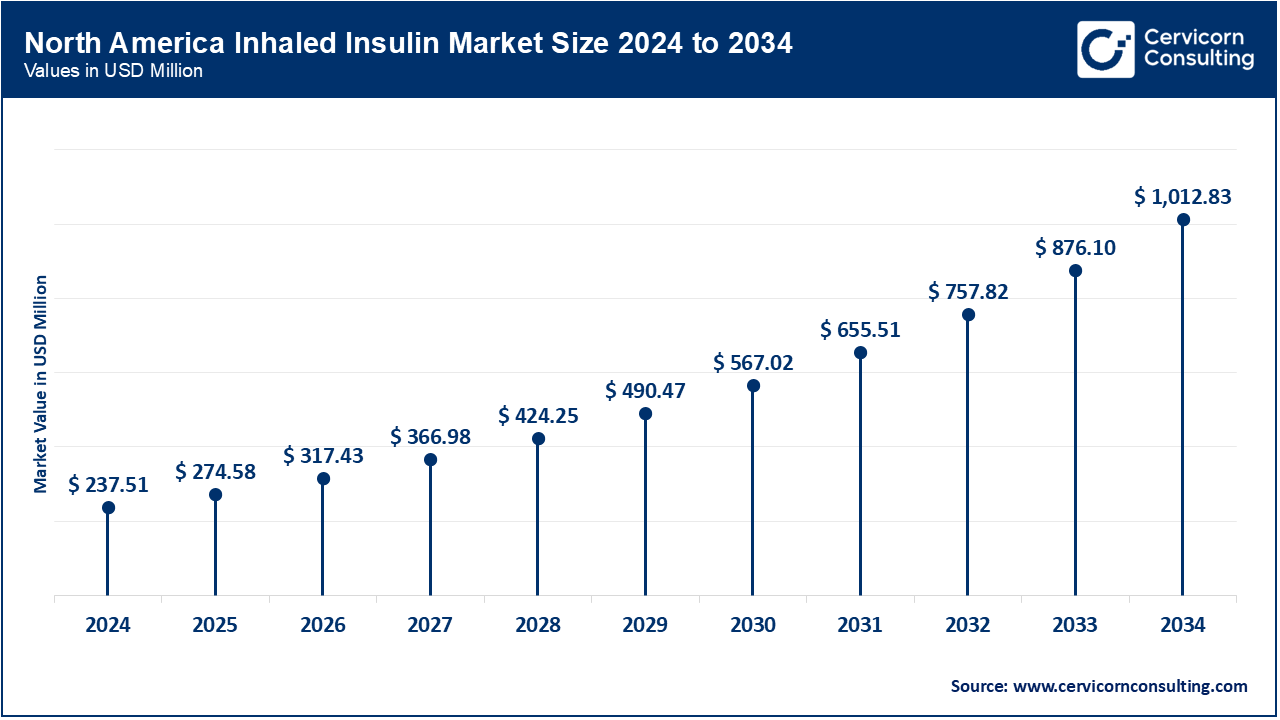

The North America inhaled insulin market size was valued at USD 237.51 million in 2024 and is expected to reach around USD 1,012.83 million by 2034. North America dominates the market due to its well-established healthcare infrastructure, high awareness of diabetes management, and early adoption of innovative treatments like Afrezza. The United States holds a strong position with high diabetes prevalence, favorable reimbursement rates, and widespread support for FDA-approved products. Furthermore, the presence of key pharmaceutical giants and ongoing clinical trials in the region facilitate stable growth. The trend towards non-invasive, convenient insulin delivery systems also drives demand in North America.

The Asia-Pacific inhaled insulin market size was estimated at USD 152.25 million in 2024 and is projected to hit around USD 649.25 million by 2034. The Asia-Pacific region is witnessing the fastest growth, driven by a rapidly growing diabetic population, particularly in nations such as China and India. Increased healthcare spending, urbanization, and lifestyle changes are fueling a greater incidence of diabetes. Although awareness and acceptance of inhaled insulin are still emerging, increased access to healthcare services, heightened government efforts, and rising pharmaceutical investment make APAC an extremely promising market. Attempts to introduce low-cost inhaled insulin alternatives are also expected to drive expansion in this region.

The Europe inhaled insulin market size was accounted for USD 182.70 million in 2024 and is predicted to surpass around USD 779.10 million by 2034. Europe represents a growing market, supported by a strong focus on innovation, regulatory clearances, and patient-oriented healthcare paradigms. Germany, the UK, and France are pursuing cutting-edge solutions for diabetes care, including inhaled insulin. While the level of market penetration is moderate compared to that in North America, heightened public awareness campaigns, positive reimbursement settings, and health system digitization are driving markets to adopt. The region's focus on enhancing the quality of life for diabetic patients favors the adoption of non-invasive insulin delivery approaches.

The LAMEA inhaled insulin market size was valued at USD 36.54 million in 2024 and is anticipated to reach around USD 155.82 million by 2034. The LAMEA region is an emerging market, driven by improved healthcare access and a growing prevalence of diabetes. Adoption rates are low due to limited availability and costs, but healthcare reforms and foreign investments in the pharmaceutical sector are likely to enhance market conditions. Latin American countries such as Brazil and Mexico show significant potential due to rising healthcare awareness and the demand for modern diabetes care. Economic growth and urbanization in the Middle East and Africa are expected to drive gradual growth over the next few years.

The inhaled insulin market is segmented into product type, indication, distribution channel, end user, and region. Based on product type, the market is classified into rapid-acting inhaled insulin, and long-acting inhaled insulin. Based on the indication, the market is categorised into type 1 diabetes, and type 2 diabetes. Based on distribution channel, the market is classified into hospital pharmacies, retail pharmacies, online pharmacies, and diabetes clinics & specialty centers. Based on end user, the market is classified into hospitals, homecare settings, specialty clinics, and ambulatory surgical centers (ASCs).

Rapid-acting inhaled insulin dominates the market due to its ability to precisely replicate the human body's natural insulin response during mealtime. It acts quickly, with peak action occurring within 12–15 minutes, providing swift control of post-meal blood glucose surges. Rapid-acting forms, including Afrezza, have gained popularity as people seek quicker and more convenient insulin delivery. This segment is favored by type 1 and type 2 diabetic patients who require efficient mealtime insulin without injections, making it a strong market contender.

The long-acting inhaled insulin segment is the fastest-growing due to its potential to offer a once-daily insulin option for diabetes patients. As the market for long-acting insulins expands, patients are increasingly looking for easy, needle-free solutions that provide sustained blood glucose control. Although still in its early stages, this sector is expected to grow rapidly, particularly as clinical trials continue to show positive results regarding safety and efficacy, generating strong interest from both patients and healthcare providers.

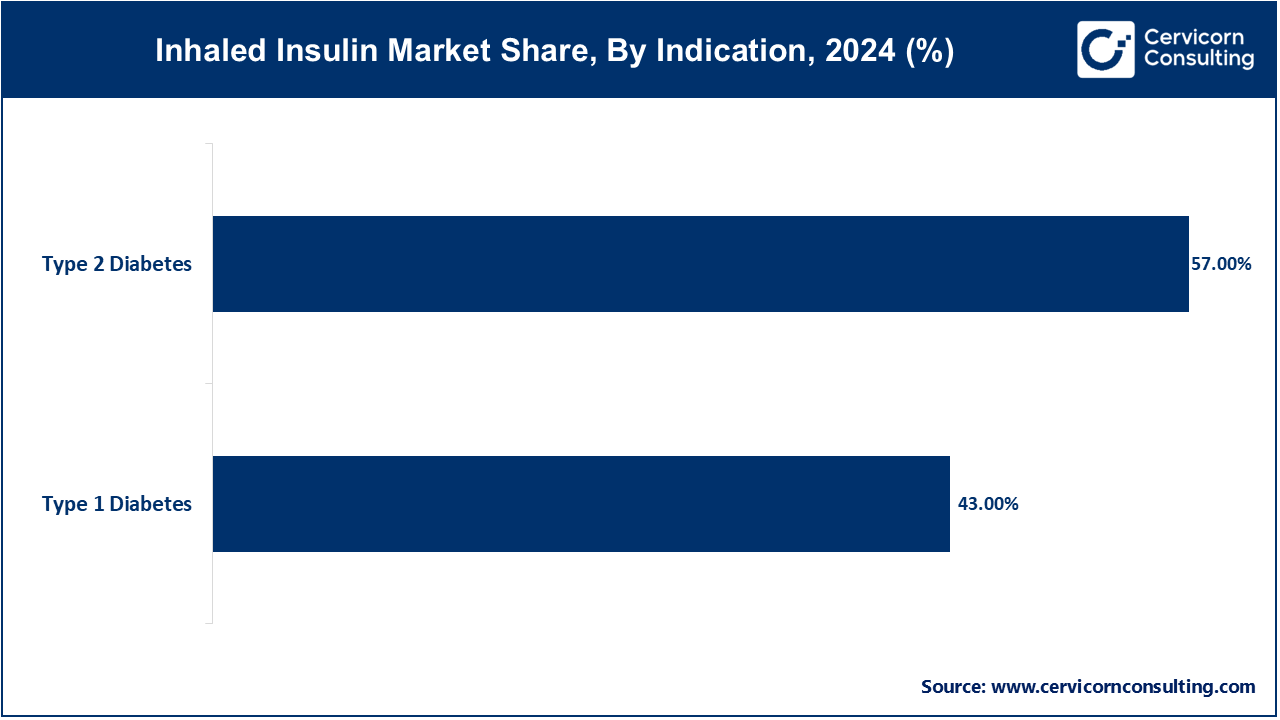

Type 2 diabetes dominates the inhaled insulin market due to its higher prevalence compared to type 1 diabetes. The increasing global incidence of type 2 diabetes, driven by lifestyle factors such as obesity, sedentary behavior, and poor diet, has created a significant demand for alternative insulin delivery methods. Inhaled insulin offers a noninvasive solution that appeals to patients needing mealtime insulin therapy who wish to avoid traditional injections, thus driving its widespread use in managing type 2 diabetes.

The type 1 diabetes segment is the fastest-growing segment within the inhaled insulin market, primarily due to the increasing accessibility of quick-acting inhaled insulin. This provides a viable and convenient alternative to multiple daily injections for type 1 diabetes care. As further clinical research and trials validate the safety and efficacy of inhaled insulin for type 1 diabetes, demand for needle-free insulin solutions continues to rise, making this sector a critical area for expansion.

Retail pharmacies are the dominant distribution channel for inhaled insulin due to their wide accessibility and convenience for patients. Patients can easily obtain inhaled insulin products from local retail pharmacies, which are typically well-stocked with diabetes medications. This convenience is a key factor contributing to the high sales volume through this channel, making it the most prevalent distribution method for inhaled insulin.

The online pharmacy segment is the fastest-growing distribution channel for inhaled insulin. With the rise of e-commerce and the increasing trend toward online healthcare shopping, patients are opting for the convenience of purchasing insulin products from online platforms. This segment is experiencing rapid growth, driven by factors such as doorstep delivery, privacy concerns, and the increasing use of telemedicine and remote healthcare services, making it an attractive option for patients seeking easy access to medications.

Hospitals are the dominant end-user segment for inhaled insulin due to their primary role in patient care, especially for individuals with complex diabetes cases or intensive treatment regimens. Hospitals provide a controlled environment for administering insulin therapies, including inhaled insulin, and have the necessary medical infrastructure and skilled professionals to monitor patient responses effectively. This establishes its leading position in the marketplace.

The homecare settings segment is the fastest-growing end-user segment for inhaled insulin. With an increasing number of diabetic patients managing their conditions at home through self-monitoring and self-administration of insulin, there is a rising demand for home-friendly insulin delivery methods. Inhaled insulin offers a more comfortable and convenient option for home use, which accounts for the rapid adoption among patients who prefer to manage their condition outside of a clinical setting. This trend is anticipated to accelerate as patients seek more flexible and accessible treatment options for managing diabetes at home.

The competitive landscape of the inhaled insulin market is moderately consolidated, with a few key players dominating due to their technological expertise, regulatory approvals, and established distribution networks. MannKind Corporation, with its flagship product Afrezza, holds a significant market share and remains the frontrunner in this field. Other notable players include Dance Biopharm (now Aerami Therapeutics) and Novo Nordisk, which are investing in research and development to introduce more advanced, patient-friendly inhaled insulin formulations. Strategic collaborations, product innovations, and an expanding geographical presence are common approaches adopted by these companies to maintain competitiveness and cater to the growing global demand for non-invasive insulin therapies.

Market Segmentation

By Product Type

By Indication

By Distribution Channel

By End User

By Region