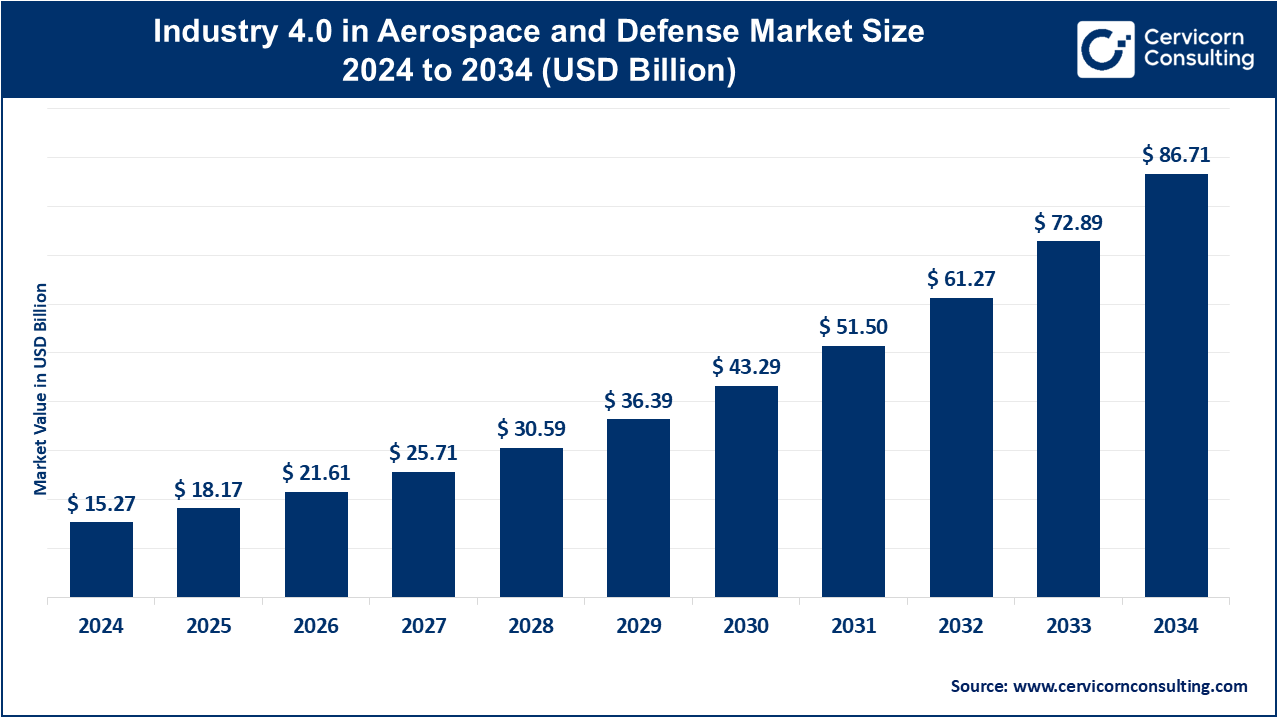

The global industry 4.0 in aerospace and defense market size was valued at USD 15.27 billion in 2024 and is expected to surpass around USD 86.71 billion by 2034, exhibiting at a compound annual growth rate (CAGR) of 18.96% over the forecast period 2025 to 2034. The aerospace and defense (A&D) sector is undergoing revolutionary growth with the application of Industry 4.0 technologies like artificial intelligence (AI), machine learning (ML), Internet of Things (IoT), advanced robots, and digital twin technologies. These technologies are facilitating smarter manufacturing processes, making it possible to monitor, maintain, and manage supply chains in real-time. Increased operational efficiency, cost reduction, and safety are some of the key drivers in this sector. For example, Boeing has adopted digital twin technology to simulate and optimize airplane systems, cutting down maintenance and system failure time significantly. Furthermore, defense agencies like the U.S. Department of Defense have been investing heavily in additive manufacturing and AI-based logistics to automate and improve readiness.

Another key growth driver is the heightened geopolitical tensions and global defense modernization efforts putting pressure on countries to adopt cutting-edge technologies to remain at the forefront. Airbus partnered with Palantir Technologies in 2024 to speed up its digital transformation utilizing big data and analytics to predict fleet maintenance and streamline supply chains. Similarly, the NATO DIANA program (Defense Innovation Accelerator for the North Atlantic) has been financing startups employing Industry 4.0 innovations to solve defense-related problems. Sustainability goals are also putting pressure on aerospace companies to adopt smart manufacturing to be energy efficient and reduce emissions. Such technologies not only improve product lifecycle management but also enable quicker innovation cycles, hence making Industry 4.0 a growth driver for the future in the A&D sector.

What is Industry 4.0 in Aerospace and Defence?

In aerospace and defense (A&D), "Industry 4.0" refers to the incorporation of cutting-edge technologies such as automation, artificial intelligence (AI), the Internet of Things (IoT), big data analytics, and additive manufacturing to maximize output, boost operational effectiveness, and optimize decision-making within the industry. The use of digital twins for real-time system simulations, predictive maintenance to minimize downtime, and smart manufacturing to provide precise production control are important elements. For instance, Lockheed Martin has implemented 3D printing for quick prototyping and part production, while Boeing uses AI and machine learning to ensure quality control in aircraft assembly. Big data analytics enhances supply chain management and operational readiness, and IoT-enabled devices are used to track the condition of equipment. The aerospace and defense industries are experiencing faster innovation cycles, improved performance, and lower costs as a result of this digital transformation.

Artificial Intelligence and Machine Learning in Aerospace and Defense

Artificial intelligence and machine learning are transforming aerospace and defense by enabling predictive maintenance, autonomous systems, and real-time decision-making. These technologies optimize operations and improve safety by predicting equipment failure and optimizing fleet management. Companies like GE Aerospace are incorporating AI to improve operational efficiency and optimize fleet performance.

Additive Manufacturing (3D Printing) in Aerospace and Defense

Additive manufacturing, or 3D printing, is revolutionizing the manufacture of aerospace and defense products by allowing the creation of sophisticated, lightweight components with reduced waste and shorter cycle times. The technology can be applied to on-demand production, which erases supply chain risks and makes aircraft more fuel-efficient.

Digital Twins and Digital Thread in Aerospace and Defense

Digital twins and the digital thread are revolutionizing the way aerospace and defense manufacturers handle product lifecycles by mimicking physical assets with virtual counterparts. They facilitate real-time monitoring and simulation, speeding up product development, predictive maintenance, and decision-making across the lifecycle.

Edge Computing and IoT in Aerospace and Defense

Edge computing and the Internet of Things (IoT) are enhancing aerospace and defense sectors with real-time data capture and analysis at the point of origin, reducing latency and enhancing decision-making to the fullest. This is needed for mission-critical applications, which require immediate response to potential issues without centralized data processing.

Report Scope

| Area of Focus | Details |

| Market Size in 2025 | USD 18.17 Billion |

| Expected Market Size in 2034 | USD 86.71 Billion |

| Projected CAGR from 2025 to 2034 | 18.96% |

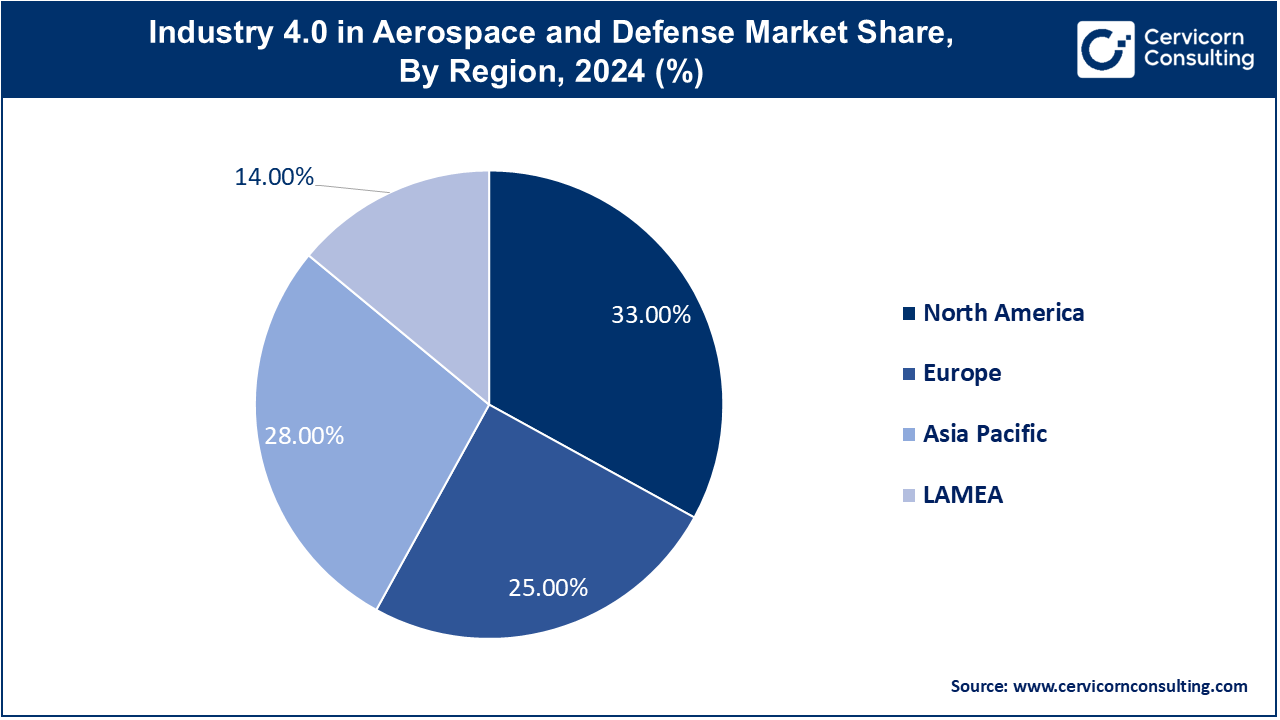

| Dominant Region | North America |

| Fastest Growing Region | Asia-Pacific |

| Key Segments | Component, Technology, Deployment Mode, Application, End User, Region |

| Key Companies | Boeing, Lockheed Martin, Raytheon Technologies, Airbus, Northrop Grumman, General Electric (GE Aerospace), Honeywell Aerospace, BAE Systems, Rolls-Royce, Safran Group, Siemens |

Enhanced Operational Efficiency

Cost Reduction and Innovation

High Initial Investment

Cybersecurity Risks

Supply Chain Optimization

Sustainability and Environmental Impact

Integration Complexities

Workforce Transformation

The Industry 4.0 in aerospace and defense market is segmented into various regions, including North America, Europe, Asia-Pacific, and LAMEA.

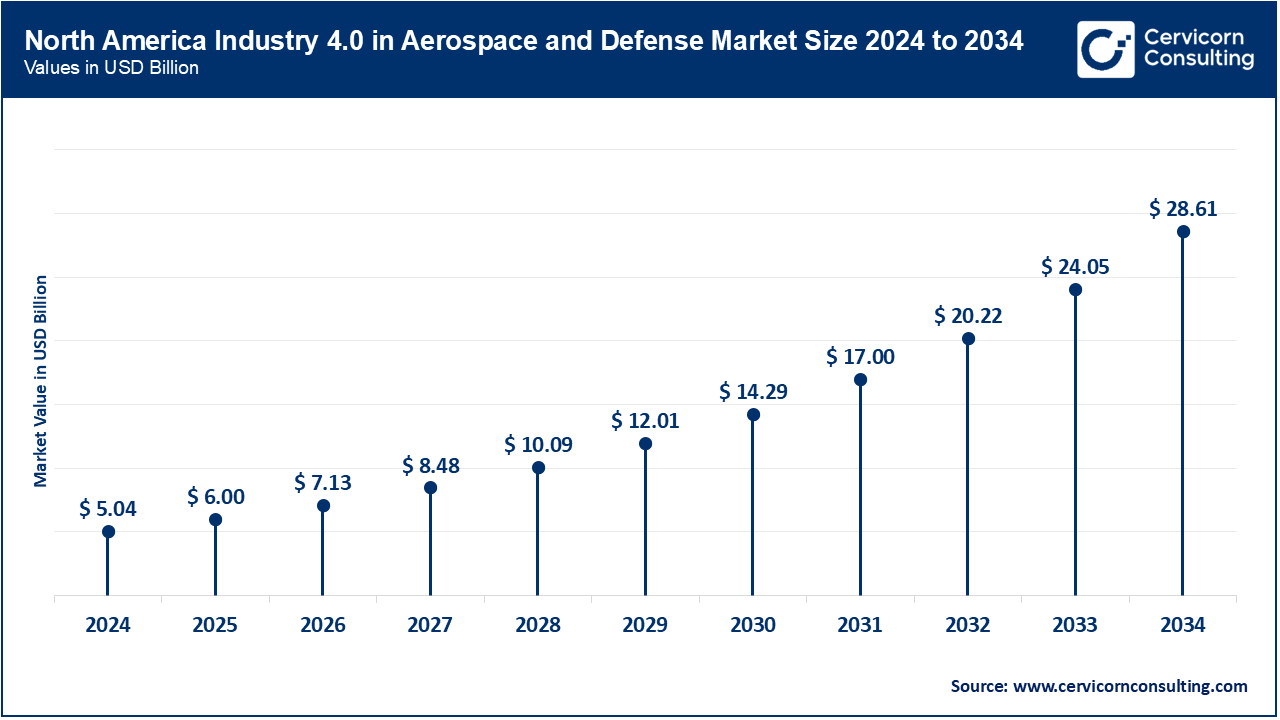

The North America industry 4.0 in aerospace and defense market size was reached at USD 5.04 billion in 2024 and is expected to surpass around USD 28.61 billion by 2034. North America, particularly the United States, leads in the adoption of Industry 4.0 within the aerospace and defense sectors. This progress is driven by high defense spending, a robust aerospace manufacturing base, and significant digital transformation efforts by major players such as Boeing, Lockheed Martin, and Raytheon Technologies. The U. S. Department of Defense continues to invest heavily in AI, cybersecurity, autonomous systems, and digital twin technologies to enhance its military capabilities. In 2024, the Pentagon launched several smart warfare programs that combine AI and data analytics with mission planning and logistics, further strengthening regional supremacy.

The Asia-Pacific industry 4.0 in aerospace and defense market size was estimated at USD 4.28 billion in 2024 and is projected to hit around USD 24.28 billion by 2034. APAC is the fastest-growing region in the Industry 4.0 aerospace and defense market, driven by substantial investments from countries such as China, India, Japan, and South Korea in defense modernization and intelligent manufacturing. China's "Made in China 2025" and India's "Make in India" initiatives are encouraging aerospace companies to adopt automation, IoT, and AI. In 2024, India's Hindustan Aeronautics Limited (HAL) introduced AR/VR-based training simulations for aircraft assembly, while China's AVIC utilized 3d printing and predictive maintenance for military aircraft platforms.

The Europe industry 4.0 in aerospace and defense market size was accounted for USD 3.82 billion in 2024 and is predicted to surpass around USD 21.68 billion by 2034. Europe holds a significant market share, with companies like Airbus, BAE Systems, and Rolls-Royce adopting Industry 4.0 technologies to improve manufacturing efficiency, sustainability, and digital innovation. The European Defense Fund (EDF) and initiatives such as "Clean Sky" are funding the integration of digital twins, intelligent robotics, and additive manufacturing to develop greener, smarter aircraft systems. In 2024, Airbus expanded its use of edge computing and real-time analytics to enhance supply chain transparency and reduce carbon emissions in its manufacturing facilities.

The LAMEA industry 4.0 in aerospace and defense market size was valued at USD 2.14 billion in 2024 and is anticipated to reach around USD 12.14 billion by 2034. The LAMEA region is in the early stages of Industry 4.0 adoption in aerospace and defense but is making steady progress due to rising defense budgets and government-supported aerospace development. Middle Eastern countries like the UAE and Saudi Arabia are investing in AI-based drone technologies and intelligent surveillance as key components of national defense. In 2024, Saudi Arabia's GAMI (General Authority for Military Industries) launched a digital transformation program to localize smart aerospace production. Latin America and Africa are gradually exploring automation and IoT to enhance aircraft maintenance and military logistics.

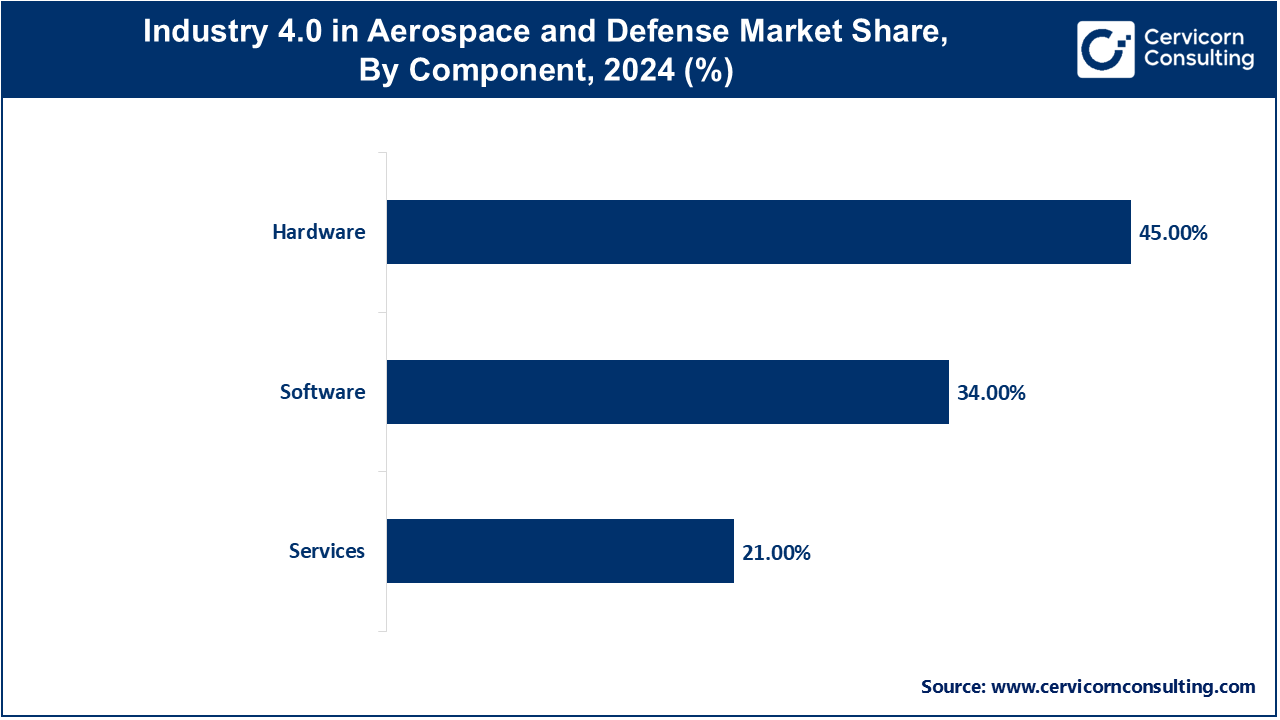

The Industry 4.0 in aerospace and defense market is segmented into component, technology, deployment mode, application, end user, and region. Based on the components, the market is classified into hardware, software, and services. Based on the technology, the market is categorised into Internet of Things (IoT), Artificial Intelligence (AI) and Machine Learning (ML), Big Data & Analytics, Augmented Reality (AR) / Virtual Reality (VR), Digital Twin Technology, Robotics and Automation, 3D Printing / Additive Manufacturing, Cybersecurity, Cloud Computing, and Edge Computing. Based on deployment mode, the market is classified into on-premises, cloud-based, and hybrid. Based on application, the market is categorised into design & engineering, manufacturing & assembly, supply chain & logistics, maintenance, repair, and overhaul (MRO), quality control and inspection, simulation and training, inventory management, and predictive maintenance. Based on end user, the market is classified into commercial aviation, defense, space agencies and companies, unmanned aerial vehicles (uavs) / drones sector, and maintenance, repair & overhaul (MRO) providers.

Hardware holds the largest share in the Industry 4.0 aerospace and defense market due to the physical hardware like IoT sensors, robots, AR/VR headsets, and 3D printers is at the core. These are the building blocks for automation and data collection on defense systems, aircraft, and shop floors. Boeing and Lockheed Martin employ cutting-edge hardware to enable real-time monitoring and improved production.

Services are emerging as the fastest-growing component segment, driven by the increasing demand for managed services, system integration, and consulting. As aerospace and defense firms transform their businesses digitally, they increasingly turn to skilled service providers to roll out, operate, and extend Industry 4.0 technology. This can be seen in the fact that firms like Accenture and Deloitte offer end-to-end digital transformation offerings.

IoT is the most dominant technology in aerospace and defense, enabling real-time device monitoring, aircraft health analysis, and intelligent logistics. For instance, in 2024, Boeing used IoT-based systems in all its aircraft fleets to enhance operational visibility and reduce unplanned maintenance.

Digital twin technology is the fastest-growing segment due to its ability to replicate physical systems virtually for testing, monitoring, and predictive maintenance. In 2024, Lockheed Martin and GE Aerospace rapidly expanded their use of digital twins to enhance aircraft performance and reduce lifecycle costs, propelling adoption in defense and aviation.

On-premises deployment dominates the market due to stringent security, data sovereignty, and compliance requirements in aerospace and defense. Military and defense contractors prefer to own the infrastructure and data outright, especially when they work with mission-critical systems or sensitive designs.

Cloud-based deployment is growing the fastest, fueled by scalability, remote access, and affordability. Companies such as NASA and space startups are adopting cloud platforms for real-time collaboration, simulation, and analytics to facilitate faster innovation and decision-making.

Manufacturing and assembly remain the leading application segment, driven by the need for intelligent manufacturing, robotics, and additive manufacturing. Aerospace firms like Airbus and Raytheon Technologies are spending on making production lines autonomous to achieve greater precision, less wastage, and quicker delivery timelines.

Predictive maintenance is the fastest-growing application, as aerospace and defense companies seek to reduce unplanned downtime and optimize scheduling. In 2024, GE Aerospace implemented AI-based predictive systems on several military fleets, achieving lower costs and greater mission readiness.

The defense sector dominates the Industry 4.0 market, with government-backed modernization programs heavily investing in AI, robotics, cybersecurity, and digital twins. The U.S., Chinese, and NATO military forces are integrating these technologies for smart warfare, logistics, and fleets.

The UAVs/drones sector is expanding rapidly with the incorporation of AI, real-time analysis of data, and edge computing to enable autonomous flight. In 2024, General Atomics and Northrop Grumman employed AI-powered drones to carry out surveillance and tactical operations, reflecting greater reliance on intelligent unmanned systems.

The industry 4.0 in aerospace and defense market features a highly competitive environment driven by rapid technological advancements and increasing demand for digital transformation across defense and aerospace operations. Organizations are placing emphasis on embracing smart manufacturing technologies, including IoT-based systems, AI-powered analytics, digital twins, and cybersecurity solutions, to improve operating efficiency, drive costs down, and maintain mission-readiness. The industry is experiencing a spate of collaborations, strategic partnerships, and R&D driven by innovation to modernize production, maintenance, and logistics. During 2024, the competitive interest turned to real-time aircraft analytics, AR/VR-enabled training modules, and predictive maintenance tools to enhance safety, minimize downtime, and bolster defense capabilities across the world.

Market Segmentation

By Component

By Technology

By Deployment Mode

By Application

By End User

By Region