The India smart electricity meter market size was valued at USD 305.81 million in 2025 and is expected to be worth around USD 1,721.94 million by 2035, exhibiting at a compound annual growth rate (CAGR) of 18.9% over the forecast period from 2026 to 2035. India smart electricity meter market is growing because the government has strong policies and financial support to install smart meters across the country. The government's schemes aim to modernize the power grid, reduce energy losses, improve billing accuracy, and replace old meters with smart meters under programs like the Revamped Distribution Sector Scheme. These measures help utilities manage peak loads better and give consumers easier access to real-time usage data, which boosts the adoption of smart electricity meters across residential and commercial segments.

Another key factor driving the India smart electricity meter market is the rising electricity demand from rapid urbanization and growth in population that increases the need for efficient energy management. Smart meters help reduce transmission losses, support advanced metering infrastructure, and encourage energy conservation. A recent example is the installation of 47.6 million smart electricity meters across India under various government schemes, showing how the market is expanding quickly toward nationwide digitalization of power distribution systems.

Strong Government Policy Support and Investment Driving Market Growth

India smart electricity meter market is strongly driven by clear government policy support and large public investment in power distribution reforms. The central government is actively funding smart meter deployment to reduce power losses, improve billing efficiency, and strengthen the financial health of distribution companies. Programs like nationwide smart metering targets encourage utilities to replace traditional meters with smart meters at a large scale. These policies lower project risk for private players, attract technology providers, and speed up adoption across states. As a result, consistent government investment creates stable demand and plays a major role in accelerating the growth of the India smart electricity meter market.

Key Government Policies:

| Policy Name | Launched By | Key Details |

| Revamped Distribution Sector Scheme (RDSS) | Government of India (Ministry of Power) | Focuses on reducing AT&C losses, improving billing efficiency, and large-scale deployment of prepaid smart meters for DISCOMs with central financial support. |

| Smart Meter National Programme (SMNP) | Ministry of Power & EESL | Aims to replace conventional electricity meters with smart prepaid meters through bulk procurement and implementation across states. |

| Advanced Metering Infrastructure (AMI) Guidelines | Ministry of Power | Provides technical and operational guidelines for smart meters, communication systems, and data management to standardize nationwide smart metering projects. |

Rapid Growth in Smart Electricity Meter Adoption Accelerating Market Expansion in India

The sharp rise in smart electricity meter adoption from 2018 to 2025 clearly shows accelerating implementation across India, especially after 2022. Early years reflect pilot projects and limited rollouts, while the steep jump in recent years highlights large-scale execution driven by government-backed programs and utility reforms. This rapid increase creates strong demand for meter manufacturing, communication technologies, installation services, and data management platforms. As adoption scales quickly, it encourages further investment, strengthens supplier confidence, and pushes utilities to modernize operations, directly driving sustained growth of the India smart electricity meter market.

1. Deployment of Over 47 Million Smart Meters

In December 2025, India’s smart meter rollout reached a milestone of 47 million smart electricity meters installed across the country. This large-scale deployment shows rapid progress in replacing old analog meters and helps utilities collect accurate data, reduce losses, and improve billing efficiency. This milestone increases utility confidence and accelerates further investment in smart grid technologies.

2. Government Reports 34.6 Million Smart Meters Installed Under RDSS

In July 2025, the Ministry of Power reported that 34.6 million smart meters have been installed across India under the Revamped Distribution Sector Scheme (RDSS) with over 203 million meters sanctioned. This milestone reflects strong policy support and financial backing, driving the market by creating predictable demand for meter manufacturers and service providers.

3. Wirepas Deploys 5 Million Smart Meters Across Multiple States

In early 2025, Wirepas achieved the deployment of more than 5 million smart electricity meters using Mesh technology in states such as Assam, Bihar, Gujarat, and Maharashtra. This private sector achievement demonstrates successful large-scale technology implementation and encourages more companies to participate in the India smart electricity meter market.

4. Government Plans Full Interoperability for Smart Meters by 2026–27

In December 2025, the Indian government announced plans to enforce full interoperability for smart electricity meters so that meters from different manufacturers can work seamlessly with any utility system. This milestone will drive market growth by reducing vendor lock-in, lowering costs, and increasing flexibility for utilities when choosing smart meters, which attracts more competition and innovation.

The India smart electricity meter market is segmented into phase, communication technology, technology, end-user, and region.

Single-phase meters dominate the India smart electricity meter market because most residential electricity connections operate on single-phase supply. Large-scale government programs prioritize household-level meter replacement to improve billing accuracy and reduce power theft. Utilities prefer single-phase meters due to their lower procurement cost and faster installation time. Easy maintenance and suitability for both urban and rural deployment further strengthen their dominant position.

India Smart Electricity Meter Market Share, By Phase, 2025 (%)

| Phase | Revenue Share, 2025 (%) |

| Single-Phase Meters | 71.8% |

| Three-Phase Meters | 28.2% |

Three-phase meters are the fastest-growing segment due to increasing power demand from commercial complexes and industrial facilities. Expansion of manufacturing hubs, warehouses, and infrastructure projects increases the need for higher load capacity and reliable power monitoring. These meters support better voltage regulation and energy quality analysis. Growth in industrial electrification and commercial real estate continues to drive strong adoption.

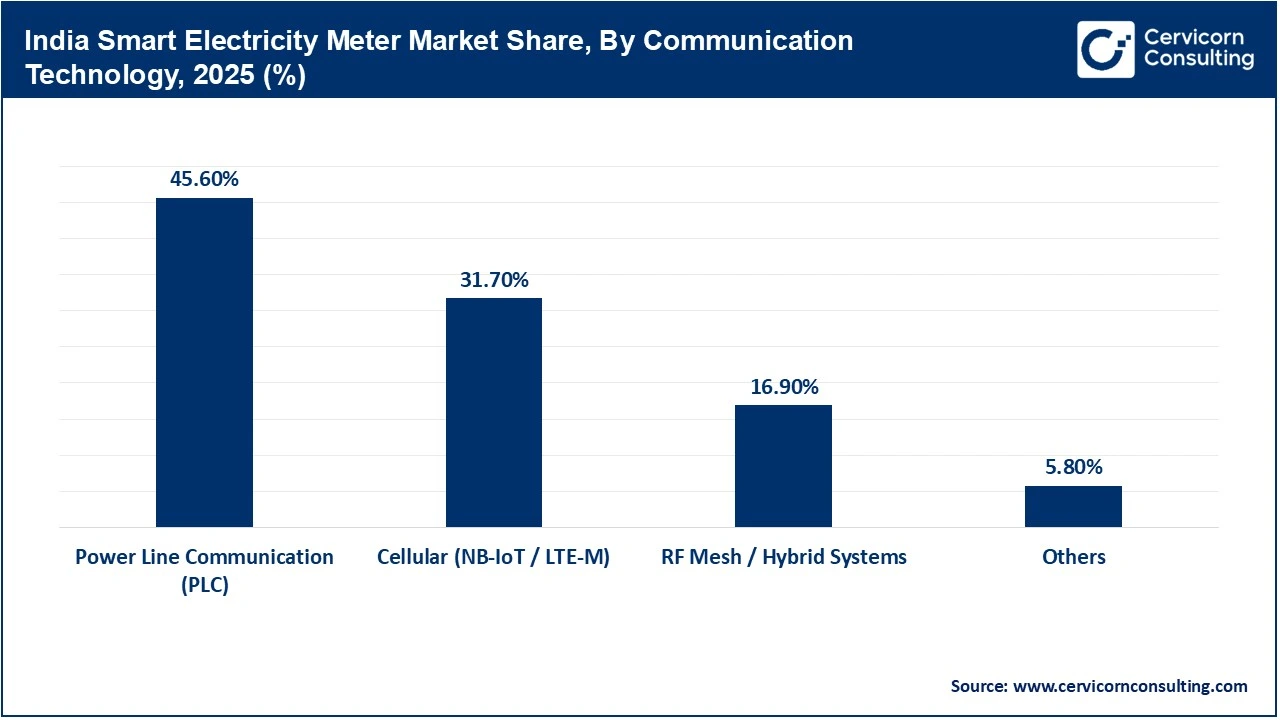

Power Line Communication dominates the India smart electricity meter market because it uses existing power distribution lines to transmit data. This approach reduces dependency on external telecom networks and lowers deployment complexity. Utilities favor PLC for wide-area rollouts, especially in rural and semi-urban regions. Its proven performance and compatibility with legacy grid systems support continued dominance.

Cellular communication is the fastest-growing segment due to expanding mobile network coverage and improved reliability of IoT technologies. NB-IoT and LTE-M enable secure, real-time data transmission and remote meter control. Utilities increasingly adopt cellular solutions in urban areas where fast deployment is needed. Declining connectivity costs and better network penetration accelerate growth.

Automatic Meter Reading dominates the India smart electricity meter market because it provides a practical and affordable solution for basic automation. AMR systems reduce human error and improve billing efficiency without major infrastructure upgrades. Utilities with limited budgets often prefer AMR as an initial modernization step. Its simplicity and shorter implementation timelines make it widely adopted.

India Smart Electricity Meter Market Share, By Technology, 2025 (%)

| Technology | Revenue Share, 2025 (%) |

| Automatic Meter Reading (AMR) | 57.9% |

| Advanced Metering Infrastructure (AMI) | 42.1% |

Advanced Metering Infrastructure is the fastest-growing segment driven by strong government focus on smart grid development. AMI supports two-way communication, prepaid billing, demand response, and remote disconnection. These capabilities help utilities improve operational efficiency and consumer service. Long-term cost savings and policy incentives continue to boost adoption.

The residential segment dominates the India smart electricity meter market due to the large number of household electricity consumers. Government-led smart meter programs mainly target residential users to improve revenue collection and reduce theft. High-volume installations create economies of scale for manufacturers. Rising urban housing development and rural electrification strengthen this segment's dominance.

India Smart Electricity Meter Market Share, By End-User, 2025 (%)

| End-User Segment | Revenue Share, 2025 (%) |

| Residential | 67.6% |

| Commercial | 20.4% |

| Industrial | 12.0% |

The commercial segment is the fastest-growing as electricity consumption increases in offices, malls, hospitals, and educational institutions. These users demand better control over energy usage and billing transparency. Smart meters support peak load management and energy efficiency initiatives. Rapid urbanization and expansion of service-based industries drive sustained growth in this segment.

Market Segmentation

By Phase

By Communication Technology

By Technology

By End-User