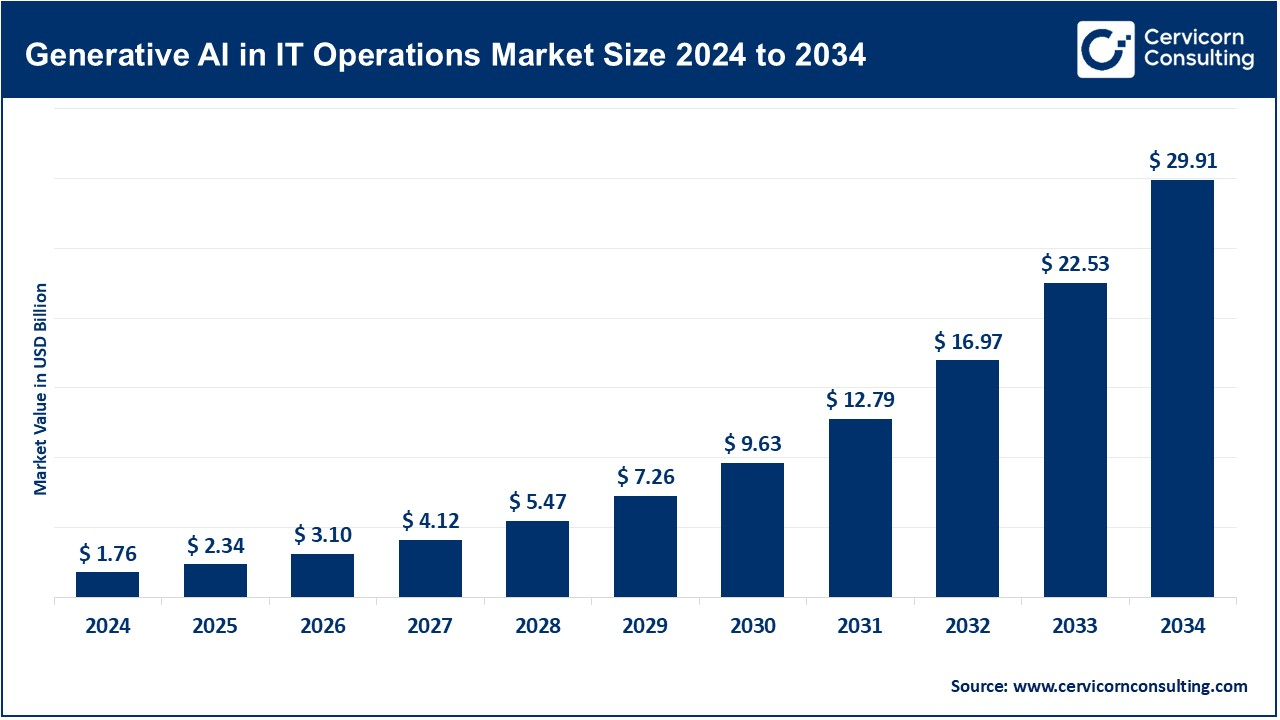

The global generative AI in IT operations market size was valued at USD 1.76 billion in 2024 and is expected to be worth around USD 29.91 billion by 2034, exhibiting a compound annual growth rate (CAGR) of 32.74% over the forecast period 2025 to 2034. The generative AI in IT operations market is primarily driven by the growing need for automation and intelligent decision-making across complex IT infrastructures. With the increasing scale of digital changes, organizations face huge amounts of IT events, alerts, and data logs, which are difficult and error-prone to monitor manually. The generative AI Real-Time Route Cost Analysis enables automated resolution by detecting and generating scripts, summaries, and recommendations, which reduces downtime and operating costs. Additionally, the integration of large language models (LLM) in IT operating equipment enhances broad adoption, enabling natural language questions and automated documents.

A major growth factor is the increasing demand for cost-efficient and scalable solutions in hybrid and multi-cloud environments. As enterprises expand their cloud footprints, managing distributed systems requires intelligent devices that can dynamically adapt. Generative AI fills this gap by offering reference-awareness and automation. A recent example of this is the launch of ServiceNow's "New Assist" in 2024, which uses generative AI to provide a ticket summary and resolution suggestion. This innovation has helped reduce the time of IT service resolution by 40% in pilot enterprise settings, demonstrating the tangible effects of generative AI on operational efficiency.

What is a Generative AI in IT Operations?

Generative AI in IT Operations refers to the application of generative artificial intelligence technologies, such as large language models (LLMs), natural language processing (NLP), and generative neural networks, to automate, optimize, and enhance IT operational processes. These systems go beyond traditional surveillance by generating materials such as resolution scripts, event summaries, future state models, and intelligent alerts. Major applications include automatic event reaction, root cause analysis, smart alerting, predictive maintenance, log analysis, and documentation generation. This empowers IT teams to reduce manual workloads, respond rapidly to issues, and maintain high system availability.

Adoption Trends of Generative AI in IT Operations:

| Insight | Description |

| Reduction in IT incident resolution time | Up to 40% with GenAI-powered tools like ServiceNow's Now Assist |

| Adoption among global enterprises (pilot stage) | Over 60% of Fortune 500 testing GenAI in IT operations (2024 data) |

| Accuracy improvement in root cause prediction | ~30–50% higher than rule-based AIOps systems |

| Increase in IT operations automation | 55% of IT tasks can be automated using LLM-based systems |

| Impact on operational costs | Up to 25% cost savings reported in large-scale IT environments |

| Popularity of natural language interfaces in ITOps | 70% of IT admins prefer GenAI-powered interfaces for usability |

Integration of GenAI with ITSM Platforms

Generative AI is becoming a core feature in modern IT Service Management (ITSM) tools, where it's transforming how incidents are logged, processed, and resolved. Platforms like ServiceNow have integrated GenAI into their ecosystem through products like Now Assist, which automatically generates incident summaries, suggests solutions, and even drafts responses. This has enabled IT teams to reduce manual workload and improve operational efficiency significantly. In 2024, several enterprises reported that Now Assist helped cut incident resolution time by up to 40%, showcasing its impact in real-world IT environments.

Rise of Natural Language Interfaces for ITOps

One of the most user-centric advancements in Generative AI for IT operations is the widespread adoption of natural language interfaces. These interfaces allow IT personnel to interact with systems using plain English commands or questions, making tools more accessible and reducing the learning curve for new users. IBM Watsonx Assistant, for example, allows administrators to ask questions like “Why did server X crash last night?” and receive contextual responses generated by AI. This trend is democratizing IT operations and enabling faster onboarding and decision-making, especially in large-scale support environments.

Predictive Automation Using LLMs

Beyond reactive support, Generative AI is enabling predictive automation in IT operations. By leveraging large language models trained on historical incident data and logs, platforms can now forecast potential failures and suggest preventive measures. Dynatrace’s Davis AI exemplifies this trend by using predictive analytics and GenAI to alert teams before incidents occur and generate remediation scripts on the fly. This shift from reactive to proactive operations is reducing downtime and ensuring higher availability for critical services in sectors like finance, healthcare, and telecommunications.

Multi-Cloud & Hybrid Environment Support

As organizations increasingly operate across multiple cloud platforms and on-premise environments, Generative AI is being adapted to handle these complex infrastructures. Tools like Google Cloud’s Duet AI for DevOps are helping DevOps teams by automatically generating deployment scripts, optimizing resources, and identifying potential misconfigurations across cloud providers. With the ability to understand and manage hybrid workloads, GenAI ensures consistent performance and governance, empowering organizations to scale their operations without increasing risk or manual oversight.

Report Scope

| Area of Focus | Details |

| Market Size in 2025 | USD 2.34 Billion |

| Expected Market Size in 2025 | USD 29.91 Billion |

| Projected Market CAGR from 2025 to 2034 | 32.74% |

| Dominant Region | North America |

| Fastest Growing Region | Asia-Pacific |

| Key Segments | Component, Application, Deployment Mode, Enterprise Size, Region |

| Key Companies | Microsoft, IBM, Google Cloud (Alphabet), ServiceNow, Amazon Web Services (AWS), Splunk (Cisco), Dynatrace, BMC Software, Moogsoft, PagerDuty, Freshworks, Oracle |

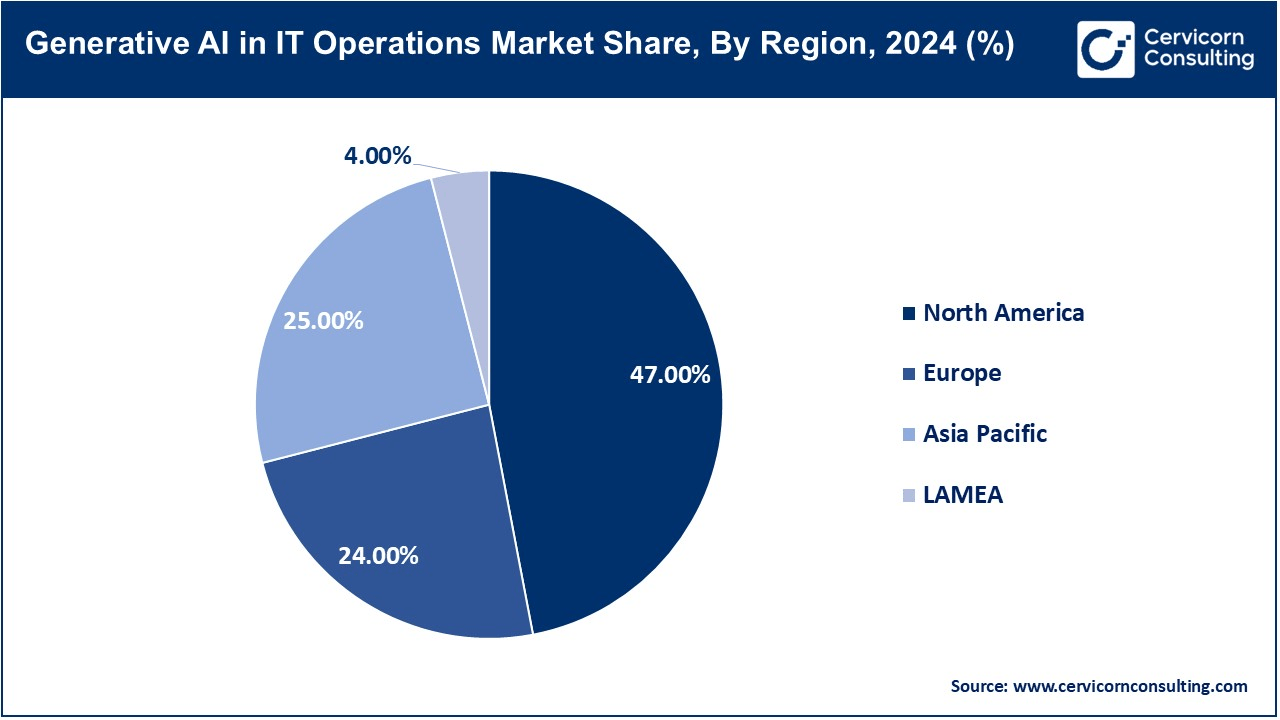

The generative AI in IT operations market is segmented into various regions, including North America, Europe, Asia-Pacific, and LAMEA.

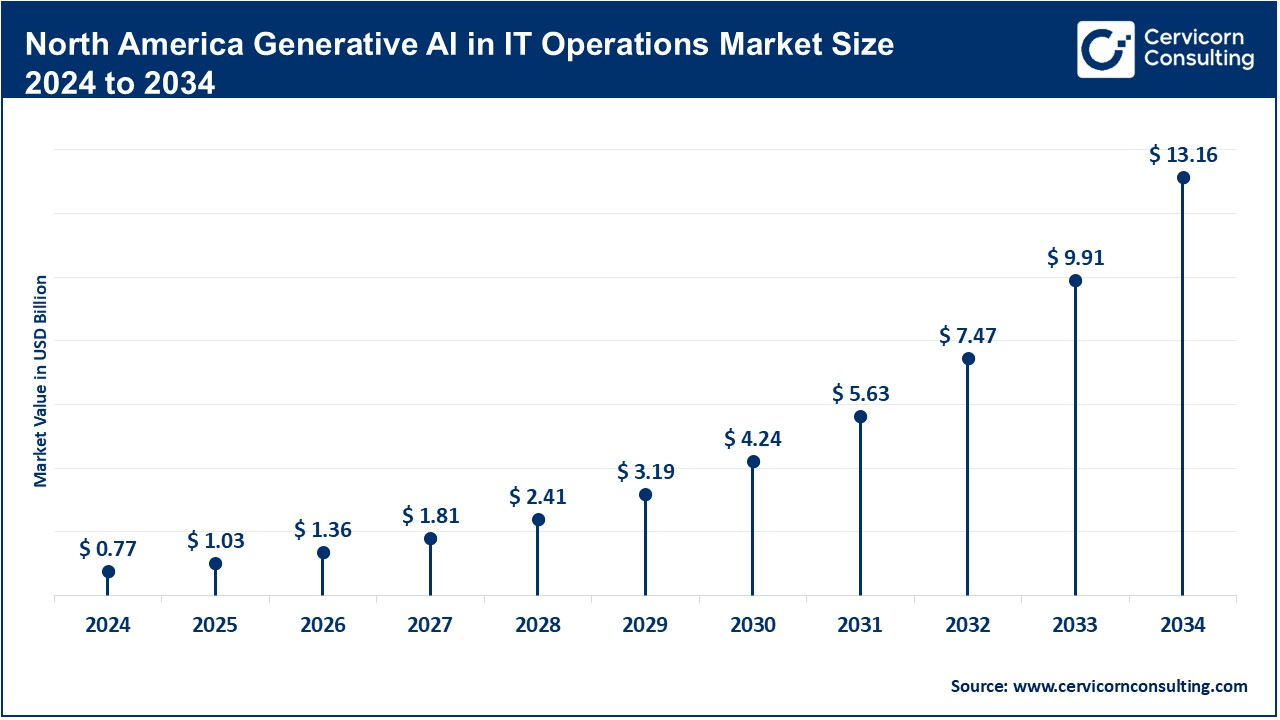

The North America generative AI in IT operations market size was valued at USD 0.77 billion in 2024 and is expected to reach around USD 13.16 billion by 2034. North America remains the dominant market, primarily due to its mature digital ecosystem, advanced cloud infrastructure, and high R&D investment. The region is home to leading GenAI vendors like IBM, Google, Microsoft, and ServiceNow, which continuously innovate to deliver robust IT operations tools. Adoption is particularly strong in industries such as BFSI, healthcare, and telecom, where real-time system availability and predictive maintenance are critical. Enterprises in North America also benefit from strong collaboration between academia and industry, producing a skilled talent pool and fostering innovation. However, challenges related to ethical AI deployment and data privacy continue to be closely monitored by regulators and enterprises alike.

The Asia-Pacific generative AI in IT operations market size was accounted for USD 0.44 billion in 2024 and is expected to hit around USD 7.48 billion by 2034. APAC is experiencing the fastest growth, thanks to widespread digital transformation initiatives, especially in countries like China, India, Japan, and Australia. Organizations across banking, manufacturing, retail, and government sectors are increasingly deploying GenAI for incident management, automation, and system forecasting. The rise of AI and 5G-backed smart cities, cloud-native startups, and tech-forward government policies (e.g., India’s Digital India mission and China’s Next Generation AI Plan) are major accelerators. However, the region faces challenges like uneven AI readiness across countries, infrastructure limitations in rural areas, and the need for improved AI governance frameworks. Despite this, the abundance of data, tech-savvy populations, and cost-effective AI talent are powerful growth enablers.

The Europe generative AI in IT operations market size was estimated at USD 0.42 billion in 2024 and is projected to surpass around USD 7.18 billion by 2034. Europe exhibits steady and resilient growth, driven by a strong regulatory environment, focus on data ethics, and demand for sustainable IT practices. Enterprises here are leveraging GenAI in IT operations to comply with stringent data protection laws like GDPR while improving system efficiency and uptime. Countries like Germany, France, and the UK are leading adopters, with a focus on integrating GenAI into smart infrastructure, Industry 4.0, and digital healthcare initiatives. Furthermore, the EU’s investments in AI research through programs like Horizon Europe are encouraging startups and enterprises to experiment with innovative IT solutions. Nonetheless, concerns over data localization and the cautious approach to third-party AI integration slightly moderate growth compared to North America and APAC.

The LAMEA generative AI in IT operations market size was valued at USD 0.07 billion in 2024 and is anticipated to reach around USD 1.20 billion by 2034. LAMEA (Latin America, Middle East, and Africa) presents high-growth potential, although it currently lags behind in adoption compared to other regions. Countries like the UAE, Saudi Arabia, and Brazil are investing in large-scale AI and smart city projects (e.g., Saudi Arabia’s NEOM and UAE’s AI Strategy 2031) that encourage GenAI use in IT and infrastructure management. Telecommunications and energy sectors are leading the charge, using GenAI for automated system monitoring, fault prediction, and capacity planning. However, the region faces hurdles such as digital divide, limited AI literacy, and infrastructure gaps in underdeveloped areas. Global tech players partnering with local enterprises and increasing cloud penetration are key trends helping bridge these gaps and fuel adoption.

The generative AI in IT operations market is segmented into components, application, deployment mode, enterprise size, and regions. Based on component, the market is classified into software, and services. Based on the application, the market is categorised into anomaly detection & incident management, root cause analysis (RCA), capacity planning, change risk analysis, intelligent alerting, predictive analytics & forecasting, automation of IT tasks, log analysis & monitoring, and security & compliance automation. Based on deployment mode, the market is categorised into on-premises, cloud-based, and hybrid. Based on enterprise size, the market is classified into small and medium enterprises (SMEs), and large enterprises.

Software: The software segment is the dominant component in the Generative AI in IT Operations market, driven by its essential role in delivering capabilities such as discrepancy detection, forecasting analytics, and automation. These tools are crucial for modernizing IT operations and are widely adopted by enterprises to enhance operational efficiency and accuracy.

Services: The services segment is the fastest-growing component of this market as enterprises increasingly seek support for integrating and customizing GenAI solutions. With the complexity of implementation and the need for specialized knowledge, the demand for consulting, training, and managed services has risen sharply.

Generative AI in IT Operations Market Revenue Share, By Component, 2024 (%)

| Component | Revenue Share, 2024 (%) |

| Software | 60% |

| Services | 40% |

Anomaly Detection & Incident Management: Anomaly detection and incident management is the dominant application segment, as GenAI has the ability to detect and react to issues before they escalate, establishing a foundation for flexible IT operations. This helps reduce downtime, improve reliability, and enhance customer experience.

Automation of IT Tasks: Automation of IT tasks is the fastest-growing application, fueled by the need to reduce manual workloads, eliminate repetitive operations, and cut costs. GenAI automates tasks such as ticket resolution, patch management, and system monitoring, transforming IT efficiency across sectors.

Root Cause Analysis (RCA): Root Cause Analysis benefits from GenAI’s pattern recognition and data correlation capabilities, which accelerate troubleshooting and minimize service disruptions. By quickly identifying the source of issues, it enhances accountability and stability.

Capacity Planning: GenAI improves capacity planning by analyzing historical trends to predict future infrastructure demands. This prevents overprovisioning and resource deficiencies, ensuring cost-effective scalability and resource adaptation.

Change Risk Analysis: In change risk analysis, GenAI evaluates the potential effects of IT changes by referencing historical events and system behavior, helping teams avoid unplanned outages and improve deployment strategies.

Cloud-Based: Cloud-based deployment is both the dominant and fastest-growing subsegment, due to its scalability, low upfront costs, and accessibility. Organizations prefer cloud solutions for rapid deployment and seamless integration with existing equipment.

On-Premises: On-premises deployment remains relevant for organizations prioritizing data sovereignty and control. During slow growth, it provides high adaptability and protection, especially in regulated industries.

Hybrid: Hybrid deployment balances the benefits of both cloud and on-premises models, offering flexibility for organizations with mixed infrastructure needs or compliance requirements.

Large Enterprises: Large enterprises are the dominant users of GenAI in IT operations due to their resources for investing in complex IT infrastructure and advanced AI capabilities. These organizations benefit most from full-scale automation, analysis, and custom integration.

Small and Medium Enterprises (SMEs): SMEs represent the fastest-growing enterprise segment, driven by accessible, inexpensive, and easy-to-deploy cloud-based GenAI tools. GenAI helps automate SME functions and scale operations without the need for comprehensive IT teams.

The competitive landscape of the generative AI in IT operations industry is characterized by the presence of many global technology giants and emerging startups, all trying to increase their AIOP offerings through continuous innovation, strategic partnerships, and acquisitions. Companies such as IBM, Microsoft, Google, ServiceNow, and Dynatrace lead the market with broad platforms that integrate AI for tasks such as discrepancy detection, future maintenance, and IT automation. Meanwhile, startups and mid-tier firms are gaining traction by offering niche, agile, and scalable solutions to suit specific industries or enterprise sizes. The competition is fast as vendors race to integrate large language models (LLM), improve accuracy, and develop AI rules. The speed of innovation and ecosystem compatibility in this developed market are reshaping competitive mobility to open-source contributions and cloud-based applications.

Market Segmentation

By Component

By Application

By Deployment Mode

By Enterprise Size

By Region