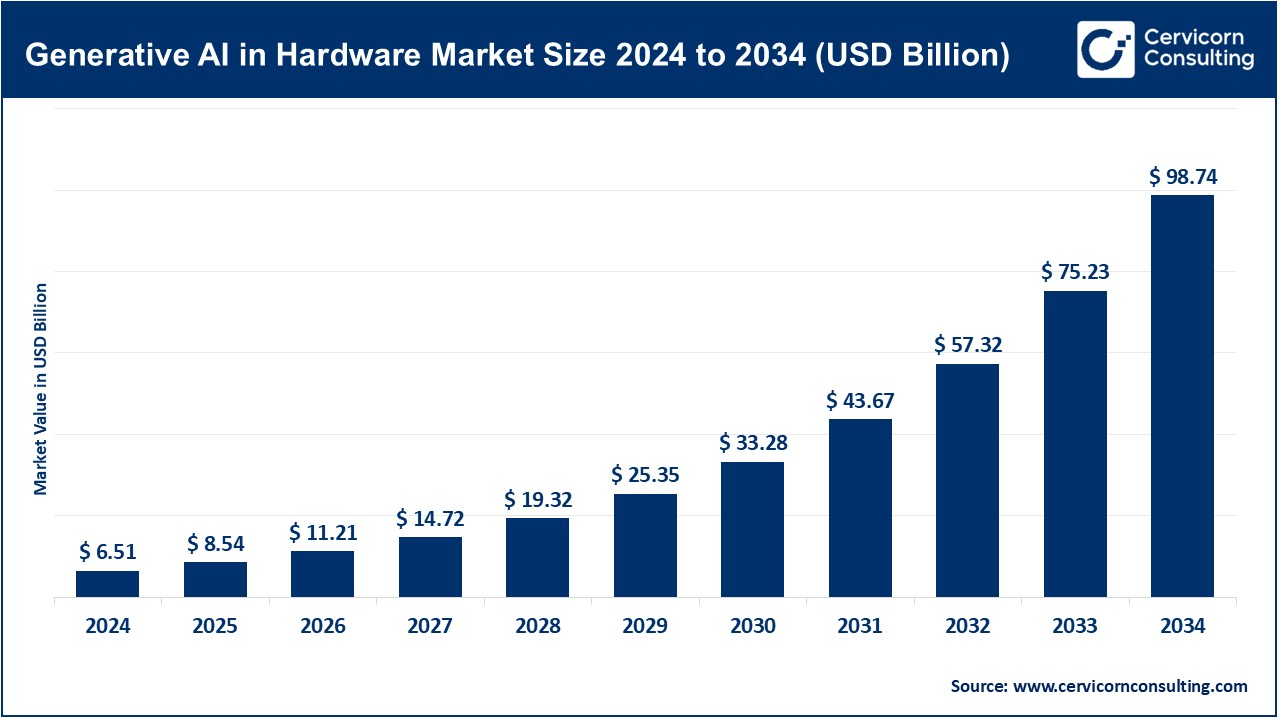

The global generative AI in hardware market size was valued at USD 6.51 billion in 2024 and is expected to be worth around USD 98.74 billion by 2034, exhibiting a compound annual growth rate (CAGR) of 31.24% over the forecast period 2025 to 2034. The generative AI in hardware market growth is mainly driven by the increasing demand for high-capacity computing hardware that facilitates the training and inference of large-scale AI models. As generative AI models like GPT, Stable Diffusion, and DALL·E become more computationally intensive, organizations require purpose-built hardware in the form of GPUs, TPUs, and custom accelerators to efficiently support compute-intensive workloads. This growing computational demand, particularly in cloud and data center environments, compels tech giants and startups to invest significantly in AI-optimized chips and systems that provide low latency, high throughput, and power efficiency.

One of the major growth drivers is the widespread adoption of generative AI in applications such as healthcare, automotive, media, and finance, which need scalable and reliable hardware to produce, simulate, and process data in real-time. Furthermore, the introduction of edge AI and on-device generative models, especially for mobile, internet of things (IoT), and embedded systems, is creating new opportunities for low power and space-constrained hardware solutions. Government initiatives to develop AI infrastructure and continuous innovations in semiconductor technologies are also propelling market growth.

What is a Generative AI in Hardware?

Generative AI in Hardware refers to the specific computer hardware and infrastructure used for training and deploying generative artificial intelligence models, like large language models and image generators. This hardware includes GPUs, TPUs, AI accelerators, memory, and networking technologies designed to meet the high data throughput requirements of parallel processing and generative AI workloads. The application of generative AI hardware in fields such as natural language processing for conversational AI and virtual assistants, image generation for creative industries, video creation, real-time speech synthesis, and code generation for software development, in addition to its roles in autonomous driving and digital twins, significantly influences its market penetration. These applications demand high-performance, efficient, and scalable hardware solutions capable of handling highly computational challenges while providing real-time AI augmentation experiences.

Snapshot of Leading Technologies and Market Dynamics in AI Hardware:

| Insight | Details |

| Leading GPU Providers | NVIDIA, AMD, Intel |

| Specialized AI Chips Introduced | Google TPU, Cerebras CS-2, Graphcore IPU |

| Data Centers Increasing AI Hardware Investments | Significant rise in cloud AI infrastructure budgets |

| Edge AI Growth | Growing adoption in mobile and IoT devices |

| Energy Efficiency Focus | Increasing emphasis on low-power AI hardware |

| AI Hardware Innovation | Rapid development in custom ASICs and FPGAs |

Dominance of Specialized AI Chips

Expansion of AI Infrastructure Projects

Integration of AI Capabilities in Personal Devices

Strategic Acquisitions to Enhance AI Hardware Development

Report Scope

| Area of Focus | Details |

| Market Size in 2025 | USD 8.54 Billion |

| Projected Market Size in 2034 | USD 98.74 Billion |

| Expected Market CAGR 2025 to 2034 | 31.24% |

| Dominant Region | North America |

| Fastest Growing Region | Asia-Pacific |

| Key Segments | Component Type, Deployment Mode, Application, End-User, Region |

| Key Companies | NVIDIA, AMD, Intel, Google (TPU), Apple (Neural Engine), Amazon (AWS Inferentia, Trainium), Microsoft (Azure AI hardware), IBM, Graphcore, Cerebras Systems, SambaNova Systems, Tenstorrent, Qualcomm, Huawei, Baidu (Kunlun chip) |

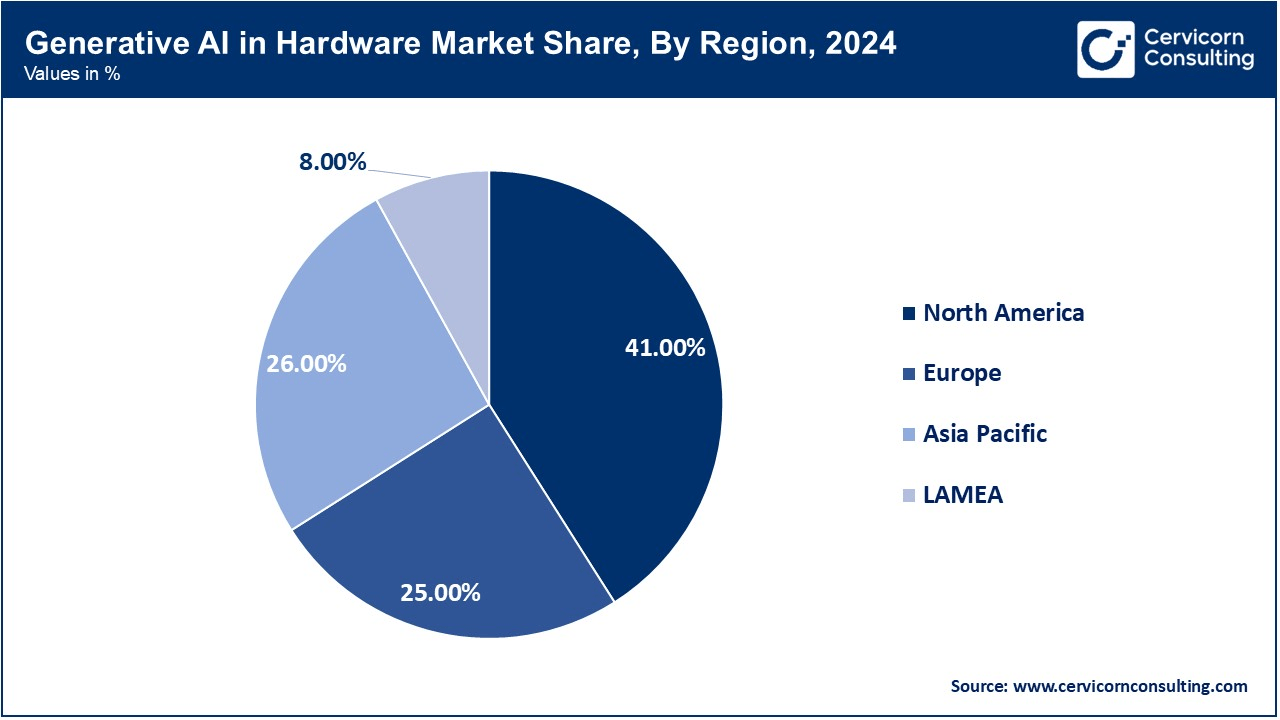

The generative AI in hardware market is segmented into various regions, including North America, Europe, Asia-Pacific, and LAMEA.

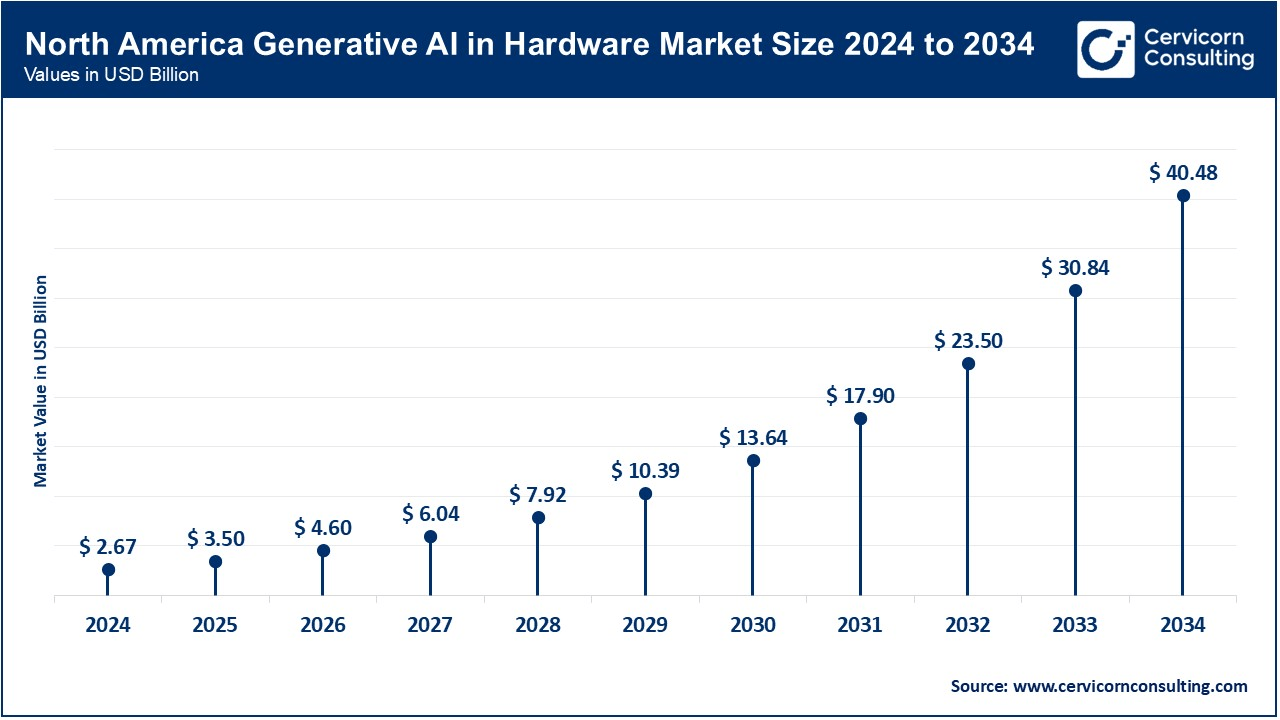

The North America generative AI in hardware market size was reached at USD 2.67 billion in 2024 and is expected to hit around USD 40.48 billion by 2034. North America dominates the market, led by the United States, due to its robust tech ecosystem, AI R&D investments, and domestic leaders such as NVIDIA, Intel, AMD, and Google. The region houses the majority of AI data centers and start-ups, benefiting from strong industry-academia connections. Supportive government policies, including AI-targeted funding and semiconductor manufacturing regulations, further fuel innovation and adoption in the market.

The Asia-Pacific generative AI in hardware market size was estimated at USD 1.69 billion in 2024 and is projected to reach around USD 25.67 billion by 2034. APAC is the fastest-growing market, driven by accelerated digitalization, increased AI uptake in emerging markets like China, India, South Korea, and Japan, and government-sponsored AI initiatives. China is making substantial investments in developing domestic AI chips to reduce reliance on Western technology. The rise of consumer electronics, smart manufacturing, and edge AI in APAC also creates tremendous demand for small, high-performance hardware solutions.

The Europe generative AI in hardware market size was accounted for USD 1.63 billion in 2024 and is predicted to surpass around USD 24.69 billion by 2034. Europe holds a significant market share, prioritizing ethical AI adoption and sustainable hardware solutions. The European Union's leadership in developing trustworthy AI and data protection is influencing generative AI hardware development and deployment. Germany, France, and the UK are all investing heavily in AI infrastructure, while European chip makers and research institutes collaborate on next-generation semiconductor designs that address performance and environmental needs.

The LAMEA generative AI in hardware market size was valued at USD 0.52 billion in 2024 and is anticipated to grow USD 7.90 billion by 2034. The LAMEA region is an emerging player, showing increasing interest in AI-driven innovation, particularly in sectors like healthcare, oil & gas, and fintech. Middle Eastern countries such as the UAE and Saudi Arabia are launching national AI strategies and building AI-focused infrastructure. However, the lack of high-performance computing centers and the high costs of AI hardware pose significant barriers to widespread adoption across much of the region.

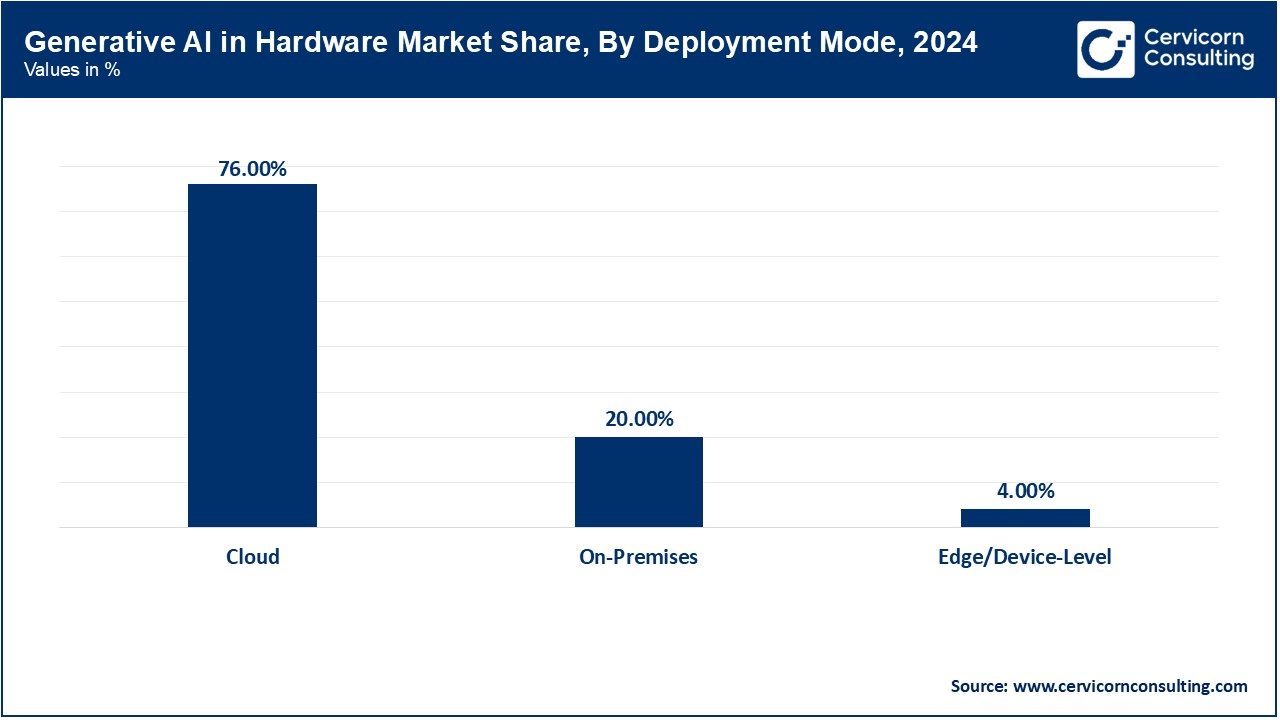

The generative AI in hardware market is segmented into component type, deployment mode, application, end-user industry, and regions. Based on component type, the market is classified into AI processors / chips, memory, storage devices, networking hardware, custom AI accelerators, and edge AI hardware. Based on the deployment mode, the market is categorised into cloud, on-premises, and edge / device-level. Based on application, the market is categorised into text generation, image & video generation, speech & audio generation, code generation, synthetic data generation, and digital twin & simulation. Based on end-user industry, the market is classified into IT & telecom, healthcare & pharmaceuticals, automotive, BFSI (banking, financial services & insurance), retail & e-commerce, media & entertainment, defense & aerospace, and others.

The AI processor/chips segment dominates the market as it serves as the primary computational engine behind the generic AI model. Companies such as Nvidia, AMD, and Intel consistently enhance GPU and CPU performance to meet the demands of complex model training and estimation tasks. These processors power data centers, cloud platforms, and edge devices, forming the backbone of generative AI infrastructure.

The custom AI accelerator segment is projected to experience the highest growth rate, fueled by the need for tailored hardware for specific tasks. Major tech companies like Google (TPUS), Amazon, and Tesla (Dojo) are developing specialized chips that enhance performance and energy efficiency for generative tasks. This shift towards specialization is accelerating as businesses strive to reduce delays and costs while increasing throughput.

The cloud deployment segment currently holds the largest market share. It provides the necessary scalable computing power for training and deploying large generative models. Major public cloud providers like AWS, Azure, and Google Cloud offer AI-optimized solutions, simplifying the process for businesses to leverage powerful infrastructure without hefty capital expenditures.

On the other hand, the edge/device-Level deployment mode is experiencing the fastest growth. The demand for compact and efficient edge AI hardware is increasing, driven by the rise of on-device AI applications such as real-time voice synthesis, personalized materials, and wide-angle cameras. Edge chips (e.g., Qualcomm's AI engine, Apple Neural Engine) enable generic AIs to innovate and operate in low-power, real-time environments.

Image & Video Generation leads the market due to the widespread use of generative models in media, advertising, and design companies. Applications like DALL·E, Midjourney, and RunwayML have pushed the limits of imagination to the point that they require robust hardware to deliver quality, real-time output.

However, Synthetic Data Generation is emerging as the fastest-growing application. Healthcare, autonomous driving, and cybersecurity are some of the sectors applying synthetic data to address data availability and privacy concerns. This emerging trend is fueling the demand for hardware systems to generate large amounts of realistic, high-quality synthetic data for training and simulation.

The IT and telecom sector dominates the generative AI hardware market due to its early mover advantage and widespread adoption of AI across various services, infrastructure, and operations. These industries have in-house R&D and data centers, enabling them to utilize proprietary hardware and advanced chips to accelerate the development and deployment of generative models.

Generative AI in Hardware Market Revenue Share, By End-User Industry, 2024 (%)

| End User | Revenue Share, 2024 (%) |

| IT & Telecom | 28% |

| Healthcare & Pharmaceuticals | 18% |

| Automotive | 14% |

| BFSI (Banking, Financial Services & Insurance) | 12% |

| Retail & E-commerce | 10% |

| Media & Entertainment | 8% |

| Defense & Aerospace | 6% |

| Others | 4% |

Meanwhile, the healthcare and pharmaceuticals industry is projected to grow at the fastest pace. The demand for rapid drug discovery, advanced medical imaging, and the generation of synthetic biological data has led to significant investments in AI hardware. Generative AI aids researchers in simulating molecules, creating synthetic medical scans, and enhancing diagnostic accuracy—each of these endeavors requiring high-performance AI hardware environments.

The competitive landscape of the generative AI hardware market is characterized by intense innovation, strategic partnerships, and rapid product advancements. Key players such as NVIDIA, AMD, Intel, Google, IBM, Apple, and Qualcomm drive the market by continually enhancing AI chip performance, power consumption, and scalability to meet evolving generative AI requirements. These organizations are significantly investing in custom-designed AI accelerators, edge AI hardware, and cloud AI infrastructure to gain a competitive advantage. The market is also witnessing increased cooperation among semiconductor firms, cloud providers, and AI startups, along with a rise in M&A deals to improve AI hardware offerings and accelerate time-to-market for future-generation products.

NVIDIA

AMD

Intel

Market Segmentation

By Component Type

By Deployment Mode

By Application

By End-User

By Region