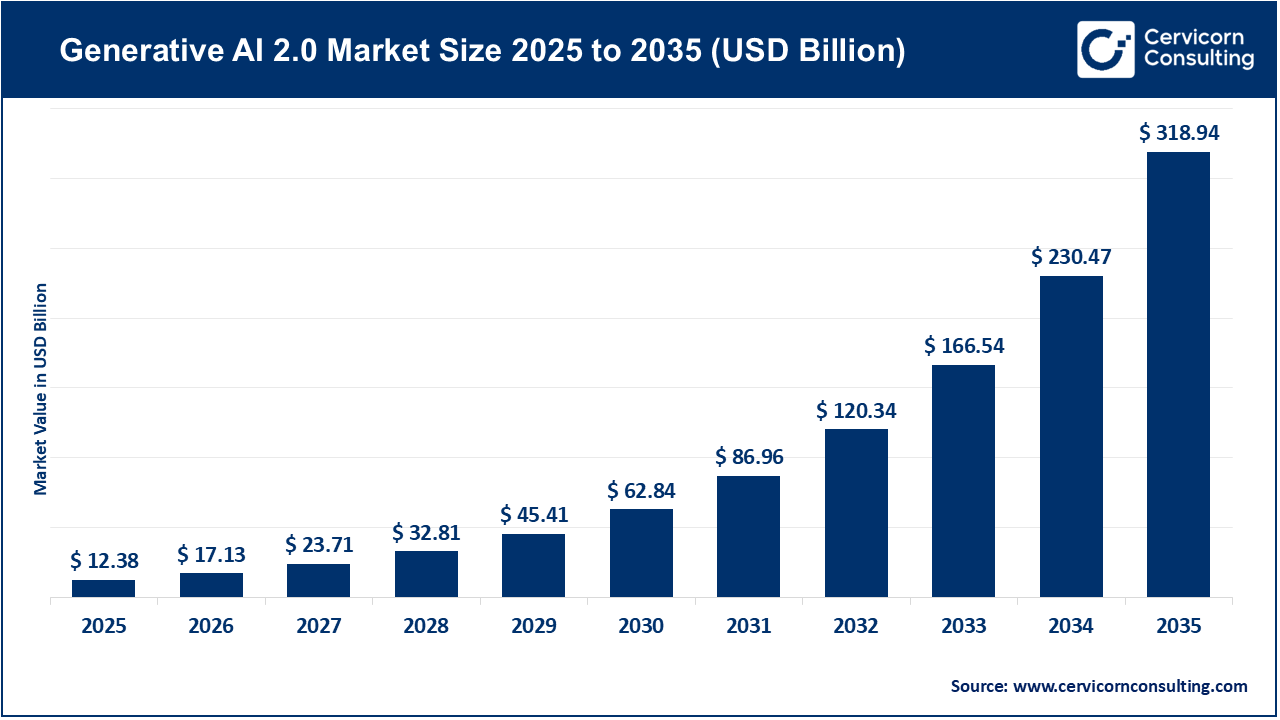

The global generative AI 2.0 market size was valued at USD 12.38 billion in 2025 and is expected to be worth around USD 318.94 billion by 2035, exhibiting at a compound annual growth rate (CAGR) of 38.7% over the forecast period from 2026 to 2035.

Generative AI 2.0 market is continuously growing propelled by the increasingly rapid growth of foundation and multimodal models that eventually allow a system to generate and understand text, image, audio, video, and code in one model. Compared to the earlier generation of GenAI, GenAI 2.0 has a broader understanding of the context surrounding a user request, can adapt to it in real-time, and possesses performance capabilities at the enterprise level. This multi-faceted capability has led to a rapid increase in utilization for content creation, conversational AI, software development, and data synthesis. With an increasing amount of high-performance computing resources being available via cloud computing platforms, along with new specialized AI acceleration devices. The ability to develop and deploy advanced generative capabilities will become less expensive to operate at scale, spreading these capabilities for use across enterprises of all sizes.

Another significant driver of growth is the increased demand for enterprise automation, personalization, and productivity improvements across many different types of businesses, including media & entertainment, healthcare, BFSI, retail, and marketing. Organizations are increasingly adopting Generative AI 2.0 into their core operational processes, like customer engagement, customizing products, and discovering new medicines through drug development, and creating accurate patient documentation to help reduce costs while speeding up their ability to make informed decisions. Additionally, there is a large influx of capital investments into the AI sector from large global technology companies, creating large ecosystems of AI suppliers, as well as government-sponsored grant programs aimed at accelerating the pace of digital transformation through AI innovation.

Rapid Expansion of Cloud and AI Infrastructure Accelerating Generative AI 2.0 Market Growth

Cloud and AI are growing rapidly and are essential drivers of the Generative AI 2.0 market because the combination of the scalable infrastructure offered by cloud platforms along with the very high-performance AI hardware will allow organizations to train, deploy, and operate enormous, multimodal AI models in real time. Large cloud providers are making significant investments in both AI hardware, such as high-performance GPUs and other accelerators, developing optimized AI-as-a-Service platforms that provide ease of access to enterprises and new start-ups entering the market. The growth of these infrastructures supports the use of generative AI models for a wider range of enterprise-wide and mission-critical applications through faster inference, reduced latency, and reduced costs associated with scaling. As a result, businesses can now provide employees with access to the capabilities of Generative AI 2.0 in various ways through embedding these tools within their day-to-day work processes such as content creation, conversation agents, health care analysis, and software development. This will lead to further substantial expansion of the GenAI 2.0 market.

1. Microsoft Expands Multibillion-Dollar AI Infrastructure with OpenAI Partnership

Microsoft has greatly increased its partnership with OpenAI and committed multibillion-dollar investments to develop an AI supercomputing infrastructure on Azure. The goal of this investment is to develop advanced data centers, create new AI accelerator technology, and support large multi-modal foundational models. This investment is a key driver in the market for enterprise-level generative AI 2.0 applications across several sectors. The support of U.S. governmental policies promoting cloud-based innovations and AI technologies will help to grow the nation's leadership in AI through the strengthening of commercial AI adoption.

2. Google Launches Gemini Multimodal AI with Government-Backed AI Research Support

Google has introduced its Gemini multimodal AI models, which can understand and generate text, images, videos, and code from within one system. This major step forward for Generative AI 2.0 allows more organizations to implement its use in different fields such as healthcare, education, and enterprise productivity. Additionally, the launch of Gemini with government support for AI research and funding digital transformation initiatives for the U.S. and Europe. By the integration of Gemini into Google Cloud and Google Workspace, these initiatives are designed to support innovation, workforce productivity, and the responsible development of AI.

3. NVIDIA Accelerates Sovereign AI Programs with Government Partnerships

NVIDIA expanded its sovereign AI initiatives by partnering with governments across North America, Europe, and Asia to build national AI infrastructure. These initiatives are focused on deploying high-performance GPUs and AI platforms to support domestic development of generative AI. This milestone creates a demand for Generative AI 2.0 by providing solutions for both compute availability and data sovereignty concerns, while government participation helps sustain the long-term funding for infrastructure, promotes the establishment of local AI ecosystems, and accelerates the implementation of advanced generative models across both the public and private sectors.

4. European Union Launches Large-Scale Public Funding for Generative AI and Responsible AI Frameworks (2024)

The European Union has established extensive public funding initiatives such as AI research centers, startup companies, and enterprise implementations. The on-going funding efforts, along with their regulatory framework to promote ethical and safe usage of generative AI technologies. These initiatives help drive the adoption of generative AI in many industries, including health, veterinary medicine, financial services, manufacturing, and public services. The support provided by governments will help support the on-going development of the generative AI ecosystem and create a more robust and inclusive environment for innovative business growth.

The GenAI 2.0 Market is segmented into various regions, including North America, Europe, Asia-Pacific, and LAMEA. Here is a brief overview of each region:

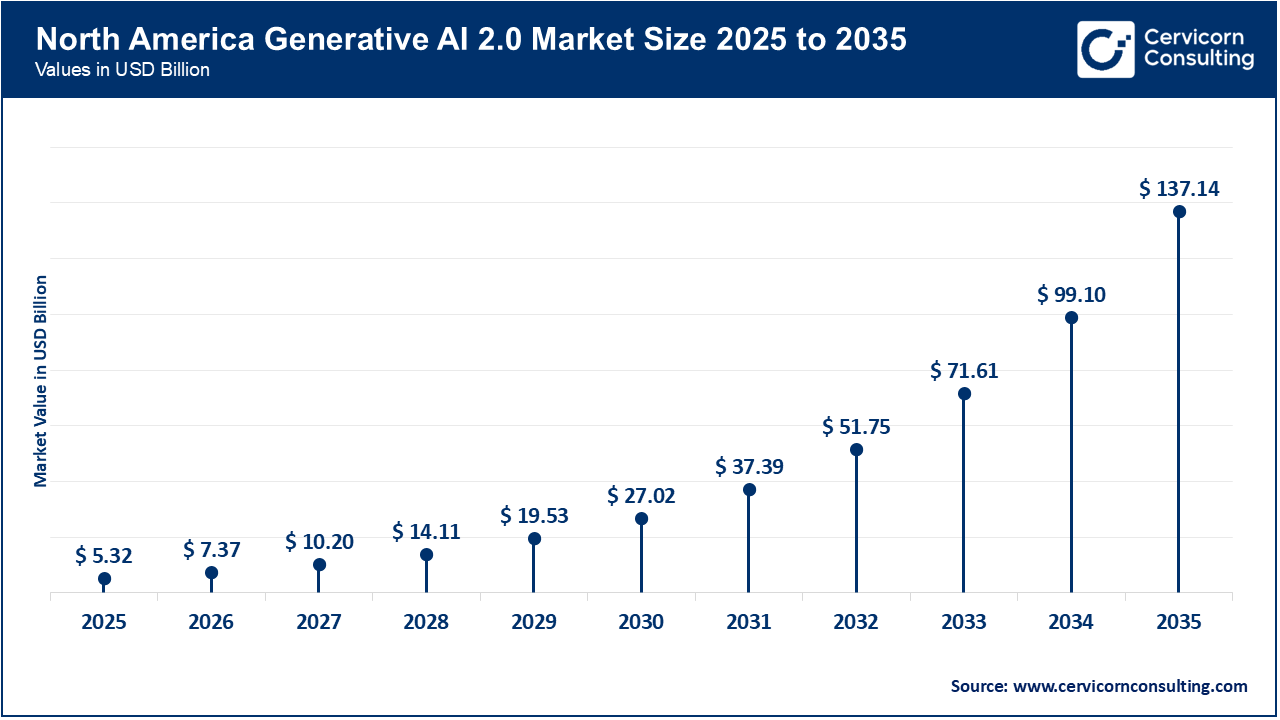

The North America generative AI 2.0 market size was valued at USD 5.32 billion in 2025 and is expected to reach around USD 137.14 billion by 2035. North America leads the market due to the early adoption of advanced AI technologies, a solid cloud-supporting infrastructure, and a high number of enterprise investments in digital transformation. The presence of significant AI companies, hyper-scale cloud providers, and a robust supply of venture capital-backed funding enables the rapid development and launch of new products. Additionally, as generative AI is used extensively within the industry of producing content, building software applications, and providing customer service as well as health care, the demand for AI has increased and therefore has driven growth within the market. In addition, supportive government programs also contribute to further solidifying the region's position in the marketplace.

Recent Developments:

The Asia-Pacific generative AI 2.0 market size was estimated at USD 3.71 billion in 2025 and is forecasted to hit around USD 95.68 billion by 2035. Asia Pacific is the fastest-growing region because of the rapid pace of digital transformation, increased use of cloud computing technology, and governmental policies to support AI activities and applications. Major countries in Asia, including China, India, Japan, and South Korea, have also invested heavily in AI research and development and the delivery of smart manufacturing and digital services through technology-enabled solutions. In addition, there is a growing need for AI-based customer engagement, e-commerce personalization, and healthcare solutions, which increases the adoption and utilization of generative AI in both existing enterprises and new startups.

Recent Developments:

The Europe generative AI 2.0 market size was reached at USD 2.48 billion in 2025 and is predicted to surpass around USD 63.79 billion by 2035. Europe is expected to continue growing steadily in the market with an increase in enterprise adoption of generative AI and a growing awareness of the need for responsible and ethical use of AI technology. Europe has a strong advantage with multiple leading research facilities in addition to the expanding use of artificial intelligence in tasks within BFSI, Manufacturing, healthcare, and robust regulatory framework that allow for building confidence among European businesses. European companies are looking to adopt generative AI for automate tasks, analyze data, and create content, while adhering to data protection regulations.

Recent Developments:

Generative AI 2.0 Market Share, By Region, 2025 (%)

| Region | Revenue Share, 2025 (%) |

| North America | 43% |

| Asia-Pacific | 30% |

| Europe | 20% |

| LAMEA | 7% |

The LAMEA generative AI 2.0 market was valued at USD 0.87 billion in 2025 and is anticipated to reach around USD 22.33 billion by 2035. Latin America and the Middle East & Africa, are potential opportunities for Generative AI 2.0 due to their increased availability of cloud storage, more developed digital banking services, and greater focus on smart cities. Companies in oth areas are starting to embrace AI technology to better serve customers and automate processes and offer better services. Although the adoption rates of Generative AI 2.0 are still coming into play, investments continue to increase, and market accessibility continues to improve the ability to access Generative AI.

Recent Developments:

The genAI 2.0 market is segmented into offering, data modality, application, industry, and region.

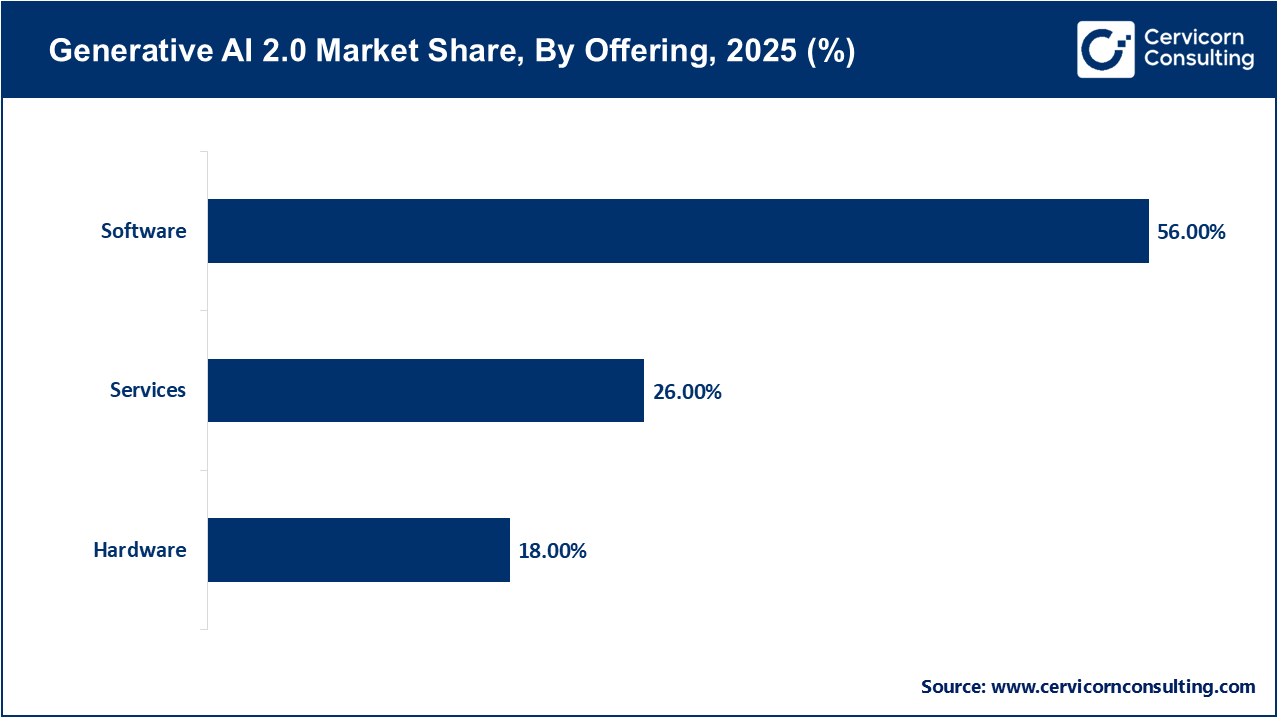

Software holds the largest share in the Generative AI 2.0 market because of the value being generated by AI models, platforms, and applications. Enterprise software tools, generative AI platforms, and foundation models offer the most extensive content creation, automation, and analytic capabilities. Businesses prefer software products, to a significant extent, because they can more easily be scaled and updated than hardware or other types of products. Additionally, the speed at which many businesses are adopting AI-based solutions enables software to be the most dominant source of revenue.

Services are the fastest-growing segment to support companies in successfully implementing Generative AI 2.0 effectively. Many companies require consulting, systems integration, customization of models, and ongoing maintenance services. As AI systems become increasingly complicated, businesses turn to service providers for the safe and efficient deployment and compliance with regulatory requirements. This growing need for the expertise of service providers has resulted in a rapid growth of AI-based service business opportunities.

Text-based generative AI segment dominates the current Generative AI 2.0 marketplace as a result of early adoption and wide use in chatbots, content generation, document analysis, and customer service applications. Text models require significantly less training and deployment than other types of generative AI models. Additionally, many companies have incorporated text-based AI into their day-to-day operations, thereby establishing text models as the predominant source of revenue generation in the Generative AI 2.0 market.

Generative AI 2.0 Market Share, By Data Modality, 2025 (%)

| Data Modality | Revenue Share, 2025 (%) |

| Text | 32% |

| Multimodal | 26% |

| Image | 18% |

| Video | 12% |

| Audio & Speech | 8% |

| Code | 4% |

Multimodal AI is the fastest-growing segment because it has the capability of understanding and creating written content, visual content, audio content, and video content. Therefore, multimodal AI has the opportunity to be extremely beneficial in real-world applications such as healthcare diagnosis, digital marketing, and product creation. As companies seek to implement more sophisticated and engaging forms of artificial intelligence, they are increasingly turning to multimodal AI for increased growth and development in the sector.

Content creation is the leading segment, as Generative AI 2.0 is widely used to create content such as articles, images, videos, marketing messaging, and social media campaigns. Various types of media companies, marketers, and enterprises utilize AI to produce content faster and at lower costs. The ability to provide quality digital content so rapidly is one of the dominant revenue sources within the Generative Artificial Intelligence marketplace.

Generative AI 2.0 Market Share, By Application, 2025 (%)

| Application | Revenue Share, 2025 (%) |

| Content Creation | 35% |

| Conversational AI | 25% |

| Product Discovery & Personalization | 18% |

| Code Generation | 12% |

| Synthetic Data | 10% |

Conversational AI is the fastest-growing segment due to the increasing use of AI chatbots, virtual assistants, and customer service solutions in the B2C space. Additionally, companies leverage conversational AI to enhance customer service, provide 24x7 supports, and eliminate much of the work done by humans for their customers. Additionally, continued advancements in language understanding and context awareness for Generative AI 2.0 continue to create new opportunities for conversational AI to further infiltrate other industries as well.

Media and entertainment dominate the Generative AI 2.0 market because the industry widely uses AI technologies to create content, video editing, music generation, animation, and special effects. Generative AI allows businesses to quickly generate high-quality creative content while at the same time lowering production costs and manual efforts. The growth of streaming platforms, social media, and digital advertising has produced a growing need for ongoing content creation and has resulted in this industry being the largest and most active user of generative AI technologies.

Generative AI 2.0 Market Share, By Industry, 2025 (%)

| Industry | Revenue Share, 2025 (%) |

| Media & Entertainment | 31% |

| Healthcare | 19% |

| BFSI | 17% |

| E-commerce & Retail | 13% |

| Automotive | 9% |

| Marketing & Advertising | 8% |

| Others | 3% |

Healthcare is the fastest-growing industry in the Generative AI 2.0 market due to the adoption of Artificial Intelligence (AI) for digital healthcare applications, such as image analysis, discovery and development of drugs, clinical documentation, and virtual patient support. With the implementation of generative AI, doctors and medical staff can work more efficiently, make fewer mistakes, and make more informed treatment decisions. The growing investment in digital healthcare, combined with the increasing need for accuracy and speed in providing efficient and effective medical solutions, has led to a high level of growth in the healthcare sector.

OpenAI

Google (Alphabet)

Microsoft

By Offering

By Data Modality

By Application

By Industry

By Region