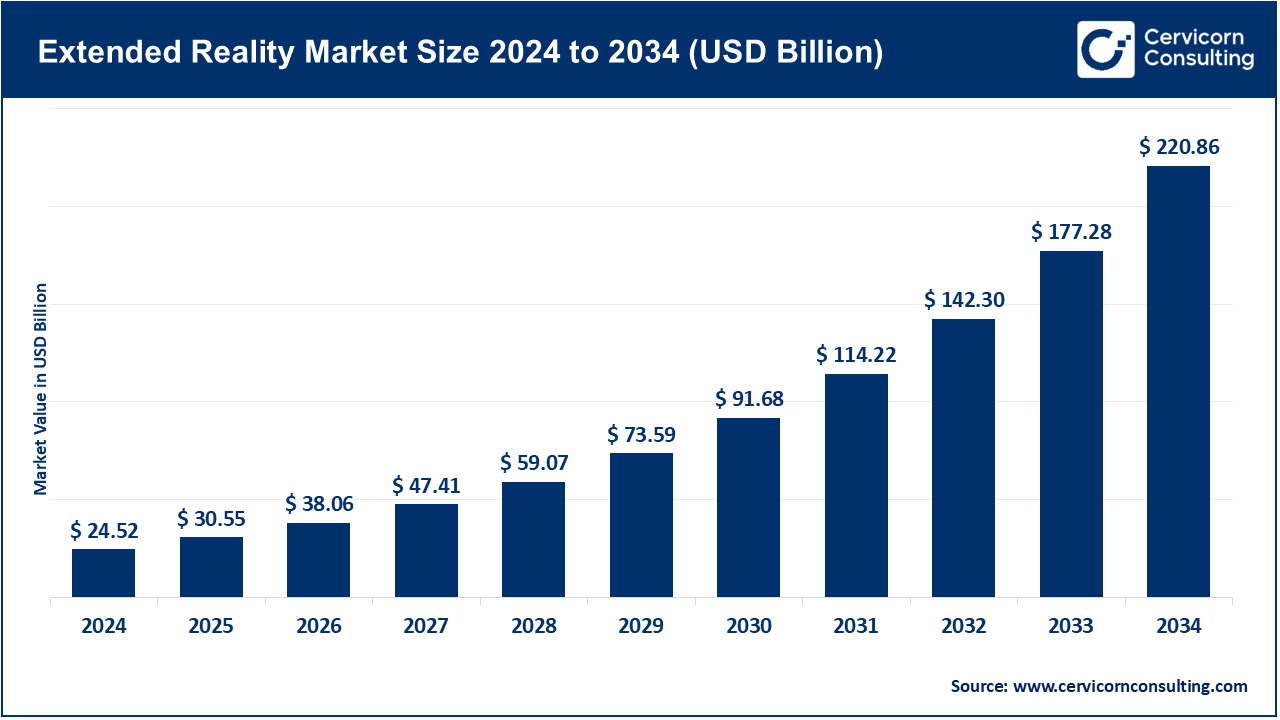

The global extended reality market size was estimated at USD 24.52 billion in 2024 and is anticipated to surpass around USD 220.86 billion by 2034, growing at a compound annual growth rate (CAGR) of 28% over the forecast period 2025 to 2034. The extended reality market is on the rise owing to the increasing need for immersive experiences, transformative shifts toward digital technology, and the uptake of XR in gaming, healthcare, education, manufacturing, real estate, and retail. The main contributing factors include enterprise uptake, hardware and software improvements, increased focus in XR content, and endorsement of innovation by the government. XR has enhanced training, remote collaboration, interactive marketing, and digital twin applications thereby improving organizational efficiency and engagement.

What is extended reality?

Extended Reality or XR, is the umbrella term for Virtual Reality (VR), Augmented Reality (AR), and Mixed Reality (MR) technologies which are the merging of the physical and digital worlds. XR 22e:pr JA 23 devices like headsets, smart glasses, and haptic controllers enable real time interaction with digital objects and environments. Their applications are immersive learning, training simulations, interactive marketing, and numerous industrial operations which in turn helps organizations improve experience, collaboration, and operational outcomes.

Company Distribution Across Different Funding Stages (Extended Reality Market)

| Funding Stages | Number of Companies |

| Seed | 311 |

| Early Stage VC / Series A | 297 |

| Self Funded | 163 |

| Late Stage VC / Series C | 136 |

| Venture Round | 131 |

| Acceletor/Incubator | 104 |

| M&A | 95 |

| Public Company | 75 |

Surge in AI-Enhanced Smart Glasses: The merger of technology and AI with smart spectacles is transforming the XR industry. In August of 2025, Meta partnered with EssilorLuxottica to release the Ray-Ban Meta smart glasses 2 which marked the exponential growth of wearable XR. This collaboration has surpassed 2 million units sold, a fundamental leap for wearable XR technology. Meta's $3.5 billion investment in EssilorLuxottica's AI initiatives showed strong faith in smart eyewear evolving as the next computing paradigm.

Emergence of Android-Based Mixed Reality Headsets: Vivo’s release of the Android-based Vivo Vision-Discovery MR headset in August 2025 marked the downfall of Samsung’s anticipated Project Moohan, making the latter the first Android Powered MR headset. Along with the hallmark features of dual Micro-OLED 8K displays, it is powered with Qualcomm's Snapdragon XR2+ Gen 2 chip, promising high-speed spatial computing. The launch of Vivo into the MR market dominates the competition towards Android-based immersive experiences.

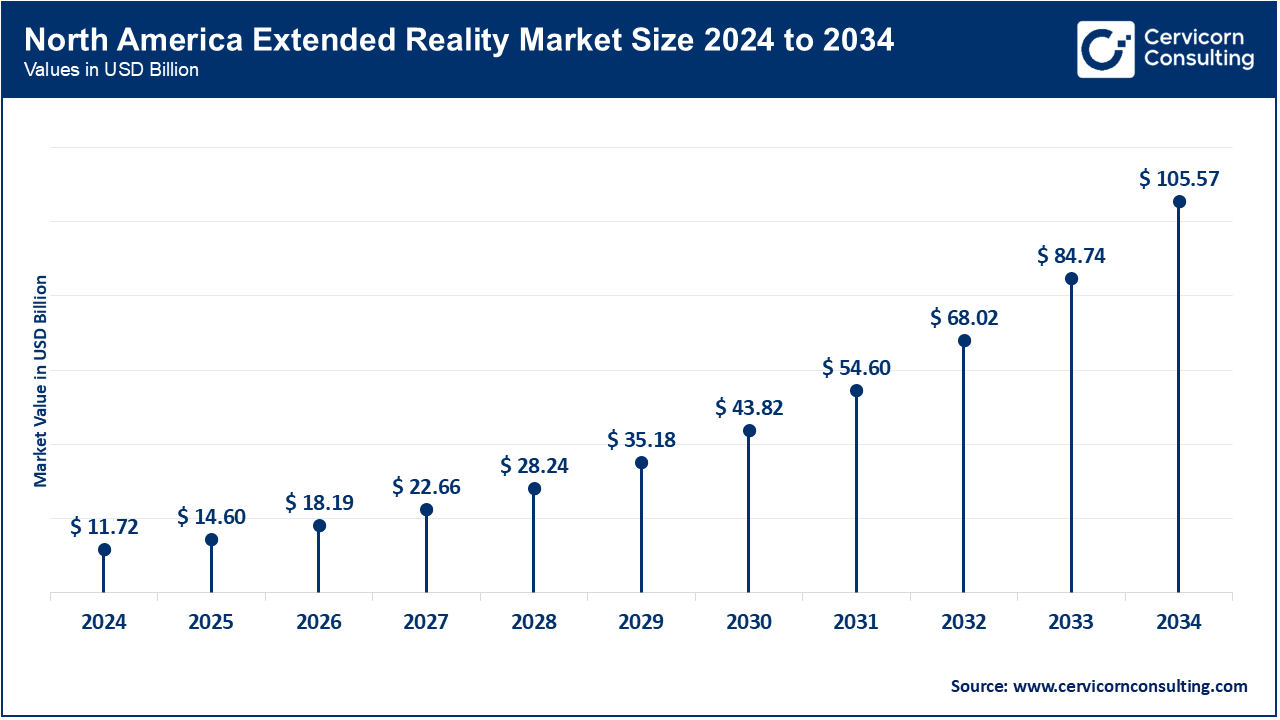

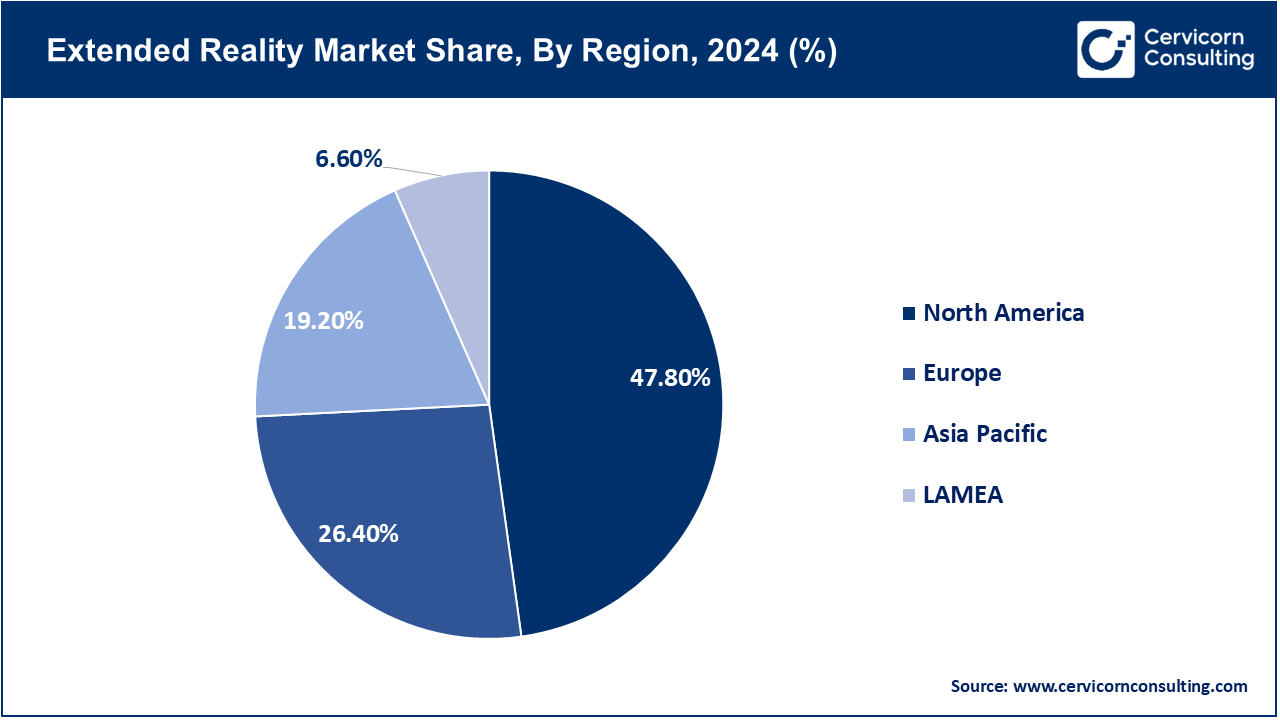

The extended reality market is segmented into several key regions: North America, Europe, Asia-Pacific, and LAMEA (Latin America, the Middle East, and Africa). Here’s an in-depth look at each region.

The region is becoming a center for XR development owing to government policies, research activities, and corporate spending. In April 2025, U.S. Department of Energy initiated a pilot XR innovation program in California, spending in excess of USD 1.2 billion on clean energy and technology. The project is focused on immersive training solutions for the renewable energy and industrial sectors in XR driven workforce development. This shows the commitment of North America to leveraging XR technologies for innovation as well as productivity and industrial efficiency. The region is still attractive for new XR research and commercialization investment from start-ups and multinational companies.

Europe still drives XR adoption as a region because of well-defined climate goals, green technology funding, and new policies on industrial digitization. In March 2025, Germany launched a USD 0.046 billion program directed to the use of XR in industrial design, training, and manufacturing with the goal of improving productivity and reducing operational inefficiencies. This program is part of the large German Industry 4.0 initiative which promotes the use of immersive technologies in manufacturing and vocational training. Adoption of XR in Europe is rapidly growing in the manufacturing, health care, and entertainment sectors. Europe remains the front-runner in developing standardized frameworks for XR use and inter-country collaborations.

The adoption of XR in the Asia-Pacific region is being advanced through smart city projects and large-scale industrial initiatives. In August 2025, China opened an XR Industrial Park in Shandong Province with an investment of over USD 2 billion, specializing in immersive manufacturing, digital twin technologies, and training. The park incorporates advanced XR hardware and software for optimization of industrial processes and workforce productivity. This highlights China’s model of industrial modernization while showing intent to secure leadership in the XR ecosystem. Other countries in the region, including Japan and South Korea, are also focusing on XR-enabled smart infrastructure.

The LAMEA region is actively driving the adoption of XR in the industrial, educational, and energy domains. Brazil’s state of Ceará linked an XR-enabled innovation facility to Wind Farm 3, with USD 600 million in investment. The facility employs XR for training, collaboration, and operations supervision in renewables. This marks the most significant XR incorporation in energy and industrial sectors in Latin America. Other countries from Middle East and Africa are also implementing XR for urban design, healthcare, and educational programs.

Large Enterprises: A multinational automotive company started using XR in its design process in February 2025, allowing different engineering teams to work together in a metaverse. Large enterprises use XR to enhance workflow efficiency and minimize expenditures. XR enables the virtual and remote scaling of prototyping, training, and customer engagement. Adoption gives companies the ability to innovate and increase productivity. XR is being adopted by large corporations in all business units.

XR Market Share, By Organization Size, 2024 (%)

| Organization Size | Revenue Share, 2024 (%) |

| Large enterprises | 62.10% |

| Small & Medium-sized Enterprises | 37.90% |

Small & Medium-Sized Enterprises (SMEs): A local retail store employed AR in its product display systems in January 2025 which increased customer footfall and sales. XR is being adopted by SMEs to improve customer service, streamline business processes, and productivity. XR enables small to compete with big firms through the use of immersive technologies. It is applied to marketing, training, and virtual engagement. SMEs are able to access affordable XR technologies which aids in business expansion.

Mixed Reality (MR): The mixed reality segment has dominated the market. A tech company launched an MR headset in August 2025 that enabled users to engage with holographic objects in real time. MR is applied in training, design, and collaboration. Companies are increasingly using MR to converge physical and virtual workflows. It offers better immersive experiences for enterprises and consumers. MR is increasingly being adopted in various industries due to availability of supporting hardware.

Augmented Reality (AR): A museum launched an AR application in July 2025 which provided visitors with enrich interactive exhibits to enhance the educational experience. AR enhances interactivity through the addition of digital content over the real world. Educational and cultural institutions are using AR to enhance interactivity with visitors. Other industries, such as retail, advertising, and marketing have adopted the use of AR as well. The technology is improving further with the integration of mobile devices.

Virtual Reality (VR): VR simulators for pilots are being used in training in flight schools as of June 2025 which is enhancing skill acquisition and safety. For training and simulation purposes, users are fully immersed in digital environments. Such technology is being increasingly used in educational institutions and enterprises for realistic practice. The use of virtual simulators is on the rise in the gaming, healthcare, and industrial sectors. It improves learning and readiness in operations.

Business Engagement: In May 2025, a global consulting firm implemented XR technology in virtual meetings and training sessions for better communication and travel cost savings. XR is leveraged across industries for strategic collaboration, training, and operational improvements. Corporations utilize XR for better engagement and enhanced management of workflows. Applications of XR technology in the business realm bolster efficiency and streamline operational hurdles. Adoption continues to increase as firms look to immerse employees more deeply with business tasks.

XR Market Share, By Type, 2024 (%)

| Type | Revenue Share, 2024 (%) |

| Business Engagement | 53.20% |

| Consumer Engagement | 46.80% |

Consumer Engagement: In April 2025, a fashion retailer launched an AR application allowing customers to virtually try on clothes which enhanced both customer satisfaction and sales. XR captivates consumers with interactivity and immersion. Retail and entertainment industries leverage XR for the purpose of creating moments that are difficult to forget. XR is also used more frequently for marketing engagement and for engagement analytics. Adoption by consumers spurs innovative efforts and growth in the XR technology market.

Services: The services segment has captured highest revenue share in the market. In March 2025, a tech consultancy began offering XR development services to their clients. XR services include implementation, consulting, and ongoing support. Companies hire service providers to assist with XR integration into their workflows. This development enables companies to utilize XR technologies without needing to develop and maintain in-house capabilities. Services facilitate the rapid implementation of XR and improve the operational results.

Software: In February 2025, a software company introduced a new XR development platform which simplified the development of immersive applications. XR software comprises platforms, applications, and tools which enable the experiences. Both developers and enterprises employ software to tailor XR solutions to their needs. Advances in software innovation enables the creation of increasingly interactive and scalable XR deployments. The software market facilitates the expansion of consumer and business applications of XR.

Hardware: In January 2025, a hardware manufacturer revealed a new lightweight XR headset with enhanced comfort and performance features. XR hardware comprises headsets, controllers, and sensors that allow users to interact with the system. Advancements in hardware boost the immersive experience and the adoption rate. Companies are now designing lighter and more ergonomic devices for prolonged use. The XR market depends on constant innovations in hardware.

Media & Entertainment: The media & entertainment segment has captured highest revenue share in the market. In August 2025, London hosted the immersive theatre production, “Elvis Evolution,” which featured XR technology to blend AI footage and interactive environments. This is a good example of how XR is changing the nature of entertainment. Through XR, entertainment engagement has been elevated and interactive narrative and story-driven drama have become possible. Media companies are adopting XR to create concerts, virtual cinemas, and live events. The rate of expansion is accelerating, fueled by advances in technology and content.

Consumer Goods & Retail: In May 2025, a number of retail chains began using XR to allow customers to view products in the context of their home environment prior to purchase. This improved the shopping experience and lowered the rate of returns. XR is being used by retailers to improve the shopping experience and interaction with the brand. The use of virtual try-ons for clothes, furniture, and accessories is on the rise. The tailored nature of XR offerings is being driven by consumer demand in this industry.

Manufacturing, Government, and Public Sector: The U.S. Army had recently received over 120,000 Microsoft HoloLens AR Headsets for training and operational use under a contract provided to the arms in June 2025. Public sector organizations are using XR for design, planning and simulation. In the manufacturing sector, Companies are using XR for remote collaboration and to enhance assembly processes. XR is being explored by Government agencies for urban planning and training. These examples amplify XR's flexibility in large-scale operations.

Telecommunications and IT: In July 2025, XR remote network diagnostics and maintenance were adopted by telecom companies. This meant engineers could solve technical problems at a fraction of the cost by minimizing travel. XR is being adopted as a means for remote collaboration and virtual meetings. XR is also being adopted by IT for the cloud and edge computing. Overall, the integration is beneficial for team collaboration, productivity, and operational efficiencies.

Healthcare and Life Sciences: In India, a recently opened hospital implemented XR based training programs for their staff in May 2025. Other hospitals are using XR for remote consultations and training. XR simulations are used for remote interactive medical training and patient care. The technology improves learning competencies and reduces training timelines. The XR technology is still in the early phases of adoption in the medical field and is being explored for efficient solutions for patient care.

BFSI (Banking, Financial Services & Insurance): A major bank implemented an XR-powered virtual customer care service where clients can engage with virtual customer care agents for assistance in April 2025. XR is aiding in improving customer engagement for financial institutions. Banks are starting to adopt XR for financial data visualization and virtual consultations. Insurance companies are utilizing XR for risk evaluation and training. Overall, the technology is enhancing the sector’s efficiency and client experiences.

Others: An educational institution started offering XR history and science classes in March 2025. This marked the integration of the XR technology to the educational sector. With the rise of XR in education, engagement and knowledge retention are expected to rise. XR is also being used in specialized training and professional workshops. The vast range of applications testified to the versatility of XR technologies.

Market Segmentation

By Type

By Component

By Organization Size

By End-users

By Application

By Region