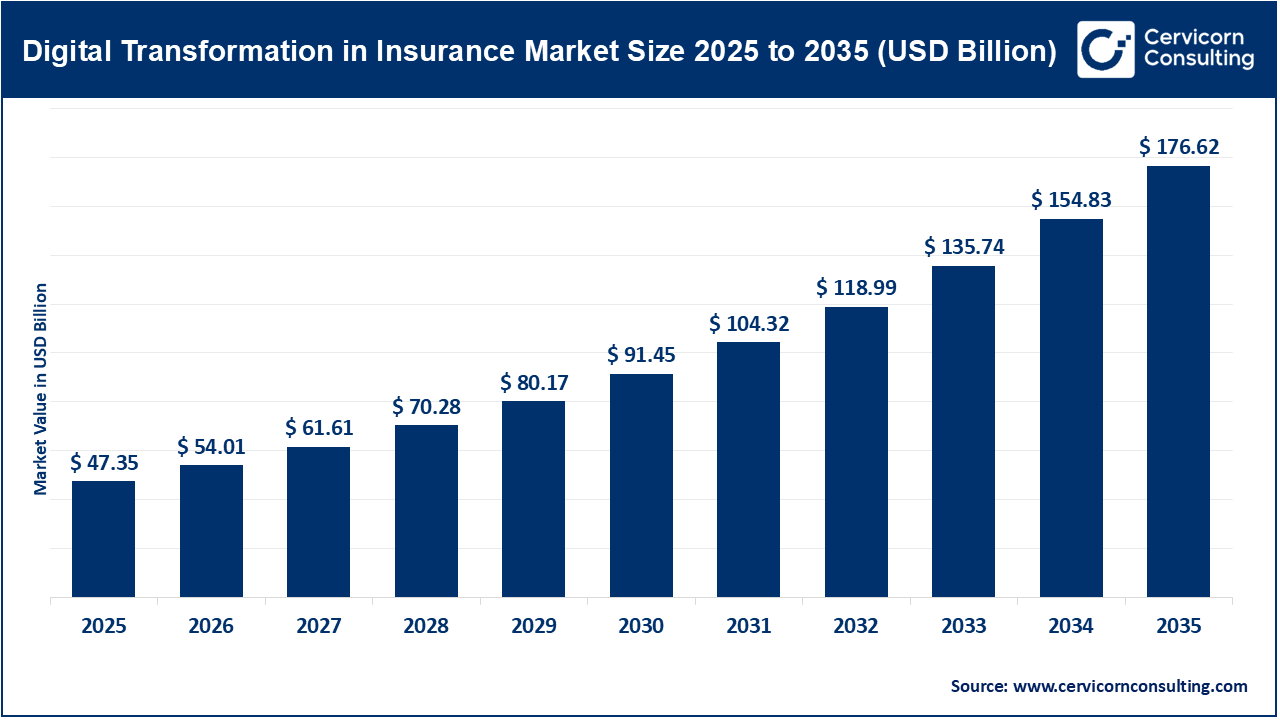

The global digital transformation in insurance market size was valued at USD 47.35 billion in 2025 and is expected to surpass around USD 176.62 billion by 2035, exhibiting at a compound annual growth rate (CAGR) of 14.1% over the forecast period from 2026 to 2035. The digital transformation in insurance market is primarily driven by the need to improve customer experience, operational efficiency, and speed to market in an increasingly competitive environment. Customers now expect seamless, omnichannel, and personalized insurance journeys similar to those offered by digital-native companies, pushing insurers to adopt AI, cloud computing, big data analytics, and mobile platforms. Rising volumes of structured and unstructured data from sources such as IoT devices, telematics, and wearables are enabling more accurate risk assessment, dynamic pricing, and real-time underwriting. At the same time, insurers face growing pressure to reduce operational costs and error rates, which is accelerating the adoption of automation, robotic process automation (RPA), and straight-through processing across underwriting, policy administration, and claims management.

Growth in this market is further supported by regulatory modernization, ecosystem partnerships, and the expansion of InsurTech collaboration models. Regulators in many regions are encouraging digital reporting, e-KYC, and data transparency, making digital infrastructure a necessity rather than an option. Cloud-based core system modernization allows insurers to replace legacy systems with scalable, flexible platforms that support faster product launches and integration with third-party ecosystems. Additionally, increasing investment in InsurTech startups and strategic partnerships between traditional insurers and technology providers are accelerating innovation across health, life, and property & casualty insurance lines. Together, these factors are driving sustained long-term growth in digital transformation spending across the global insurance industry.

Rapid Adoption of AI-Driven Automation Across Insurance Operations

The rapid adoption of AI-driven automation is a major trend accelerating growth in the digital transformation in insurance market. Insurers are increasingly implementing artificial intelligence and machine learning solutions to automate underwriting, claims processing, fraud detection, and customer service operations. These technologies significantly reduce manual effort, shorten turnaround times, and improve accuracy in decision-making. As customer expectations for faster and more transparent services continue to rise, AI-enabled automation is becoming a critical component of insurers’ digital strategies.

In addition to operational efficiency, AI-driven automation enables insurers to leverage large volumes of data for predictive analytics and personalized offerings. Real-time risk assessment, dynamic pricing models, and automated claims settlement enhance customer experience while improving profitability. The scalability of AI solutions, combined with cloud deployment, allows insurers of all sizes to adopt advanced capabilities with lower upfront investment. This trend is driving sustained technology spending and strengthening long-term market growth.

Recent Investments Activity in the Digital Transformation in Insurance Market

| Company | Investment | Description |

| FurtherAI | USD 25 Mn Series A | Raised funding led by Andreessen Horowitz to scale AI-powered automation in commercial insurance workflows, accelerating document processing, intake, and claims automation. |

| InsuranceDekho | USD 70 Mn funding round | Indian insurtech raised USD 70 million backed by Beams Fintech Fund, MUFG, and BNP Paribas Cardif to enhance digital insurance offerings and platform expansion. |

| Norm AI | USD 48 Mn funding | Secured capital for AI-driven compliance and regulatory automation tools, strengthening insurer digital operations and governance solutions. |

| Nirvana Insurance | USD 80 Mn Series C | California-based startup raised USD 80 million, boosting its trucking and specialty insurance platform capabilities with tech enhancements. |

| Peak3 | USD 35 Mn Series A | Funding to accelerate SaaS insurance tech expansion in UK/EU markets, strengthening digital insurance delivery and operations. |

| Azos | USD 30.5 Mn Series B | Brazilian insurtech raised Series B to expand life insurance tech and market reach in Latin America. |

| Korint Insurtech | EUR 5 Mn funding | European insurtech secured EUR 5 million to advance digital insurance transformation capabilities and platform growth. |

| Outmarket AI | USD 4.7 Mn seed funding | Seed round to develop AI-intelligent commercial insurance insights and workflow solutions. |

| Euroins Bulgaria (Eurohold) | EUR 58.8 Mn capital increase | Large insurer raised funds to support digital transformation initiatives and regional expansion. |

1. Launch of India’s Bima Sugam Digital Insurance Platform

India launched Bima Sugam, a unified digital insurance marketplace under the Insurance Regulatory and Development Authority of India (IRDAI), designed to digitize policy issuance, servicing, and claims across insurers on one platform. This initiative streamlines customer access to insurance products, reduces paperwork, and enhances transparency across the value chain—catalyzing wider adoption of digital channels and increasing overall insurance penetration in a large emerging market.

2. ZestyAI’s ZORRO Discover AI for Regulatory Insight

InsurTech ZestyAI introduced ZORRO Discover, an AI agent tailored to analyze complex regulatory documents using advanced language models, helping insurers navigate compliance and competitive landscapes more efficiently. By reducing manual effort and accelerating insights from regulatory data, this development helps insurers modernize compliance operations, lowers operational risk, and supports faster strategic responses—boosting confidence in digital capabilities.

3. SoundHound AI & Apivia Courtage Partnership for AI-Driven Contact Centers

SoundHound AI expanded its partnership with French insurer Apivia Courtage, deploying advanced conversational AI (Amelia 7) across contact centers to enhance customer engagement and automate service inquiries. This collaboration demonstrates how generative and conversational AI can elevate customer experience, reduce service costs, and improve operational responsiveness, encouraging broader investment in AI infrastructure across insurers.

4. India’s Insurance Policy Reforms Enabling Digital Growth (2025)

Recent policy reforms in India, including the Amendment of Insurance Laws allowing 100 % foreign direct investment and digital product initiatives like national claims exchanges, significantly boosted digital policy issuance, AI/ML underwriting, and customer engagement platforms. These reforms attract capital, foster competition, and drive digital innovation adoption—accelerating tech-led growth in one of the world’s fastest-growing insurance markets.

The digital transformation in insurance market is segmented into various regions, including North America, Europe, Asia-Pacific, and LAMEA. Here is a brief overview of each region:

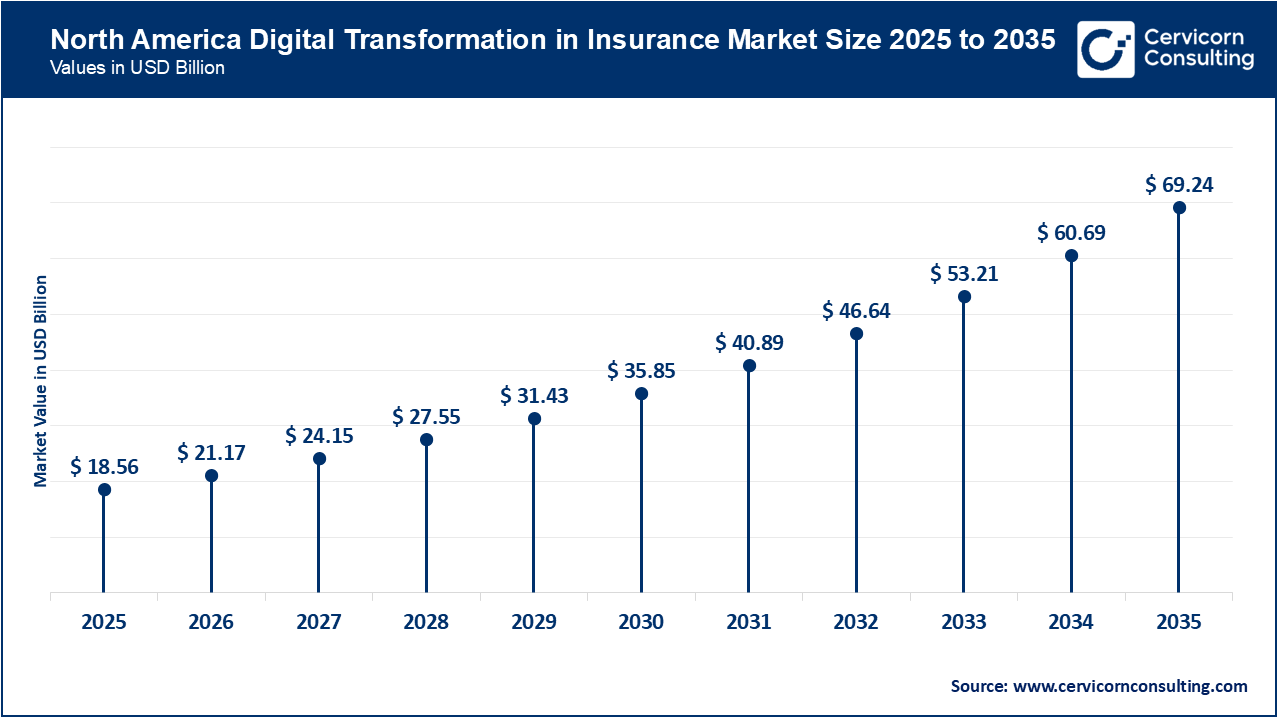

The North America digital transformation in insurance market size was valued at USD 18.56 billion in 2025 and is predicted to surpass around USD 69.24 billion by 2035. North America remains a dominant force in the digital transformation of insurance largely due to its strong technological infrastructure, extensive InsurTech ecosystem, and high levels of digital investment from both incumbents and startups. Insurers in the region lead in adopting advanced analytics, AI-driven underwriting, cloud migration, and automated claims — supported by favorable regulatory environments and significant venture capital inflows. The region’s mature digital payment and mobile penetration further enhance customer expectations, accelerating digital adoption across life, health, and property & casualty insurers. North America’s ecosystem fosters rapid scaling of digital platforms, making it a global hub for innovation and strategic partnerships in insurance technology.

Recent Developments:

The Asia-Pacific digital transformation in insurance market size was estimated at USD 9.42 billion in 2025 and is forecasted to grow around USD 35.15 billion by 2035. Asia-Pacific is growing at the fastest pace in the market, propelled by the rapid adoption of mobile, cloud, and data analytics technologies alongside strong government support for fintech and digital inclusion. Countries such as China, India, and Japan are witnessing rising demand for AI-powered claims processing, digital policy platforms, and embedded insurance within large-scale digital ecosystems. Government initiatives, digital identity programs, and regulatory sandboxes help reduce barriers to innovation, while demographic shifts and expanding middle classes increase insurance penetration through digital channels. The region’s combination of entrepreneurial InsurTech activity and supportive policy frameworks is accelerating digital transformation more dramatically than in other regions.

Recent Developments:

The Europe digital transformation in insurance market size was reached at USD 14.25 billion in 2025 and is projected to hit around USD 53.16 billion by 2035. Europe is driven by regulatory frameworks such as GDPR and Solvency II that promote digital customer experiences, data protection, and operational transparency. European insurers are increasingly investing in omnichannel platforms, advanced analytics, and InsurTech partnerships to meet evolving consumer demands for personalized, secure, and efficient services. The push toward sustainability reporting and digital compliance tools also adds momentum to transformation programs, while federated data initiatives enable better risk modeling and fraud detection. Europe’s strong emphasis on digital trust and customer rights creates a fertile environment for digital solutions that enhance both compliance and experience.

Digital Transformation in Insurance Market Share, By Region, 2025 (%)

| Region | Revenue Share, 2025 (%) |

| North America | 39.2% |

| Europe | 30.1% |

| Asia-Pacific | 19.9% |

| LAMEA (Latin America, Middle East & Africa) | 10.8% |

The LAMEA digital transformation in insurance market was valued at USD 5.11 billion in 2025 and is anticipated to reach around USD 9.07 billion by 2035. The LAMEA is driven by innovation hubs, rising InsurTech ecosystems, and the need to expand insurance access to underserved populations. In Latin America, insurers are partnering with banks and startups to introduce microinsurance and AI-based claims platforms, leveraging mobile penetration and digital wallets for broader reach. Middle Eastern financial centers like Dubai’s DIFC are fostering regulatory sandboxes that allow startups to test digital models, while African markets are exploring mobile-first insurance solutions adapted to local needs. Growth in LAMEA is supported both by demand for inclusive insurance and accelerating digital infrastructure.

Recent Developments:

The digital transformation in insurance market is segmented into technology, solution type, deployment mode, end user, and region.

Cloud computing dominates the market as it forms the foundation for modernizing legacy systems and enabling enterprise-wide digital operations. Insurers increasingly rely on cloud platforms to achieve scalability, cost efficiency, faster deployment, and seamless integration with advanced technologies such as AI and analytics. Cloud adoption supports core functions including policy administration, claims processing, and customer engagement while ensuring regulatory compliance and business continuity. Hybrid and public cloud models are especially preferred by large insurers seeking flexibility, resilience, and innovation at scale.

Digital Transformation in Insurance Market Share, By Technology, 2025 (%)

| Technology | Revenue Share, 2025 (%) |

| Artificial Intelligence (AI) & Machine Learning | 24% |

| Big Data & Advanced Analytics | 18% |

| Cloud Computing | 28% |

| Internet of Things (IoT) | 12% |

| Blockchain | 8% |

| Robotic Process Automation (RPA) | 10% |

Artificial intelligence and machine learning represent the fastest-growing technology segment due to their transformative impact on underwriting, claims automation, fraud detection, and personalized pricing. Insurers are rapidly adopting predictive analytics, computer vision, and generative AI to reduce processing time, improve decision accuracy, and enhance customer experience. Increasing data availability from digital channels, IoT devices, and customer interactions further accelerates AI adoption. As insurers pursue data-driven operations and automation, AI continues to attract significant investment and drives long-term market growth.

Policy administration systems dominate the solution segment as they serve as the operational backbone of insurance companies. Digital transformation initiatives typically prioritize upgrading these systems to manage policy issuance, renewals, endorsements, and cancellations more efficiently. Modern policy administration platforms enable automation, regulatory compliance, and real-time data access across multiple distribution channels. By improving operational efficiency and supporting new digital products, these systems play a critical role in enabling insurers to scale operations and deliver consistent customer experiences across life, health, and P&C insurance lines.

Digital Transformation in Insurance Market Share, By Solution Type, 2025 (%)

| Solution Type | Revenue Share, 2025 (%) |

| Policy Administration Systems | 22% |

| Claims Management | 20% |

| Customer Relationship Management (CRM) | 14% |

| Risk & Compliance Management | 11% |

| Billing & Payment Solutions | 9% |

| Underwriting & Pricing Engines | 14% |

| Digital Distribution Platforms | 10% |

Digital distribution platforms are the fastest-growing solution segment as insurers increasingly shift toward direct-to-consumer models and online marketplaces. These platforms enable faster customer acquisition, lower distribution costs, and improved transparency across product offerings. Growth is driven by rising consumer preference for online purchasing, mobile-first engagement, and embedded insurance models. Insurers and InsurTechs are investing heavily in digital channels to expand reach, especially in emerging markets, making digital distribution a major growth driver within the overall digital transformation ecosystem.

Cloud-based deployment dominates the market as insurers increasingly replace traditional on-premises systems with scalable and flexible cloud solutions. Cloud deployment enables faster implementation, lower capital expenditure, and continuous system updates, which are critical for supporting digital transformation initiatives. Regulatory acceptance of cloud infrastructure and improvements in data security have further strengthened adoption. Insurers leverage cloud-based platforms to integrate AI, analytics, and automation tools efficiently, making cloud deployment the preferred model for both large enterprises and mid-sized insurance providers globally.

Digital Transformation in Insurance Market Share, By Deployment Mode, 2025 (%)

| Deployment Mode | Revenue Share, 2025 (%) |

| On-Premises | 28% |

| Cloud-Based | 72% |

Cloud-based deployment is also the fastest-growing segment as smaller insurers and intermediaries accelerate migration from legacy systems. SaaS-based insurance solutions reduce upfront investment and simplify access to advanced digital capabilities such as AI-driven underwriting and automated claims. The need for remote operations, real-time data access, and faster innovation cycles further supports rapid cloud adoption. As digital ecosystems expand, cloud-based deployment continues to grow at a faster pace than traditional on-premises infrastructure across all insurance segments.

Insurance companies represent the dominant end-user segment, accounting for the largest share of digital transformation spending. Life, health, and property & casualty insurers are investing heavily in modern core systems, AI-powered analytics, digital claims management, and customer engagement platforms. Competitive pressure, regulatory requirements, and the need to improve operational efficiency drive large-scale digital initiatives among insurers. Their financial capacity and strategic focus on long-term transformation position insurance companies as the primary drivers of market demand.

Digital Transformation in Insurance Market Share, By End User, 2025 (%)

| End User | Revenue Share, 2025 (%) |

| Insurance Companies | 65% |

| Reinsurance Companies | 7% |

| Insurance Brokers & Agents | 18% |

| Third-Party Administrators (TPAs) | 10% |

Insurance brokers and agents are the fastest-growing end-user segment as they rapidly adopt digital tools to remain competitive in an increasingly digital insurance ecosystem. CRM platforms, digital sales tools, analytics, and automated policy management solutions help intermediaries enhance customer engagement and operational efficiency. As insurers digitize distribution channels, brokers and agents must integrate with insurer platforms and marketplaces. This necessity is driving accelerated technology adoption among intermediaries, contributing to strong growth in this segment.

By Technology

By Solution Type

By Deployment Mode

By End User

By Region