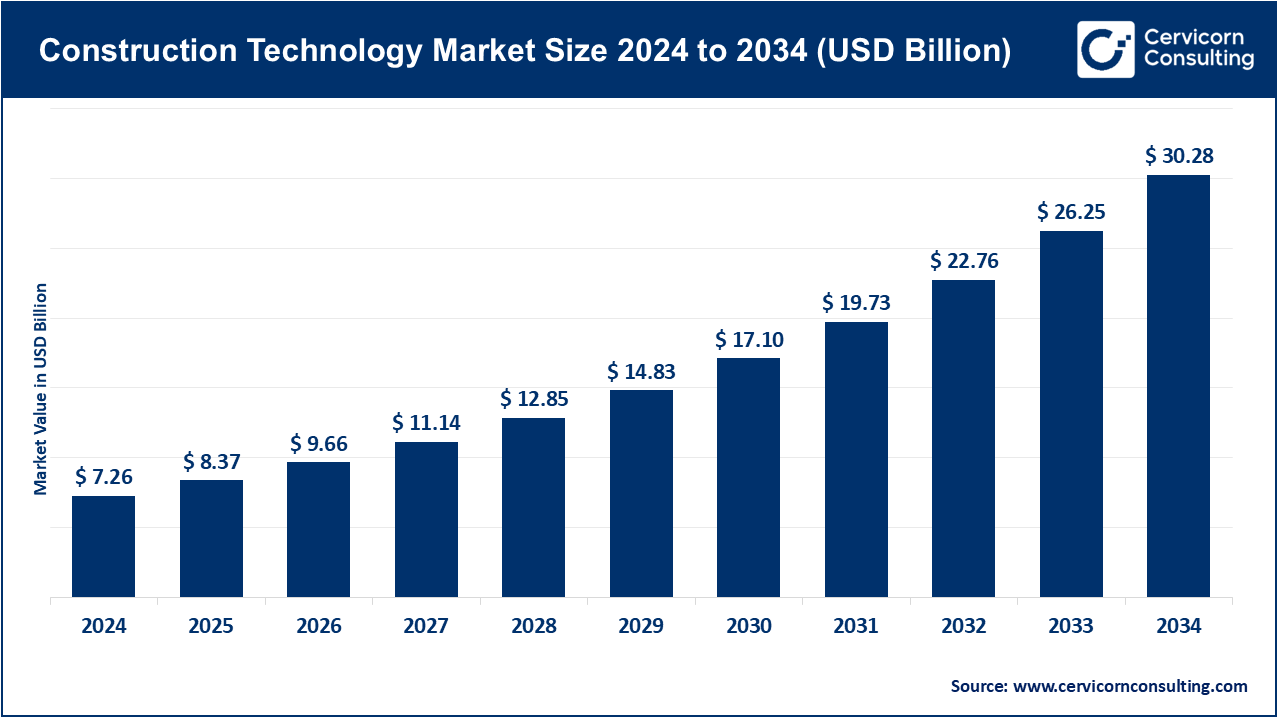

The global construction technology market size was valued at USD 7.26 billion in 2024 and is expected to reach around USD 30.28 billion by 2034, growing at a compound annual growth rate (CAGR) of 16.8% over the forecast period from 2025 to 2034.

The construction technology market is gaining momentum because of the growing demand in the regards to smart infrastructure, sustainability objectives, and labor productivity. The scope of construction technologies that transform the design, execution and monitoring of projects includes AI-aided project management, 3D printing and modular construction, drones, BIM (Building Information Modeling) and IoT-enabled monitoring. The innovations promote efficiency, less wastage of materials, safety of the workers, and quickening of the projects. With cities becoming densely built up and regulations on emissions becoming stricter, construction technology is critical in the setting up of resilient, cost-efficient, and environment-friendly infrastructure that is net-zero or smart city compliant.

Construction technology market is the part of the market which elaborates and deploys innovative tools, software, and machines to enhance the construction process, productivity, safety, and sustainability. It incorporates the use of Building Information Modeling (BIM), drones, 3D printing, robotics, AI, the Internet of Things (IoT), and the modular construction. Such developments optimize the process of planning a project, human collaboration in real-time, cut labor expenses, and material wastage. The market is availed to residential, commerce, and infrastructure projects to curb issues of shortage of labor and project delays. Contrary to the traditional paradigm, the construction tech market, motivated by urbanization, smart city development and the need to develop efficient construction-related solutions is turning the old paradigm into something new by supplanting the old methods with faster, safer, and more sustainable results.

Construction Cost in 2024

| Type | Share, 2024 (%) |

| Footing | 11% |

| Plastering | 16% |

| Painting | 4% |

| Basement | 11% |

| Flooring | 7% |

| Roof | 16% |

| Joineries and Grills | 6% |

| Brickwork | 16% |

| Electrical and Plumbing | 7% |

| Other Expenses | 6% |

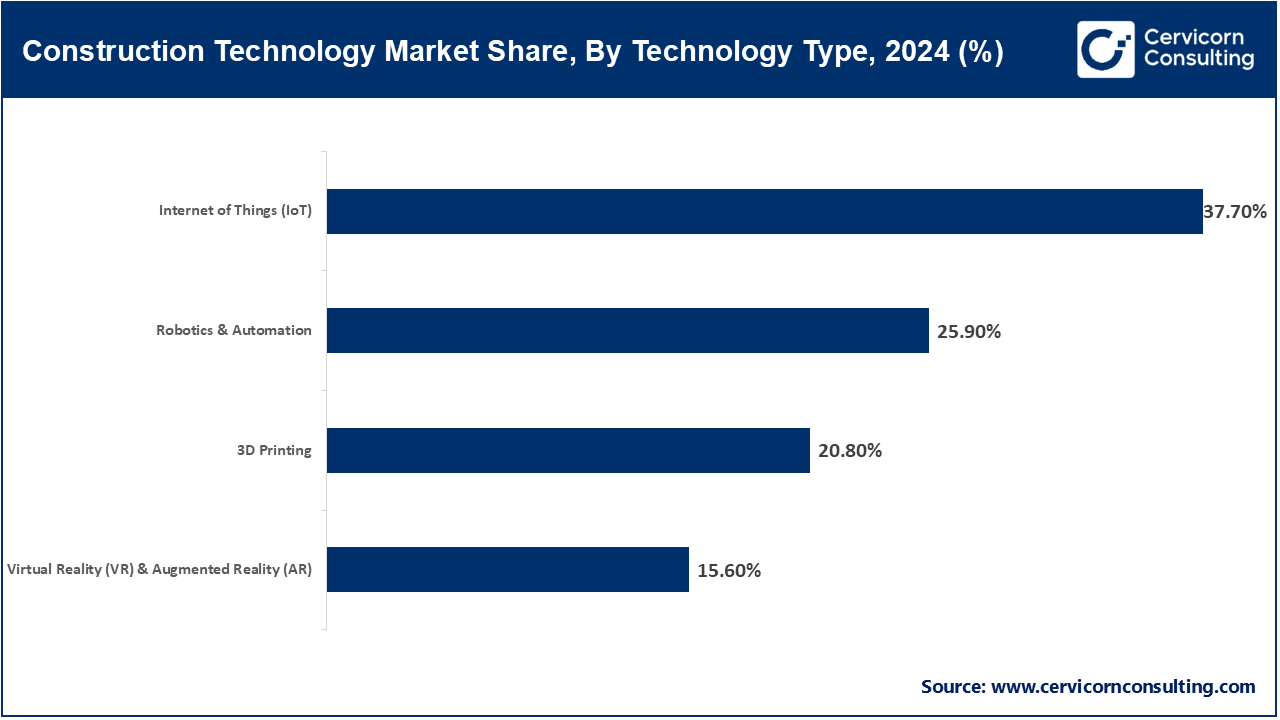

3D Printing: 3D printing constructs structures in layers of concrete or composite materials allowing structures to have complex shapes i.e. the construction process is faster and only minimal wastage is incurred. In December 2022, a European consortium finished their first concrete prototype, a pedestrian bridge in three dimensions that proved structurally viable. In years since, 3D-printed utility buildings have been given the go signal by a number of municipalities as prototype buildings. Such real-world applications reflect how the printing is moving away from lab experimentation to regulated, useable infrastructure in all industries.

Robotics & Automation: Robotics is the use of automatic or semi-automated machine to do brick laying, excavation of the ground and handling of material to increase precision and cut on labor. In March 2023, Built Robotics put commercial autonomous earthmoving excavators into use on a large scale on a Texas highway project. This installation lowered rework and also enhanced safety due to the limited operator error. Adoption is increasing since faith in robotic dependability is developing, and rule and guideline conditions are changing to correspond with automated business processes.

Virtual Reality (VR) & Augmented Reality (AR): VR throws users into completely digital spaces, whilst AR super-imposes digital data on the real-world views, perfecting design reviews, instruction, and site preparation. In July 2024, one of the larger contractors launched AR-equipped glasses on one of its Dubai skyscraper projects, where it allows engineers to see utilities in real-time in order to complete the installations. This on-site use enhanced the coordination of trade and decreased the installation mistakes, which contributed to greater toleration of immersive technologies over complicated constructions.

Internet of Things (IoT): IoT links sensors, devices and equipment to send on site condition, asset performance and safety measure in real time. An example is a U.S. bridge project in October 2022 which utilised IoT sensors to monitor structural loads and vibration at construction stages. The data empowered prevention of over-stressing and allowed making proactive adjustments. Increased real-time monitoring deployments later on have made the IoT offering a necessity in critical infrastructure projects, as well as make the assets and infrastructure longer-lasting.

On-Premise: on-premise System is comprised of local servers or data centers that are placed within the construction firm providing complete control and tailoring of data. Data security needs cause many established construction companies to keep them. In January 2024 an engineering consultancy improved its on‑premises BIM suite to facilitate offline collaboration at far-apart locations. In spite of the increase of cloud consumption, on-premise is still prevalent in organizations that consider regulatory compliance a priority or operate in a low-connection area.

Construction Technology Market Share, By Deployment Mode, 2024 (%)

| Deployment Mode | Revenue Share, 2024 (%) |

| On-Premise | 38.80% |

| Cloud-Based | 61.20% |

Cloud‑Based: Cloud based systems where services are maintained in the cloud offsite and access is available using the internet where it allows collaboration, scale ability and working remotely. One international contracting organization in May 2023 migrated one of its main project management platforms to the cloud-native architecture with AI-informed analytics. This has led to a 20 percent decrease in RFIs and better alignment of stakeholders across continents. A notable result of the shift is the powerful movement in favor of cloud applications that enable work among distributed teams and modern collaboration processes.

Residential Construction: The residential building industry uses technology to build houses, apartments or low-cost dwellings, and allows faster building, controlling costs, and customizing. In November 2023, a US startup finished a 50‑unit modular housing project with automated panelized housing, and provided the housing units 30% faster than typically constructed homes. It was the success that led to a demand of prefabricating affordable housing requirements by local governments using mandates. It reveals the way technology is transforming the model of delivering housing.

Commercial Construction: Commercial work encompass offices, retail stores, hospitality and institutional buildings with technology making designs more accurate and facility operations within the building. Digital-twin modeling was used to test façade under wind loads in Singapore on a high-rise office building in August 2022 even when actual construction had not taken place. This virtual validation made fewer structure modifications and enhanced structure performance. It is an example of how large-urban projects can be improved whereby digital tools introduce benefit to risk mitigation and can save costs.

Industrial Construction: Industrial construction is that of factories, plants and processing plants, which needs detailed drawing, safety precautions and heavy-duty installations. In February 2025, Malaysia-based petrochemical plant completed a large-scale revamp where it deployed AR-assisted assembly in its operations with laborers being able to overlay mechanical schemes directly onto piping to facilitate easier and safer attachment. This practice saved 18 percent of the installation time and put an emphasis on the importance of AR in multi-mechanical settings.

Infrastructure Construction: Infrastructure includes roads, bridges, tunnel, rail and utilities, durability and safety are of utmost importance; there is greater monitoring and resilience thanks to tech. In June 2024 a European rail regulator utilised AI-enabled drones to conduct a survey of bridge superstructures in a transit corridor to identify damage and schedule work to be undertaken to address it before it becomes apparent. Infrastructure projects where high expectations are put on the safety of the population are seeing this proactive surveillance model become commonplace.

Construction Contractors: Construction contractors who carry out construction projects and manage schedules and budgets with the help of technology. In July 2024 a general contractor released a cloud-native production tracking tool which cut delay by 25 percent in a large mixed use project in Chicago. The driving force behind the adoption was the necessity to have a real-time visibility of the sites. Contractors are turning more towards digital platforms in order to manage complexity and achieve a competitive advantage.

Architects & Designers: Designers and architects use BIM, VR, and parametric models to develop, project and see what they are creating prior to construction. In March 2023, a client walkthrough of one of the museums, enabled by VR, was released by an architectural firm in London and enabled the stakeholders to feel the space months before even ground-breaking. This immersive tool enhanced stakeholder buy-in, and eliminated change orders during the contract construction period. VR-based design improvement provides greater client alignment.

Construction Technology Market Share, By End User, 2024 (%)

| End User | Revenue Share, 2024 (%) |

| Construction Contractors | 40.60% |

| Architects & Designers | 21.10% |

| Facility Managers | 15.20% |

| Government & Public Infrastructure | 12.80% |

| Others | 10.30% |

Facility Managers: Facility managers manage buildings after construction, have access to tech to manage the structure through maintenance, energy management, and asset tracking. In April of 2025, one of the facilities in a hospital implemented IoT sensors networks to be able to monitor the performance of HVAC and the use of the elevators, and predictive maintenance of both became possible, and downtime was reduced by 30%. It also detected inefficiencies in the use of power early. FM tools which are enabled by digital technologies hold the primary role in advancing occupant experience and decreasing the lifecycle expenses.

Government & Public Infrastructure: Governments and other public institutions have significant asset portfolios of infrastructure and utilize technology to regulate, plan and keep citizens safe. An example of this was a municipal government that commissioned a digital twin of its water system in September 2022, where the digital twin can help it discover leaks in real-time and optimize the water supply system. Through the years, the water loss has decreased by 12 percent as a result of using the platform. Scaling the usage of infrastructure tech requires the support of the general population, which refers to the role of the public sector.

Software: Digital platforms (BIM, ERP, analytics, scheduling) are used in the design, planning and management workflows as software. In May 2024, an award-winning BIM provider added AI-enabled clash detection and identified an extra 70 per cent of design conflicts prior to work starting onsite. With this innovation, preconstruction phases were shortened. Software has remained the mainstay of digital project delivery in terms of making smarter data driven decisions amongst all stakeholders.

Construction Technology Market Share, By Component, 2024 (%)

| Component | Revenue Share, 2024 (%) |

| Software | 42.50% |

| Hardware | 33.20% |

| Services | 24.30% |

Hardware: Hardware includes on-site devices such as drones, scanners, sensors or robotics that either collect data or do work. Last October, a construction company started to fly LiDAR-equipped drones on highway projects to create topo maps in hours rather than days. The super-high-resolution data enhanced the accuracy in grading and also minimized the field visitations. Improvements in hardware are swiftly changing field processes of old by making them data-rich and automated.

Services: These services incorporate consulting, training, integration, maintenance and support of tech deployment in construction. In February 2025, a contech consultancy established a certification of the drone-based inspection services through training over 200 professionals in North America. The program was intended to formalize the measures of using drones and their safety technique in examining the bridges. The service offerings are shifting towards aiding companies to use the technology, optimize it and to scale it.

The construction technology market is segmented into several key regions: North America, Europe, Asia-Pacific, and LAMEA (Latin America, Middle East, and Africa). Here’s an in-depth look at each region.

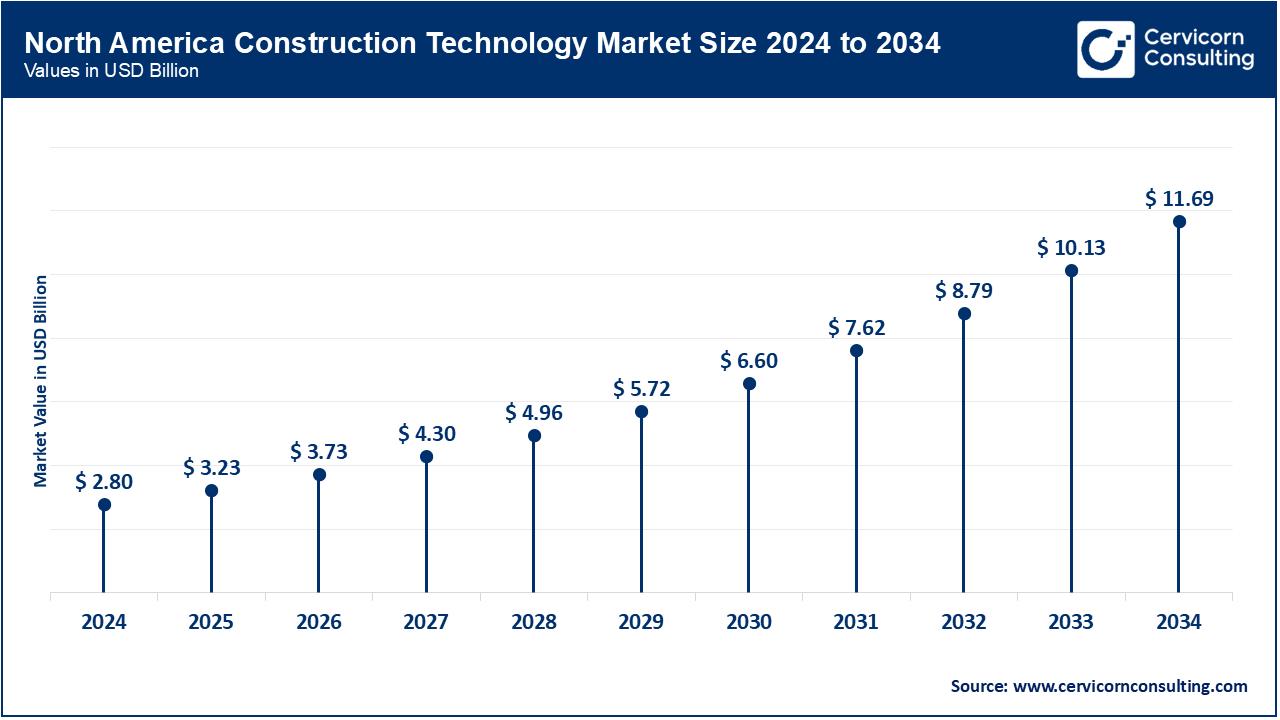

North America is a pioneer in terms of adoption of construction technology because it has heavy infrastructure investment, robust R&D and regulatory framework. Other countries such as U.S, Canada and Mexico are concentrating on digitization, automation as well as existing building. A nationwide project on digital infrastructure was initiated in October 2023 by U.S. Department of Transportation that included AI manufactured bridge safety monitoring systems in it. This project reflects the fact that American cities are integrating intelligent devices into the public infrastructure design and implementation.

Europe has been ahead in green construction, digital regulation and the use of AI, BIM, and low-carbon materials. Innovation is facilitated by strict rules of emission and Green Deal in EU member states. In March 2023, the European Union invested USD 900 million on a transnational project using digital twins to cover the transportation infrastructure of Germany, Netherlands and France. This joint project displays the way in which the EU can drive massive innovation by means of coordinated tech approaches.

The Asia-Pacific is a very dynamic area when it comes to building technology as urbanization and state-proposed smart city initiatives have been growing significantly, as well as forecasts of labor shortages. Such countries as China, India, and Australia are using AI, drones, and BIM on huge scale. In April of 2023, Japan initiated an US$ 1.8 billion project to introduce robotrouters of earthmoving and robot-sensors earth site monitoring to the suburban area of the Tokyo expansion. The nature of this investment shows the aggressive and technologically advanced pattern of infrastructure development and growth in this region.

LAMEA (Latin America, Middle East, and Africa) is also embracing construction technology to enhance infrastructure delivery, solve housing crisis and deal with climate-related threats. Venture in the town and foreign investments help the region expand. In June 2023, African Development Bank financed a digital infrastructure project in four West African countries with the installation of smart road monitoring frameworks. This investment attests to the increased interest in digitalized construction in the underserved areas.

Market Segmentation

By Component

By Technology Type

By Deployment Mode

By Enterprise Size

By Application

By End User

By Region