The introduction of US tariffs on the metals sector has led to a complex and divergent market impact, negatively affecting overall metal demand while simultaneously causing significant price volatility and separation between US and global markets. US tariffs, specifically those imposed on aluminium and steel, are designed to bolster US domestic prices and strengthen local production, but they have also resulted in market instability elsewhere. Global market prices (excluding the US) may experience weakening and volatility due to two primary factors: oversupply outside of the US resulting from reduced exports to the US, and a negative direct and indirect impact on global demand. Indirectly, tariffs on metal-intensive imported products, such as home appliances and automobiles, also reduce the ultimate demand for steel and aluminium. This overall weak pricing environment is expected to impact the global metal and steel sectors, especially those in Asia.

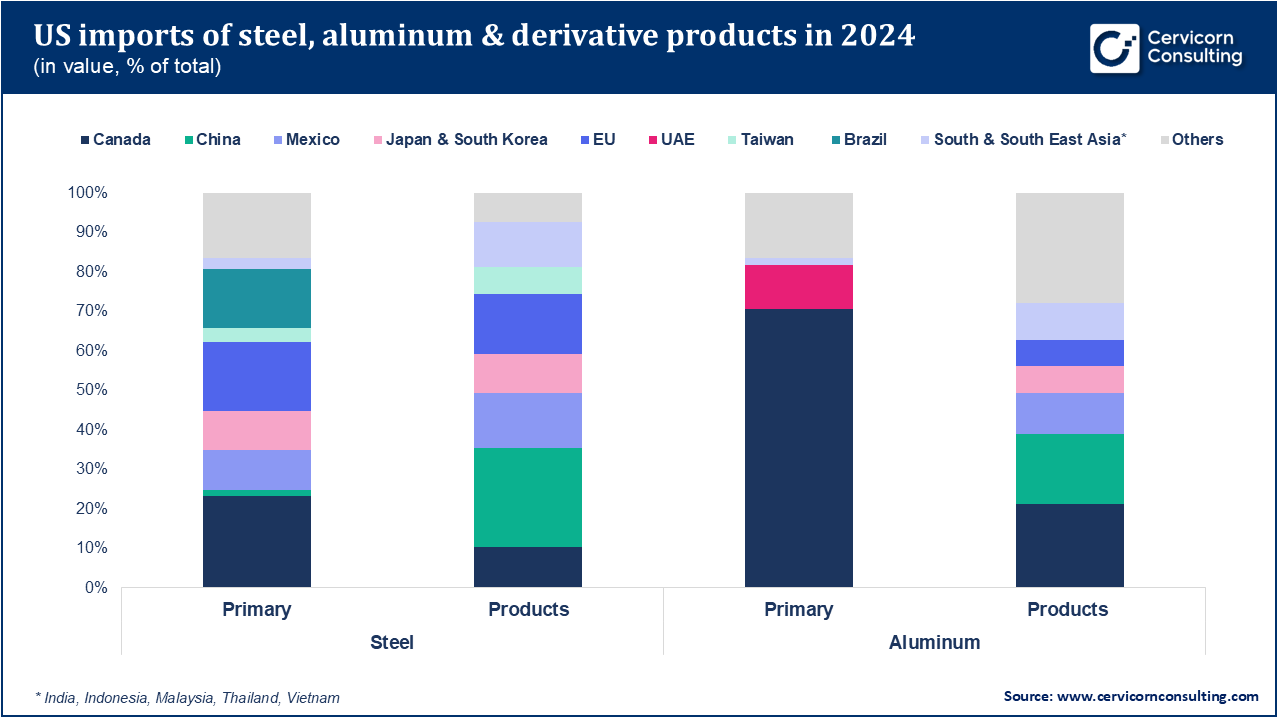

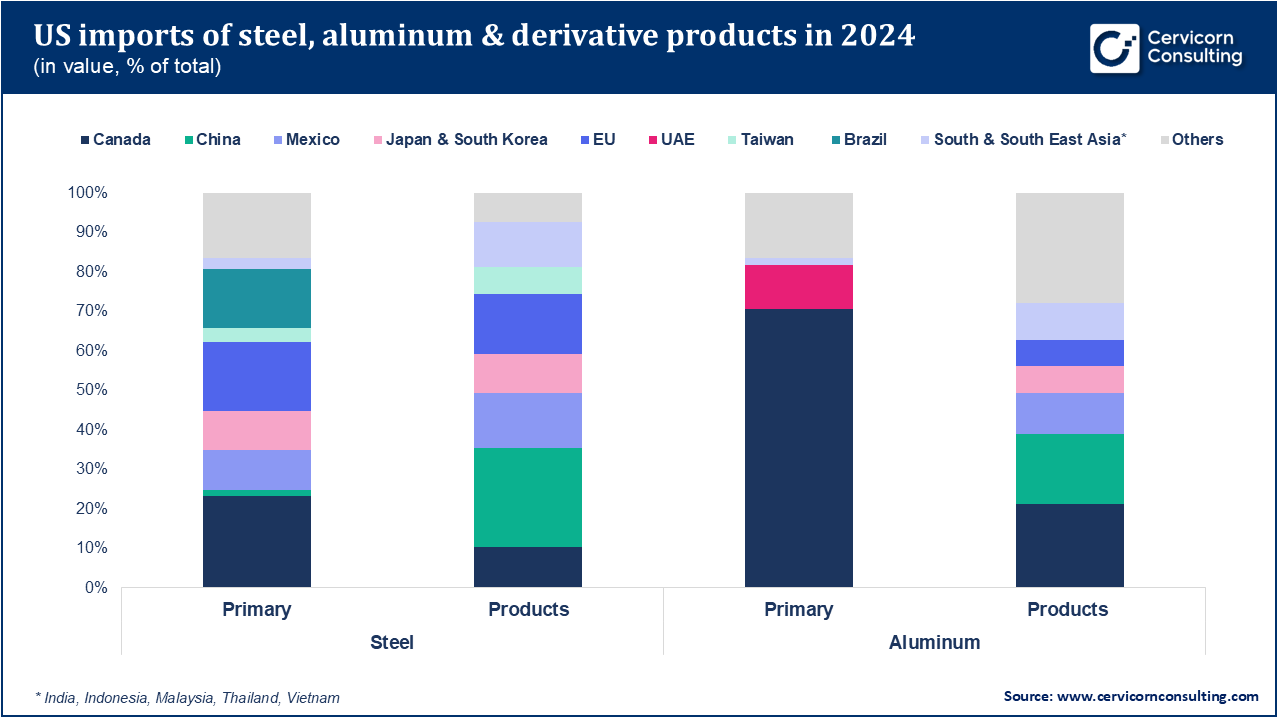

The tariffs have created a notable divergence in pricing, particularly for steel and aluminium. Following the imposition of 25% tariffs on all steel and aluminium imports starting March 12 2025, prices have hiked in the US while lowering elsewhere, expanding the price gap. The price gap for hot rolled coil (HRC) between the US and China widened significantly, reaching USD 592/tonne on March 26, 2025, up from USD 345/tonne on January 1, 2025. US domestic ferrous and non-ferrous metals producers generally stand to benefit from these tariffs through increased market share and additional revenue due to higher prices, which is expected to boost their margins. Conversely, US industries heavily reliant on steel and aluminium as inputs—including construction, automotive manufacturing, and food packaging—face significantly higher costs, which could lead to a burden of over USD 100 billion annually for production chains and consumers if high tariff rates persist. Major exporters to the US, such as Canada (the largest supplier of steel and aluminium), face challenging conditions and must contend with redirecting exports amid an already oversupplied global market.

In contrast to industrial metals like steel and aluminium, copper and gold are identified as the "winning metals" under the current tariff environment. The impact on copper has been distinct: the mere announcement of a potential tariff on imported copper prompted a sharp price increase globally, including on the New York Comex and London Metal Exchange (LME). This reaction was driven by fears of supply disruption, triggering a global redirection of copper supplies toward the US, which subsequently created shortages in other regions and widened the price gap between Comex and LME. Copper is forecast to be the only industrial metal in deficit in 2025, supported by tight mined supply and intact demand growth driven by the energy transition. Due to its widespread usage, lack of substitutes, and market supply shortage, copper prices are expected to eventually strengthen both globally and within the US. Meanwhile, gold is expected to outperform as a safe asset, as investors seek hedging against global uncertainties such as delayed interest rate cuts, currency weakness, geopolitical tensions, potential inflation, and recession.

Key Pointers

- Tariff Rate and Scope: The US implemented 25% tariffs on all steel and aluminium imports effective 12 March 2025. Country-specific tariffs were added to metal tariffs, resulting in some non-USMCA-compliant imports from Canada and Mexico facing up to 50% tariffs.

- Copper's Unique Situation: The high price surges in copper were initiated by an order on 25 February 2025, directing the US Commerce Department to evaluate the necessity of additional tariffs on imported copper to protect national security (a Section 232 investigation).

- Impact on Exporters: Canada is the most significant supplier affected by the tariffs on aluminium and steel. Canada shipped 87% of its total steel exports to the US in 2024, and its basic metal production is forecast to contract in 2025 and 2026.

- US Import Dependency: The US heavily relies on imports for both steel (approximately 26% of consumption) and aluminium (74% of demand in 2024).

- Downstream Effects (Mexico): The tariffs extend to secondary products. Exports of aluminium derivatives from Mexico, such as empty aluminium cans, are subjected to the tariff. This could raise the price of products like exported beer.

- Industry Outlook: The outlook for overall industrial metals (excluding copper) is generally not promising in 2025, due to deceleration in demand growth exacerbated by US tariffs and delayed economic recovery in China.

- Top Beneficiaries: Companies with strong copper and gold portfolios, such as Zijin Mining and Freeport McMoRan (FCX), are identified as top picks. FCX, in particular, is positioned as a key beneficiary of potential US copper tariffs due to its US operation contributing 30% of its total copper production.

Metal Price Forecast (based on average)

| (USD/tonne) |

2022 |

2023 |

2024 |

2025F |

2026F |

| Steel (World Benchmark HRC) |

788 |

622 |

540 |

507 |

518 |

| China's Benchmark HRC |

571 |

481 |

433 |

416 |

424 |

| China's Benchmark Rebar |

558 |

467 |

420 |

408 |

408 |

| Iron ore (Fe 62% fine) |

122 |

121 |

110 |

99 |

96 |

| Seaborne Hard Coking Coal Contract |

372 |

292 |

252 |

202 |

200 |

| Aluminium |

2,710 |

2,281 |

2,458 |

2,650 |

2,700 |

| Copper |

8,797 |

8,478 |

9,147 |

9,700 |

9,700 |

| Zinc |

3,478 |

2,647 |

2,779 |

2,700 |

2,750 |

| Lead |

2,150 |

2,138 |

2,073 |

2,000 |

2,050 |

| Nickel |

25,607 |

21,474 |

16,812 |

17,000 |

17,500 |

Impact on US and Global Steel Prices and Markets

The introduction of tariffs, specifically the 25% US tariffs on all steel imports, effective from March 12, 2025, has significantly impacted the global steel industry by creating market divergence, volatility, and uncertainty. The primary goals of these tariffs are to bolster US domestic prices and strengthen local production.

The US tariffs on steel have caused a notable divergence in pricing between the US and the rest of the world.

- US Market: Tariffs are expected to bolster US domestic prices. Following the tariff implementation, US Hot Rolled Coil (HRC) prices have risen by 31% year-to-date (YTD) to USD984/tonne as of 26 March. This increase in prices, driven partly by the reliance on imports for US steel consumption (approximately 26% of demand in 2024), is expected to boost the margins of domestic ferrous producers. Domestic producers also gain market share due to reduced foreign competition. However, this volatility requires efficient planning in sectors like construction, with specific contingencies recommended for installed structural steel and galvanised steel conduit.

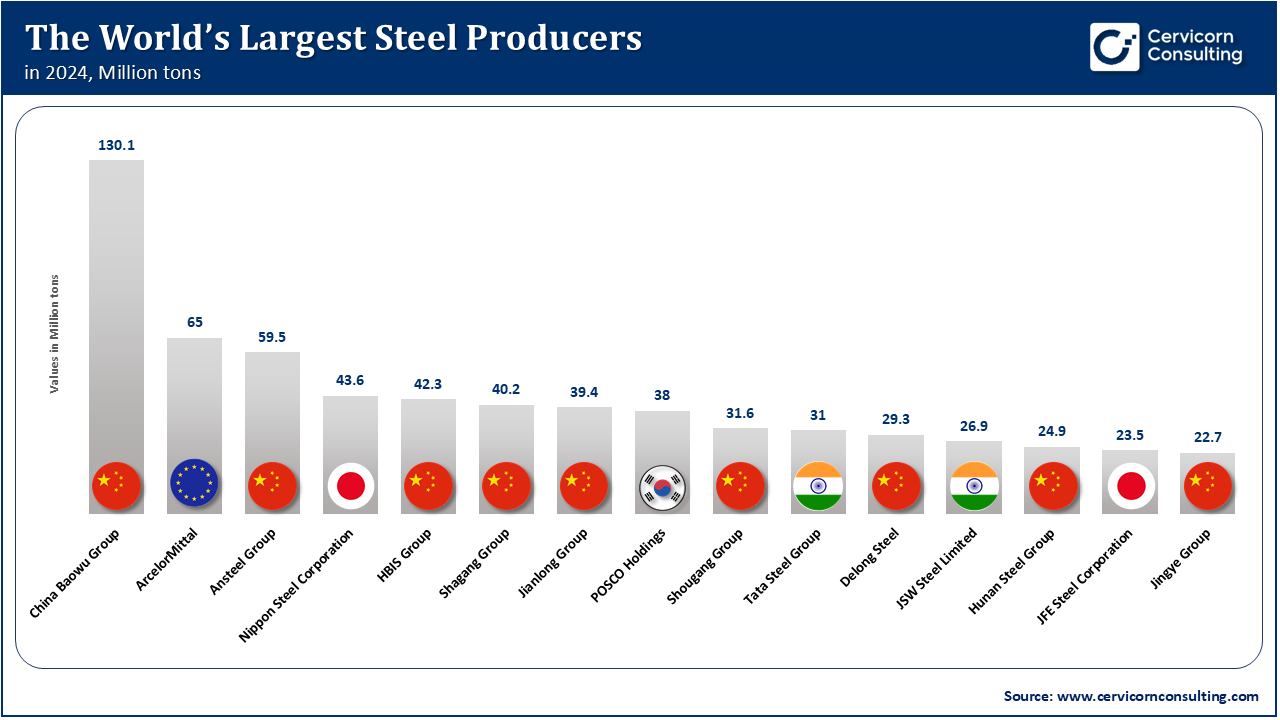

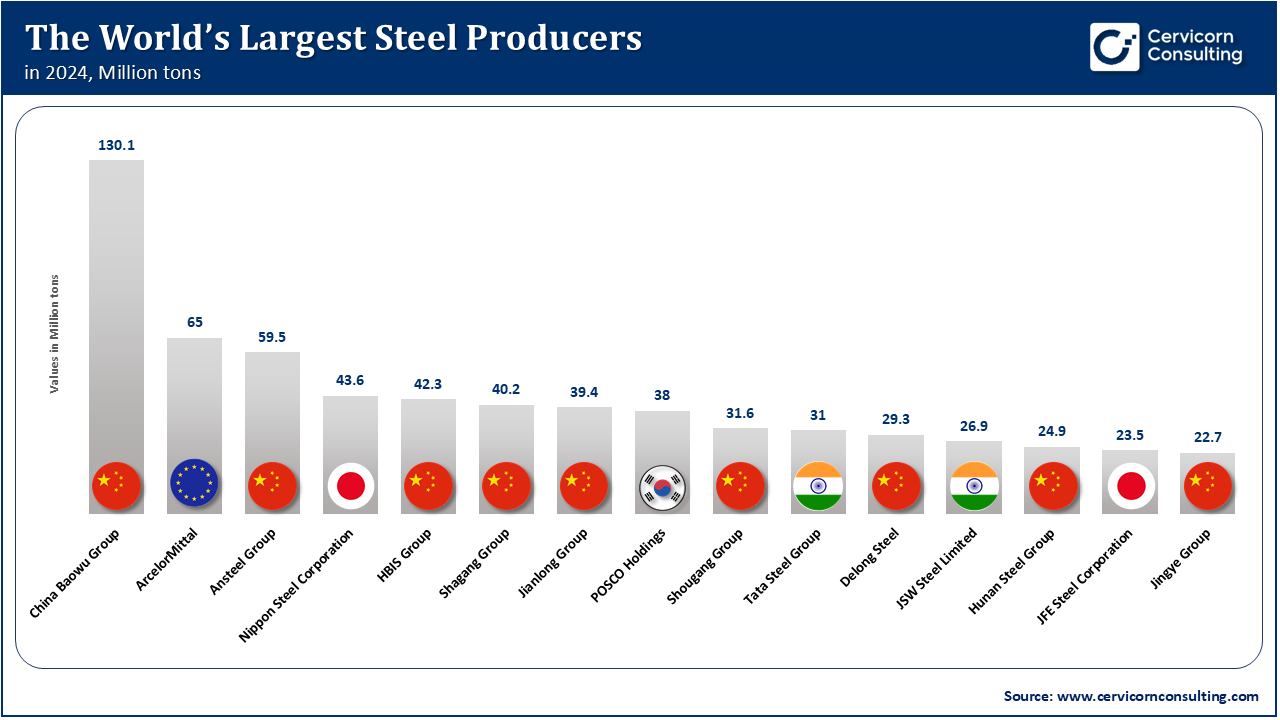

- Global Market (Ex-US): Global steel prices (excluding the US) are expected to experience volatility and weakening. This is due to oversupply outside the US as exports previously bound for the US are rerouted. For instance, HRC prices in China declined by 4% YTD to USD 392/tonne by 26 March 2025, widening the price gap between the US and China to USD 592/tonne. Weak prices are expected to impact global metal and steel sectors, particularly in Asia.

Downstream Effects and Demand Reduction

The tariffs have a substantial negative impact on steel demand both directly and indirectly.

- Indirect Demand Reduction: Tariffs on US imports of metal-intensive products like automobiles and home appliances indirectly reduce the overall demand for steel and aluminium. The US automotive sector is specifically decelerating, partly due to the 25% tariff on imported cars and car parts.

- Increased Costs for Consumers and Industries: US industries heavily reliant on steel as inputs—including construction, automotive, and manufacturing—face significantly higher costs. The original 25% tariff on steel was estimated to add USD 22.4 billion to input costs; with the increased tariff rate of 50% on steel and aluminium from certain regions (effective June 4), this cost could double, creating an estimated burden of over USD 100 billion annually for production chains and consumers.

Impact on Key Exporters

Countries that rely heavily on exporting steel to the US are severely affected:

- Canada: Canada is the single largest supplier of steel to the US market, accounting for 23% of US finished steel imports in 2024. Canada shipped 87% of its total steel exports to the US in 2024. The tariffs "will bite," making it challenging for Canada to redirect this steel amid an oversupplied global market. Basic metal production in Canada, particularly iron and steel, is forecast to contract significantly in 2025 and 2026.

- Mexico: The US imports 26% of the steel it consumes, and Mexican steel exports to the US represented 12% of US finished steel imports in 2024. Shipments of steel from Mexico to the US were reduced by 9.6% between January and May 2025 following the imposition of tariffs. Exports of steel-based products such as pipes are also subject to tariffs. Non-USMCA-compliant imports from Mexico faced a 50% tariff from March 12, 2025.

- Asia: The global weak pricing environment resulting from the tariffs will inevitably impact Asian steel sectors. While Asian countries generally have limited direct impact on export volume to the US compared to Canada, Brazil, and Mexico, South Korea (10% of US imports) and Vietnam (5% of US imports) are likely to see the biggest impact on steel export volume in Asia. China's steel industry also faces headwinds due to overcapacity, low prices, and the domestic property sector decline, although only 2% of US finished steel imports came from China in 2024.

The introduction of tariffs on metals, particularly steel and aluminium, has had a significant and complex impact on the construction industry in the US and globally, primarily by escalating input costs and introducing price volatility.

Increased Costs and Price Volatility

The US construction industry is a leading consumer of both steel and aluminium, making it highly susceptible to the effects of the new tariffs.

- Higher Raw Material Costs: The tariffs, aimed at revitalising domestic production, have caused domestic steel producers to raise their prices. Following the discussion of tariffs, hot-rolled steel futures peaked in mid-June at USD 924/tonne, over 40% higher than prices in December 2017 (USD 660/tonne). Raw steel prices generally increased nearly 40% from the beginning of 2018 to June 2018. US tariffs on steel and aluminium are expected to bolster US domestic prices.

- Impact on Installed Costs: The price increase in raw steel directly raises the total cost of fabricated and installed steel products, although the cost of labour remains unchanged. Raw steel accounts for 15% to 30% of the total cost of these products. Assuming raw steel costs settle around 20% higher than pre-tariff prices, the cost of a tonne of raw steel would rise from USD 775/tonne to USD 930/tonne. This translates to an installed structural steel cost increase of 3.4% to 4.4%.

- Extreme Volatility: The most extreme volatility has been observed in galvanised steel conduit, where material costs increased by 40% in some cities after the tariff announcement.

- Contingency Recommendations: To mitigate unexpected project costs caused by volatile pricing, efficient planning is required. For installed structural steel, carrying a 4–5% contingency was recommended through 2018, decreasing to 3–4% in early 2019. For installed galvanised steel conduit, a much higher contingency of 12–16% was recommended for the subsequent six months, decreasing to 6–8% for the following six months.

Supply Chain Risks and Business Uncertainty

The tariffs have introduced risks related to supply and planning for contractors and fabricators in the US:

- Supply Shortages: As tariffs diminish foreign competition, domestic producers are tasked with supplying a much larger share of demand. The US was the largest importer of steel in the world in 2017, with imports accounting for more than 30% of US consumption. Until domestic steel mills can increase capacity and run optimally, fabricators and contractors may struggle to secure sufficient steel for projects.

- Contractor Risk: Due to the current volatility in raw steel prices, many suppliers only guarantee pricing if an order is placed within one week. This exposes contractors to increased risk if supplier quotations expire before work begins. Contractors may start pricing this risk unless project owners permit adjustments based on current supplier quotations, though this risk is expected to decrease as domestic capacity increases.

- Impact on Overall US Economy: The imposition of tariffs on steel and aluminium could significantly raise costs for American industries, especially those heavily dependent on these metals as inputs, with construction being a key affected sector. The original 25% tariff on steel and aluminium was estimated to add USD 2.4 billion to input costs; with the increased tariff rate of 50%, this cost could double, creating a burden of over USD 100 billion annually for production chains and consumers.

- Slowing Demand: Demand from key buyer sectors, including construction, is set to decelerate in the US. Business confidence and investment in the US metals and steel industry have also been dented by the uncertainty associated with the tariff policy.

International and Indirect Impacts

While the direct impact is felt within the US construction supply chain, the effects ripple internationally:

- Indirect Demand Reduction: Tariffs on US imports of metal-intensive products, such as automobiles and home appliances, indirectly reduce the ultimate demand for steel and aluminium. Decelerating demand from sectors like automotive also affects metals used in construction.

- International Competitiveness: In Germany, demand from industries like residential construction remains modest, and the country's export-oriented economy is affected by tariffs, although higher demand from rail engineering and government-funded infrastructure investments could provide some relief to domestic metal producers. In Italy, low demand from local construction contributed to a stagnant metals market in the preceding year.

- Global Metal Demand Drivers: Global population growth, particularly in India, Indonesia, and sub-Saharan Africa, is expected to drive global metal demand for construction and infrastructure projects in the medium to long run. In India, strong domestic demand driven by rapid urbanisation and a growing population is expected to sustain metals and steel production, ensuring a solid outlook for metals demand from construction growth. Government-backed infrastructure projects and housing demand in Australia are also expected to sustain domestic steel consumption.

- Copper in Construction: Copper is a key material used in the construction and manufacturing industries, with its demand expected to rise from increased investment in data centres, EV infrastructure, and renewable energy.

The future of the metal industry is characterized by a significant divergence driven by US tariffs on steel and aluminium, leading to a largely unpromising outlook for overall industrial metals outside of copper. Global basic metals output is forecast to experience a marked slowdown, with growth predicted at only 2.2% in 2025, further slowing to a meagre 0.7% in 2026. This general deceleration in demand growth is primarily attributed to the negative impact of US tariffs combined with the delayed economic recovery in China. In specific regions heavily dependent on US exports, the future looks challenging; for instance, Canada's basic metal production is set to contract by 2.2% in 2025 and 4.5% in 2026 due to difficulties redirecting steel exports amid an oversupplied global market. The tariffs are projected to continue negatively affecting global metal demand and prices by increasing oversupply outside the US and decreasing overall global demand, indirectly reducing demand for steel and aluminium used in metal-intensive products like automobiles.

In stark contrast to other industrial materials, copper and gold are poised as the "winning metals" under the current tariff regime. Copper is projected to be the only industrial metal in deficit in 2025, supported by robust demand growth from the energy transition and tight mined supply. Demand for copper is intrinsically linked to infrastructure for electric vehicles (EVs), renewable energy, and data centres. While near-term volatility is possible after recent price surges, copper prices in the US and globally are expected to eventually strengthen due to its widespread usage, the global supply shortage, and the lack of substitutes. LME average copper prices are forecast to increase to USD 9,700/tonne in 2025. Meanwhile, gold is expected to outperform as a safe asset, as investors seek hedging measures against ongoing global uncertainties, including geopolitical tensions, weakening currencies, potential inflation stemming from tariff policies, and delayed interest rate cuts or recessionary fears.

Within the US, domestic steel and aluminium producers are expected to benefit from the tariffs in the short term, gaining market share and higher revenue, which should boost their margins. US domestic prices are expected to rise significantly, with HRC prices forecast to increase by 23% in 2025, peaking in the third quarter before easing as supply increases and high prices dampen demand. However, this future is clouded by political uncertainty; the overall tariff policy uncertainty has dented business confidence and investment in the US metals and steel industry, as businesses are hesitant to invest in new production facilities if the tariffs could be removed. Furthermore, the continuation of high tariffs on steel and aluminium inputs could lead to a massive annual cost burden of over $100 billion for US production chains and consumers.

Looking at the broader future of key Asian producers, the weak global pricing resulting from tariffs is expected to impact Asian metal and steel sectors. China’s steel production, while facing near-term headwinds from overcapacity and a domestic property sector decline, is structurally expected to plateau out until 2030 before declining over the long run as urbanisation slows. Conversely, China’s aluminium sector, while facing short-term risks due to its dependency on the US export market, is anticipated to show resilience in the medium term due to its cost competitiveness and growing global demand driven by the clean energy transition. This divergence underscores future investment strategies; companies focused on copper and gold are seen as top picks.

Get expert-driven insights to support your research needs — contact us for details at sales@cervicornconsulting.com | +91 7499931916