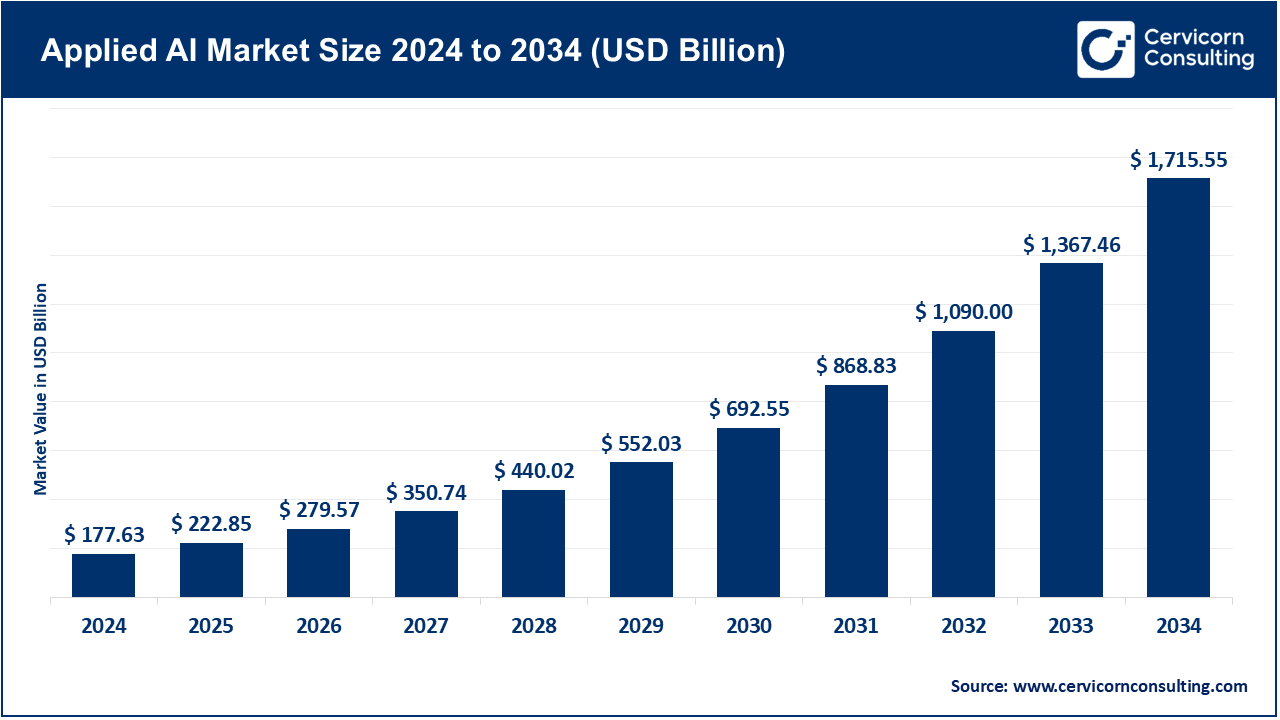

The global applied AI market size was valued at USD 177.63 billion in 2024 and is expected to reach around USD 1715.55 billion by 2034, expanding at a compound annual growth rate (CAGR) of 25.46% over the forecast period from 2025 to 2034. The applied AI market is growing rapidly because business is looking clever and fast to make decisions. Unlike basic automation, applied AI uses machine learning and data to solve real -world problems in areas such as Finance, Retail and Manufacturing. This helps companies improve efficiency, reduce costs and provide better customer experience. Edge computing and AI tools grow more accessible, applied AI is now an important part of digital changes in industries. As the demand for intelligent systems increases, applied AI is becoming necessary for innovation and development.

The practical use of artificial intelligence technologies�to address real-world problems, enhance workflows, and spur innovation across a range of sectors is known as AI. It comprises applying various artificial intelligence techniques, such as computer vision, natural language processing, machine learning, and deep learning, to particular systems and applications. A well-liked branch of applied AI called natural language processing (NLP) is used in chatbots and virtual assistants to understand and react to human language, improving user interaction and customer support. By evaluating medical data to help with diagnosis, therapy recommendation, and drug discovery, artificial intelligence is revolutionizing patient care in the healthcare industry.

Report Scope

| Area of Focus | Details |

| Market Size in 2025 | USD 222.85 Billion |

| Expected Market Size in 2034 | USD 1,715.55 Billion |

| Projected CAGR 2025 to 2034 | 25.46% |

| Leading Region | North America |

| Fastest Growing Region | Asia-Pacific |

| Key Segments | Component, Technology, Deployment Mode, Industry Vertical, Application, Region |

| Key Companies | Amazon Web Services (AWS), Apple, Baidu, Google (Alphabet Inc.), IBM, Intel, Meta, Microsoft, NVIDIA, Open AI |

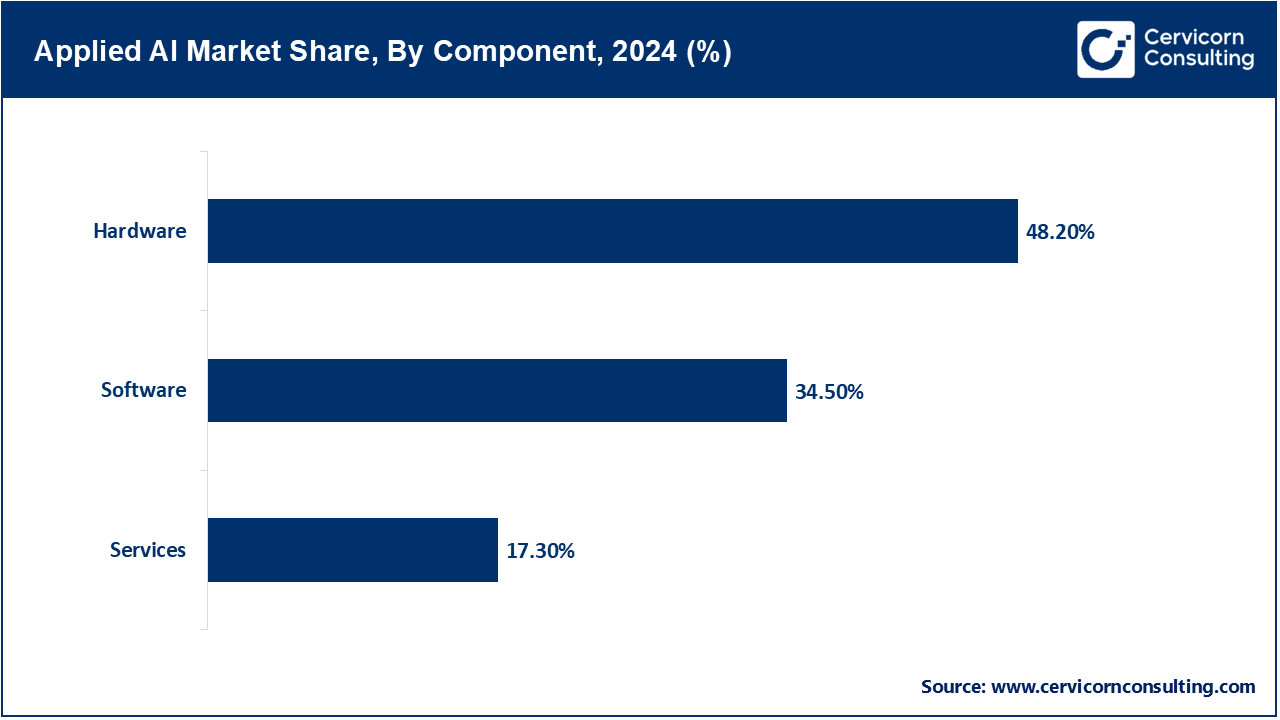

Hardware: The hardware includes AI specific processors such as GPU, TPU and Asics that runs on the complex machine learning computations. In May 2024, the Intel launched its Gaudi2 AI accelerator, targeting AI invention functions in data centers on a large scale. This development challenged the Nvidia's dominance in AI chips. Major cloud providers began testing Gaudi2 for enterprise workload. The launch showed the growing demand for flexible, high-demonstration AI infrastructure.

Software: Software refers to platforms, library and framework that facilitates the development, signs and monitoring of the AI model. In November 2023, Hugging Face released Autotrain 2.0, a no-code model training equipment that enables users to fine-tune AI without coding. Legal and life science startup adopted it widely. The equipment made AI development more accessible in non-technical teams. This demonstrated changes towards simplified AI solutions.

Services: Services include consultation, integration, training, and AI supports that help adopt businesses and scale the AI system. In February 2025, Accenture acquired APTIO's AI advisor hand to strengthen its enterprise AI capabilities. This expanded its cloud-foreign services to telecom and BFSI customers. The acquisition highlighted the increasing demand for AI expertise. Service providers are important for end-to-end AI implementation.

Machine Learning: The machine focuses on using the Learning algorithms that is learnt from data to decide or make predictions. In June 2022, Google introduced the Wartax AI Workbench to simplify ML workflow integration for deployment from notebooks. Enterprises in healthcare and retail adopted IT for data science workflows. The platform accelerated the end-to-end ML experiment and scaling. This reinforced the operation ML operating as a competitive advantage.

Natural Language Processing: NLP enables machines to explain, generate and analyze the human language in both text and speech forms. In January 2025, Meta launched the LLAMA-2, which was an open weight LLM for the enterprise AI applications. The model was adopted for safe chatbott and legal document processing. This allowed firms to host the model privately without cloud dependence. The release fuel the enterprise-centered NLP innovations.

Applied AI Market Share, By Technology, 2024 (%)

| Technology | Revenue Share, 2024 (%) |

| Machine Learning | 42.10% |

| Natural Language Processing (NLP) | 25.40% |

| Computer Vision | 20.30% |

| Others | 12.20% |

Computer Vision: The computer vision allows the system to understand and interpret visual data from images and videos. In October 2024, Microsoft launched the Custom Vision for Enterprises, enabling no-code visual model training. The manufacturers applied it to the defect detection and shelf monitoring. This helped reduce dependence on external development teams. The forum was quickly adopted in consumer goods and logistics areas.

On-Premises: On-premises purinogen means installing and running AI infrastructure locally within the organization's data environment. In March 2023, Siemens deployed an on-romance AI module in factories for real-time defect analysis and process control. This reduced production errors and protects data privacy. The solution became necessary for a high-protection industrial environment. Many firms favored this model for cases of delayed-sensitive use.

Applied AI Market Share, By Deployment Mode, 2024 (%)

| Deployment Mode | Revenue Share, 2024 (%) |

| On-Premise | 36.30% |

| Cloud | 63.70% |

Cloud: Cloud-purinogen distributes AI tools and models on the Internet using remote servers for flexibility and scale. In August 2024, AWS launched the bedock, enabling businesses to use the foundation model through managed APIs. This allowed medium -sized firms to create chatbott and AI workflows without infrastructure. Bedrock enables the document summary and accelerated model integration for analytics. The use of cloud-country AI uses rapidly expanded post-launch in cases.

Healthcare: The healthcare segment has dominated the market. In healthcare, AI supports clinical diagnosis, medical imaging, treatment plan and administrative automation. In September 2023, Pathai achieved $ 0.16 billion to increase its pathology AI platform to detect early cancer. American hospitals adopted the equipment widely by mid-2012. The system improved clinical accuracy and decision-making. AI continued to gain confidence in life science for high-day analysis.

BFSI: Banking, Financial Services, Insurance: AI in BFSI helps to detect fraud, credit scoring, compliance and automate individual banking experiences. In April 2025, JP Morgan Chase acquired AI Startup, Venules for $0.2 billion to increase real -time fraud analytics. The forum flagged off the discrepancies in transactions behaviour in branches. This enabled strict compliance and reduced false positivity. The acquisition strengthened the AI-driven risk control.

Retail and e-commerce: Retail and e-commerce use AI for demand forecasting, recommendation engine and visual search. In November 2022, Walmart launched the camera-based checkout, which reduced the line time by 40% in the pilot stores. The system scanned the item as they were placed in the vehicle. This improved customer throughput and operational efficiency. Other retailers soon started operating similar AI solutions.

Predictive Analytics: The predictive analytics segment hold leading position in the market. The predictive analytics involves using AI models to predict the trends, behaviors and events based on historical data. In July 2024, Palantir launched Bridgeai for Risk modeling of predicting supplies. The manufacturers used it to estimate the delays and reducing the overtaking. This adapted the inventory with minimal manual intervention. Predictive AI became an important tool in logistics management.

Image and speech recognition: The image and speech recognition system explains visual and audio input to automate the system classification or transcription. In December 2023, Adobe added generic speech recognition to the Creative Cloud for automatic video captioning. Material creators reduced editing time and improved access. This feature quickly became popular among media agencies. AI played a central role in the creative workflows.

Autonomous System: The autonomous system uses AI to operate vehicles, drones or machines without the direct involvement of human control. In June 2025, Vaymo received regulatory approval to operate driverless ride-linging services in Los Angeles. Commercial purinogen began in urban areas named. This marked a success for the autonomy of the real world. It further enhances advanced trust and regulation around self-driving applications.

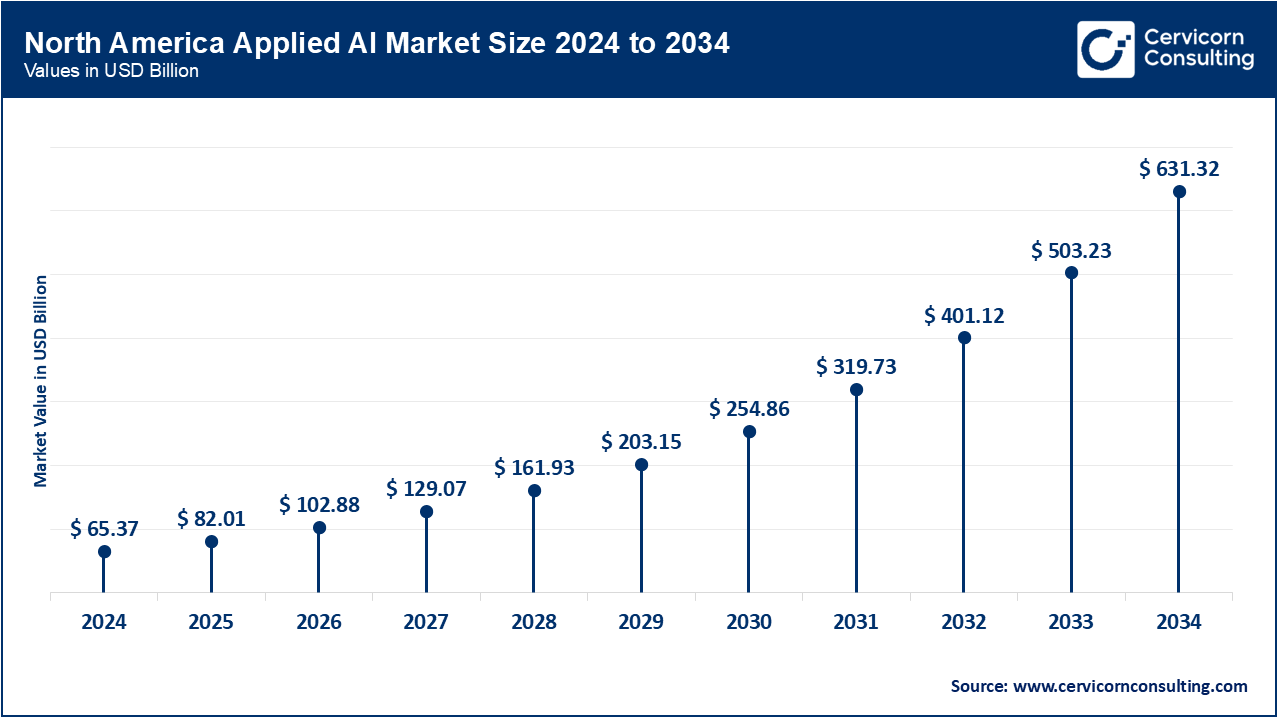

The applied AI market is segmented into several key regions: North America, Europe, Asia-Pacific, and LAMEA (Latin America, Middle East, and Africa). Here�s an in-depth look at each region.

North America includes U.S., Canada, Mexico and comprehensive areas - where advanced infrastructure and large technical ecosystems accelerate AI adoption in enterprises, healthcare, manufacturing, and government sectors. U.S. Heavy R&D leads with investment and startup activity; Canada benefits from university partnerships and immigration policies; Mexico and other gently are built data centers and skills. In April 2023, Microsoft opened a new AI data center sector in Canada to serve North American customers with low-oppression, sovereign cloud services. This expansion outlined the region's commitment to the creation of AI infrastructure and sovereignty.

Europe includes major economies such as Germany, France, UK, Italy, Spain, Russia, Netherlands, and the rest, which focus on strong regulatory structures, digital changes initiatives and "reliable AI". It mixes public sector AI programs with private innovation, supported by the European Union's funding and local educational-industry cooperation. In August 2024, Germany unveiled its national AI aggressive and promised �200 billion - $219 billion towards AI Infrastructure, Research, and Industry. This landmark funding announced a major acceleration in AI abilities and regional harmony.

Applied AI Market Share, By Region, 2024 (%)

| Region | Revenue Share, 2024 (%) |

| North America | 36.80% |

| Europe | 28.20% |

| Asia-Pacific | 24.40% |

| LAMEA | 10.60% |

The Asia-Pacific includes China, Japan, India, South Korea, New Zealand, Australia, Taiwan and the rest of the sector-from manufacturing automation in China to service-centered AI in India and various maturity levels for advanced robotics in Japan/South Korea. Government policies in China and India have inspired AI strategy programs and local innovation. In January 2025, India launched its National AI Strategy 2.0, committing INR 50,000 crore ($6 billion) to applied AI in agriculture, healthcare, and education-signaling a significant step in alternate-market AI deployment and capacity-building.

LAMEA includes Brazil, Middle East countries, and African nations, marked by early-stage AI adoption, public sector use cases, and growing investments in digital banking, telecom, and agriculture. Infrastructure and skills gaps exist, but regional governments are initiating AI as part of smart city and fintech efforts. In March 2025, the UAE�s Ministry of Artificial Intelligence launched the �AI 4 All� initiative, partnering with local universities to deploy applied AI pilots in health and public services�an important milestone illustrating regional intent to catch up technologically.

Market Segmentation

By Component

By Technology

By Deployment Mode

By Industry Vertical

By Application

By Region