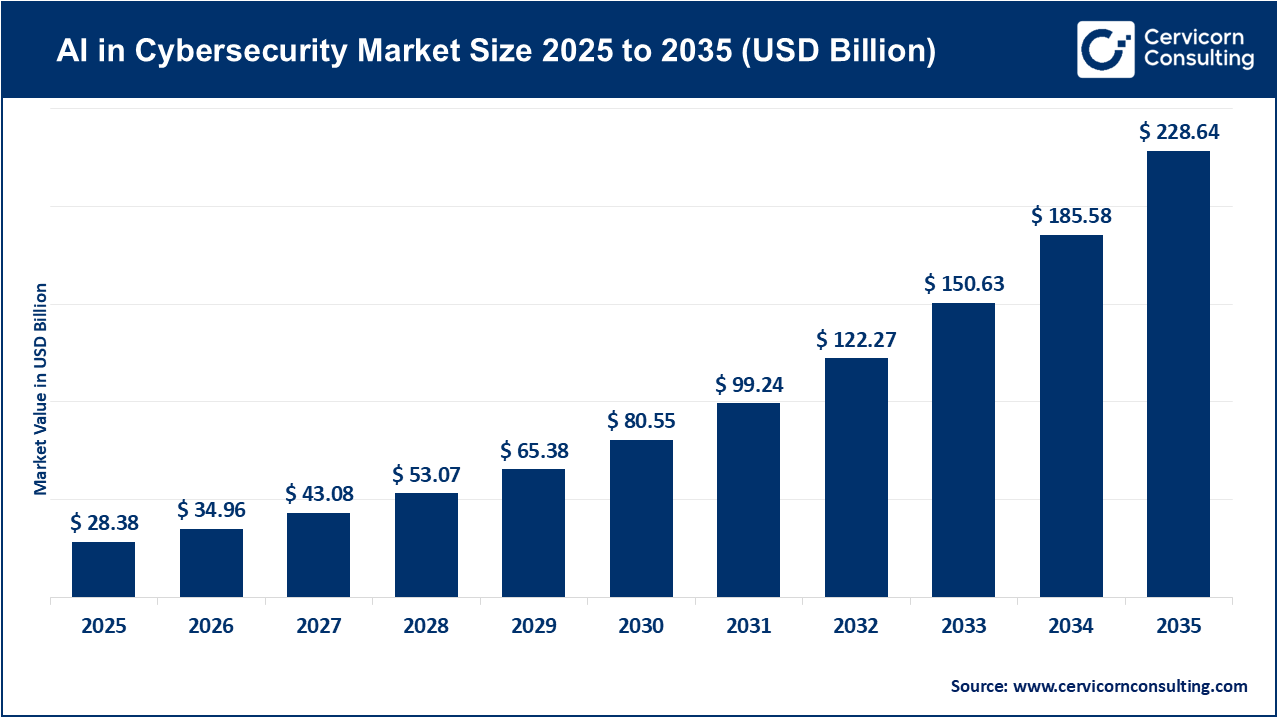

The global AI in cybersecurity market size was valued at USD 28.38 billion in 2025 and is forecasted to surpass around USD 228.64 billion by 2035, exhibiting at a compound annual growth rate (CAGR) of 23.2% over the forecast period from 2026 to 2035. The AI in cybersecurity market is experiencing rapid growth, mainly driven by the need for human analytics in a "big data" security landscape. According to reports, this market continued to expand rapidly from 2025, driven by the adoption of AI across sectors such as finance, healthcare, and critical infrastructure. The primary growth factor is the increasing volume and speed of security logs generated by modern organizations, which surpass human analytical capabilities. AI acts as a force multiplier for security teams, analyzing vast amounts of data to identify even the smallest signs of compromise that humans might overlook.

Another factor fueling growth is the economic impact of data breaches. Data indicates that organizations utilizing AI can identify and contain breaches approximately 100 days quicker than those without AI tools. Moreover, the shift to decentralized work settings, propelled by edge computing adoption, has widened the attack surface—heightening the demand for AI-driven security systems that function autonomously across dispersed locations.

Increasing Use of AI-Powered Predictive Analytics to Anticipate Cyber Threats

One of the key trends in the AI in cybersecurity market is a shift from reactive detection to predictive intelligence. Businesses have historically taken a reactive approach, and few existing security models still focus on responding to known threats. However, AI algorithms generate predictive insights by monitoring vast amounts of global threat data and identifying trends and patterns over time. Platforms like these enable security teams to gain insights that help them anticipate attackers and potential attack vectors before they are exploited, allowing to proactively strengthen their systems. These predictive models analyse historical breach data and other contextual event logs to estimate the likelihood that a business will encounter specific threats, thereby helping organisations allocate resources more effectively. The trend towards predictive intelligence is evident in the increasing adoption of AI-powered threat intelligence platforms that leverage unstructured data from the dark web and social media to provide early warnings of emerging campaign attacks.

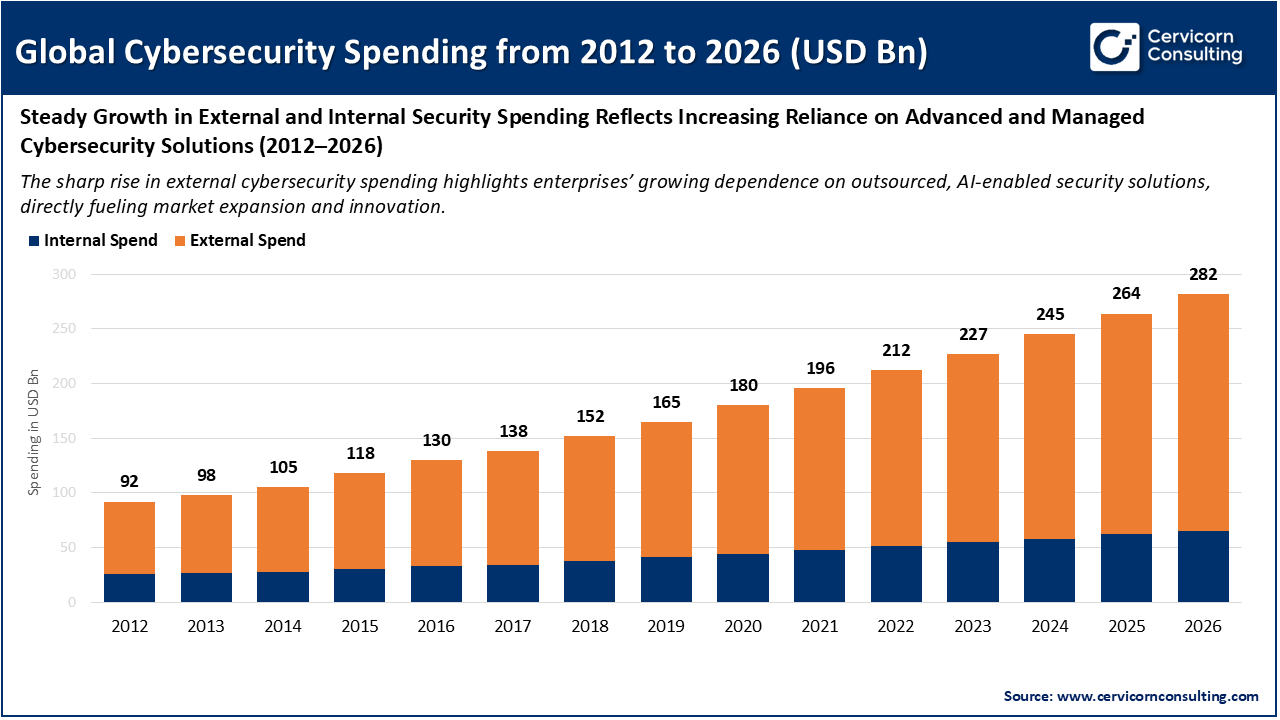

Rising Global Cybersecurity Spending Accelerating Market Growth

The data highlights a strong and sustained increase in global cybersecurity spending, driven primarily by rapid growth in external spending.

Internal Spend: Spending on in-house cybersecurity resources such as internal security teams, infrastructure, and operations.

External Spend: Spending on third-party cybersecurity solutions and services, including software, managed security, and consulting.

As cyber threats become more complex and frequent, organizations are increasingly outsourcing security functions to specialized vendors offering AI-driven, scalable, and continuously updated solutions. The faster growth of external spend compared to internal spend indicates a shift toward managed and technology-led security models, directly fueling expansion of the cybersecurity market and encouraging innovation among solution providers.

1. Recency of Corporate Technological Advances

In March 2025, NVIDIA made a significant announcement regarding an expansion of their Morpheus framework to incorporate real-time LLMs to monitor and detect data leakage and prompt injection attacks for enterprise-level AI applications. Following this announcement in June, Intel launched its latest processor line with hardware-level AI security to help provide silicon-based protection against advanced persistent threats. Finally, Microsoft rolled out general availability of its AI-native security platform, marking a significant step toward a unified cloud security ecosystem. These developments in hardware and software are increasingly being fused together to harness the computational power necessary for real-time AI-mediated defence.

2. Government Cybersecurity Policy Frameworks and Initiatives

Government actions have played a significant role in providing the regulatory certainty needed to develop markets. A key milestone was the full enactment of the EU AI Act, which will come into effect in late 2025, providing clear guardrails for the use of AI across critical infrastructure and cybersecurity efforts. This regulatory framework sets a high standard for data quality and human involvement and influences how global AI security tools are developed. Additionally, in 2024 and 2025, several North American government agencies established AI security consortiums to develop standardised threat-sharing protocols. These consortiums demonstrate the use of governance in technology to develop AI security methods in a trust-based manner, fostering a more cooperative global security landscape.

3. Strategic Capital Investment and Funding Rounds

The financial trajectory of the AI in Cybersecurity Market is driven by record capital investments. Important milestones, such as Cisco's acquisition of Splunk in January 2025 (a multi-billion dollar deal representing shifts in strategic capital toward consolidated data and AI platforms), highlight this trend. This acquisition, along with several others, reflects a pattern of market consolidation through legacy vendor acquisitions of AI-native startups to enhance analytical capabilities. Additionally, record funding rounds for startups in 2024 and 2025 in both "AI-for-Security" and "Security-for-AI" demonstrate investor confidence in the future importance of autonomous defense systems. These funding rounds provide the essential momentum to move from proof-of-concept and prototype development to enterprise-critical infrastructure.

4. Global Security Collaborations and Ecosystems

Collaborative efforts among multiple countries and industries have become a key milestone in strengthening global defenses. In late 2025, a major initiative was introduced to facilitate cross-border threat intelligence sharing focused on AI anomaly detection, enhancing understanding of threats within software-defined networks. Such collaborations are essential for proactively monitoring countries that harbor actors moving across jurisdictions. Additionally, the use of open-source AI security frameworks is expanding rapidly among smaller organizations. Open-source adoption offers these groups access to the collective knowledge of global security practitioners. As the ecosystem grows, AI-driven security must extend beyond large enterprises, contributing to a more resilient and inclusive digital economy.

Report Scope

| Area of Focus | Details |

| Market Size in 2026 | USD 34.96 Billion |

| Market Size in 2035 | USD 228.64 Billion |

| Market CAGR 2026 to 2035 | 23.20% |

| Key Region | North America |

| High-growth Region | Asia-Pacific |

| Key Segments | Offering, Security Type, Technology, Application, Vertical, Region |

| Key Companies | NVIDIA, Intel, CrowdStrike, Palo Alto Networks, Fortinet, Check Point Software Technologies, Vectra AI, SentinelOne, Cybereason, Microsoft, IBM, Cisco, Symantec, Sophos, Zscaler |

The AI in cybersecurity market is segmented into various regions, including North America, Europe, Asia-Pacific, and LAMEA. Here is a brief overview of each region:

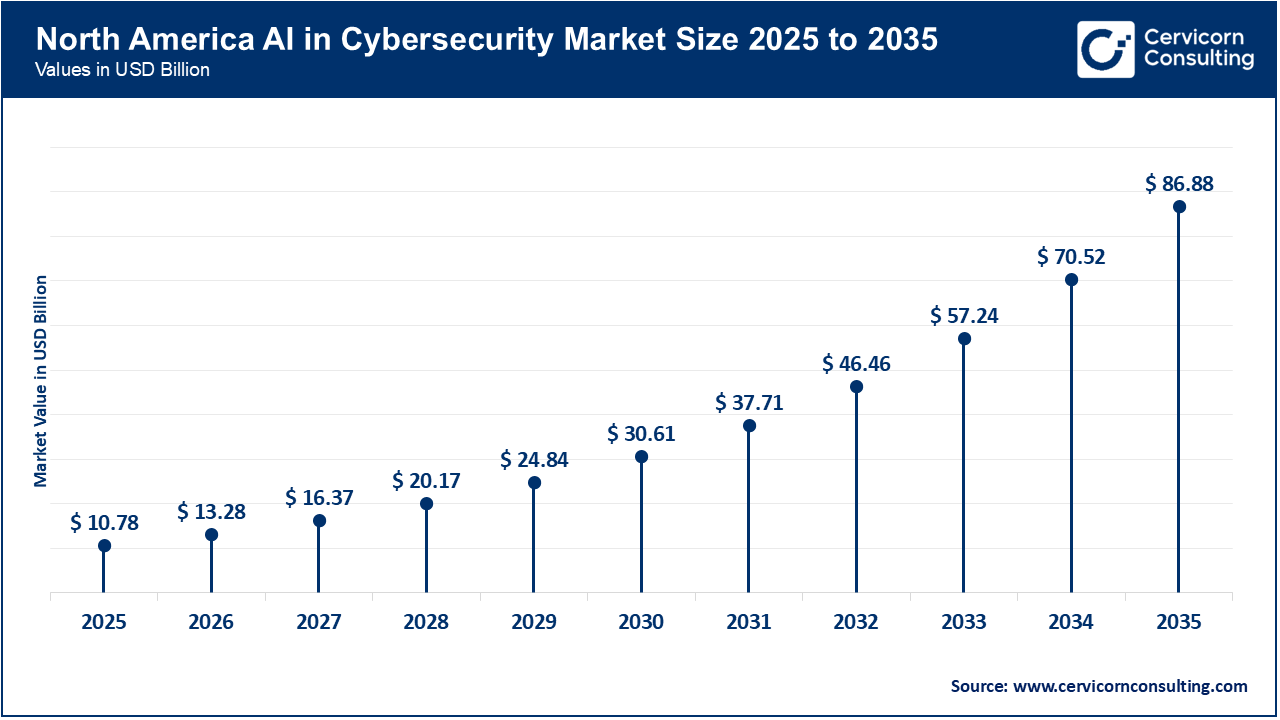

The North America AI in cybersecurity market size was valued at USD 10.78 billion in 2025 and is predicted to attain around USD 86.88 billion by 2035. North America currently holds the largest share of the market. The region's dominance is driven by a high concentration of technology providers and cybersecurity start-ups. It consistently invests in both private and federal sectors. For instance, the US government prioritizes AI for national defense, funding numerous AI-driven security projects. The market’s early adoption of cloud-native technology and swift AI model integration into corporate governance further support this leadership. Large enterprises use AI not only for prevention but also for risk management and automating compliance, fueling the development of advanced AI security solutions that are often exported globally.

Recent Developments:

The Asia-Pacific AI in cybersecurity market size was estimated at USD 8.51 billion in 2025 and is projected to surge around USD 68.59 billion by 2035. APAC is the fastest-growing market. This expansion is driven by rapid digital transformation in emerging economies like India, China, and Southeast Asia. These nations are digitizing their economies and expanding digital sectors, attracting cybercriminals and state-sponsored hackers, which increases the need for advanced security measures. Additionally, the region shows growing signs of international cooperation as countries aim to strengthen their security capabilities. With its mobile-first economies and the rollout of 5G networks, APAC will have more opportunities for AI-powered security at the edge. The large user base and increasing number of state-sponsored threat actors will further propel market growth in the region.

Recent Developments:

The Europe AI in cybersecurity market size was reached at USD 6.81 billion in 2025 and is expected to hit around USD 54.87 billion by 2035. The European market is distinguished by its heavy regulation. Laws such as the General Data Protection Regulation (GDPR) and the recent EU AI Act have created a legal framework for data privacy and the ethical deployment of artificial intelligence in the Cybersecurity Market. As organizations are required to adopt highly accurate and transparent AI tools to avoid significant penalties, these regulations will drive the demand and expansion of AI technology. European companies are also emphasizing "sovereign AI" and local data processing to ensure compliance with data residency requirements. Several initiatives are in progress to support research and development efforts aimed at positioning the European Union as a unified response to cyber threats. Market growth will be driven by high demand for AI solutions that are privacy-by-design, considering individual rights while also safeguarding against advanced security threats.

Recent Developments:

AI in Cybersecurity Market Share, By Region, 2025 (%)

| Region | Revenue Share, 2025 (%) |

| North America | 38% |

| Europe | 24% |

| Asia-Pacific | 30% |

| LAMEA | 8% |

The LAMEA AI in cybersecurity market was valued at USD 2.27 billion in 2025 and is anticipated to reach around USD 18.29 billion by 2035. LAMEA presents a significant emerging market. In the Middle East, particularly among Gulf Cooperation Council (GCC) countries, governments are actively diversifying their economies through technology, investing heavily in smart cities and digital government services. This diversification has heightened the awareness of cybersecurity needs as part of the digitization of critical infrastructure. In Latin America and Africa, growth will be driven by investments in fintech and greater access to affordable cloud services. These regions face challenges such as income disparities, varying levels of technological maturity, and economic instability. Nevertheless, adopting AI-driven security offers an opportunity to overcome existing security challenges. With an expanding threat landscape, the demand for scalable, AI-powered security solutions in LAMEA will continue to increase.

Recent Developments:

The AI in cybersecurity market is segmented into offering, security type, technology, application, vertical, and region.

Solutions dominate the AI in cybersecurity market due to their central role in threat detection, prevention, and response. AI-powered software platforms integrate machine learning, analytics, and automation to monitor networks, endpoints, and cloud environments in real time. Enterprises increasingly prefer unified security solutions that offer scalable deployment, continuous updates, and centralized visibility. The growing need for real-time threat intelligence, automated incident response, and compliance management continues to drive strong demand for AI-based cybersecurity solutions across large enterprises and regulated industries.

AI in Cybersecurity Market Share, By Offering, 2025 (%)

| Offering | Revenue Share, 2025 (%) |

| Hardware | 14% |

| Solutions | 56% |

| Services | 30% |

Services represent the fastest-growing offering segment as organizations seek expert support to deploy and manage complex AI-driven cybersecurity systems. Managed security services, consulting, and incident response services are gaining traction, especially among small and mid-sized enterprises lacking in-house expertise. The rising complexity of cyber threats, combined with skill shortages, has increased reliance on service providers for continuous monitoring, model tuning, and threat analysis, accelerating growth in this segment.

Network security dominates the AI in cybersecurity market as organizations prioritize protecting core digital infrastructures from advanced and persistent threats. AI-driven network security solutions enable real-time traffic analysis, anomaly detection, and automated threat mitigation. With the increasing volume of data traffic and interconnected systems, enterprises rely heavily on AI to identify suspicious patterns and prevent breaches. The widespread adoption of AI-based intrusion detection and prevention systems has reinforced network security’s leading market position.

AI in Cybersecurity Market Share, By Security Type, 2025 (%)

| Security Type | Revenue Share, 2025 (%) |

| Infrastructure Security | 47% |

| Data Security | 24% |

| Application Security | 18% |

| Others | 11% |

Cloud security is the fastest-growing security type segment due to the rapid adoption of cloud computing, hybrid IT environments, and software-as-a-service platforms. AI-powered cloud security solutions provide continuous monitoring, automated compliance enforcement, and adaptive threat detection across dynamic cloud workloads. As organizations migrate critical data and applications to the cloud, the demand for AI-enabled visibility, risk assessment, and threat prevention in cloud environments continues to rise at a high growth rate.

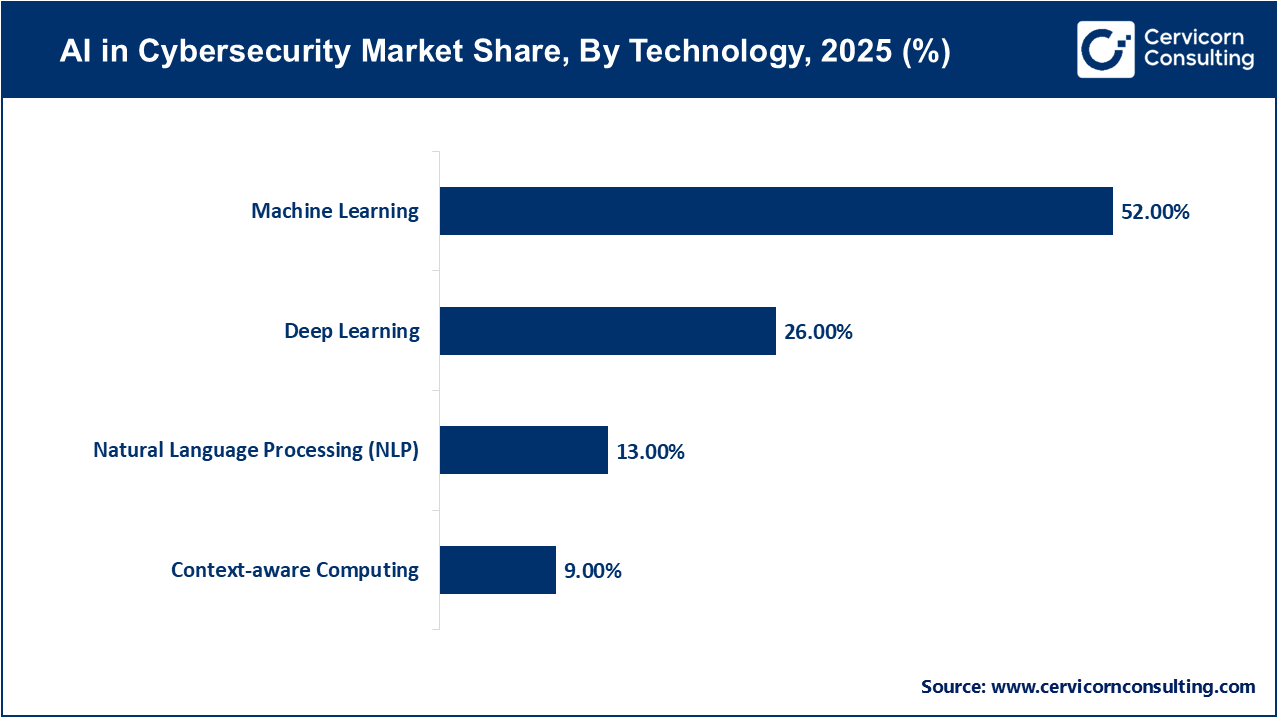

Machine learning dominates the AI in cybersecurity market as it forms the foundation of most modern security solutions. ML algorithms are widely used for behavioral analysis, anomaly detection, malware identification, and threat classification. Their ability to continuously learn from new data and adapt to evolving attack patterns makes them essential for real-time cybersecurity operations. The maturity, scalability, and proven effectiveness of machine learning technologies have resulted in widespread adoption across multiple security applications.

Deep learning is the fastest-growing technology segment due to its ability to analyze complex and high-dimensional data. Deep neural networks are increasingly used for detecting zero-day threats, advanced malware, and sophisticated attack techniques. Their superior accuracy in recognizing subtle patterns within large datasets makes them ideal for modern cybersecurity challenges. As computational capabilities improve and cyber threats become more complex, deep learning adoption is accelerating rapidly.

Threat intelligence dominates the application segment as organizations prioritize proactive detection and prevention of cyber threats. AI-driven threat intelligence platforms analyze vast datasets, including historical attack data, threat feeds, and external sources, to provide real-time insights. These solutions enable security teams to identify emerging threats, understand attacker behavior, and respond quickly. The growing need for predictive and contextual threat awareness has made threat intelligence a core application of AI in cybersecurity.

AI in Cybersecurity Market Share, By Application, 2025 (%)

| Application | Revenue Share, 2025 (%) |

| Identity & Access Management (IAM) | 17% |

| Data Loss Prevention (DLP) | 15% |

| Unified Threat Management (UTM) | 14% |

| Fraud Detection / Anti-Fraud | 21% |

| Threat Intelligence | 23% |

| Others | 10% |

Fraud detection is the fastest-growing application segment, driven by the rapid expansion of digital payments, online banking, and e-commerce. AI-powered fraud detection systems use behavioral analytics and real-time transaction monitoring to identify suspicious activities with high accuracy. Increasing incidents of financial fraud and identity theft are pushing organizations to invest in advanced AI solutions, fueling strong growth in this segment across BFSI and retail sectors.

The BFSI sector dominates the AI in cybersecurity market due to its high exposure to cyber threats and stringent regulatory requirements. Financial institutions manage vast volumes of sensitive customer and transaction data, making them prime targets for cybercriminals. AI-driven cybersecurity solutions help BFSI organizations detect fraud, prevent data breaches, and ensure regulatory compliance. Continuous digital transformation and rising online transactions further reinforce BFSI’s leading market share.

AI in Cybersecurity Market Share, By Vertical, 2025 (%)

| Vertical | Revenue Share, 2025 (%) |

| BFSI | 27% |

| Government & Defense | 15% |

| IT & ITES | 19% |

| Healthcare | 11% |

| Manufacturing | 8% |

| Retail & E-Commerce | 7% |

| Telecommunications | 6% |

| Automotive & Transportation | 5% |

| Others | 2% |

Healthcare is the fastest-growing vertical in the market as the sector rapidly digitizes patient records and adopts connected medical devices. The increasing frequency of cyberattacks targeting healthcare systems has heightened the need for advanced security solutions. AI helps healthcare organizations detect anomalies, protect sensitive patient data, and ensure system availability. Regulatory pressures and the critical nature of healthcare operations continue to accelerate adoption in this vertical.

By Offering

By Security Type

By Technology

By Application

By Vertical

By Region